TelexFree affiliates form “ad hoc committee”, make demands

![]() For affiliates who invested in TelexFree, the current situation is a bonafied mess.

For affiliates who invested in TelexFree, the current situation is a bonafied mess.

Little to nothing has been officially communicated to affiliates, with the roadmap of fund recovery a murky minefield of uncertainty.

I’ve tried my best to analyze and cover what’s happened on the legal front, but short of predicting an inevitable Chapter 7 liquidation, at present have no idea how long this is going to take. Or more importantly, what the alternatives are.

We know the court-appointed Trustee isn’t interested in perpetuating the myth that TelexFree was a legitimate business, but he’s been rather quiet of late. And paradoxically representing the best interests of TelexFree as an estate, hasn’t to my knowledge communicated anything formally to the company’s investors.

Quick to file applications demanding millions of dollars be paid to them for services rendered to assist TelexFree in dodging financial liabilities to affiliates via bankruptcy filings, Alvarez & Marsal North America, Greenberg Traurig and Gordon Silver have together requested $5.64 million in expenses.

Not happy with the possibility of funds being released to these firms, a group of ninety-four TelexFree affiliates have formed what they’re calling an “ad hoc committee”.

Led by counsel at Brown Rudnick, these affiliates are now seeking a rejection or temporary suspension of the reimbursement claims.

The committee’s objection comes on the eve of a September 23rd hearing to determine the fate of the three firm’s reimbursement claims.

The ninety-four affiliates who have signed their name to the objection express their frustration at the current climate facing TelexFree investors, particularly those who don’t speak English:

As this Court is aware, nearly five months have passed since these debtors (collectively, the “Debtors” or “TelexFree”) filed for Chapter 11 relief because of the collapse of their Ponzi scheme that drew in cash reported to exceed $1 billion or more, largely from individuals targeted from non-English speaking communities and for whom these losses often represented a major part of their life savings.

The vast majority of the Debtors’ general unsecured creditors are the hundreds of thousands of Promoters unknowingly engaged to promote the Debtors’ Ponzi scheme. Most are unfamiliar with the Chapter 11 process.

As the scheme targeted immigrant communities, including the Brazilian, Dominican, Nigerian and Russian communities, many Promoters do not speak English fluently.

The bulk of the Debtors’ unsecured creditors cannot engage with these Chapter 11 Cases in any meaningful way.

During this five month period, the U.S. Securities and Exchange Commission (the “SEC”) has filed an emergency civil enforcement action against the Debtors, these cases have been transferred from the District of Nevada to this Court, responsible persons have been criminally charged and others have fled or attempted to flee the country, and a Chapter 11 Trustee has been appointed.

Upon information and belief, negotiations have been commenced among the Chapter 11 Trustee and the estate’s largest apparent creditor — the United States government — on the division of property of the estate between assets surrendered to Federal authorities as criminal forfeitures, and assets administered in the Debtors’ chapter 11 estate for the benefit of creditors.

Notwithstanding these critical developments, no official committee of unsecured creditors has yet been formed, there is virtually no reliable information about these proceedings available to creditors, and creditors have no entity dedicated solely to representing their interests.

There has been to date virtually no reliable information publicly provided to these creditors, in any language, leaving them vulnerable to expensive further abuse, excessive anxiety and loss.

Many of the victim creditors have been approached by vulture investors seeking to use the present information vacuum to prey upon helpless consumer victims of this Ponzi scheme, including by offering to buy claims for pennies on the dollar.

Even more egregiously, unscrupulous attorneys have been advising Promoters they must engage an attorney to file a proof of claim against the Debtor, and attempting to charge these individuals exorbitant fees to prepare those proofs of claim.

Special bankruptcy counsel to the Ad Hoc Committee assisted in shuttering one of the most glaring examples of Promoter abuse: a widely-viewed YouTube video in which an attorney claimed that proofs of claim were immediately due (though no bar date has yet been set), that defective claims would be invalidated without notice to the claimant (contrary to standard bankruptcy practice), and that proofs of claim must be accompanied by a “declaration re: electronic filing” (which is also patently untrue).

Here at BehindMLM we’re no stranger to the antics of Brazilian TelexFree ringleaders. Carlos Costa still regularly appears in YouTube videos promising affiliate investors all sorts of rubbish.

The latest video, published just a few days ago, sees Costa promise affiliates that “something better than TelexFree” is just around the corner.

