Color Street Review: Can you compete with Walmart?

![]() Color Street operate in the personal care niche and are based out of New Jersey in the US.

Color Street operate in the personal care niche and are based out of New Jersey in the US.

Heading up Color Street is headed up by Founder and President, Fa Park.

So the story goes, Park’s business concept

So the story goes, Park’s business concept

began in 1984, when Fa Park was on a bus stuck in a traffic jam and saw a woman in a nearby cab trying to polish her nails.

He thought, “There has to be a better way!”

He bought some nail polish and started experimenting with it, starting by painting it on different types of paper.

After countless attempts, he finally created a process where although the top was dry, the bottom was still moist and could be adhered to the nail.

Mr. Park’s revolutionary vision, a 100% nail polish strip, was born!.

Fast forward decades with much hard work to perfect and patent his product, Mr. Park’s innovation has become a leader in the beauty industry.

Color Street launched in mid 2017. Park also owns the non-MLM companies Incoco and Coconut Nail Art, through which similar products to Color Street are marketed and sold.

Read on for a full review of the Color Street MLM opportunity.

Color Street Products

Color Street market nail polish strips, which the company claims are “made in USA with globally patented technology”.

Color Street market nail polish strips, which the company claims are “made in USA with globally patented technology”.

Features of the strips touted on the Color Street website include;

- base, color and top coats of high-quality liquid nail polish in each strip

- brilliant, salon-quality manicures in just a few minutes, with no drying time, smudges, or streaks and

- 100% real nail polish, not stickers Flexible—can be gently stretched for a perfect fit

A full catalog is provided on the Color Street website.

Prices start at $11 for solid colors, $12-$13 for the fancier designs and $14 for “French manicure” patterns.

The Color Street Compensation Plan

Color Street’s compensation plan combines retail sales with residual unilevel team commissions.

Generation and Lifestyle Bonuses are offered as additional performance-based incentives.

Color Street Affiliate Ranks

There are twelve affiliate ranks within the Color Street compensation plan.

Along with their respective qualification criteria, they are as follows:

- Stylist – generate and maintain 300 PV a month

- Senior Stylist maintain 300 PV a month, generate and maintain two unilevel legs with a Stylist in each, generate 1000 GV a month and at least 2000 GV accumulated in total

- Team Leader – maintain 300 PV a month, generate and maintain three unilevel legs with a Stylist in two and a Senior Stylist or higher in the third, generate 2500 GV a month and at least 5000 GV accumulated in total

- Director – maintain 300 PV a month, generate and maintain four unilevel legs with a Stylist in one, a Senior Stylist in two and a Team Leader or higher in the fourth, generate 7500 GV a month and at least 20,000 GV accumulated in total

- Senior Director – maintain 300 PV a month, generate and maintain five unilevel legs with a Stylist in two, a Team Leader or higher in two and a Director or higher in the fifth, generate 25,000 GV a month and at least 50,000 GV accumulated in total

- Executive Director – maintain 300 PV a month, generate and maintain six unilevel legs with a Stylist in three, a Director or higher in two and a Senior Director or higher in the sixth, generate 50,000 GV a month and at least 150,000 GV accumulated in total

- Senior Executive Director – maintain 300 PV a month, generate and maintain seven unilevel legs with a Stylist in four, a Senior Director or higher in two and an Executive Director or higher in the seventh, generate 150,000 GV a month and at least 500,000 GV accumulated in total

- National Executive Director – maintain 300 PV a month, generate and maintain eight unilevel legs with a Stylist in four, a Senior Director or higher in two, an Executive Director in one and a Senior Executive Director in the eighth, generate 300,000 GV a month and at least 1,000,000 GV accumulated in total

- Sapphire National Executive Director – maintain National Executive Director qualification with an additional National Executive Director unilevel team leg

- Ruby National Executive Director – maintain National Executive Director qualification with two additional National Executive Director unilevel team legs

- Emerald National Executive Director – maintain National Executive Director qualification with three additional National Executive Director unilevel team legs

- Diamond National Executive Director – maintain National Executive Director qualification with four additional National Executive Director unilevel team legs

PV stands for “Personal Volume” and is sales volume generated by retail sales and an affiliate’s own orders.

GV stands for “Group Volume” and is PV generated by an affiliate’s downline.

Note that for Team Leader and higher, up to 50% of required monthly GV can be sourced from any one unilevel leg (there is no restriction for required accumulated GV).

Retail Commissions

Color Street affiliates earn a 25% to 35% retail commission, based on their total retail sales volume each month.

- generate up to $599 in monthly retail sales = base 25% retail commission

- generate $600 to $1199 in monthly retail sales = 28% retail commission rate

- generate $1200 to $1799 in monthly retail sales = 30% retail commission rate

- generate $1800 to $2399 in monthly retail sales = 32% retail commission rate

- generate $2400 or more in monthly retail sales = 35% retail commission rate

Enroller Bonus

The Enroller Bonus is a flat 3% bonus paid on generated sales volume down two levels of recruitment.

