Trust Investing Ponzi collapses, pulls “hackers!” exit-scam

The Trust Investing Ponzi scheme has collapsed.

The Trust Investing Ponzi scheme has collapsed.

Rather than just admit the scheme ran out of investor funds to pay out, CEO Diego Chaves claims the company was hacked.

While Trust Investing appears to have ties to Russia, Diego Chaves is believed to be based out of Spain.

Having just covered Spain’s Trust Investing securities fraud warning issued in April, I went digging for clues on Chaves current status.

That led me to Trust Investing’s official FaceBook page, on which I was able to piece together Trust Investing’s collapse.

Trust Investing appears to have begun collapsing in late 2021. The first sign Trust Investing was on the rocks was the introduction of “Truster Coin” in mid 2021.

MLM crypto Ponzi schemes typically introduce native shitcoins as part of their exit-scam strategy. Initially presented as an alternative withdrawal method, eventually the scam switches to only paying out in its shitcoin.

TrusterCoin was officially launched in October 2021. Trust Investing also launched TrusterExchange, granting them tighter controls on affiliate withdrawals.

Between TrusterCoin’s announcement and launch, Trust Investing implemented withdrawal restrictions in tether.

I don’t have a specific timeline for this but in November 2021, Chaves announced restrictions in place would be easing.

GOOD NEWS: Starting today, 11/04 your withdrawal limit will increase to 35,000 USDT and this limit will be weekly.

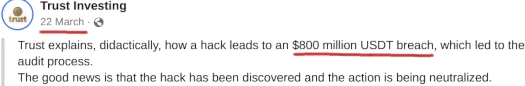

That reprieve was short-lived. Sometime in late November or December 2021, Trust Investing pulled a “we got hacked!” exit-scam.

Chaves claimed hackers made off with $800 million and a 90 day audit was immediately announced.

This is of course all baloney to cover up Trust Investing collapsing.

On March 4th Chaves announced the fictional audit had been completed.

As everyone has received the news, our audit came to an end on February 28, 2022.

After three long months of very hard and constant work. We’re done within 90 days.

We’re getting a lot of new information that’s astonished us. Many, given the volume of resources involved in this hack.

Unfortunately, the impact was very strong. It is important to note that this huge theft that we had, allowed us to manage our company with transparency and seriousness during all three months.

Better than that, the company continues to grow and structure itself with new businesses such as Trust Energy.

“Trust Energy” appears to be a fictional marketing ruse Trust Investing came up with in 2021. “Trust Recycle” is another one.

For all this, as we have already said, we will need fifteen working days to be able to validate the data that the auditing company is providing us.

We will rely on this clear way to be able to formulate a structuring plan for all our Trusters. And we will make all payments through a coherent restructuring plan to all our affiliates.

We will have another communication on this topic from March 21.

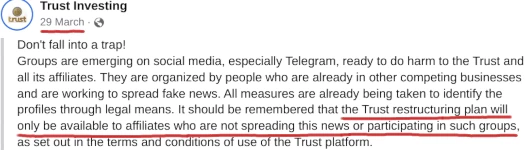

To avoid backlash, Trust Investing disabled feedback from investors on all its social media profiles.

In late March Chaves and Trust Investing net-winners got together in Spain, to discuss the next part of their “restructuring” exit-scam.

The first step was assuring investors that, after $800 million had purportedly been stolen, they’d “fixed the glitch”.

Investors who complained or asked questions were threatened with termination:

Chaves and the Trust Investing promoter meeting lasted a week. At the end of the week a “recovery plan” was announced:

The recovery plan was announced in two phases.

The first phase saw Chaves promise a 115% ROI on invested tether. This would be paid out through a new platform, hosted on “dauntrustentuvida.com”.

KYC was also announced. This is so Trust Investing could delay and deny withdrawals as required.

The second phase was the aforementioned transition to only paying out in a native token. As opposed to TrusterCoin, Chaves claimed Trust Investing would launch a new token for phase 2.

Why not TrusterCoin you ask? Well…

TrusterCoin did the Ponzi shitcoin pump and dump, then itself promptly collapsed.

