AtmosO2 Review: Ocular Tech’s “cashback” securities scheme

![]() AtmosO2 provides no information on their website about who owns or runs the business.

AtmosO2 provides no information on their website about who owns or runs the business.

In fact as I write this, the AtmosO2 website is nothing more than an affiliate login form.

The AtmosO2 website domain (“atmost02.com”) was privately registered on October 18th, 2018.

Further research reveals AtmosO2 marketing videos identifying Dager Contreras (right) as CEO of the company.

Further research reveals AtmosO2 marketing videos identifying Dager Contreras (right) as CEO of the company.

According to Contreras’ LinkedIn profile, he co-founded Ocular Compliance Tech.

According to Ocular Compliance Tech’s website,

Ocular is an Anti- Money Laundering (AML) compliance platform that provides instant verification of a customer`s background (KYC).

The platform leverages cryptographic security mechanisms employed in distributed ledger technologies to ensure that data cannot be tampered with, while allowing users full control over how their data is stored and shared.

Contreras’ LinkedIn profile suggests Ocular Compliance Tech launched in early 2017.

The current Alexa traffic ranking of 11.7 million for the company’s website suggests Ocular Compliance Tech flopped.

Nonetheless Ocular Compliance Tech ties Contreras to the cryptocurrency industry. I wasn’t able to find any prior MLM involvement.

Contreras LinkedIn profile cites his location as California in the US. This is presumably where AtmosO2 is also being operated from.

Read on for a full review of the AtmosO2 MLM opportunity.

AtmosO2 Products

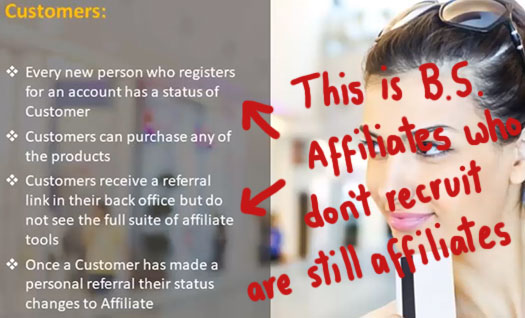

AtmosO2 has no retailable products or services, with affiliates only able to market AtmosO2 affiliate membership itself.

The Atmos2 Compensation Plan

AtmosO2 affiliates invest funds on the promise of an advertised annual ROI:

- Essentials Pack – invest €125 EUR and receive an annual ROI of up to €1500 EUR

- Premium Pack – invest €250 EUR and receive an annual ROI of up to €3500 EUR

- VIP Pack – invest €750 EUR and receive an annual ROI of up to €10,000 EUR

- Elite Pack – invest €5000 EUR and receive an annual ROI of up to €25,000 EUR

ROI payments are based on supplied debit card usage, which is calculated weekly.

For each €100 spent by an AtmosO2 affiliate on their card each week, they are eligible to receive a ROI of up to €3200.

After 12 months an AtmosO2 affiliate must reinvest if they wish to continue receiving ROI payments.

The exception to this is the Elite Pack tier, which is on a three-year recurring basis.

Referral Commissions

AtmosO2 affiliates are paid 20% of funds invested by personally recruited affiliates.

Residual Commissions

AtmosO2 pays residual commissions via a unilevel compensation structure.

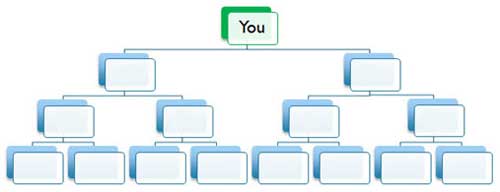

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

AtmosO2 caps payable unilevel team levels at fifteen.

Residual commissions are paid out as a percentage of funds invested as follows:

- generate €125 PV a month and receive 20% on level 1 (personally recruited affiliates

- generate €250 PV a month and two or more recruited downline investments and receive 20% on level 1, 3% on levels 2 and 3 and 2% on levels 4 and 5

- generate €750 PV a month and two or more recruited downline investments and receive 20% on level 1, 3% on levels 2 and 3 and 2% on levels 4 to 9

- generate €750 PV a month, two or more recruited downline investments and €5000 GV a month and receive 20% on level 1, 3% on levels 2 and 3 and 2% on levels 4 to 10

