BNP Paribas USDT Review: Stolen identity “click a button” Ponzi

BNP Paribas USDT fails to provide ownership or executive information on its website.

BNP Paribas’ website domain (“catousd.com”), was registered with bogus details on June 12th, 2025.

Of note is BNP Paribas’ website domain being registered through the Chinese registrar Alibaba (Singapore).

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

BNP Paribas USDT’s Products

BNP Paribas USDT has no retailable products or services.

Affiliates are only able to market BNP Paribas USDT affiliate membership itself.

BNP Paribas USDT’s Compensation Plan

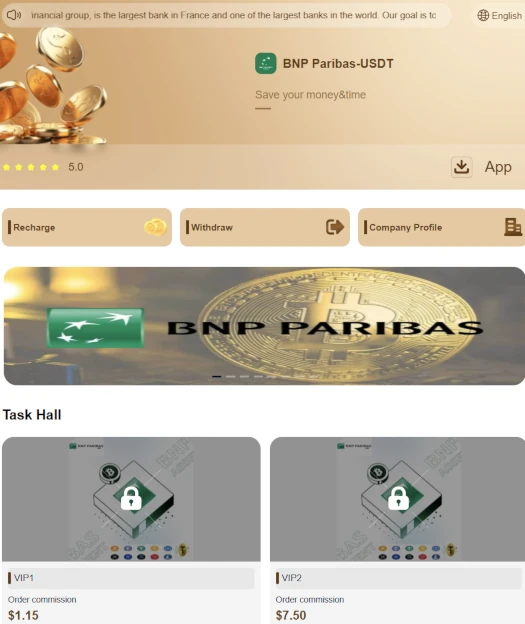

BNP Paribas USDT affiliates invest tether (USDT). This is done on the promise of advertised returns:

- VIP1 – sign up as a BNP Paribas USDT affiliate, click buttons and receive 1.15 USDT a day (note cant withdraw unless invest at VIP2 or higher)

- VIP2 – invest 11 USDT and receive 7.5 USDT a day

- VIP3 – invest 39 USDT and receive 25 USDT a day

- VIP4 – invest 109 USDT and receive 75 USDT a day

- VIP5 – invest 239 USDT and receive 185 USDT a day

- VIP6 – invest 519 USDT and receive 455 USDT a day

- VIP7 – invest 999 USDT and receive 955 USDT a day

- VIP8 – invest 1999 USDT and receive 1855 USDT a day

- VIP9 – invest 3699 USDT and receive 3555 USDT a day

- VIP10 – invest 6999 USDT and receive 6855 USDT a day

- VIP11 – invest 9999 USDT and receive 9855 USDT a day

- VIP12 – invest 16,999 USDT and receive 16,555 USDT a day

The MLM side of BNP Paribas USDT pays on recruitment of affiliate investors.

Referral Commissions

BNP Paribas USDT pays referral commissions on invested USDT down three levels of recruitment (unilevel):

- level 1 (personally recruited affiliates) – 12%

- level 2 – 3%

- level 3 – 1%

Downline Investment Bonus

BNP Paribas USDT rewards affiliates for generating downline investment over a rolling 24-hour period:

- generate 1000 USDT in downline investment and receive 100 USDT

- generate 3000 USDT in downline investment and receive 500 USDT

- generate 8000 USDT in downline investment and receive 1500 USDT

- generate 18,000 USDT in downline investment and receive 3800 USDT

- generate 30,000 USDT in downline investment and receive 7000 USDT

Joining BNP Paribas USDT

BNP Paribas USDT affiliate membership is free.

Full participation in the attached income opportunity requires a minimum 11 USDT investment.

BNP Paribas USDT Conclusion

BNP Paribas USDT is yet another “click a button” app Ponzi scheme.

BNP Paribas USDT misappropriates the name and branding of BNP Paribas, a French multinational bank and financial services company.

Needless to say BNP Paribas USDT has nothing to do with BNP Paribas the French bank.

BNP Paribas USDT doesn’t bother coming up with a ruse. This makes it a typical “task-based” Ponzi scheme.

The assigned task in BNP Paribas USDT is “orders”. This sees BNP Paribas USDT investors log in daily to “click a button”.

Clicking the button daily qualifies BNP Paribas USDT investors to receive advertised daily returns.

Beyond that clicking a button inside BNP Paribas USDT does nothing. There is no external revenue; all BNP Paribas USDT does is recycle newly invested funds to pay earlier investors.

