AuBit Review: Freeway token “no risk” Ponzi scheme

AuBit operates in the cryptocurrency MLM niche.

AuBit operates in the cryptocurrency MLM niche.

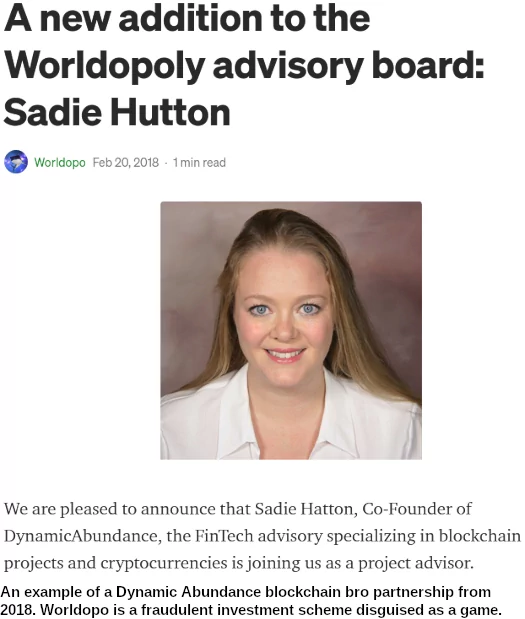

The company is headed by two CEOs; Sadie Hutton and Graham Doggart. Mark Kearns works as AuBit’s Chief Operation Officer.

Hutton, Doggart and Kearns co-founded Dynamic Abundance in 2012.

Dynamic Abundance claims to offer “fintech advisory” and “strategic services”.

Although Dynamic Abundance’s website is still up, the company appears to be defunct as of 2018.

As per their respective LinkedIn profiles, Kearns Hutton and Doggart are based out of Malta.

Malta is a scam-friendly jurisdiction with little to no active MLM regulation.

Despite its owners representing they are based out of Malta, Aubit provides a corporate address in Seychelles on its website.

Not withstanding Seychelles being another scam-friendly jurisdiction with little to no active MLM regulation, the provided address belongs to multiple businesses.

A third corporate address for AuBit International is provided on AuBit’s website linked “legal document”.

This is another virtual address in the Cayman Islands – yet another scam-friendly jurisdiction with no active MLM regulation.

The use of virtual addresses suggests AuBit exists, if at all, in Seychelles and the Cayman Islands in name only.

Interestingly enough AuBit’s own LinkedIn profile states the company has been in operation since 2017. This aligns with AuBit’s website domain, which was first registered in October, 2017.

Whatever AuBit’s initial incarnation was, it appears to have collapsed.

In February 2021 Sadie Hutton published an article on Medium detailing AuBit’s “relaunch”.

This review is based on that relaunch offering.

Read on for a full review of AuBit’s MLM opportunity.

AuBit’s Products

AuBit has no retailable products or services.

Affiliates are only able to market AuBit affiliate membership itself.

AuBit’s Compensation Plan

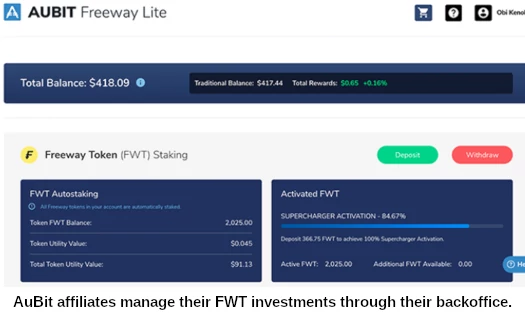

AuBit affiliates invest in the company’s own Freeway token.

AuBit affiliates invest in the company’s own Freeway token.

Once invested in, Freeway tokens are parked in AuBit on the promise of guaranteed annual returns.

- AuBitised Bitcoin Supercharger – 33% annual ROI

- AuBitised Ethereum SuperCharger – 20% annual ROI

- AuBitised Binance Coin SuperCharger – 20% annual ROI

- AuBitised USD Supercharger – 43% annual ROI

- AuBitised Eurosmith Supercharger – 43% annual ROI

- AuBitised Gold Supercharger – 20% annual ROI

- AuBitised ADA Supercharger – 20% annual ROI

- AuBitised DOT Supercharger – 20% annual ROI

AuBit also claims to offer non-supercharged investment plans. No specific details are provided.

Despite the names, AuBit’s investment plans have nothing to do with their namesakes.

These base products simulate the performance of Bitcoin, Ethereum, and BNB respectively plus incremental growth in volume through AuBit revenue rewards.

AuBit arbitrarily determines ROI percentages.

Note that AuBit charges a “buy-in fee” on each investment but doesn’t disclose the fee amount.

The MLM side of Aubit pays on funds invested by recruited affiliates.

Referral Commissions

AuBit pays a 10% referral commission on returns earned by personally recruited affiliates.

Referral commissions are paid in Freeway tokens.

Residual Commissions

AuBit’s pays a 2.5% commission on returns earned by an affiliate’s entire downline.

This downline is tracked via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

AuBit’s marketing states the 2.5% residual commission is paid on the “entire group”.

Joining AuBit

AuBit affiliate membership appears to be free.

Minimum and maximum investment amounts, if any, are not provided.

Conclusion

AuBit is the culmination of years of failed blockchain bro project involvement by its founders.

With Dynamic Abundance having run its course and gone nowhere, Sadie Hutton, Graham Doggart and Mark Kearns have launched their own “no risk” blockchain bro scheme.

The AuBit Freeway is a brand new asset management platform that provides a new route to the world’s top investment products not previously available.