- generate €750 PV a month, two or more recruited downline investments and €10,000 GV a month and receive 20% on level 1, 3% on levels 2 and 3 and 2% on levels 4 to 11

- generate €750 PV a month, two or more recruited downline investments and €25,000 GV a month and receive 20% on level 1, 3% on levels 2 and 3 and 2% on levels 4 to 12

- generate €750 PV a month, two or more recruited downline investments and €50,000 GV a month and receive 20% on level 1, 3% on levels 2 and 3 and 2% on levels 4 to 13

- generate €750 PV a month, two or more recruited downline investments and €100,000 GV a month and receive 20% on level 1, 3% on levels 2 and 3 and 2% on levels 4 to 14

- generate €750 PV a month, two or more recruited downline investments and €200,000 GV a month and receive 20% on level 1, 3% on levels 2 and 3 and 2% on levels 4 to 15

PV stands for “Personal Volume” and is a combination of personal investment and investment by personally recruited affiliates.

GV stands for “Group Volume” and is the sum total of PV generated by your downline (directly and indirectly recruited affiliates).

Note that up to 50% of required GV each month can come from any one unilevel team leg.

Card Spend Commissions

Each AtmosO2 affiliate is provided with a debit card. These cards are supposedly attached to a provided “international bank account”.

The Ocular Tech website states the cards are provided through a partnership between OlePay and Jack Chang.

AtmosO2 pays a commission on the amount downline affiliates spend with their supplied cards.

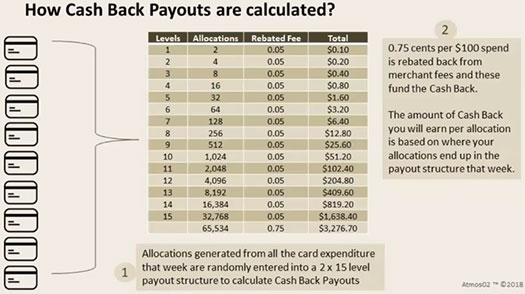

These commissions are paid out via a 2×15 matrix.

A 2×15 matrix places an AtmosO2 affiliate at the top of a matrix, with fifteen positions directly under them:

These two positions form the first level of the matrix. The second level of the matrix is generated by splitting these two positions into another two positions each (4 positions).

Levels three to fifteen of the matrix are generated in the same manner, with each new level of the matrix housing twice as many positions as the previous level.

Card spend commissions are paid out based on amounts spent by affiliates placed into the matrix.

How much of a commission is paid on each spend is determined by what level of the matrix an affiliate is placed on:

- funds spent on level 1 generate a 20% commission

- funds spent on levels 2 and 3 generate a 3% commission

- funds spent on levels 4 to 15 generate a 2% commission

Ocular Tokens

AtmosO2 affiliates who invest at the Elite Pack tier receive €200 EUR worth of Ocular Tokens.

Ocular Tokens are not publicly tradeable and appear to exist only within AtmosO2.

AtmosO2 does not publicly disclose the current internal value of Ocular Tokens to potential investors.

Joining AtmosO2

AtmosO2 affiliate membership is tied to investment at one of three offered tiers:

- Essentials Pack – €125 EUR

- Premium Pack – €250 EUR

- VIP Pack – €750 EUR

- Elite Pack – €5000 EUR

Note that with the exception of the Elite Pack tier, the above affiliate fee amounts are annually recurring.

Elite Pack fees are due every three years.

The primary difference between the investment tiers is increased income potential via the AtmosO2 compensation plan.

Conclusion

To put it simply, the math behind AtmosO2 doesn’t add up.

As per the above official AtmosO2 marketing presentation slide, for each €100 spent 75 cents is put into a cashback pool.

AtmosO2 affiliates who spend €100 or more receive supposedly randomized positions in a 2×15 matrix, through which €3276.70 worth of collected 75 cent merchant fee payments are distributed.

Through this system, AtmosO2 affiliates can receive annual returns of up to €25,000 EUR.

Just to put that into perspective, that’s 33,333 seventy-five cent transaction fees.

And remember, AtmosO2 don’t allocate the full 75 cents to any one affiliate, it’s split over a maximum 65,534 affiliates.

Yeah I’m not even going to attempt the potential math on that one, suffice to say you’re looking at millions of €100 payment merchant fees for just one potential €25,000 annual ROI.

