CopyHub Review: Boris CEO trading ruse Ponzi

![]() CopyHub fails to provide ownership or executive information on its website.

CopyHub fails to provide ownership or executive information on its website.

CopyHub’s website domain (“app.copyhub.trade”), was privately registered on October 10th, 2024.

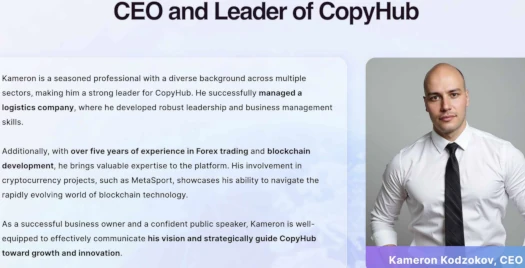

Further research reveals CopyHub citing “Kameron Kodzokov” as its CEO:

Kameron Kodzokov doesn’t exist outside of CopyHub’s marketing. This makes him a prime Boris CEO candidate.

I don’t have a name but circa 2022, whoever is playing Kodzokov was working as a language teacher in Russia:

This ties in with Boris CEO scammers typically being Russian and/or Ukrainian.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

CopyHub’s Products

CopyHub has no retailable products or services.

Affiliates are only able to market CopyHub affiliate membership itself.

CopyHub’s Compensation Plan

CopyHub affiliates pay a fee to invest funds with “a trader”.

- $50 fee = invest up to $500

- $100 fee = invest up to $1000

- $250 fee = invest up to $2500

- $500 fee = invest up to $5000

- $1000 fee = invest up to $10,000

- $2500 fee = invest up to $25,000

- $5000 fee = invest up to $50,000

- $10,000 fee = invest up to $100,000

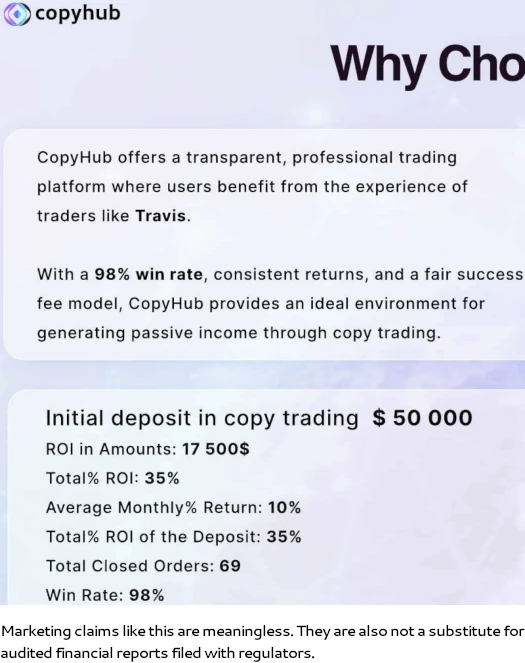

CopyHub solicits investment on the promise of “consistent monthly returns of 8-10%”.

Note that CopyHub charges a 38% fee on all ROI withdrawals. This fee is withheld until the fee paid to access the ROI tier is generated in returns.

The MLM side of CopyHub is tied to fees paid by recruited affiliate investors.

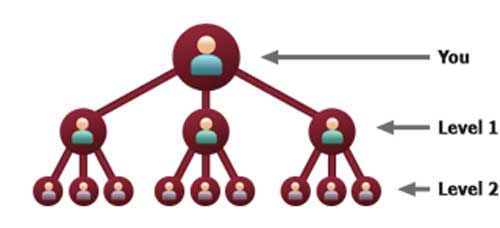

Each CopyHub investment tier fee corresponds to a 3×10 matrix tier.

A 3×10 matrix places a CopyHub affiliate at the top of a matrix, with three positions directly under them:

These three positions form the first level of the matrix. The second level of the matrix is generated by splitting each of these first three positions into another three positions each (nine positions).

Levels three to ten of each matrix are generated in the same manner, with each new level housing three times as many positions as the previous level.

As stated, each CopyHub fee tier corresponds with a matrix tier. This means that there are eight 3×10 matrix tiers.

CopyHub affiliates buy into each tier by paying the corresponding investment tier ($10 to $10,000).

Once bought in, positions in an unlocked matrix tier are filled via fees paid by directly and indirectly recruited affiliates also buying into the tier.

