CannerGrow Review: Cannerald Ponzi reboot w/ CADT token exit-scam

![]() CannerGrow claims to operate in the MLM cryptocurrency niche.

CannerGrow claims to operate in the MLM cryptocurrency niche.

CannerGrow’s website domain (“cannergrow.com”) was registered on April 5th, 2019.

Sascha Waeschle is listed as the owner, through an address in Rottweil, Germany.

According to CannerGrow’s website, the company is “a project founded by Cannerald”.

Cannerald claims to be a “Swiss research and production company of cannabis.”

According to a Cannerald marketing presentation;

The company was founded in 2017 as a project of MSL Industries GmbH and was spun off as a separate company on 18.07.2018 as Cannerald GmbH based in Pfäffikon, Switzerland.

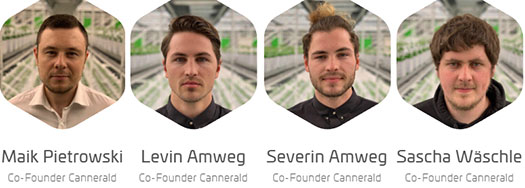

The four founders of Cannerald, Sascha Adrian Waeschle, Severin Jem Amweg, Levin Kim Amweg and Maik Marcel Pietrowski founded the company with the aim of becoming Europe‘s largest cannabis producer and exporter.

The only link to MLM I was able to establish is a June 2019 interview, in which Maik Pietrowski states he

started in multi-level marketing for insurance in 2014.

Followed by the sale of vacuum cleaners and then the online marketing with various networks.

Cannerald’s website domain was registered in late December 2017. The company claims it was “registered in July 2018.”

Despite launching roughly a year ago, Alexa tracks next to no traffic to Cannerald’s website (rank ~5 million).

This suggests Cannerald as a stand-alone business was a flop.

CannerGrow appears to have been launched a few months ago to resuscitate what’s left of Cannerald.

Read on for a full review of the CannerGrow MLM opportunity.

CannerGrow’s Products

CannerGrow has no retailable products or services, with affiliates only able to market CannerGrow affiliate membership itself.

CannerGrow’s Compensation Plan

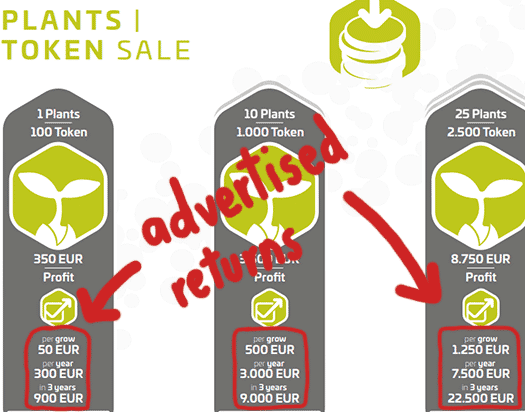

CannerGrow affiliates invest funds on the promise of “expected value” advertised returns.

- 1 Plants – invest €350 EUR and receive €50 EUR every two to three months

- 10 Plants – invest €3500 EUR and receive €500 EUR every two to three months

- 25 Plants – invest €8750 EUR and receive €1250 EUR every two to three months

- 100 Plants – invest €35,000 EUR and receive €5000 EUR every two to three months

Referral Commissions

CannerGrow pays referral commissions via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

CannerGrow caps payable referral commissions at five unilevel team levels.

Referral commissions are paid out as a percentage of funds invested across these five levels as follows:

- level 1 (personally recruited affiliates) – 5%

- level 2 – 2%

- levels 3 to 5 – 1%

ROI Matching Bonus

CannerGrow pays a matching bonus on returns paid to unilevel team affiliates.

The ROI Matching Bonus is capped at the same five levels as referral commissions (see above):

- level 1 – 10% ROI match

- level 2 – 4% ROI match

- levels 3 to 5 – 2% ROI match

Joining CannerGrow

CannerGrow affiliate membership is attached to an initial €350 to €35,000 EUR investment.