The platform rewards users with redistributed revenues for greater total returns with no additional risk.

In reality AuBit is your typical MLM crypto Ponzi scheme.

Aubit affiliates invest in investment plans through the company’s own Freeway tokens.

Freeway token (FWT) was launched in late 2020 by AuBit. It is publicly tradeable but realistically holds no value outside of AuBit’s investment scheme.

Said investment scheme sees affiliates park FWT with the company in various staking plans.

These plans, as detailed in the compensation section above, guarantee annual returns.

AuBit represents it generates external revenue through ‘little-known but highly-powerful revenue and cash-flow generating sources.’

This is blockchain bro waffle for crypto trading, the ruse of choice adopted by MLM crypto Ponzi schemes.

AuBit’s revenue comes from the trading of its own funding in quant-trading strategies.

Freeway has multiple revenue sources including fees, the quant-trading of its own funds, the growth of its own assets that grow on every trade, and more.

There is no evidence of AuBit trade being engaged in trading. Nor is there any verifiable evidence of AuBit using external revenue of any kind to pay affiliate withdrawals.

Being a passive investment opportunity, AuBit’s scheme constitutes a securities offering.

This requires it to register with financial regulators in every jurisdiction is solicits investment in.

This legally required registration would also see AuBit file periodic audited financial reports.

These reports are the only way for consumers to verify AuBit isn’t just recycling invested funds.

Both the choice to commit securities fraud and failing to provide audited financial reports lends itself to AuBit operating as a Ponzi scheme.

Aware that the US is the top regulator of securities fraud on the planet, up until recently AuBit was careful about openly soliciting investment from US residents.

On August 28th AuBit uploaded a video to YouTube titled “Freeway Lite US: OPEN NOW”:

In the video Sadie Hutton reveals AuBit is now soliciting investment from US citizens and residents.

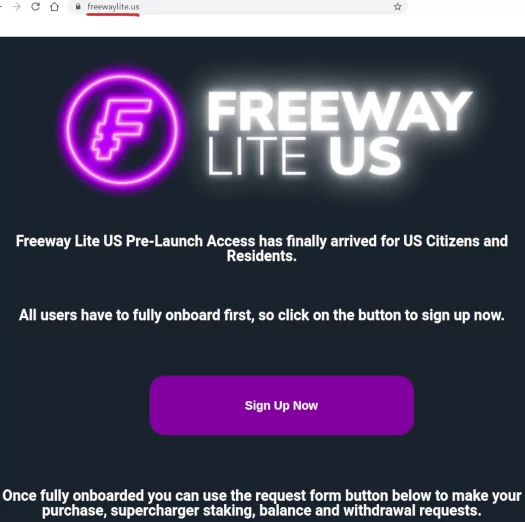

For some reason this is taking place on the secondary AuBit domain “freewaylite.us”:

In the video Hutton goes on to touch on regulatory requirements;

[0:50] The timeline for access to Freeway Lite US has been affected by the most recent US legal advice.

Meaning there are significant additional requirements for the automated and freely accessible system, which include a dedicated US Telegram group and customer service team.

Just so we’re clear, there is nothing about having to have a Telegram group or customer service in the Securities and Exchange Act.

If they were actually serious about satisfying regulatory requirements in the US, the first step is registering AuBit and its executives with the SEC.

A search of the SEC’s public Edgar database reveals neither AuBit or its executives are registered with the SEC.

This means that in the US and everywhere else in the world, AuBit has and continues to commit securities fraud.

As with all MLM Ponzi schemes, once affiliate recruitment dries up so too will new invesmtent.

This will starve AuBit of ROI revenue, eventually prompting a collapse.

With respect to AuBit, the company states returns ‘could be lowered at any time, or even removed entirely.’

That will be your first sign of a collapse, alongside withdrawal issues.

The math behind Ponzi schemes guarantees that when they collapse, the majority of participants lose money.

Update 9th January 2021 – Aubit has rebranded as Freeway.

Update 24th October 2022 – Freeway has collapsed.

Update 19th October 2025 – Whoever controls the Aubit/Freeway YouTube account has closed it (Sadie Hutton or Graham Doggart).

This review originally contained a link to the cited “Freeway Lite US: OPEN NOW” video. Due to the YouTube channel being deleted, that link has been disabled.

Interesting that you chose to ignore solid positives like thier partnership with Origin or Baanx. As well as the $3.2 million invested by Greenbank in Canada last year.

In addition the rebranding of Ardu prime a fully regulated EU brokerage with 22 years experience as Aubit Prime…

Be careful with your reports. Some of your comments could be considered slanderous.

bullshit that doesn’t change the fact AuBit is committing securities fraud?

As would anyone doing actual due-diligence into AuBit. Legitimacy via association isn’t a thing.

AuBit is offering a passive investment opportunity. Aubit needs to register with financial regulators and provide audited financial reports.

The only reason they don’t is because it’s a Ponzi scheme.

Facts are facts.

By rebranding a fully regulated EU brokerage they are registered, in the EU at least. They have done all they can to fit in with regulations wherever possible.

(Ozedit: derails removed)

Yeah that’s not how securities regulation works, in the EU or anywhere else on the planet.

Either AuBit is registered to offer securities and is complying with audited financial reports, or they’re committing securities fraud.

Still haven’t seen any kind of documented proof that there is something illegal going on… Just speculation and conjecture.

@ Colg

For the umpteenth time: libel is written, slander is spoken. What Oz wrote is written. Stop being a moron and learn the difference.

You don’t “fit in with regulations wherever possible”. You comply. End of. Anything else is illegal.

