USI-Tech management ignore US/Canada, focus on rest of world

If it wasn’t already obvious that USI-Tech management had no intention of addressing regulatory compliance in the US and Canada, communication of renewed promotional efforts elsewhere in the world have all but confirmed it.

If it wasn’t already obvious that USI-Tech management had no intention of addressing regulatory compliance in the US and Canada, communication of renewed promotional efforts elsewhere in the world have all but confirmed it.

On December 20th the Texas Securities Board sent shock waves through the MLM cryptocurrency Ponzi scene by issuing USI-Tech with a securities fraud cease and desist.

USI-Tech had ten days to request an emergency hearing, which would have required them to make a showing of good faith in an attempt to have the cease and desist lifted pending a hearing on the matter.

That deadline came and went, with the wider deadline for USI-Tech to provide the Texas Securities Board with evidence proving it is not a Ponzi scheme fast approaching.

If USI-Tech don’t provide the requested evidence by January 20th, USI-Tech’s securities offering will be declared officially illegal in the state of Texas. Although not confirmed, it is believed a federal SEC investigation is likely also underway.

Since December 20th, USI-Tech management have gone into hiding. Aside from two generic messages provided to affiliates in their backoffice, USI-Tech management have failed to personally address the alleged securities violations.

Now in a schedule being distributed to USI-Tech affiliates outside the US and Canada, it appears the priority for management is to keep investment alive elsewhere in the world.

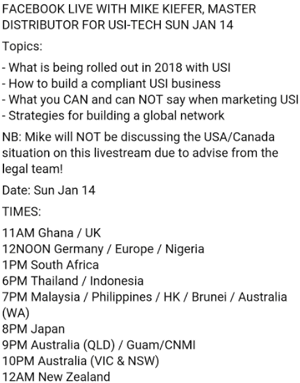

According to a schedule doing the rounds, Mike Kiefer, USI-Tech’s Global Master Distributor, will be holding a Facebook Live event on Sunday, January 14th.

According to a schedule doing the rounds, Mike Kiefer, USI-Tech’s Global Master Distributor, will be holding a Facebook Live event on Sunday, January 14th.

US and Canadian affiliates hoping for answers are sure to be disappointed, with the message stating

Mike will NOT be discussing the USA/Canada situation on this livestream due to advise from the legal team!

Instead Kiefer will be promoting USI-Tech by explaining

- what is being rolled out in 2018 with US

- how to build a compliant USI business

- what you CAN and can NOT say when marketing USI and

- strategies for building a global network

If I may, after USI-Tech stopped paying out their largest affiliate-base (US), they probably now have quite a bit of spare cash to splash around the world.

Once that runs out though it’s inevitable that without US promotion, USI-Tech is going to crash hard.

No doubt Tech Coin will be brought up, although who’s going to invest in that now that they’ve seen how USI-Tech handles regulatory enquiries – who knows.

How to build a compliant USI business? Simple, register your securities offering with regulators in jurisdictions you operate in before illegally offering unregistered securities.

There’s nothing about “don’t say this, don’t say that” pseudo-compliance legalizing securities fraud in the Securities and Exchange Act.

And isn’t USI-Tech’s strategy for building a global network obvious?

Convince a ton of people in the US to invest, cut them off, use their money to build globally and hope for the best.

One last thing I’ll point out is that while the mention of lawyers could be construed as legal efforts being taken to respond to the Texas Securities Board’s notice, this is unlikely.

Not withstanding the fact that USI-Tech would have registered with the SEC had it of been operating legitimately to begin with, providing the Texas Securities Board with the requested information should have taken a week, tops.

If USI-Tech has engaged lawyers post December 20th, they’re not working on behalf of restoring business operations in the US.

They’re working to secure invested funds (likely through more fraud) and keep USI-Tech’s principals out of court.

Dangling hope in front of USI-Tech’s affiliates is part of the exit-strategy, as complaints to regulators only makes Mike Keifer and the gang’s running off with US investor money that much harder.

As the January 20th response deadline looms closer, stay tuned…

Can’t the affiliates call up a lawyer in Dubai and launch a lawsuit???

Their uplines and USI-Tech management are holding their money hostage.

“Shut the fuck up or else!”