Conclusion

CannerGrow represents that its affiliates are investing in cannabis plants.

CannerGrow is launching a Plant Sale.

With our plant sale, every one will be able to participate from this billion dollar Market.

In our facilities, we are able to produce cannabis in premium quality.

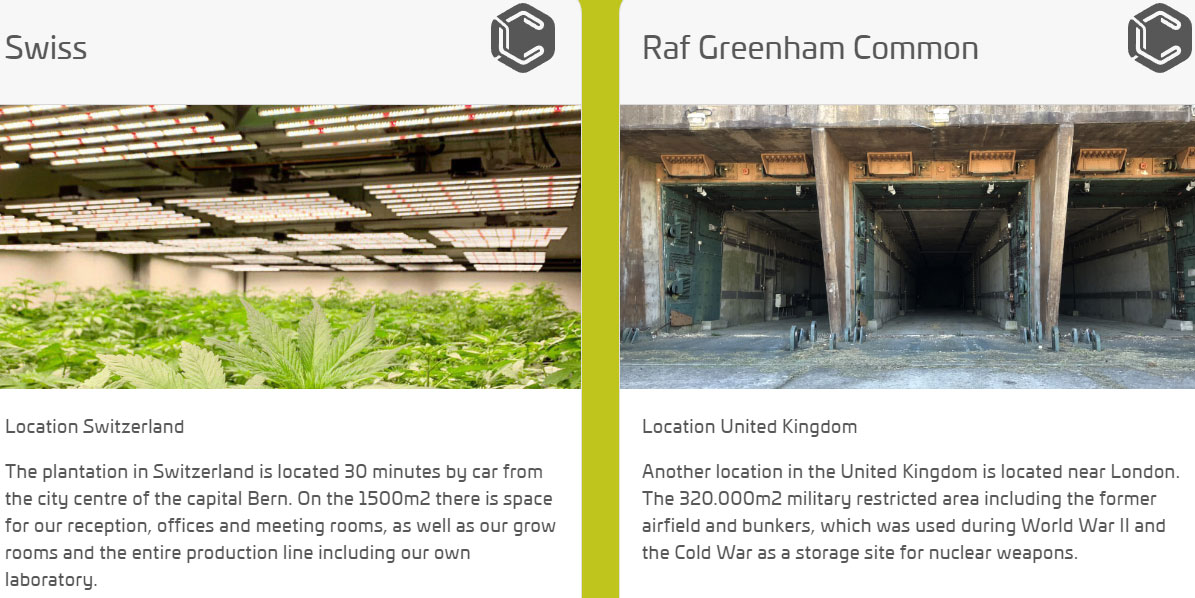

As part of Cannerald’s business operations, the company purportedly has two growing warehouses in Switzerland and the UK (click to enlarge).

Every digital sold Plant will represent a physical space of a plant in our Growroom.

We offer the service to grow Plants on this place, it will be harvested every 2-3 month. You will get full control over the harvest.

Without even trying to validate CannerGrow’s claims, an obvious question presents itself:

CannerGrow’s advertised returns are purportedly 50% of revenue generated per plant. The other 50% is kept by the company.

If Cannerald’s business operations are capable of generating a consistent €10,000 EUR return on a €35,000 investment “every 2-3 month(s)”, why did Cannerald flop?

Remember, Cannerald’s website was registered in December 2017. So what has its founders been doing since then?

Secondary concerns regarding CannerGrow’s MLM opportunity are regulatory in nature.

Quite obviously CannerGrow is offering a passive investment opportunity. It’s affiliates invest funds into the company, do nothing and collect a passive return.

This constitutes a securities offering, requiring Cannerald to register its CannerGrow investment opportunity with financial regulators.

Cannerald makes no representation on its website that it has registered in any jurisdiction it solicits investment in.

This means that, irrespective of everything else, Cannerald and CannerGrow are committing securities fraud.

Not that that’s probably going to bother most of their investors. As I write this Alexa currently pegs Russia as accounting for 76% of traffic to CannerGrow’s website.