- Stylist and Senior Stylist ranked affiliates earn 3% on level 1 (personally recruited affiliates)

- Team Leader and higher ranked affiliates earn 3% on levels 1 and 2

Residual Commissions

Color Street pay residual commissions via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

Color Street cap payable unilevel team levels at four.

Residual commissions are paid out as a percentage of sales volume generated across these four levels.

How many unilevel team levels a Color Street affiliate earns residual commissions on is determined by rank:

- Stylists earn 3% on level 1 (personally recruited affiliates)

- Senior Stylists earn 3% on levels 1 and 2

- Team Leaders earn 3% on levels 1 to 3

- Directors and higher earn 3% on levels 1 to 4

Note that it’s possible to receive overrides on downline affiliates who are not qualified to earn residual commissions on all four available unilevel team levels.

Team Bonus

Executive Director and higher ranked affiliates earn a 1.5% Team Bonus on their entire unilevel team volume.

If an Senior Director is in a unilevel leg, the Team Bonus for that leg is capped at four levels after them.

Generational Bonus

Color Street define a generation when an Executive Director or higher is found in a unilevel leg.

This affiliate caps off the first generation of that unilevel leg, with the second beginning immediately thereafter.

If a second Executive Director or higher exists deeper in the leg. The second generation is capped off and the third begins.

If no such ranked affiliate exists, the last generation of that leg extends down its full depth.

Using this generation structure, the Generational Bonus pays a 3% bonus on sales volume generated by up to three generations per unilevel leg.

- Executive Directors earn 3% on one generation in a unilevel leg

- Senior Executives earn 3% on up to two generations and

- National Executives earn 3% on up to three generations

Lifestyle Bonus

Executive Director and higher affiliates qualify for a monthly Lifestyle Bonus.

- Executive Directors receive $500

- Senior Executive Directors receive $750

- National Executive Directors receive $1000

Sapphire National Executive Director and higher rewards

For Sapphire National Executive and higher ranked affiliates, the current Color Street compensation plan states;

The rewards for achieving Sapphire National Executive Director are not paid in commissions, change periodically, and are detailed in a separate document that highlights rewards for promotions to higher ranks.

A previous Color Street compensation plan dated January 2018 details National Leadership Bonus Pools.

Each pay period, Color Street places at least 1% of its total

monthly PV into National Leadership Bonus Pools to be shared by Sapphire, Ruby, Emerald, and Diamond Executives.

The Sapphire, Ruby and Emerald pools are 20% of the 1% pool. The Diamond pool contains the remaining 40%.

Other than maintain Sapphire National Executive Director and higher ranks, there doesn’t appear to be any additional qualification criteria.

I’m also not clear on why this was removed from the current Color Street compensation plan documentation.

Joining Color Street

Basic Color Street affiliate membership is $129 and comes with an assortment of Color Street products and nail care accessories.

Conclusion

Prior to launching Color Street, Fa Park has been successfully selling nail products through his Incoco and Coconut Nail Art brands.

As far as I can tell, there’s no difference between Color Art’s nail products and that of Incoco and Coconut Nail Art, other than the designs offered and pricing.

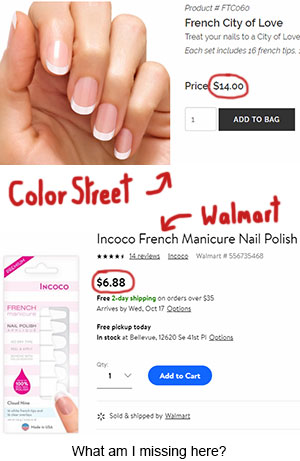

A check on the Walmart website reveals Incoco and Coconut Nail Art products going for $4.97 to $6.88.

Of particular note is Incoco’s French Manicure line, which goes for $6.88 versus Color Street’s $14.

Of particular note is Incoco’s French Manicure line, which goes for $6.88 versus Color Street’s $14.

I’ve singled out the French Manicure line as the designs across Color Street and Incoco appear to be identical.

This I feel is going to be your biggest challenge in marketing Color Street. Granted Color Street appears to offer a much wider range of designs than Incoco and Coconut Nail Art, but those price-points are still a significant hurdle.

I also observed Color Street products readily available on both Amazon and eBay – which made this particular sentence from Color Street’s compensation plan all the more significant;

A Stylist may sell the product or service for whatever price he or she chooses.

Furthermore, if Park is able to sell nail products for practically half-price with Walmart’s mark-up, why is Color Street so comparatively expensive?

One would hope it isn’t the compensation plan artificially driving pricing up.