To placate investors who’d already scammed more than they invested, thus waiting for phase 1 to drag on, Trust Investing continued to publish meaningless weekly ROI reports:

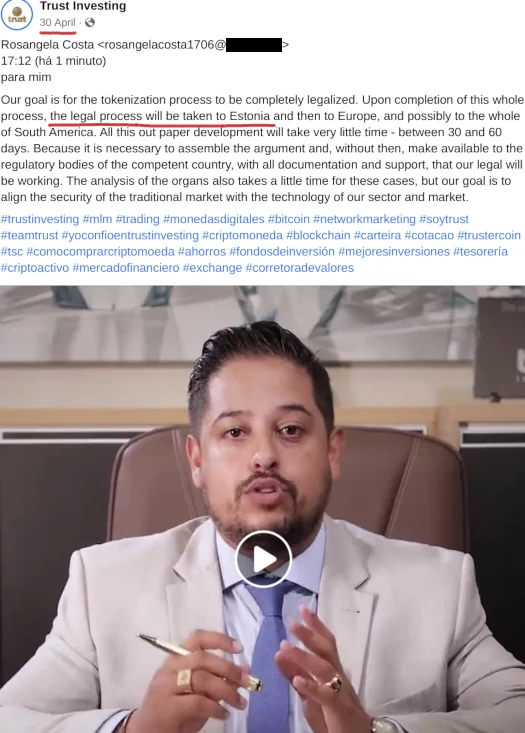

In an April 30th update, Chaves revealed Trust Investing was going the Estonian shell company route:

It’s mostly died down now but, a few years ago, scammers were using Estonian shell corporations to open MLM crypto Ponzi banking channels.

On May 4th Chaves announced Trust Investing was getting its oWn BlOcKChAiN.

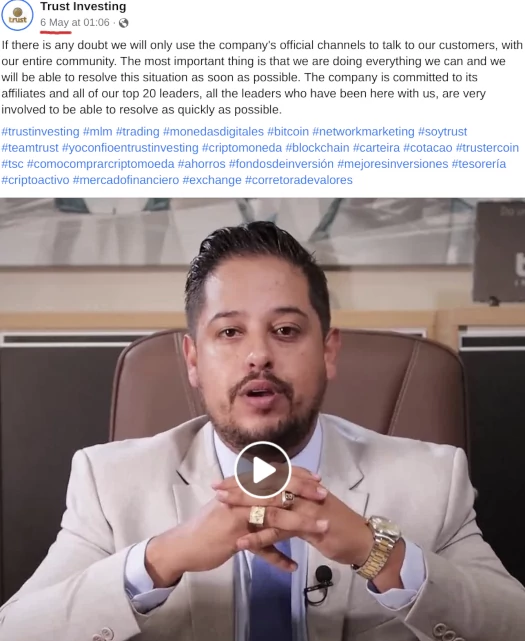

Chaves’ last update was on May 6th:

Phase 1 of Trust Investing’s recovery plan (repaying investors 115% of their losses), is supposed to finish at the end of this month. There have been no status updates on how that’s going since the Luna crypto crash earlier this month.

As above, TrusterCoin is over. Trust Investing’s website is still up but a visit to “dauntrustentuvida.com” reveals a “maintenance work” page:

It should be obvious to anyone with half a brain that Trust Investing is over. Rather than just admit that (and investor complaints), Chaves has embarked on a seven-month long exit-scam.

Why Spanish authorities haven’t taken any further action against Trust Investing and Chaves is unclear.

A securities fraud warning isn’t going to cut it at this stage, arrests need to be made while Chaves and friends are still in Spain. By the time they flee to Dubai or wherever, investors are well and truly screwed.

Pending any further updates to Trust Investing’s collapse and drawn out exit-scam, stay tuned…

Diego Chaves’ post collapse “suit and tie” videos look awfully Boris like.

I wonder what they’ve got on him to keep the charade going. Surely it’d just be safer to jump on a plane to Dubai at this point?

If Boris scammers truly are behind Trust Investing, I believe this is the first drawn out exit-scam from them, as opposed to the usual overnight collapse.

Michael Daher taking notes?

He’s literally wearing the same exact outfit with the same skew tie knot and same strands of hair sticking up “days apart” hahahaha

Seems everything is prerecorded hmmm

What babbling BS they put out for gullible victims to eat up.

So… where are all the millionaires that kept defending this obvious Ponzi scam in the comments?

What about their glorious monopoly money paper gains? They are awfully quiet!!