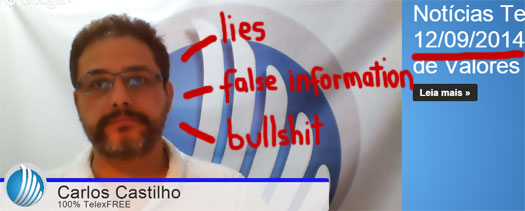

Brazilian TelexFree investors like Carlos Castilho regularly assist Costa, by publishing YouTube “updates” full of fabrications and misleading and outright false interpretations of regulatory legal proceedings in the US.

Castilho was one of the infamous group of Brazilian affiliates who declared “victory” at the first Nevada bankruptcy hearing. Live on YouTube as the hearing itself played out, Castilho and his cohorts pushed the fiction that five or so judges had practically given TelexFree the all-clear.

Other TelexFree affiliates appear in political videos of Costa’s, endorsing his campaign to secure a seat in Brazilian government.

Under the guise of campaigning to legalize MLM Ponzi schemes, Costa hopes to escape criminal charges via election to public office. Secondarily, Costa has also positioned himself to dismiss any regulatory action taken against him as political persecution.

Getting back to what’s happening the US though, in light of currently receiving no representation in the current bankruptcy proceedings, the self-appointed ad hoc committee of TelexFree affiliates are asking that

the fee applications be disallowed or that consideration thereof be postponed until an official committee of unsecured creditors is formed.

On August 1, 2014, A&M, Greenberg Traurig, and Gordon Silver each filed a Fee Application.

A&M seeks authority to apply a $1 million pre-petition retainer to $876,463.72 in fees and expenses.

Greenberg Traurig seeks authority to apply a $3,726,604.89 retainer to $1,044,813.95 in fees and expenses.

Finally, Gordon Silver requests allowance of compensation and reimbursement of expenses in a total amount of $229,712.85.

While the Ad Hoc Committee is fully supportive of the U.S. Trustee’s ongoing efforts to form a creditors’ committee soon, it believes that the upcoming hearing on the Fee Applications is a major case event that cannot pass without direct and formal creditor input.

Unfortunately, without the presence of an official committee, empowered by the Bankruptcy Code with the ability and resources to investigate “any . . . matter relevant to the case,” no one body can speak authoritatively for all creditors.

Notwithstanding, the Ad Hoc Committee, populated solely by what it believes to be a representative sample of all general unsecured creditors, has taken it upon itself to review the Fee Applications, and respectfully submits that the tasks for which compensation and reimbursement is sought benefited neither the Debtors’ estate nor its creditors.

The Ad Hoc Committee respectfully requests this Court (i) enter an order disallowing the Fee Applications in their entirety, or (ii) postpone consideration of the Fee Applications until an official committee of unsecured creditors is appointed.

The legal basis the committee makes its request is that

Beyond debate, compensation paid under Bankruptcy Code Section 330 (as requested in the Fee Applications) must be for “necessary” services and expenses. 11 U.S.C. § 330(a)(1).

In determining reasonable compensation for professionals, a court must consider “whether the services were necessary to the administration of, or beneficial at the time at which the service was rendered toward the completion of, a case under this title.” 11 U.S.C. § 330(a)(3)(C).

The Fee Applications reflect charges for services that were neither necessary to the administration of, nor beneficial to the completion of, these Chapter 11 Cases.

Rather, the Ad Hoc Committee respectfully submits that tasks performed resulted only in unnecessary delay and waste to the detriment of the interests of unsecured creditors.

I wholly agree. It is plain as day that the whole bankruptcy mess TelexFree instigated was nothing more than an attempt to thwart pending regulatory action.

A&M seeks authority to apply a $1 million prepetition retainer to $876,463.72 in fees and expenses.

A review of A&M’s Fee Application reveals that the bulk of its prepetition fees and expenses were incurred in advising the Debtors as to a “restructuring” of what was a fraudulent enterprise — a restructuring which would be unrealistic and contrary to both public policy and applicable law.

Postpetition fees and expenses were also incurred in responding to discovery requests served by the Trustee, in cooperating with governmental investigations by the Securities and Exchange Commission and the United States Department of Justice into the Debtors’ affairs, and in preparing its Application.

Not one has resulted in any demonstrable benefit to creditors.