Twit

I’m going to guess that in writing this hit piece, you never once reached out to the team for comment, since you have materially incorrect facts throughout the article.

Fees are fully disclosed.

Rewards are not paid in FWT.

Sec regulates US securities, which until last week Aubit did not serve.

Aubit acquired a fully regulated European brokerage.

Seychelles, Malta, etc are tax havens, and why huge numbers of companies use them as head office locations.

AuBit’s team invest in the native FWT token … yes, and align their interests with users. Hardly a sign of a Ponzi.

This is a poorly written, poorly researched, intentionally misleading “article” that is borderline slanderous.

@Colg

Securities fraud is illegal the world over. Ignoring it doesn’t make it any less illegal.

@Alex

Unless AuBit are misrepresenting their MLM opportunity on their website and in their marketing material, I had no need to.

Buy-in fees were not public at time of publication.

What are they paid in? AuBit sure as shit isn’t paying 43% annual returns in USD or 33% annually in bitcoin in perpetuity.

You receive FWT in your backoffice and cash out previously invested funds. It’s not rocket science.

Securities fraud is illegal the world over. Every country has an SEC equivalent and equivalent securities laws.

That’s great. AuBit is not registered with financial regulators and is committing securities fraud.

With respect to MLM due-diligence, these are also jurisdictions with little to no active regulation of securities fraud. That’s why scammers choose them.

Nobody said it was. Using new investment to pay annual returns of up to 43% is what makes AuBit a Ponzi scheme.

Where did you get your false info. From. It’s not MLM neither a ponzi scheme. They have over 14mil in superchargers.

From AuBit. They’re not exactly secretive about their securities fraud.

MLM comp plan = MLM company

MLM company + securities fraud = Ponzi scheme

1. If you want to make specific financial claims about AuBit please provide legally required audited financial reports.

2. How much a Ponzi scheme takes in has no bearing on it being a Ponzi scheme.

i see AuBit have EMI License with the UK FCA on their roadmap.

Do you think that would require the necessary audited financial reports, and could provide better clarity on ROI?

Aubit is not registered with the FCA. You can verify this yourself on the FCA’s website:

register.fca.org.uk/s/

Anything else is not a substitute for registering with financial regulators and providing audited financial reports.

AuBit has taken an ownership share of Ardu Prime, a fully regulated EU brokerage.

Having rebranded as Aubit Prime Brokerage they are now fully regulated in Germany and Greece allowing trade in the European Union and are Approved by the Financial Conduct Authority in the UK.

Their stated goal is to fulfil regulations in every country where needed.

So knowing they are already fully approved in two G7 countries (Germany and UK), and also Greece, (Within one year of official launch) gives me confidence that SEC approval is coming very soon if not already attained.

Please do some research and reconsider this libelous article.

That’s not how financial regulation works. Either AuBit has registered with financial regulators and is providing audited financial reports, or it hasn’t.

Who they do or don’t buy part ownership in is irrelevant.

As long as Aubit itself hasn’t registered and provided backdated audited financial reports, it’s committing securities fraud and operating illegally.

AuBit Prime is a registered trading name owned and operated by Ardu Prime. (Ozedit: snip, see #2)

For clarity, in the post above I listed the regulated licences Ardu Prime holds in the UK, Germany and Greece in order to provide investment products in those jurisdictions.

The moderator clipped that information out with the instruction to “see #2”, and I assume he meant I should refer to the point there that “Legitimacy via association isn’t a thing”.

I agree with that comment.

The point I was trying to make by listing Ardu Prime’s licences is that it is a financial institution with 22 years experience of providing regulated services.

The moderator is correct to say that Aubit’s association with Ardu does not give it automatic legitimacy. But it is also correct to say that were Ardu Prime to knowingly associate itself with a ponzi scheme – as is implied here – then that would completely undermine its position as legitimate brokerage.

There are plenty of projects and companies (Ozedit: derails removed)

The above article correctly points out that there is a lack of clarity about where Aubit acquires the funds to provide such high rates of interest. Aubit should address this.

Yep.

If we look at Ardu Prime’s website Alexa ranking, it’s over 8 million. That’s a dead business.

As opposed to integrating with a broker with a reputation to lose, this is akin to buying a shell company in an attempt at legitimacy via association.

As previously discussed, legitimacy via association isn’t a thing.

An Alexa ranking provides information about a company’s website traffic. It says nothing about the underlying business.

If you want to make specific financial claims about Ardu Prime please provide legally required audited financial reports.

Not withstanding Ardu Prime hasn’t filed any financial reports with the FCA, I wasn’t making specific financial claims about Ardu Prime.

An online business with no website traffic = dead business.

Dead business = nothing to lose, and easy for Ponzi scammers to rock up and purchase it.

Fun Fact: Ardu Prime was downgraded to a “temporary permission” FCA license last December. The company is registered in Gibraltar.

Scam-friendly jurisdictions like Gibraltar are selected by scammers because they have no active regulation of MLM related securities fraud.

None of this really matters, seeing as AuBit isn’t registered to offer securities anywhere on the planet.

Worth pointing out though, as with Ponzi schemes the dodginess always starts to pile up.

That’s Ardu Prime’s responsibility to provide their required audited financial reports, not Oz.

It is fun watching you trying to put lipstick on a pig with a new dress trying to make it legitimate. You must have a lot invested in this since you are trying so hard to defend it.

Nope, not a cent. I’m researching Aubit as an investment option.

That’s why I’m on your website and involved in this dialogue. Your site provides information for the benefit of investors to help them not get ripped off.

I see you’re also keen on having a go at anyone who questions your findings.