BNP Paribas USDT is part of a group of “click a button” app Ponzis that emerged in late 2021.

Examples of already collapsed “click a button” app Ponzis using the stolen identity ruse are RadPowerBikes VIP, ABB AI and Websea USDT.

Since 2021 BehindMLM has documented hundreds of “click a button” app Ponzis. Most of them last a few weeks to a few months before collapsing.

“Click a button” app Ponzis disappear by disabling both their websites and app. This tends to happen without notice, leaving the majority of investors with a loss (inevitable Ponzi math).

In the lead up to a collapse, “click a button” Ponzi investors also tend to find their accounts locked. This typically coincides with a withdrawal request.

As part of a collapse, “click a button” Ponzi scammers often initiate recovery scams. This sees the scammers demand investors pay a fee to access funds and/or re enable withdrawals.

If any payments are made withdrawals remain disabled or the scammers cease communication.

Organized crime interests from China operate scam factories behind “click a button” Ponzis from south-east Asian countries.

In September 2024, the US Department of Treasury sanctioned Cambodian politician Ly Yong Phat over ties to Chinese human trafficking scam factories.

Through various companies he owns, Phat is alleged to shelter Chinese scammers operating out of Cambodia.

Myanmar claims to have deported over 50,000 Chinese scam factory scammers since October 2023. With “click a button” app scams continuing to feature on BehindMLM though, it is clearly not enough.

In late January 2025, Chinese ministry representatives visited Thailand. The stated aim of the visit was to tackle organized Chinese crime gangs operating from Myanmar.

In early February 2025, Thailand announced it had cut power, internet access and petrol supplies to Chinese scam factories operating across its border with Myanmar.

As of February 20th, Thai and Chinese authorities claim ten thousand trafficked hostages had been freed from Myanmar compounds.

Also on February 20th, five Chinese crime bosses were nabbed in a wider raid of four hundred and fifty arrests in the Philippines.

On March 19th it was reported that, despite the recent raids and arrests, “up to 100,000 people” are still working in Chinese Myanmar scam factories.

As of April 2025 and in response to a crackdown across Asia, newly opened Chinese scam factories have been reported in Nigeria, Angola and Brazil.

Myawaddy is an area in Myanmar along the Thai border. Myawaddy is under the control of the Karen National Army (KNA).

The KNA, led by warlord Chit Thu (right) and sons Saw Htoo Eh Moo and Saw Chit Chit, protect and profit from organized Chinese criminals running “click a button” Ponzi scam factories.

On May 5th the US imposed sanctions on Chit Thu (right).

On May 5th the US imposed sanctions on Chit Thu (right).

The Treasury said the warlord, Saw Chit Thu, is a central figure in a network of illicit and highly lucrative cyberscam operations targeting Americans.

The move puts financial sanctions on Saw Chit Thu, the Karen National Army that he heads, and his two sons, Saw Htoo Eh Moo and Saw Chit Chit, the department said in a statement, freezing any U.S. assets they may hold and generally barring Americans from doing business with them.

Britain and the European Union have already imposed sanctions on Saw Chit Thu.

A May 25th report cites Myanmar and Loas as having “towering scam economies”. Cambodia however is reported to be a hotspot for Chinese criminal activity.

Cambodia is likely the absolute global epicentre of next-gen transnational fraud in 2025 and is certainly the country most primed for explosive growth going forward.

Cambodia is becoming the centre of an exploding global scam economy driven primarily by Chinese organised crime.

Chinese gangs are reported to operate in Cambodia under the protection of unnamed local politicians.

In June 2025, Amnesty International claimed Cambodia’s government was

“deliberately ignoring” abuses by cybercrime gangs who have trafficked people from across the world, including children, into slavery at brutal scam compounds.

The London-based group said in a report that it had identified 53 scam centres and dozens more suspected sites across the country, including the Southeast Asian nation’s capital, Phnom Penh.

The prison-like compounds were ringed by high fences with razor wire, guarded by armed men and staffed by trafficking victims forced to defraud people across the globe, it said, with those inside subjected to punishments including shocks from electric batons, confinement in dark rooms and beatings.

Regardless of which country they operate from, ultimately the same group of Chinese scammers are believed to be behind the “click a button” app Ponzi plague.

Regardless of which country they operate from, ultimately the same group of Chinese scammers are believed to be behind the “click a button” app Ponzi plague.

Update 9th September 2025 – BNP Paribas USDT has collapsed. As at the time of this update BNP Paribas’ website has been disabled.