Commission payments out of these fees paid are determined by which level of the matrix a new fee-paying affiliate is placed:

- 4% of the fee paid is paid out on level 1 of the matrix

- 8% of the fee paid is paid out on level 2 of the matrix

- 12% of the fee paid is paid out on level 3 of the matrix

- 16% of the fee paid is paid out on level 4 of the matrix

- 20% of the fee paid is paid out on level 5 of the matrix

- 24% of the fee paid is paid out on level 6 of the matrix

- 28% of the fee paid is paid out on level 7 of the matrix

- 32% of the fee paid is paid out on level 8 of the matrix

- 36% of the fee paid is paid out on level 9 of the matrix

- 40% of the fee paid is paid out on level 10 of the matrix

Note that CopyHub only lets affiliates earn up to 40% in MLM commissions of what they have personally invested.

New investment is required to continue earning once this cap is reached. This requires payment of higher fees.

Also note that CopyHub’s marketing states:

Users must renew their matrix within 3 days of expiration.

Failing to do so results in the user losing their position in the matrix and disabling their account until renewal.

The expiry date on fees paid isn’t specified.

Joining CopyHub

CopyHub affiliate membership is tied to a $50 to $10,000 access fee.

This fee has to be periodically renewed by CopyHub don’t specify how long a fee payment lasts for.

CopyHub fee payments and investments are made in tether (USDT).

CopyHub Conclusion

I couldn’t see any indication CopyHub runs an API trading scheme so it appears invested funds are held within the company.

The alternative to this would be a typical “lulz can’t touch our money” scam model.

Regardless of which model is used, CopyHub soliciting investment on the promise of 8% to 10% a month constitutes a securities offering.

CopyHub fails to provide evidence it has registered with financial regulators in any jurisdiction.

As opposed to marketing claims like this…

…audited financial reports filed with regulators is the only way to verify CopyHub is paying ROI withdrawals with trading revenue.

This is not only a legal requirement, failure to register with regulators and file reports constitutes securities and commodities fraud.

This ties into CopyHub having a fictional Boris CEO and otherwise operating illegally. With nothing marketed or sold to retail customers, the MLM side of CopyHub constitutes a pyramid scheme.

In addition to the “trading” fraudulent investment scheme detailed above, CopyHub also runs an inhouse token “staking” model Ponzi.

CopyHub has created Trade Flow Token, through which it runs “staking programs” and “revenue-sharing opportunities”. This is code for “Ponzi schemes”.

- Standard – invest $600 to $1999.98 in TradeFlow tokens and receive 10% annually

- Premium – invest $2000 to $4999.98 in TradeFlow tokens and receive 14% annually

- Elite – invest $5000 to $9999.98 in TradeFlow tokens and receive 18% annually

- VIP – invest $10,000 or more in TradeFlow tokens and receive 22% annually

Although TradeFlow staking returns are calculated annually, staking periods are 90 days (bonus 1%), 180 days (bonus 2%) or 365 days (bonus 4%).

Trade Flow Token has been set up on the domain “trade-flow.io”, registered on September 7th through an incomplete address in Bucharest.

As it stands the only verifiable source of revenue entering CopyHub is new investment.

Using new investment to pay ROI withdrawals would make CopyHub a Ponzi scheme.

As with all MLM Ponzi schemes, once affiliate recruitment dries up so too will new investment.

This will starve CopyHub of ROI revenue, eventually prompting a collapse.

The math behind Ponzi schemes guarantees that when they collapse, the majority of participants lose money.

Watch for the start of CopyHub’s collapse when payouts are switched to Trade Flow Tokens only.

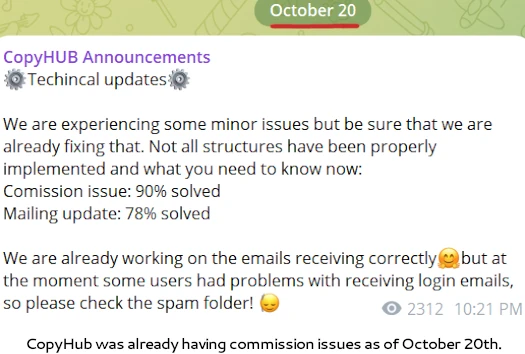

Side note: CopyHub is a TLC spinoff. The story is that after the TLC ‘leadership’ disappeared, some of the ‘good-hearted’ folks there created CopyHub to create the promised copy trade feature of TLC and recover the money TLC ‘investors’ lost. But we all know they are just milking the naive people again.

Probably the same people are pulling the strings.