Without writing off the country entirely, there’s typically only one type of MLM investment opportunity Russians are interested in.

As part of their regulatory reporting requirements, CannerGrow is required to disclose how and to whom they’re purportedly selling their cannabis harvests to.

They don’t do this, leaving new investment as the sole verifiable source of revenue entering CannerGrow.

Using new investment to pay existing affiliates a two to three monthly return makes CannerGrow a Ponzi scheme.

Was Cannerald launched with the intention of being a Ponzi scheme back in 2017/2018? No idea. But that’s what the business is today.

As with all MLM Ponzi schemes, once affiliate recruitment slows down so too will new investment.

This will starve CannerGrow of ROI revenue, eventually prompting a collapse.

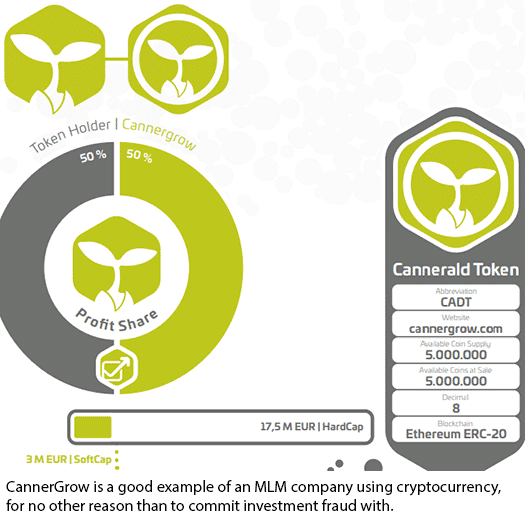

In order to screw over their investors as much as possible, CannerGrow will exit-scam through their CADT token.

For absolutely no legitimate reason whatsoever, CannerGrow is launching CADT to facilitate their investment fraud.

Cannergrow is planning a Plant | Token sale with a hard cap of 17.5 M EUR.

The Token will be an ERC-20 Smart Contract Token on the Ethereum Blockchain.

Every 100 Token are backed up with 1 Plant (50.000. Plants | 5.000.000 Token).

CADT exists solely to convert investor bitcoin into something the company can use to track investment and returns.

Withdrawals will be processed through an internal exchange, up until invested funds run dry.

At that point CannerGrow will pay some dodgy exchange to list CADT publicly.

Once listed, Cannerald’s founders capitalize on the inevitably hype pump and sell off as much CADT as they can.

They then exit with what’s left of invested funds.

CannerGrow affiliates meanwhile are left bagholding worthless CADT, which promptly dumps to $0 after being listed.

This is the classic MLM crypto exit-scam that has played out over and over again before.

Here we go again…

Is Ari Maccabi promoting this from the Philippines?

Check!

Is Steve Lawson promoting this from the U. K.?

Check!

What are the chances this is the latest in a long line of Ponzi SCAMS these crooks have sold to gullible idiots?

>> 100% <<

Step right up folks! Lose all your money again …

SD

This article is fairly new, but without any links ..

I couldn´t find the homepage where to invest my money into the ICO. if you have one, please let me know.

a revenue of 50Euros every 2nd to 3rd month is not far fetched and a promise to bring the stars to earth .. it´s realistic , you have a return of investment of 14-18 month .. what´s the big fucking deal here?

of course the company has too little profit, that will be a problem. however it´s registered in the “handelsregister” in switzerland, cannerald.com/legal

and handelsregister-hra.ch/online-handelsregister-schwyz/

just search for cannerald. as always the future will tell the truth.

The token exit-scam comes after they’ve got your money. Nevertheless I still provided screenshot evidence of CannerGrow’s token plans.

Being far fetched or not is not a substitute for regulatory compliance.

Securities in Switzerland are regulated by the Swiss Financial Market Supervisory Authority.