Fun fact: As a result of Brexit, in December 2020 all European Economic Area companies previously permitted by the FCA to provide services in the UK were given the option to shift to the Temporary Permissions Regime.

Those EEA companies on the TPR now need to reapply for FCA registration, and all have signalled their intent to do so. Suggesting this is a ‘downgrading’ by the FCA is plain wrong.

Fun Fact: Temporary Permissions isn’t full registration. It’s a downgrade.

Not withstanding Ardu Prime is a dead business. It’s not providing any financial services to anyone in the UK or anywhere else.

More Fun Facts: Ardu Prime is an irrelevant shell company purchased by Ponzi scammers. AuBit is committing securities fraud because it’s a Ponzi scheme.

Research into Aubit begins and ends with securities fraud and it being a Ponzi scheme.

If you wish to continue discussing Brexit, Ardu Prime or anything else offtopic, do it somewhere else.

1) Temporary Permissions actually aren’t downgrades, Ryan M is correct. They’re a result of Brexit and a mechanism to enable EU firms to service UK customers. Any claim to the alternative is baseless.

2) Ardu’s traffic is not relevant. It’s a small EU Regulated brokerage which has traditionally only served a small number of high net worth clients.

It’s unreasonable to expect high website traffic from a rather small number of customers who likely don’t access their accounts on a highly regular basis.

Put your objective hat on and consider the other argument – It is logial for AuBit to purchase a smaller scale brokerage with a long-term flawless reputation which they can expand, than to purchase a more expensive, larger brokerage.

3) AuBit receive legal advice from top UK law firm Simmons & Simmons. This fact alone is enough to stamp out baseless claims from individuals with non-legal backgrounds that AuBit are operating outside of the law.

4) In the vast majority of cases, countries do not have any regulations in place for cryptocurrencies. (Ozedit: strawmans removed)

I can’t be bothered arguing semantics with FWT bagholders. Temporary isn’t full, it’s a downgrade.

1. If you want to make representations of Ardu Prime’s financials, please provided audited financial reports.

2. A dead business is a shell company. That’s all Ardu Prime is and has been for some time (why it was purchased).

First Ponzi? Run a search for “legal opinion” on the search bar and you’ll soon realize legal opinions justifying securities fraud = toilet paper.

Here’s an obvious one that comes to mind, OneCoin – OneCoin Leaks: Schulenberg & Schenk legal opinion (2015)

Paying a lawyer to justify securities fraud doesn’t negate financial laws.

This is a strawman. The issue is securities fraud, not cryptocurrencies.

No country on the planet exempts cryptocurrency investment schemes from securities fraud.

Just noticed this has been added to Aubit’s website since this review was published:

Lol scammers, pseudo-compliance doesn’t work. At least AuBit have acknowledged they’re committing securities fraud though.

Securities fraud is just as illegal outside the US.

Thanks for the reply and for sharing the Onecoin story, interesting read.

However, your point about temporary and attempt to link it to something negative on Ardu’s end delegitimises your wider argument. I don’t think you understand TPR’s so please do more research.

There are a lot of financial document’s on Ardu’s website. Unfortunately my Greek isn’t very good!

Correlation isn’t causation. Your review happens to have been published at around the time the SEC have been scrutinising crypto in the US. Regulations are coming soon.

AuBit still offers US access: freewaylite.us/ – this way AuBit can pre-empt regulatory change and still offer their main services to customers outside of the US. The second site is more manoeuvrable and can be shut down if needs be I suppose, depending on what Gary Gensler does.

Hold up, I didn’t spin it as a negative. I stated the downgrade as a matter of fact.

Ultimately it is inconsequential to anyone who is pushing Ardu Prime’s FCA registration as being a substitute for AuBit being registered.

US authorities began investigating OneCoin prior to 2017. Securities fraud has been illegal since 1933.

Securities regulation doesn’t work like that. AuBit is one entire run by the same people.

AuBit is not registered to offer securities in the US or anywhere else in the world.

The up to date annual financial records of the brokerage being discussed above are available and freely downloadable at the Greek General Electronic Commercial Registry (Geniko Emboriko Mitroo-G.Ε.ΜH.).

Cool. In that case you’ll have no problem proving Ardu Prime isn’t a dead business then.

Thanks for this breakdown.

I am holding some FWT but it’s not hard to see that they seem dodgy.

Any negative sentiment I can find online is littered with fanboys threatening legal action in the comments, which is text book MLM defence.

Do you and commenters still feel like this after the recent news of an EU regulated brokerage?

Seems that it is more legit to me in light of this news?

What some brokerage is or isn’t has nothing to do with AuBit commititng securities fraud because it’s a Ponzi scheme.

Legitimacy via association isn’t a thing.

Hi Oz,

Thanks for coming back.

But isn’t that the point, it does matter? Because they are now regulated and licensed to provide financial services? They appear on the FCA website for example?

Happy to be corrected otherwise.

Alex

I must have missed the part where AuBit registered with financial regulators and provided audited financial reports?

Oh right, that didn’t happen. So no, it doesn’t matter.

AuBit continues to commit securities fraud, because it’s a Ponzi scheme.

On their website, it now it says the following: AuBit Prime is a registered trading name owned and operated by Ardu Prime. Ardu Prime SA is an EU Regulated entity and MiFID II compliant. (Hellenic Capital Market Commission License: 4/164/20.7.1999, FCA reference: 725166, BaFin ID: 10146106).

So it appears Aubit is now the trading name of Ardu Prime, which is indeed on the FCA website, although they do only have ‘Temporary Permission’ owing to being regulated in another EEA country.

