CapitalSpring Review: Dubai MLM crypto Ponzi

CapitalSpring fails to provide ownership or executive information on its website.

CapitalSpring fails to provide ownership or executive information on its website.

CapitalSpring’s website domain (“credi-spring.org”), was privately registered on August 17th, 2025.

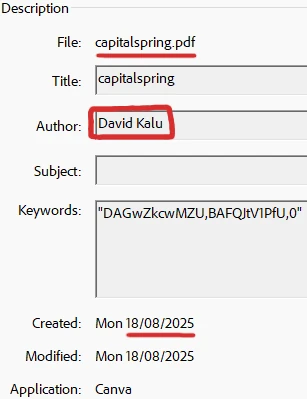

One name we can attach to CapitalSpring is David Kalu, author of CapitalSpring’s marketing documents:

In an attempt to appear legitimate, CapitalSpring provides a London, UK address on its website. This address doesn’t appear to have anything to do with CapitalSpring.

Of note is CapitalSpring providing different addresses in its marketing documents:

Mauritius is a scam-friendly jurisdiction with little to no regulation of MLM related securities fraud.

Due to the proliferation of scams and failure to enforce securities fraud regulation, BehindMLM ranks Dubai as the MLM crime capital of the world.

BehindMLM’s guidelines for Dubai are:

- If someone lives in Dubai and approaches you about an MLM opportunity, they’re trying to scam you.

- If an MLM company is based out of or represents it has ties to Dubai, it’s a scam.

If you want to know specifically how this applies to CapitalSpring, read on for a full review.

CapitalSpring’s Products

CapitalSpring has no retailable products or services.

Promoters are only able to market CapitalSpring promoter membership itself.

CapitalSpring’s Compensation Plan

CapitalSpring promoters invest USD equivalents in cryptocurrency.

This is done on the promise of advertised passive returns:

- Spring Start Plan – invest $400 to $1900 and receive 0.15% an hour

- Growth Flow Plan – invest $2000 to $4900 and receive 0.3% an hour

- Harvest Plus Plan – invest $5000 to $39,900 and receive 0.5% an hour

- VIP Ultimate – invest $40,000 to $99,900 and receive 10% a day

- VIP2 Ultimate – invest $100,000 to $100,000,000,000 and receive 15% a week

CapitalSpring pays referral commissions via a unilevel compensation structure.

A unilevel compensation structure places a promoter at the top of a unilevel team, with every personally recruited promoter placed directly under them (level 1):

If any level 1 promoters recruit new promoters, they are placed on level 2 of the original promoter’s unilevel team.

If any level 2 promoters recruit new promoters, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

CapitalSpring caps payable unilevel team levels at five.

Referral commission rates are determined by which plan new investment is made in:

- investment into Spring Star Plan pays 5% on level 1 (personally recruited promoters), 10% on level 2, 15% on level 3, 20% on level 4 and 25% on level 5

- investment into Growth Flow Plan pays 10% on level 1, 20% on level 2, 30% on level 3, 40% on level 4 and 50% on level 5

- investment into Harvest Plus Plan pays 5% on level 1, 10% on level 2, 15% on level 3, 20% on level 4 and 30% on level 5

- investment into VIP Ultimate pays 2% on level 1, 5% on level 2, 8% on level 3, 10% on level 4 and 15% on level 5

- investment into VIP2 Ultimate pays 8% on level 1, 12% on level 2, 16% on level 3, 20% on level 4 and 30% on level 5

Joining CapitalSpring

CapitalSpring promoter membership is free.

Full participation in the attached income opportunity requires a minimum $400 investment.

CapitalSpring solicits investment in undisclosed cryptocurrencies.

CapitalSpring Conclusion

Capital Spring represents it generates external revenue via “professional traders”.

CapitalSpring fails to provide verifiable evidence it generates external revenue of any kind.

Furthermore, CapitalSpring’s business model fails the Ponzi logic test.

If CapitalSpring already has “professional traders” generating 15% a week, what does it need your money for?

As it stands, the only verifiable source of new revenue entering CapitalSpring is new investment.

Using new investment to pay ROI withdrawals would make CapitalSpring a Ponzi scheme.

As with all MLM Ponzi schemes, once promoter recruitment dries up so too will new investment.

This will starve CapitalSpring of ROI revenue, eventually prompting a collapse.

The math behind Ponzi schemes guarantees that when they collapse, the majority of participants lose money.

Update 28th September 2025 – CapitalSpring has collapsed. As at the time of this update CapitalSpring’s website has been disabled.

I read:

Looks like CapitalSpring collapsed between me researching for this review and publication.

@Oz, the website is accessible again.

These scammers should do their homework better! 😀 Quote from the website.

However, ARC Consultancy & Development LTD is marked on the map, which was actually located at the address given when it was founded in May 2020.

postimg.cc/67nzqFDw

credi-spring.org/contact

ARC Consultancy & Development LTD is a dormant company and has two directors: Daniel Masih and Inderjeet Masih.

find-and-update.company-information.service.gov.uk/company/12603949/officers