You can verify CannerGrow is not registered to offer securities in Switzerland here – finma.ch/de/finma-public/bewilligte-institute-personen-und-produkte/

Basic incorporation is not a license to offer securities and with respect to securities regulation, is meaningless.

Yes, Ari Maccabi one of the biggest serial scammers of all time is promoting this. Definitely one to stay away from.

Ari Maccabi is just evil. Scam after cheezy scam. A horrible human being.

Also this: sexoffender.publicrecordrepository.com/79/21/792111-schlomo_aryeh_maccabi.pdf

I see why he and Scoville got along.

Lawson also awful & seems broke.Cant even pimp a ponzi properly.

The list of low life “leaders” (fraudsters) jumping on the Ponzi bandwagon is growing.

Matt Feast. Scott Donohue. Steve (loser) Lawson. Ari Maccabi (worth mentioning more than once). Ryan Con(artist)ly. Noel Murtagh. Alan Kavanagh.

Did I mention Ari Maccabi? Lol

Ryan Conley is pimping this one as well. I guess KaratBars isn’t rolling in big enough to keep him from expanding his “portfolio” of frauds.

Ari Maccabi has a new student who is helping him push crypto scams.

Aaron Civitarese (Civi). His concept works pretty well. Very authentic and very sympathetic on the surface. And he has cool sales funnels.

It will take you a few clicks to realize he is promoting a Ponzi. I bet Ari taught him that.

He’s been hating on Ponzi wallets, promoting Arbistar at the same time. Lol.

Now, he is obviously on that Cannabis deal.

facebook.com/100022881144091/posts/509642899808410?sfns=mo

They will have to cover up all Switzerland with Cannabis plants to meet this huge demand. That thing is all over Facebook now.

And obviously there is unlimited availability of plants. Lol.

Well, I’ve visited the plant myself and seen it, in Switzerland, I’ve seen the plants and talked with the Founders and the growers.

Hmm… a lot of effort for all this should be a scam? such a nonsense, there is probably someone jealous or so! Everybody can check the peoples background or from their partners like OSRAM.

And they don’t do an ICO or Tokensale it is a plant sale just fyi.

Which

1. doesn’t prove external revenue is being used to pay affiliate returns; and

2. isn’t a substitute for regulatory registration (securities).

One can only ask why a supposedly legitimate company has chosen and continues to operate illegally around the world.

Well, I know the answer. You know the answer.

The only people pretending not to know the answer are those promoting CannerGrow for a quick buck.

Exit-scam comes later. And denying it isn’t/wasn’t part of the plan is pointless, I included a screenshot in the review.

According to Cannergrow they’re growing a strain called Harlequin. Recently they started waving a licence to cultivate cannabis in Switzerland with a thc content of less that 1%, Harlequin has a 7% thc content.

Not seen any mention of who they intend to sell the crops to but they also need to have a licence probably with similar stipulations about thc.

So what happens if they harvest a crop they can’t sell legally?

facebook.com/groups/2291672444427580/permalink/2293620904232734/

Considering CannerGrow is already advertising returns and Cannerald was founded in 2017, shouldn’t the question be where is the audited proof of external revenue?

Peter says:

For the non suckers – Its called the long con.

What a collection of scumbags…

So you want to tell me that they invest nearly 4 Millions into a cannabis factory (alone the lights are worth more than 750k as the prices are on the website from Fluence) to exit-scam with their real names and people like Stefan Amweg who is know for selling a company to Nokia and handling start-ups?

Swiss law is one of the hardest ones out there as far as i know, so they would be stupid to do it in such a country as Cannerald was feautured on the front page and page 1+2 on one of the biggest newspaper in Switzerland and even the radio as I heard.

And would Osram or Montel partner up with them if you would be right or the “Rauch” company in Macedonia?

CannerGrow are telling you all of that, and they’ve provided no audited evidence to back up any of their financial claims.

As for the newspaper bullshit and Nokia, legitimacy by association doesn’t exist.

Either CannerGrow is operating legally or it isn’t.