Greenberg Traurig, which seeks authority to apply a $3,726,604.89 retainer to $1,044,813.95 in fees and expenses, spent inordinate time fighting both the rightful transfer of these Chapter 11 Cases from Nevada (where the Debtors had nothing but a sham “rent-a-space” office in Las Vegas) to Massachusetts (where the Debtors have their principal place of business) and the appointment of a Chapter 11 Trustee (patently necessary here, where key members of Debtors’ management have been taken into criminal custody or fled the country).

Gordon Silver, which requests allowance of compensation and reimbursement of expenses in a total amount of $229,712.85, likewise incurred substantial fees and expenses contesting the motions to transfer these Chapter 11 Cases to Massachusetts and to appoint a Chapter 11 trustee.

The Ad Hoc Committee is baffled how the delay and attendant expense resulting from these doomed efforts can be deemed “beneficial” to the estate.

It is not the Ad Hoc Committee’s intent to cast aspersions on the good faith of the Applicants or on the diligence of their efforts.

However, the Ad Hoc Committee respectfully submits that the tasks performed by the Applicants, as reflected in the Fee Applications, meet no aspect of the standards set by the Bankruptcy Code for the payment of professional fees as an administrative expense of the Debtors’ estate.

My take?

Having seen the various affiliate groups pop up to try to hijack the Zeek Rewards Receivership proceedings, I’m instinctively weary of groups of investors pooling together under legal representation and interfering with regulatory legal proceedings.

Here, the committee itself notes

there is no apparent reliable report on the identity of the largest creditors of (TelexFree) and that, in Ponzi scheme cases, even if such report existed, the reported “largest” creditors are often later determined to have been early promoters of the scheme with claims based largely on anticipated profits, or whom have already recovered significant cash based on scheme distributions.

Are any of the ninety-four affiliates who have put their name on this objection net-winners in TelexFree? That I can’t say.

Regardless though, in this particular instance I’m of the belief that what they’re asking for isn’t unreasonable. So long as the committee’s involvement in this one particular matter extends no further than the objection of funds being released to firms, who served no other purpose than to facilitate TelexFree’s attempts to circumvent regulatory liability via bankruptcy proceedings, I can’t see any issues arising as a result.

In this narrow scope, I think it’s perfectly reasonable to ask that a request for millions of dollars be transferred out of TelexFree be either rejected or suspended pending further analysis.

With no communication to affiliates thus far on his ultimate intentions (other than expressing no interest in a business reorganization), can it be assumed that on September 23rd he will argue in the best interests of TelexFree victims?

Whereas TelexFree victims would no doubt prefer to see no money remitted to the firms in question, what’s stopping Darr from negotiating a discount? Is the question of whether or not these firms deserve any money even going to be raised? Darr can hardly argue that they didn’t perform requested services for the company.

This, I feel, is the crux of the problem residing in the current circus of SEC (civil), Department of Justice (criminal) and bankruptcy proceedings against TelexFree occurring simultaneously.

Individually I can get my head around the status of each proceeding, but trying to work out how each will affect the other? And ultimately just where all of this is heading?

Yeah… pass.

At the risk of further delaying proceedings, I really do think somebody needs to apply the brakes and establish just what is going to take precedence here. And perhaps more importantly, plot out a road-map so that TelexFree’s affiliates aren’t totally in the dark as to what’s likely to come.

I maintain that a group of ninety-four affiliates can hardly speak for the hundreds of thousands who lost money in TelexFree, but if they’re grouping together sparks action towards a cognitive painting of a clearer picture going forward, then all the more power to them.

Let us hope that the quagmire of confusion we currently have before us is addressed sooner rather than later.

Footnote: A full copy of the ad hoc committee’s “Objection To Applications For Allowance Of Compensation And Reimbursement Of Expenses” can be read over at Kurtzman Carson Consultants.

Update 19th September 2014 – Following discussions with the office of the court-appointed Trustee Stephen Darr, the ad hoc committee are now referring to themselves as “creditors”.

This is explained in a newly filed correction to the objection this article is based on:

This document is a slightly revised version of the document initially filed on September 12, 2014 at Docket No. 443 (the “Prior Objection”), solely to correct the identity of the objecting parties.

The Prior Objection described the Creditors as an “ad hoc committee” formed solely to seek appointment of an official committee of unsecured creditors in these cases pursuant to Section 1102(a)(1) of the Bankruptcy Code, and to take limited actions pending such formation as necessary to allow that official committee, once appointed, to undertake the critical duties imposed on that committee by the Bankruptcy Code, and composed solely of persons eligible (and who have volunteered) to serve on that official committee.