Unless I was particularly attached to unique Color Street designs, I know I’d be a little bit cheesed if I found I could the same thing half-price elsewhere.

The only positive I can attribute to Walmart undercutting Color Art’s affiliates, is the nail art product being available cheap to try for potential affiliates.

Moving onto Color Street’s compensation plan, it’s a pretty solid offering with no particular concerns that stood out

There are no retail volume qualifiers but at the same time spending $300 a month as an affiliate obviously isn’t sustainable.

And Color Street do offer two retail sales bonuses; a sliding retail commission rate and product credit incentive (not covered in the compensation plan breakdown), so really there’s no excuse.

Outside of what you keep for yourself (bit hard to market nail art if you’re not wearing it), you’re either making significant retail sales or you’re dropping out within a few months.

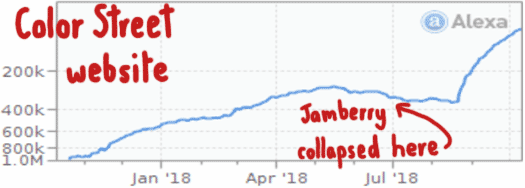

One final thought I’ll touch on is the recent spike in Color Street website activity.

The above chart, provided by Alexa, shows a sharp increase in activity from late August.

This is a few months after Jamberry Nails collapsed and was acquired by M.Global (formerly M.Network).

To what extent former Jamberry Nails affiliates have found a new home with Color Street I can’t say, but it’s not unreasonable to attribute the increase to Jamberry’s collapse.

I’m not trying to recommend one MLM opportunity over another, but I will say both Jamberry Nails and Color Street didn’t/don’t have the autoship recruitment issues M.Global has.

Update 3rd February 2024 – Color Street is still an MLM company but, as of March 1st, 2025, is slashing MLM commissions to just one level of recruitment.

The company will also compete directly against its Consultants across more retail channels.

Great review! I’m a stylist for Color Street and I can attest to the fact that it is a fabulous product. Women love it! Men as well!!

It’s been said that the Inoco and Coconut brands are not as good quality; however, I haven’t tried them yet so I can’t confirm that.

Unlike nutrition and makeup, the product is really easy to sell because of the eye-catching glitters and designs. The package includes 16 individual nail strips so many people can get a mani/pedi for $12 – that’s a deal compared to a salon visit.

Now the money…I can say that trying to maintain a PV of $300/month on a $12 (avg) product is almost impossible to consistently maintain.

Because of this, in order to move inventory and get new recruits, many top-earner, mid-level i.e. team leaders, directors and even some executive directors spend their weekends hawking their wares at various festivals and other public events.

This income will dry up once there are too many stylists trying to book up a limited number of events. This is a party MLM so home parties are pushed as well.

If one has the energy and drive to work their “side hustle” after their real job ends money can be made.

Typical MLM pranks do occur. If you don’t suck up to your upline and show that you behave well, they won’t move new stylists under you. Others will reap the rewards of new downline even if they’ve started long after you.

It can be humiliating to see all the cheery announcements of promotions every month when you’re busting your a$$ to get one or two recruits. You will spend countless amounts of energy watching seminars on recruiting and wondering what you’re doing wrong.

Also, per P&P, members are not allowed to sell on marketplaces such as eBay and Amazon, but what executive is going to out their top sellers?

They say they can’t identify the sellers, but a few online apps make them easy to identify for even a novice.

If I had started with the company when they launched I would be celebrating too that the company sold $4M in nail sets in 24 hours with the launch of the holiday seasonal sets, and sharing that I bought my home with cash.

Instead, I’m the idiot sitting on $5K of product that I will probably never sell. The good news is they have a 20% buyback program when a stylist quits!

P.S. I am not bitter, just broke.

Thanks for sharing your insight. Few questions though;

1. Did Color Street actually sell $4 mill of product to retail customers in 24 hours or is that $4 mill spent by affiliates?

2. Losing 80% of $5,000 spent trying to remain commission qualified on commissions that never come, is “good news” how?

3. If Color Street’s products are “really easy to sell”, how are you sitting on “$5K of product that (you) will probably never sell”?

This was mixed sales by customers and affiliates – I’m assuming the majority were affiliates.

It’s not good news, but at least I can return product through the 20% buyback program as opposed to some MLM companies that don’t allow for any such program.

Since we are not required to buy inventory it was my misjudgement to buy product to stay bonus qualified and help my upline promote.

The way that we make income without a downline is we receive 25% commissions on our sales/purchases weekly. We make our purchases through our own online party that runs for a maximum of two months, and depending on our sales to customers and personal purchases through the party, we earn free sets as “hostess rewards” that we can sell for 100% profit.

We then make additional income monthly on our downline’s sales if we have a downline.