It isn’t, and so it doesn’t matter what Stefan Amweg did or didn’t sell, which newspaper published Cannerald marketing material, which radio station said what, or whether Osram, Montel, or any other company partnered up them.

Geez, why is it with every new Ponzi scheme that gains traction the same fucking gullible idiots fall for the same bullshit ruses?

Waht about all of this?

(Ozedit: snip, see comment #15)

Feel free to post Cannerald’s or CannaGrow’s securities registration documents.

Meaningless marketing spam has been addressed in #15.

I did not wanted to spam just show you some official statements from Osram about Cannerald.

They are not an ICO or Token Sale, they sell plants, i haven’t visited their factory as Peter did but I do not agree with your sight of things.

If they would do illegal things the Swiss SEC would have shut them down already!

They wanted to start as an Token Sale but changed since then to just a plant sale as their lawyers advised them to but thats just what my informations are.

I would like that you visit them Oz and ask them your questions that would help all of us in the end.

It should be obvious that “official” statements from the operators of an unregistered securities scheme carry no weight.

Well I sure as shit didn’t make up the screenshot from CannerGrow’s official compensation plan included in the review.

More evidence (May 20th):

twitter.com/mauricem0001/status/1130347099806162944

More evidence (Official Cannerald Twitter account, June 9):

twitter.com/cannerald/status/1137621372467843073

The fraudulent investment scheme is quite recent as I understand it. Regulation is reactionary and takes time.

In any event the absence of regulatory intervention does not legitimize fraudulent business operations.

Whether FINMA comes knocking tomorrow, six months, a year or never, Cannerald and CannerGrow are operating illegally regardless.

I don’t need to visit Cannerald to get an answer on “why haven’t you registered your securities offering?”

Why should they be registered if they no long have anything to do with a tokensale thing.

you are right with the picture from Twitter, but in my opinion they then checked that they have to do it in another way to comply with the law which in my eyes is positive for us as investors, of course only time will tell.

@Leonardo – I think you are idiot. You call yourself investor.

When raise money from and promise a return you need to register with security body. Plus a viable business can always raise money from professional investor with paying MLM commissions.

Tell me one MLM that raises money from stupid people like that has fulfilled their obligations. All of them 6 month down the line changed their marketing shit.

Off-course people like always found the next best thing to collect commissions. You a fucking commission juncture, you are not investor.

Does anyone know a marketer by the name of Darren Little from Canada? He is promoting this Krypto and Cannibis Explosion as he puts it.

Claims nearly 500 joined his team in 72 hours. He was in Empower Network and Digital Alltitude etc.

@Leonardo

Because irrespective of whether a passive investment opportunity is offered through a token or not, it’s still a securities offering.

Unregistered securities are illegal the world over.

Yes.

Google “Darren Little” scam.

SD

Yes another Scammer Darren Little from Canada is always in partnership with Ari Maccabi…

Our friend dickie Walletblaster Arblaster is prompting this on his business FB Page.

Aaron Civitarese (Civi) is one of the founders in another new ponzi scheme called coinbitpro.

CoinBitPro is single-level commissions unless I’m missing something.

We are in 2022 !! So CannerGrow is still a scam and Ponzi ??

Thank you for publicly admitting your mistake! Please create a detailed article about your mistakes and apologies!

thank you !!

Yup. Time doesn’t legitimize a Ponzi scheme.

Alexa shows CannerGrow website traffic from Vietnam and Morocco. Another crypto bro Ponzi scheme pillaging the third world.

Those CADT bags must be heavy.

Zero judicious and insightful arguments, you completely disagreed, it’s a shame… ^^

Why waste your time arguing when you have facts?

Time kills every Ponzi, doesn’t matter how long it scams people for. Sorry for your loss.

already learn the definition of a Ponzi, then come see me again… lol.

Ponzi = new investment used to pay returns. I.e. CannerGrow’s business model.

Dumbass confirmed. Spam-binned.