Either AtmosO2 are grossly overstating potential annual returns or there’s some funny buggers going on – more on that in a bit.

My second point of contention is AtmosO2’s erroneous use of the term “cashback”.

Legitimate cashback sees consumers returned a percentage of the cash they paid for a product or service.

If a consumer receives more than the cash they paid, as is the case in AtmosO2, it’s no longer cashback but a return.

AtmosO2 are intentionally mischaracterizing the returns they pay to affiliates.

Why? Because if they were honest they’d have to admit they’re offering a security.

And this brings us to the aforementioned funny buggers.

If AtmosO2 affiliate ROIs are funded exclusively by merchant fees, I’m at a loss as to why affiliates are charged up to €5000 EUR to participate.

Other than Ocular Tokens at the Elite Pack investment tier, there doesn’t appear to be any notable difference between the other tiers – except for the annual ROI amount.

Seeing as ROIs are purportedly generated via merchant fees, why are annual ROI amounts tied to how much an affiliate invests?

You can probably see where this going…

At 75 cents for every €100 spent split between thousands of affiliates, I think it’s pretty obvious returns of up to €25,000 aren’t realistic without an additional source of revenue.

As it stands the only other revenue entering AtmosO2 is generating outside of merchant fees, is the amounts affiliates invest when they sign up.

The problem is AtmosO2 recycling any invested funds to meet advertised annual ROI amounts would make it a Ponzi scheme.

The good news is passive investment opportunities like the one AtmosO2 are offering are securities and require registration with a securities regulator. In the US, that would be the SEC.

AtmosO2 registering their passive investment opportunity with the SEC would require them to disclose the exact nature of their annual ROIs- from source funds to how they are paid out to affiliates.

The bad news is neither AtmosO2, Ocular Tech, Ocular Compliance Tech or Dager Contreras are registered with the SEC.

This means that AtmosO2 is operating illegally in the US, and indeed in any jurisdiction in which securities are regulated (pretty much every country on the planet).

Two additional compliance red-flags are commissions tied to affiliate recruitment (there is no retail in AtmosO2), and the Ocular Tokens.

According to a circulated “roadmap”, Ocular Pay tokens were supposed to be offered for sale in Q1 2018.

Whether that happened or not is unclear. What we do know however is Ocular Token is little more than an Ethereum ERC-20 shitcoin.

Ocular Coin serves no purpose outside of Ocular Tech and is not publicly tradeable.

So why is it being dumped on AtmosO2 affiliates?

Ocular Coin costs Ocular Tech and AtmosO2 little to nothing to generate. It’s easy ROI fodder.

“We give you Ocular Tokens today, lambo soon!” and that sort of rubbish. If you’ve been around anyone involved in speculative cryptocurrency long enough, you know what I’m talking about.

After enough people have invested at the Elite Pack tier, I imagine there’ll be a push to get Ocular Token listed on some dodgy exchanges.

Trouble is being tied to AtmosO2 investment, Ocular Token is also a securities offering.

This is so by way of AtmosO2 affiliates being led to believe the Ocular Tokens they’re given (in exchange for €5000 EUR), will go up in value.

Public listing of Ocular Token will also has the potential to provide AtmosO2 with ROI revenue, depending on how that pans out.

Given how Ocular Tech appears to have flopped and the current state of cryptocurrency in general though, I wouldn’t be holding my breath.

In summary, there might be some components of AtmosO2 that, when isolated, function legitimately.

When considered as a whole however, there’s no getting around the illegal unregistered securities offering and pyramid commissions.

As an AtmosO2 affiliate investor you’re either going to

- have your money tied up if the SEC moves in and shuts it down;

- lose your money when AtmosO2 affiliate recruitment collapses; or

- lose your money if OlePay pulls the plug on AtmosO2’s cards.

If an MLM company isn’t willing to operate legally, don’t give them your money.

Update 20th December 2018 – Within 24 hours of this review going live, AtmosO2 announced it is shutting down.

Ocular Tech did the KYC for the 4New scam run by fraudster Varun Datta. Their website confirms their affiliation. Also in a youtube video, Contreras names 4New as a partner.

facebook.com/groups/261004844769168/permalink/261182464751406/

You should see the Ponzi promoting all-stars that are pushing this scam.

It’s like a roll call of famous Ponzi promoters. All the big names are there, from Sharon James to Michael Faust.