I can also confirm Aubit rewards ARE NOT paid in FWT. I’ve been using the platform for several months and have been able to withdraw rewards in USDT, ETH or BTC whenever I’ve needed to.

This article has made me wary and want to question things a bit more. But from my own interactions with the platform I don’t think it’s a MLM. It might be dodgy but I’m not sure it’s MLM. Rewards aren’t dependent on referrals.

We already went through this (ref comments #1 onward). You can’t shell company your way out of securities fraud.

Returns are calculated in FWT but you withdraw subsequently invested crypto. This works until invested crypto is exhausted.

This is an extra layer of manipulation and why crypto Ponzi schemes use their own shitcoins.

MLM comp plan = MLM company.

Daily returns require new investment to cash out. This is true in both MLM and non-MLM Ponzi schemes.

Except returns aren’t calculated in FWT. They’re calculated in whatever the supercharger asset is on a daily basis eg BTC, USD etc

You invest in FWT and that’s what your returns are calculated on.

How much FWT you park in your sUpErChArGeR dictates your return.

You’ll be paid out in whatever as long as there’s new investment to steal.

Hi Oz! First, I admire your work and you’ve been such an inspiration for me. I have so much respect for you exposing these scammers.

So I did a YouTube video and wrote a post exposing this scam and they went far enough to hire a lawyer locally where I live to threaten to sue me for supposed ‘defamation’.

Do these people really wanna put themselves right inside the lion’s mouth?

I think it might be only threats. Chances are high that if your defense is built based on factual evidence, they won’t stand a chance.

These schemes also only seem to target smaller bloggers, as it might be easier to silence them, and generally they can’t afford a good lawyer to defend them.

But even this is not a big deal compared to Russia and other post-Soviet countries, where Ponzi scammers sometimes manage to win in court against more or less major bloggers (100k+ subs) due to the so-called “special trial” (basically without defendants, or if plaintiffs are unable to identify a blogger).

Hey Kir,

Thanks for the insight. Yeah, I’m definitely not intimidated by these scammers.

They are the ones breaking the law, not me.

My video and blog are not going anywhere.

@Andres

There is a definitive line between inspiration and plagiarism.

If we compare this review, researched, written and published by myself, to “your” review, we can clearly see they are mostly the same.

andreskindred.com/aubit-review/

Your YouTube video is a derivative of “your” review, which is an unauthorized copy of BehindMLM’s original work.

I’ve never turned down anyone who’s asked to republish BehindMLM content. My only condition ever has been the source (BehindMLM) is credited.

You never asked for permission. You’ve been quietly copying BehindMLM’s original content and republishing as your own since about March 2020.

For different reasons to AuBit, I’d ask you take down “your” AuBit review and every other BehindMLM review/article you’ve copied (adding a few sentences here and there is still plagiarism).

Sorry to hear about the threatened legal action.

@Oz

I am truly sorry Oz and never meant to cause any trouble. Would you be ok if I edit the posts and I acknowledge that I wrote the blogs based from reading your articles? I can even add it to the tittles with something like (as published on Behind MLM, or a disclaimer of that sort)

I am just a new blogger and I’ve put a lot of hard work for the past year to write these articles. I was just thinking that we all have to start somewhere and I really tried to make them as different as possible from yours while at the same time learning from you. But I should have known better from the moment I got started.

I understand how you feel, but by me coming here to write these comments I knew you were going to learn about my blogs. I didn’t think you would take it in a bad way, and maybe see it like we all start somewhere by sort of mimicking someone that we admire. You might have done that at some point when you got started. But maybe I’m wrong.

But again, I am truly sorry. I still have so much respect for your work, and would love for us to work out a deal.

You are 100% right, I should have contacted you before to ask for permission. All I ask is to work something out where I can at least edit them however you want me to so I don’t have to delete all that work.

I’m willing to do some Youtube videos with your permission to promote Behind MLM, or if you are ok with it I could do some videos of some of your articles while Behind MLM would be on the screen and I would acknowledge throughout the video that is 100% your content.

I don’t have a problem with BehindMLM content being used, so long as the source is credited.

As an author, if you intend to continue publishing for the long-term you’re best to come up with original content. Working solely off other’s work isn’t a long-term strategy.

So Oz, if you are so confident about your research why are you not advising Andres to stand his ground and rake his day in court?

If all of your allegations are true and solid then he should win any legal battle by a clear mile.

Because I’m not Andres’ lawyer. I stand by my own research. I don’t vouch for content published elsewhere.

Herp derp? Herp derp.

WhY dOnT yOu SuPpOrT sOmEoNe WhO pLaGiArIzEd YoUr CoNtEnT?

Hahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahaha

Why would anyone “invest” Bitcoin with this company and purchase their worthless Freeway Token?

It sounds like the same remit as the Gold Standard Partners scam, whereby “investors” were encouraged to deposit their Bitcoins and purchase a worthless G999 token.

I would not be surprised if this was simply a crafty means of getting hold of people’s Bitcoins and using them for illegal activity. After 12 months, I doubt anyone will be able to withdraw their Bitcoins or do anything with the Freeway Token.

…Just read a bit more about it.

They (AuBit) seem to misunderstand why people invest in gold. Most invest in gold as a store of wealth against banking collapse, as a hedge against inflation, and on the futures market to secure buying gold at a certain price.

Why would a gold investor trust their gold investment by buying up a crypto shit-coin and entrusting their gold with this alleged asset management company? It makes no practical sense!