Unfortunately most US and Canadian USI-Tech affiliates haven’t realized the money is gone yet.

there have been some complaints about non payments from australia and some rumors about the press fishing around usi tech.

here’s an example of “Shut the fuck up or else!” from affiliates [courtesy FB page ‘usi tech scam?’]:

facebook.com/1829396597072871/photos/pcb.1850135954998935/1850135854998945/?type=3&theater

facebook.com/1829396597072871/photos/pcb.1850135954998935/1850135858332278/?type=3&theater

Surely they’ll just cut and run Real Soon Now™? They’ve screwed their largest market, which will (should) hurt what limited potential growth they have everywhere else.

The SEC [probably] and a lot of “investors” are pretty unhappy with them. A lot of bad press is just around the corner.

You’ve got things the wrong way round.

Ponzi scams aren’t designed to be long lasting.

They know they have a limited time frame to profit before the mathematical certainty the ponzi collapses.

By cutting out the US and Canada, they have actually extended the life of USIT by several months.

If they wanted to get out with as much as possible, why wouldn’t they get out right now or as soon as possible?

They’ve cut off outgoing payments to their largest market. They’ve cut off incoming payments from their largest market. This locks up a bunch of capital for them, right now, but can also only hurt global growth, and without growth they are bleeding money fast.

If I were a scammer, I’d be getting out now.

Because that’d trigger an avalanche of investor complaints.

Smoother to hold their money hostage, tell them all to shutup and delete evidence, make a bit more money through TechCoin and when that flops then do a runner.

As long as they’ve got US investor funds held hostage, all they need to do is mention the “legal team” and that’ll keep most of them in check, until it’s too late.

That’s all assuming US authorities aren’t involved in an international investigation, which at this point is unclear.

But, you’re not.

Look outside the box, so to speak.

People outside the US and Canada are still joining.

Undoubtedly the inflow of funds has slowed, but it has by no means stopped.

50% of what it was is nothing to be sneezed at, especially when there are virtually no costs involved.

And, as Oz points out, while the rest of the world isn’t complaining, the risk of prosecution remains low.

So, I’ve noticed that you’ve written various previous articles warning against USI-Tech and also Bitconnect as possible ponzis, and now they finally came to fruition, thanks to Texas SEC in both cases. Well if my memory serves me right it should be in all three cases. More on that below.

I also noticed that you have also written about the Davio Coin as another possible scam a long time ago. If my memory serves me right, Texas also went clamping them down. Way to go Texas.

Guess what, probably you’ll soon be writing on them again because it seems the top promoters of both USI & Bitconnect are now jumping head-on to Davio and seem to be carrying their previous sheeple along the way!

I’ve never seen such aggressive greed before in the MLM industry before cryptos became the hottest trend and commodity to be in.

While the crack-downs of the SEC and FTC are great in these ponzis and bad MLM structures, I think it’s about time that they also start holding accountable any affiliate who earned anything by not only paying everything back, but also penalizing them with heavy fines to remove any incentive to promote anything even remotely illegal.

I think the big performance affiliates are playing a massive part of these ongoing scams which help create these new emerging companies every second. They depend on such affiliates to heavily promote their scam without them (owners) paying for any ads. Brilliant concept!

This needs to stop as I have a massive gut feeling that many more people are going to be burnt in 2018.

Probably 2017 was only an appetizer as every second more companies are emerging in this crypto mining space brilliantly combined with the classical MLM pyramid structure of promotion to keep the company afloat.

I guess we’ll have to see how this plays out, as no one seems to do their due diligence before they join anything.

I’m not aware of regulatory action against DavorCoin in the US at this time.

Seeing as it’s just another ICO lending Ponzi and flavor of the month though, hopefully regulators don’t let it go on for as long as USI-Tech/Bitconnect have.

I figure once USI-Tech or BitConnect goes down the rest of the clones will promptly follow.

For all the waffle about BitConnect being decentralized, shut down the website and you wipe out 95% of trading activity, along with ROI payouts.

Same as any other Ponzi scheme that an admin profits off, there’s always a point of control that can be targeted by authorities.

Agree with the rest of it though. We’ve seen investors targeted since Zeek Rewards.

Round up a few secret top earners and a few of the YouTube shills and that’ll quieten things down (till someone writes the next chapter).

Ep6 James Lockett:

I lost it at the end, PonziFighter lol!

Do you think two-bit scammers the world over would be moving to Dubai if the Dubai legal system had a history of rendering and enforcing judgements against scammers, and recovering money on behalf of defrauded foreigners?

That said, I’m sure any Dubai lawyer would be delighted to launch legal action on behalf of failed USI Tech scammers, provided they pay upfront.