Another cannabis related scam collapses

eldiario.es/catalunya/proyecto-inversion-cannabis-juicyfields-colapsa-deja-miles-inversores-atrapados_1_9175080.html

I had a few readers write in about Juicy Fields. Ponzi, yes. Scam, yes. But not MLM so I didn’t cover it.

Oz wrote in August 2019:

A lot has changed since then. The domain registration was updated on April 6, 2022 by Sascha Wäschle and also contains his private data in Germany and he named his own website code.gt.

postimg.cc/JGnxzDbK

The visitor statistics of cannergrow.com from January to March 2024 named the following countries: Germany (59.38%), Switzerland (14.08%), United States (11.78%), Austria (6.46%) and Canada (3.33%).

postimg.cc/z3SDG3JL

The visitor statistics of cannergrow.com from August to October 2024 show significantly higher figures. Now only three countries are mentioned: Germany (91.03%), Switzerland (8.03%) and Spain (0.94%).

postimg.cc/F1F80Kyk

Perhaps the number of visitors will fall again when this warning from the German BaFin from October 14, 2024 becomes known.

bafin.de/SharedDocs/Veroeffentlichungen/EN/Verbrauchermitteilung/weitere/2024/meldung_2024_10_14_CanneraldAG_en.html

The current imprint of cannerald.ch

postimg.cc/9RP42p80

cannerald.ch/imprint

Note: If you click on the “Legal” button on the cannergrow.com website, you will be redirected to cannerald.ch.

Cannerald AG, based in Fraubrunnen (Switzerland), was founded on September 22, 2020 and is managed by the following persons: Levin Kim Amweg, Stefan Amweg and Philipp Oser.

Sascha Wäschle and Maik Pietrowski are no longer mentioned in the commercial register.

moneyhouse.ch/de/company/cannerald-ag-708736771

More interesting details will follow.

Thanks for the update Melanie.

I was wondering how I missed that as I do check BaFin’s website for warnings each month. That Cannerald warning doesn’t show up in their warning list.

The scam portal cannergrow.ch was accessible until yesterday. Here is the proof:

web.archive.org/web/20241120151920/https://cannergrow.ch/

Today I get this message:

postimg.cc/Hr2gV9sF

The same error message on cannergrow.com 😀

postimg.cc/w1Vn2xNr

On October 19, 2023 the domain cannergrow.shop was registered and updated on October 20, 2024, but on the website someone calling himself Samuel Oliveira de Carvalho Matos claims the following:

postimg.cc/ZBFKZBDL

If the domain cannergrow.shop was updated on October 20, 2024 (see screenshot), it cannot have expired. I think this message is a fake. No registrar would use a private hotmail address.

postimg.cc/MnKZwpy7

Oops! I just see that the domain cannergrow.shop can be purchased for 673.97 euros.

postimg.cc/p5y0t72Y

cart.godaddy.com/go/checkout?t=1732180490092&tmskey=dpp_skip_config&itc=am_GDCart_affiliate_partner#/basket

Bernd Reinders from Bocholt, a well-known serial fraudster in Germany, describes himself on XING as an independent Cannergrow partner.

postimg.cc/S2yH2DGH

xing.com/profile/Bernd_Reinders2/web_profiles

His photo enlarged:

postimg.cc/dhgqCP7p

For the Cannergrow scam, Bernd Reinders privately registered the domain cannabis-participation.com on August 9, 2020 and updated it on January 21, 2021.

postimg.cc/rdRB2DwY

Bernd Reinders’ contact details on cannabis-participation.com:

postimg.cc/XBYV69D6

Bernd Reinders had already registered his first domain for the Cannergrow scam on May 31, 2020 and updated it on January 21, 2021:

my-cannabis-invest.com

postimg.cc/qgbzpS19

Bernd Reinders’ contact details on my-cannabis-invest.com:

postimg.cc/PP1chs44

my-cannabis-invest.com/cannergrow-cannerald-cannerrec/english/business_presentation.php

It will come as no surprise to any of our readers that Bernd Reinders was also involved in the OneCoin scam. He is also currently involved in the Skainet Systems scam.