However, after discussions with the Office of the United States Trustee, the Creditors now appreciate that the “ad hoc committee” label was not accurate, as the Creditors have not met as a group, and are not acting as a “committee” or other type of entity in any respect.

Accordingly, this Corrected Objection is filed to more accurately reflect the Creditors being, simply, creditors.

Also clarified is the question of whether or not the ninety-five (formerly ninety-four) investors who signed their names to the objection are net-losers or not.

Attorney William Baldiga writes

Primary counsel for each of the creditors who have formed the Creditors have represented to the undersigned (Baldiga) that each creditor is a “net loser” with respect to the Ponzi scheme perpetrated by the debtors.

In the informal discussions among the undersigned, the Chapter 11 Trustee and the Office of the United States Trustee, the Chapter 11 Trustee and the Office of the United States Trustee have emphasized the importance that the persons who are most clearly victims of this fraud are only those persons who have lost money invested, and who have not recovered anything from those “investments,” and who do not have claims based on expectations of gains based on amounts that they hoped would be invested by others “further down” in the fraudulent pyramid scheme.

Accordingly, the undersigned (Baldiga) has worked closely with the primary counsel for each of the creditors listed at Exhibit A attached to assure to the greatest extent practicable adherence to this important criteria.

It’s not 100% bulletproof, but based on what the attorneys representing the signed investors have told Baldiga, they are all net-losers according to Darr’s criteria.

Great update Oz,

I will never cease to be amazed by people who feel entitled to their ill gotten proceeds. They should just stand back and wait as well as be thankful someone is at least trying to recover some of their money.

Is this whole thing an absolute mess? Absolutely, but the scope of it is so large it’s going to take the receivership time to get everything in order enough to give the affiliates some type of news.

More lawsuits are just going to make this take even more time and add an additional layer of complexity to figure out.

IMHO, the TelexFree trustee should launch a website much like Bell did for ZeekRewardsReceivership.com to announce REAL updates and FAQs.

“They worked hard for your money…

So hard for it, honey,

They worked hard for your money

So you never get yours back”

My apologies to Donna Summer. 😉

In principal I agree with what the ad hoc committee said…. but if anyone is aware of what Greenburg was paid, and knows when and how to object it is Darr and the SEC (who is perhaps Telexfree’s largest creditor.)

I am not sure why the ad hoc group felt this filing was necessary but I would not exclude the possibility that their attorney is angling for a position as legal advisor to an Official Unsecured Creditor Committee.

This would be a problem as an attorney representing one affiliate or even a group of them can’t hope to adequately represent the interest of the affiliate collective.

We saw what happened in Zeek Rewards with the Ponzi pimps trying to get their man involved with the Receivership.

As it stands now all they’ve done is file this opposition. What comes of any dialogue between the committee’s lawyer and Darr remains to be seen.

We don’t know if any of the 94 named affiliates in the committee filing are net-winners, but I wouldn’t be surprised. And even if they’re not, whoever is ultimately put in charge of overseeing investor interests needs to be completely impartial.

Darr is charged with operating in the best interests of TelexFree as an entity. At some point that will have to change if he’s to remain in the picture.

“Equity aids the vigilant, not those who slumber on their rights”.

It’s actually the correct thing to do. Someone with a minimum of organizational skills will need to identify the common interests among a whole group of investors, and then communicate those interests through “proper channels”.

Currently, the Court should be the “proper channel” for some of the communication.

It’s actually how life itself works. “If you want to get something done then you will need to do something yourself, you can’t just stand back and wait for it to happen”.

“If others are doing it in an adequate way, then you don’t need to do it yourself, but you will need to do something”.

Acting as legal counsel to an Official Committee involves a much broader outlook and expanded fiduciary duty compared to advocating for an ad hoc or special interest group of course… and at this point its not even known if Official Committee (s) will be formed, but if they are, the Committee members and their attorney would represent and speak for all similarly situated individuals – creditors.

It really premature to know what scheme will be adopted for dealing with all of this given the international nature of it. Will there be a Brazilian unsecured creditor committee? A Dominican Republic Unsecured Creditor Committee?

What can be said with almost 100% assurance is that there will not be an Official Committee of the 94.

I totally agree, though I can not shake the feeling that the attorney is just making a name for himself ahead of Committee appointments.

Darr and Sec will challenge these payments.

https://www.kccllc.net/telexfree/document/1440987140912000000000033

Apparently they already have…informally. The Court has granted Darr and the SEC an extension until the 15th to answer the fee requests and apparently the parties are attempting to work something out.

