Cappmore FX Review: “Copy trading” securities fraud

Cappmore FX fails to provide ownership or executive information on its website.

Cappmore FX fails to provide ownership or executive information on its website.

Cappmore FX’s website domain (“cappmorefx.com”), was first registered in November 2021.

The private registration was last updated on January 18th, 2023, which appears appears to be the time Cappmore FX’s owner(s) took possession of the domain.

This is based on Cappmore FX’s official FaceBook page being created in March 2023.

Further research reveals Cappmore FX affiliates citing Ajay Arya as CEO of the company.

Other than noting Arya appears to be an Indian national, I wasn’t able to put together a verifiable history.

Cappmore FX marketing material cites Arya as founder of “The Teachable Tech”:

This corresponds with Saksham Trading Academy, an Indian company offering forex trading courses:

We, SAKSHAM TRADING ACADEMY (The Teachable Tech), situated at Karad, Maharashtra are one of the leading institutes for stock market trading and offer the best and uniquely designed courses.

This would suggest Cappmore FX is also being operated out of India.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

Cappmore FX’s Products

Cappmore FX has no retailable products or services.

Affiliates are only able to market Cappmore FX affiliate membership itself.

Cappmore FX’s Compensation Plan

Cappmore FX affiliates invest funds on the promise of passive returns:

- Classic – invest $10 or more

- Elite – invest $500 or more

- ECN – invest $2500 or more

The MLM side of Cappmore FX pays on recruitment of affiliate investors.

Referral Commissions

Cappmore FX pays a commission on personally recruited affiliates who invest.

Referral commission rates are determined by how much a newly recruited Cappmore FX affiliate invests:

- recruit a Classic tier affiliate and receive $6

- recruit an Elite tier affiliate and receive $9

- recruit an ECN tier affiliate and receive 12

ROI Match

Cappmore FX pays a ROI Match via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

Cappmore FX caps the ROI Match at five unilevel team levels.

The ROI Match is paid as a percentage of passive returns received across these five levels as follows:

- level 1 (personally recruited affiliates) – 8%

- level 2 – 2%

- level 3 – 1%

- levels 4 and 5 – 0.5%

Joining Cappmore FX

Cappmore FX affiliate membership is tied to an initial minimum $10 investment.

Cappmore FX Conclusion

Cappmore FX represents it generates external revenue via copy trading, purportedly tied to forex and CFD trading.

Cappmore FX is an industry leader in the forex & CFD markets.

It is our promise to deliver a powerful, user-friendly, and fair trading platform.

SimilarWeb tracks negligible website traffic for Ajay Arya’s other company, Saksham Trading. This suggests Shaksam Trading is a failed business, and so now we have Cappmore FX.

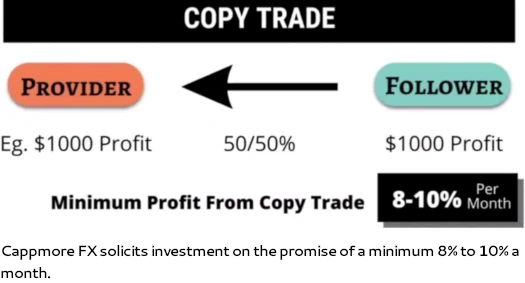

The problem with Cappmore FX is Ajay Arya is pitching a “minimum 8% to 10% a per month”.

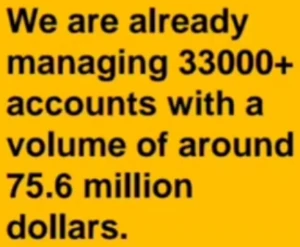

That alone is problematic but, despite only existing for a few months, Cappmore FX also claims to already be managing $75.6 million.

8% of $75.6 million comes to a minimum of $6 million dollars a month.

8% of $75.6 million comes to a minimum of $6 million dollars a month.

If Cappmore FX is already making that amount each month;

- why are they selling access for just $10; and

- why do they need your money at all?

On the regulatory front, Cappmore FX is not registered to offer securities in any jurisdiction. This means that at a minimum, Cappmore FX is committing securities fraud.

If Cappmore FX was legitimately trading at a minimum of 8% to 10% a month, why would they operate illegally by committing securities fraud?

If we combine Saksham Trading having failed, Cappmore FX committing securities fraud and its business model and marketing making no sense, we’re left with a fraudulent investment opportunity that is likely a Ponzi scheme.

As with all MLM Ponzi schemes, once affiliate recruitment dries up so too will new investment.

This will starve Cappmore FX of ROI revenue, eventually prompting a collapse.

The math behind Ponzi schemes guarantees that when they collapse, the majority of participants lose money.

Oz. Cappmore is a Forex broker that provides copy trading. Any forex trader can become a copy trading provider on the platform.

Ajay Arya is simply ONE of those copy trading providers. Ajay Arya is not the CEO or founder of Cappmore. Ajay Arya does own Saksham Trading Academy, but that is a completely separate and non-related entity to his FX copy trading.

So please re-do your research now that I’ve defined the scope a little bit for you here.

Prove it by naming another founder/CEO of Cappmore FX then. I’ve already provided evidence to the contrary.

Oz. My understanding is the 8% ( and remainder of the 5 level payout ) that CAPPMORE pays is based off of FEES charged in the Forex Trading process itself.

Recruiting isn’t mandatory and if you don’t recruit anyone, you don’t earn any of those benefits.

But Cappmore (the FX copy trading platform) is independent of the copy trader (“provider”). It is Ajay Arya that is claiming he’ll make you 8-10% a month, not Cappmore. And Ajay keeps 50% of the profits of whatever he makes. So the 8-10% is after he takes out his 50%.

Oz, I love your concept. Business exists, so therefore it’s automatically a scam.

I don’t know WHO the founder/CEO of Cappmore is. I never claimed to. But it’s not Ajay Arya and there will be no fewer than 6 people I’m sure who will back up what I’ve said here.

That’s not what I came across in my research.

This is false. The word “scam” doesn’t appear anywhere in this review. You concluded Cappmore FX is a scam yourself.

What we have called out is Cappmore FX’s securities fraud, which tellingly you haven’t addressed.

Time to stop making excuses for scammers Brian.

Thank you for confirming Ajay Arya is the founder and CEO of Cappmore FX. Have a nice day.

Whatever you call it a scam, cheat, fraud, etc. even so called licensed FOREX platforms will eat your money and you will never know what happened. Same with margin trading of crypto. Better to buy lottery tickets from the state at least some of that goes to education. Avoid anything licensed or based in the Seychelles or Cyprus.

Hi sir it’s really scam because Ajay saurabh and team y they r undergrounded ….

Not surprising. Cappmore’s official FaceBook page was abandoned on July 24th, about a week after this review was published.

When is the cappmorefx.com gonna be live and give our withdrawal?

Why on Earth would that happen? You invested into a Ponzi scheme and your money is gone. Sorry for your loss.