I’m not making sales mostly because I don’t sell at weekend events where, other than eBay and Amazon, the majority of sales are made. They are hard to find in my area and when I do find them they typically have a stylist already booked.

I’ve thought of casting my net wider, but I don’t have the the time and capital to travel too far outside of my local area.

I should have said that if I were to do events I would be successful. I’m just not hustling hard enough!

We are also encouraged to form VIP groups on Facebook to build a customer base and sell to them along with home parties and events. I sold $2,200 in 2018 through happenstance (at the grocery store, while shopping, at school, during play dates), through my group and home parties.

I have a smaller friend base on social media, and of course other people with a larger friend base would do better in that forum.

My conclusion is that even though I ran a successful brick & mortar business for 15 years I believe my personality is just not cut out for a MLM business model.

I have been thinking about joining, but the way “stylists” promote it as “a business opportunity that will change your life” has me weary about it because it is a MLM and it’s sold at Walmart and Ulta Beauty.

I guess I don’t have any questions, but it’s just hard for me to believe that “stylists” are really making meaningful profit.

If it’s too good to be true, it probably is right?

If you’re being pitched a business opportunity over the products, then you already know the answer.

I am a Senior Director with Color Street. I did not start right when the company l launched, but a few months later, in September of 2017. I was able to quit my job and to work my Color Street business “full time” after 8 months in business.

I have not had any problem ever reaching the $300 PV each month to be “bonus qualified” for the month. Many months my sales have been over $1200.

I do anywhere from 4-10 online parties each month, occasional home parties, and some vendor events throughout the year.

I wanted to point out that while our French sets are $14, they are buy one get one free, which actually makes them $7 each, which is super comparable to Incoco. The rest of our strips are buy 3 get 1 free, which also makes them cheaper than at first glance.

This is the information we received from our home office (Jan 2019) about Incoco sales. Maybe it will help clear a few things up.

I saw that you asked, “Did Color Street actually sell $4 mill of product to retail customers in 24 hours or is that $4 mill spent by affiliates?” What do you mean by affiliates?

From my understanding, the $4 million in sales was solely from orders from the Color Street website through all of the different stylists.

Like another comment said, stylists are not allowed to sell on other sites, such as ebay, amazon, etc (although just because it’s against our P&P doesn’t mean it doesn’t happen – some may be stylists, previous stylists, or customers).

While the P&P (which is in the process of being updated from my understanding) may say that we can sell for whatever price we want, we are NOT allowed to publicly sell for a different price. So if we do offer a discount, it has to be privately to our own customers.

I hope this helps clear a few things up!

Glad to hear you’re running your Color Street business with an emphasis on retail.

That wasn’t categorically stated – leaving me to question how much of the supposed $4 mill was true retail.

With respect to:

I’d have thought if the nail strips were retail viable that figure would be much higher. I sincerely hope the discrepancy is not due to affiliates making up the vast majority of purchases.

Affiliates == distributors. What you are. Retail customers have no access to the compensation plan. They purchase product and haven’t signed up for an affiliate account.

Incoco is no longer available online (only through Walmart/Ulta), so anyone who visits the Incoco website will be redirected to Color Street to shop. Very few people actually buy Incoco (only 3% of Color Street’s total sales were from Incoco), so everything else, the rest of the however many millon in dollars we do each year (I don’t have current numbers off the top of my head) is from Color Street retail – through Color Street’s website.

There are no other “affiliates” other than stylists. Did I answer that?

Walmart isn’t exactly small potatoes though. If Incoco has exposure there I’d have expected sales revenue to be a much larger percentage.

Unless of course nobody is buying … which begs the question why?

Affiliates == distributors == stylists. I only clarified because you asked what I meant by affiliates.

Thanks for the clarification.

From what I understand, before Color Street started, most of Incoco’s sales were from their website. So I don’t think Walmart has ever had the majority of their sales.

People must just not notice them, be aware of them, or be looking for them in the stores. Not sure the answer to that!

I was in Walmart yesterday looking for nail strips and only found one, something called “Dashing Diva Gloss.”

An employee working nearby saw me looking at them and told me that I shouldn’t ruin my nails with them like they ruined hers.

After conversing with her for a few minutes, we (my sons were with me) gave her the breast cancer strips because she is a survivor.

Just the amazing connections we make with people is worth the monetary cost!

Even if you pay full retail, a manicure costs a lot more than a mere $13!

If Incoco only represented 3% of retail business in 2018 then why is it stated, the relationships with the 2 large box companies has enabled Color Streets success?

Only 3%, then why maintain this relationship with with the box companies?

No mention of the Coconut line also sold at Walmart and Walmart online for a much cheaper price then Incoco. Many colors to chose from on line.

Stylists of Color Street are in direct competition with Walmart & Ulta due to their own company’s continued “relationships” (contracts) with the boxes. It’s a win win for Fa Park.