Also I myself own physical gold and silver bullion (purchased from reputable bullion dealers, i.e. NOT Karatbars) and not gold on paper. Why would I send them my physical gold, when I can store it in a Brinks facility or in a safety deposit box at my local bullion dealer (which happens to be one of the largest bullion dealers in Germany)?

They fail to mention how they will invest your funds and generate returns. I fail to see how purchasing a crypto shit-coin is going to generate returns.

The only possible means of doing so will be to pay out to existing “investors” using funds from new “investors”, which is a classic Ponzi scam.

The whole referral scheme screams of a pyramid selling/MLM Ponzi scam, as they have failed to explain how investing your assets and purchasing a crypto shit-coin is going to generate an independent revenue stream; independent that is from fleecing new investors to pay existing investors.

If it smells like shit and looks like shit, it is shit!

@ColG By the way, I’m not afraid to go to court to defend myself from this Aubit scam.

I’m sure an American judge will always be on my side when exposing an illegal company. Specially not registered with the SEC. The law is on my side.

@Andres Kindred – Ask the lawyer to explain how Aubit is “investing” the funds and assets to generate the returns for the investors. And ask for documented and independently audited proof of how they are investing funds.

I suspect you will get nothing but silence.

Interested in any updates?

Update: AuBit is still a Ponzi scheme.

Some great back n forth here. When’s the next update. Lots of waffle & nothing for me to substantiate that AuBit is a MLM fraud scheme.

Lots of pontifical ‘threats’ but lots of non action. (Ozedit: attempt to take discussion offsite removed)

I do not have them BTW as all above my head.

OZ. Rather than throwaway comments please supply some facts.

You maybe right BTW but I’d prefer facts.

Thanks

Latest Freeway update. Aubit (the name) is no longer to be used:

youtube.com/watch?v=fIcyDAOS0oQ

No idea what it all means TBH but still please let me have some facts where Freeway is a MLM scam.

It could save me one hell of a lot of money.

Thanks

Obviously you haven’t read the review, for if you had you wouldn’t be asking for some “real facts.” The review provides “real facts” this is a Ponzi.

You should be asking Aubit for “real facts” to prove they are doing what they say they are doing and are legal. Hint: They won’t because they can’t.

But by all means don’t believe Oz and his review. Don’t believe all of us telling you this is a Ponzi. Invest a boatload of cash in this.

Then when you lose it all you would have learned a very expensive lesson to stop believing all the hype these programs put out.

Learn how to do real due diligence and you won’t lose your money. It’s your job to do due diligence, not anyone else.

You don’t believe the “real facts” because you don’t want to believe the “real facts.” You are itching to get into this because greed is clouding your vision.

But I have a challenge for you: You disprove everything Oz has said about Aubit being a Ponzi, instead of the smoke screen I want more “real facts” BS.

AuBit is still committing securities fraud because it’s a Ponzi scheme. There’s nothing to update.

Fact: AuBit isn’t registered to offer securities in countries it solicits investment in.

Fact: MLM + securities fraud = Ponzi scheme

It means AuBit is a Ponzi scheme and they’re trying to dodge regulators.

LOL to this badly written article. They don’t have any proof that this a scam.

The only so called proof they have is that FWT isn’t registrated with the SEC. They don’t need to registrate with the sec you moron.

I work for GBC and I know for a fact that we did enough research before we did our 3.2 million investment.

Not only does any MLM company offering securities need to register with the SEC, they need to register with financial regulators in every country they solicit investment in.

Oh dear. Sorry for your loss.

@Mike Drinkers

Oh yes, banks are so wise in making investments! 2008 was such a great year for banks making wise investments in sub-prime mortgages! What could possibly go wrong!

I am sure Bernie Madoff and Nick Leeson trained you well!

They are selling a crypto-shit-token of zero worth and are claiming to invest monies in stocks, shares, commodities, and gold.

Why do they even need to sell a crypto-shit-token to act as an investment brokerage? Whatever happened to using fiat currency?

And how are they turning 1 troy ounce of gold into 2 troy ounces of gold? Alchemy? Do tell!

And their “referral programme” sounds awfully like pyramid selling.

GBC is a bank? And this schmuck reckons it invested $3.8 million into Aubit/Freeway?

Lol.

Thank you for the best laugh I have had in the new year! You really must think we are all as dumb as the people who are promoting and investing in this Ponzi for you to write what you posted. Your post proved this is a Ponzi.

In all of my 18 years of exposing Ponzi/Pyramid Schemes and all the other forms of cyber-crime, you made my top 10 list for the funniest and dumbest post ever.

Congratulations!! That is a hard list to join. Sorry but you didn’t make the top 7, but you tied for #8.

GBC invested $3.2 Million after doing your research! Priceless!! Still can’t stop laughing.

HA HA….. this is really a great read. Used to be involved in UK direct sales back in the day & its just reignited some memories of the cult like behaviour my some.

Some really sad angry individuals on here BTW.

So….so far….. no proof of any kind except for throwaway comment that Freeway is a ‘ponzi’ scheme. (Ozedit: snip, see #11)

bloomberg.com/press-releases/2020-11-12/greenbank-portfolio-company-announces-investment-in-us-3-2m-of-aubit-s-freeway-tokens

Dear Ponzi scammers,

Ignoring proof doesn’t make it go away.

Not surprisingly, Greenbank Capital hasn’t invested in Aubit/Freeway.

Also Greenbank Capital isn’t a bank, it’s a crypto bro company. They offer financial services to other crypto bro companies.

Shell companies for days. Which isn’t surprising, seeing as Greenbank Capital itself is a shell company factory:

crunchbase.com/organization/greenbank-capital

Not that any of this even matters, legitimacy via association isn’t a thing.