Gotta love the optimism 😛

youtube.com/watch?v=Mk1Q5nGvfFA

What you call optimism others would call straight out lies.

I think you missed the point in the emoticon following the sentence 😉

People are now posting that their pending withdraws are disappearing along their money. Being poset on the “USI Tech – Now What!?” FB page…. One guy lost .5 BTC

Yup – wallets are gone.

Even worse!!! Wallets are disappearing completely.

Update:

For those talking about the longevity of USI Tech, I would refer to another scam OneCoin that I would assume has NO blockchain and has generated hundreds of millions in token sales.

At least USI tech seems to have some mining going on from what one can see even though it dwarves the ponzi part from what one can see.

Dave’s post translated.

“We’ve paid out the top reps to calm the masses with some he said/she said rumors that people whose money was stolen will want to believe.

This will allow us to buy a little time and keep this Ponzi running in other parts of the world. Then we can shut down the company and head to a country that doesn’t extradite with our tens of millions.

Thanks to the promoters for keeping this sham alive a little longer!”

@Dave. People in the US and Canada are stupid if they haven’t already started legal action against the Dan Hunt types in this scam. You have to bring these types down for others to understand

Did any of those thieves in the hook up dare to ask their venerable leaders why they just didnt register with the Texas Security Board. Lol. They are just gutter swill

That video with Kiefer happened. The host had to keep reminding people not to ask about US/Canada or ban.

Kiefer trotted out “the lawyers” excuse about a third of the way in. Rest of the video was “let’s pretend nothing happened” marketing.

Yes, that was hilarious.

Kiefer better get some plastic surgery done quick, along with Gold.

yeah, but what was he saying?

couldn’t get one clear piece of information from that video in which he comes across as either shifty or uncomfortable.

it was all the same old ‘coming soon’ BS.

a thing i noted was that unlike his past videos, mike kiefer did not describe himself as co-founder+master distributor but only as master distributor of usi tech.

at one point in the video he said something about needing to ‘diversify’ because of what had happened in the US and canada.

if techcoin doesn’t sell, will mike kiefer bail out saying i was a victim just like you?

Payments in Australia are taking more than 3 days plus the mandatory 1 day for security purposes. What’s that all about anyway. Cashflow is drying up. Will Australia be the next to get the chop

daily ROI payout percentage is also dropping:

yeah, be happy you got paid something, those poor US and canada affiliates aren’t going to get a penny!

when there’s hardly any money left to pay other worldwide investors, do the US/canada affiliates really believe usi tech will pay anything into a dead market?

but but but, why is the daily payout low? horst jicha had promised affiliates that usi tech had a reserve fund for times like these:

where’s horst jicha BTW? all we have is mike kiefer squirming on live videos?

horst jicha and ralf gold should directly address the affiliates who have invested and lost so much money with them.

usi tech has always presented horst jicha as being from a respectable professional background, to add a veneer of legitimacy to it’s ponzi business.

in an interview in nov, 2017, horst jicha introduced himself as being from a management background in an industrial environment pertaining to building, airport and um, even nuclear plant security.

i guess if a guy can secure ^^ nuclear plants surely you can trust him with your money? 😉

youtube.com/watch?v=r1LIr-ZRYEA

but guess what horst jicha was doing in 2016?

the FB page ‘ Usi Tech Scam?’ reports:

here’s the proof:

facebook.com/1829396597072871/photos/pcb.1853261941353003/1853260438019820/?type=3&theater

lol at you horst jicha.

Well Horst Jicha always said he was involved in commercial securities. What he didn’t say was that they were securities in a ponzi.

How those eager Sales Partners were eager to hear him talk at those dinners and failed to ask him basic questions.

Lives ruined, relationships broken, reputations down the gurgler.

The USI Tech Coin must be dead in the water given Bitconnect’s rapid decline into a terminal state. USI will be lucky to survive a month

The SEC are watching all bitcoin ICOs marketed to Americans like hawks. None have been registered with the agency, in spite of the fact they meet the legal definition of a “security.”

Whether the SEC ultimately goes after USI Tech itself may largely depend on whether it or its founders have any meaningful amount of seizable assets in the country.

mobile.twitter.com/roryhighside/status/953129581426360321

Yeah I referred to that yesterday.

Joao’s claimign USI-Tech aren’t generating bitcoin package ROIs through his software. USI-Tech claim they’re generating them through mining, so that synchs.

Obviously if there’s any mining taking place it’s not paying out 1% a day, but that goes beyond what Joao shared.