Regardless of who invests in it, Aubit/Freeway is committing securities fraud outside of the three countries it has registered in (none of which provide significant traffic to its website).

MLM + securities fraud = Ponzi scheme

They are selling a crypto-shit-token of zero worth and are claiming to invest monies in stocks, shares, commodities, and gold.

Why do they even need to sell a crypto-shit-token to act as an investment brokerage? Whatever happened to using fiat currency to invest in stocks, shares, commodities, and gold?

They also fail to understand why people invest in physical gold, gold EFTs, gold futures, etc.

And how are they turning 1 troy ounce of gold into 2 troy ounces of gold? Alchemy? Do tell!

And their “referral programme” sounds awfully like pyramid selling.

As for a bank making an investment, I refer you to 2008 and the collapse of the sub-prime mortgage and the toxic debts taken on by banks. Banks do not necessarily have a good record of making sound investments!

Ah that explains the complete lack of common sense.

Know quite a few businesses that have dumped money into a few ponzi schemes including MTI.

Unfortunate when the majority of proper due diligence gets ignored because $$,can’t blame them though,they aren’t the type of institutional investor that’s required by law to actually do legal investments so why not yeet money into random scams because lambo.

All lies with no substantial evidence to back up your claims.

You can verify yourself that Aubit isn’t registered to offer securities outside of three countries (none of which it’s particularly active in).

MLM + securities fraud = Ponzi scheme

Ignoring the evidence doesn’t negate it.

Interesting the army of bot shills popping in now. must be a desperate recruitment drive.

Aubit/Freeway claims to be an investment brokerage company, but is selling a worthless crypto-shit-token.

Also why do they need me to buy a worthless crypto-shit-token in order to sell me stocks, shares, commodities and/or gold?

Aubit/Freeway claims to be an investment brokerage company, but seems awfully keen on pushing it’s “Referal” scheme that has all the hallmarks of pyramid selling.

Aubit/Freeway claims to be an investment brokerage company, but fails to understand why people invest in physical gold bullion, gold ETFs, gold futures, etc.

Aubit/Freeway is NOT registered with the UK Fiancial Conduct Authority.

Sorry for your financial loss if you have invested in this Ponzi.

Cindx, Elysian and Laborcrypto came up in my research… maybe there’s a pattern here?

There’s not much between MLM crypto scams when you dig into them.

The underlying business model is the same. Only the tokens/coins and names of people running the schemes change.

This is a strange article. I can see that previous commenters doubting the article have been responded to with sarcasm, aggression and nothing substantive, so with due trepidation…

Freeway simply isn’t MLM. There is no referral hierarchy, and the section about ‘residual commissions’ is a complete fabrication!

The ‘compensation plan’ section is grossly inaccurate, and not just because of changes since the article was posted. Investors do NOT have to buy the Freeway token – this can be bought and staked to earn additional rewards, but deposits in the superchargers are made in USD, BTC, ETH etc.

As I continue to read the article I see numerous incorrect statements (not an opinion, simply false statements easily demonstrated to be false) and constant repetition that ‘it’s a ponzi’ without a single reason given for that conclusion.

If there are valid concerns regarding Freeway then, please, I would love to hear them! I have had a deposit with Freeway for nearly a year, and have on many occasions gone digging for ‘dirt’ in order to reassure myself that my deposit is safe. I haven’t found any, but I continue to be on the lookout.

I can only conclude that behindmlm.com is a scam site itself, publishing and defending such a poorly written article containing gross factual errors and zero substantive information.

If this site were legitimate, surely it would seek to correct the errors. If this site is looking out for people, then why not provide actual reasons and evidence for claiming that a platform is a ponzi, so that potential investors would have a reason to be cautious?

If this is the strongest criticism out there of Freeway, then I do in fact feel greatly reassured, as it indicates there is no dirt to dish.

Uh, no. I personally researched this review and that is very much AuBit’s compensation plan.

Gaslighting AuBit’s MLM business model. Is this some new marketing ploy to hide the investment fraud?

The review doesn’t state they have to.

Freeway is a Ponzi scheme. Feel free to address that.

Your deposit is gone. Anything you withdraw is stealing from someone who invested after you.

Perfectly logical and sound conclusion to come to when doing due-diligence on a Ponzi scheme.

The evidence is presented in the review.

Dumbasses invest funds –> dumbasses are paid numbers on a screen –> dumbasses cash out previously invested funds. This is a closed-loop Ponzi scheme.

tHe EvIdEnCe Is A sCaM!

I appreciate that you take the time to research and come to the table with your opinions regarding MLM fraudulent or ponzi schemes.

I realize these are your opinions and appreciate that you continue to press forward. It seems like in the comments that there’s a lot of hostility regarding this and I’m not quite sure why.

I’ve started my own due diligence as well and if there’s anything new you uncover we would appreciate you sharing it. Have you read their most recent white paper?

I really think you need to read it and update the revew as needed. This is the link to it – (Ozedit: link removed, see below)

I do have a few questions regarding a few things. It would be good to know your opinion and understanding on these things.

(Ozedit: derails removed)

It’s not clear why AuBit needs to register w/ the SEC in the US? It is not a security. (Ozedit: more derails removed)

Where is the multi-tier referral compensation your referring to as MLM. I can’t find this anywhere.

Doesn’t AuBit also have a corp address in WY?

So if you set up your corporation in WY, Nevada, or Delaware for better tax advantages are all these states red flags and by companies with schemes to defraud people.

Malta is crypto friendly/accepting with tax advantages. Many crypto companies have chosen Malta, Caymans, etc. Binance also had or has an office in Malta. Are they a scam too?

Again thank you for your work. I hope it continues to provide people insight and be a resource of valid information.

Thanks

AuBit committing securities fraud because it’s a Ponzi scheme isn’t an opinion, it’s fact.

Hostility is a natural reaction to scams and scammers. The only people this ever comes as a surprise to are scams and scammers.

Feel free to point out why or what exactly I should be looking at. This review is based on AuBit’s business model.

That business model has been updated with Freeway. This is noted at the foot of the review.

This tells me you haven’t read the review, and instead have just scrolled down to post the usual marketing spam.

MLM + passive investment opportunity = securities offering.

All securities offerings need to be registered with the SEC.

Calling a passive investment opportunity “yield farming” or some other crypto bro bullshit doesn’t change what it is.

It’s part of AuBit/Freeway’s business model.

Shell company incorporation anywhere is meaningless.

It’s also a jurisdiction with no effective MLM related securities fraud regulation. MLM crypto investment schemes aren’t illegal in jurisdictions with active regulation.

The difference is Malta will let you get away with running Ponzi schemes, other jurisdictions not so much.

Anyway none of this matter because AuBit/Freeway have negligible investment coming in from Malta.

If you wish to discuss Binance or any of the other non-MLM companies I marked as derails, do it somewhere else. Thanks.

Wow, that was a very interesting read!

I don’t have any money invested with Freeway, I came here entirely out of curiosity. I don’t have an opinion about the company either way but I got a lot more information from reading the comments than I did from the article.

(Ozedit: derails removed)

I still have no clear idea about the legitimacy of the company but will be keeping an eye out for news to satisfy my curiosity. Best wishes to you all!

You can verify AuBit is not registered to offer securities in your country by checking with your financial regulator. It’s not hard.

But I don’t expect someone who glossed over the review to give a crap about securities fraud. Best of luck with the scamming.

Freeway/Aubit Prime is NOT registered with financial regulatory authorities and is therefore operating illegally.

(They bought a dormant company in Greece and tried to use that as a ruse to get around not registering with financial authorities.)

And another thing…

Why would you trust a “company” that is NOT registered with the financial regulatory authorities? A company which is operating illegally?

Why would you trust a company that claims to help you invest in gold and has ZERO understanding why people do invest in gold?

Why would you trust a company that claims to magically turn one troy ounce of gold into two troy ounces of gold?

Why would you trust a company offerring ridiculously high rates of return on investment?

Why would you trust a so called investment broker who is awfully keen on pushing a referrals programme that is suspiciously like a pyramid marketing scheme?

Why would you trust a company who uses all-new terminology like “Super Chargers, which is a term NOT used by legitimate investment brokers?

Why would you trust a company that wants you to purchase their worthless crypto shitcoin and use it in their “Super Chargers”?

The facts are you would not trust them.

They are operating illegally and are running a Ponzi scam that would have made Bernie Madoff blush with embarrassment!

When new investors (i.e. new victims) dry up, this Ponzi scam will collapse and you will not see Sadie’s backside for dust!

(This is assuming Sadie is even running the Ponzi scam. It would not surprise me if Sadie and co are just the front for an East European or Russian Mafia scam.)

Red flags for me are the rate of returns from these superchargers. No information given by aubit as to how they able to offer such high apy.

Also from discussions in their telegram group I have discovered that the supercharger rates of return are in fact bought back by freeway to allow you to sell and they state that they are not legally required to buy back your superchargers (paying you the rewards) however they do so because it is in their interests to do so (to encourage participation).

I asked them what happens if they decide to stop buying back? And they responded with: “If you are not comfortable to use the supercharger or have any doubts at all then you shouldn’t use it”.

This boils down to: “pay in, receive rewards and we promise to pay you back but we have no legal obligation to do so.”

I Find it difficult to invest any large amount of money into a system that operates in this way.

Having said all that, comments from OZ in this thread are not helping people discern facts from fiction. You, my dear internet entity are just blabbering the same phrase over and again “this is a Ponzi scheme” in the most unprofessional manner and you are not addressing the points raised by people wanting to facilitate discussion and learn more.

Take a deep breath, put your ego to one side and perhaps search your vocabulary and I’m sure you’ll find other words to use other than “Ponzi scheme” that might better convince people of your findings.

Who do you think wrote the review? I can say AuBit is a Ponzi scheme because I did the research.

Sit down.

Your inability to identify all the huge red flags,while amusing is a bit sad.

I would find it hard to invest any amount of money in an unaudited,illegal business. But maybe that’s just my common sense.

Facts are given,you ignoring them is a “you” problem.

It is.

Shame.

I see only hollow arguments,from yourself included. You not wanting to “learn more” properly from the obvious information provided is another “You” problem with discernment.

Not surprising given you being a victim of an obvious scam already.

Trying to be ironic?

How many terms are there for Ponzi scheme without saying Ponzi scheme?

Ponzi Scam perhaps.

What a vacuous imbecile.

I’ve been using Freeway for about five months and haven’t encountered any problems. I deposit and withdraw money once in a while and it only takes one or two business days to go through.

I don’t get the 43% APY because I didn’t buy any FWT, so I only get 33%; but that’s still pretty good compared to similar companies, like Midas Investments, who deliver around 15-17% APY at the headline rate.

Ever stopped to think where your 33% a year comes from?

Ponzi schemes pay out… until they don’t.

Perfect example of the greater fool theory in action.

And so the Freeway exit scam begins!

Expect to find Sadie Hutton sunning herself in Dubai on the profits from the Ponzi scam.