However whatever they come up with may be subject to objection by the Ad Hoc Group whose motion seems strategically timed and focused to force the issue of Committee formation onto center stage.

Which brings up the question: in the Bell receivership for Zeek, Bell basically kicked all “vendor claims” to secondary status compared to paying back the participants. Can Darr do the same here or are bankruptcy rules different than receiverships?

The problem I see is that Darr isn’t there for the victims. Anything he does that benefits them is incidental to maintaining the assets of TelexFree.

At some point that’s going to translate over to paying out victims but the specifics of that transition are a mystery to me.

Darr in his current capacity isn’t operating with the same objectives as a Receiver.

Not if there is fraud involved.

I don’t think Darr is going to be engaging in fraud anytime soon.

If that was his intention, first thing he’d have done is work towards restarting the business.

Argh, I knew I shouldn’t post when I was about to go to sleep.

I meant Darr’s job is to pay back the investors/creditors and vendors and who else with what’s left, sure.

But if he wants to make a play that Alvarez, GS, etc. have been retained by former management for fraudulent purposes (much like Bell’s suing Kaplan / Grimes) maybe he can negotiate a lower rate or lower the priority of payment.

Is Darr explicitly going to be involved in paying back investors though?

Or does go through the SEC (a creditor) who then organize a Receiver to distribute out what the agency receives from Darr?

Receivers derive their powers from Court Orders and can do what the Court will allow.

Bell wanted to distribute “some” money to defrauded investors as early as possible which the Court agreed was a laudable goal and thus approved a scheme whereby the vendors waited for their claims to be processed.

To do otherwise would have meant an extremely long delay for everyone anyway, so the vendors were not substantially harmed by waiting.

Important here is that the vendors have equal right to share in estate assets and have not been unduly harmed since there are sufficient assets to pay their claims, in part because Bell instituted a “rising tide” distribution scheme and has ample liquid assets at his disposal to cover vendor claims.

On the other hand Bankruptcy Trustees derive their power from statutes that extend from the Constitution through Congress into statutory law which make the procedures followed in Bankruptcy slightly more formalized than those you would find in a Receivership.

Still it seems there is enough flexibility to accomplish sequential distributions …providing doing so does not prejudice the vendors and enough assets available to accommodate it.

This is happening.

For the ZeekRewards Receivership, the trade creditors have been placed into a different class than the affiliate investors (net losers).

“Different class” = different rights. It means that the affiliates will get money first. If there’s any left-overs, the trade creditors will get their money.

Surely you have something to substantiate your claim that they are of different classes. If so please provide.

It has been mentioned in several of the court documents, e.g. Doc-170-1 [PROPOSED] ORDER APPROVING DISTRIBUTION PROCEDURES, paragraph 24 or 25 “Priority of the claims” (further details in the footnote).

Class 3 = Affiliate investors (net losers)

Class 5 = Other unsecured creditors (e.g. trade creditors)

I looked over Zeek Doc 170-1 and agree with you. Affiliate Class 3 claims will be paid in full before the Class 5 (general unsecured creditors such as vendors.) It is important to understand this, but I think its also important to understand that the “rising tide distribution method” creates a substantial reduction in the money Class C claimants are entitled to receive from the estate assets before Class 5 is entitled to payment.

Class 3 Affiliates get paid sooner, by definition…. “in full, ” but less than under what is called the “net loss method” Thus, on balance, the estate should have more remaining assets to pay Class 5 claimants than under the net loss method.

It is notable that ponzis that end up in bankruptcy are treated per the net loss method not the rising tide method.

If they get paid “in full”, the final amount will be exactly the same with BOTH methods. The total amount of losses won’t change if you use another method.

Not as I understand it. In this context “Paid in full” is the payment of what is owed under the rising tide method not full reimbursement of what an investor may have lost. There are at least two ways of calculating the distribution amount. 1. the net loss method and 2. the rising tide method.

“Withdrawals” as discussed below are the same as payments RVG made to affiliates prior to the imposition of the Receivership and taking them into account substantially reduces how much is owed to affiliates from Receivership assets.

I quote.

“Under the rising tide method, withdrawals are considered part of the distribution received by an investor and so are subtracted from the amount of the receivership assets to which he would be entitled had there been no withdrawals. (When there are no withdrawals, rising tide yields the same distribution of receivership assets as net loss.)”

NOTE: It should be apparent that the reverse of the above quote is also true, i.e., if there WERE withdrawals rising tide yields a DIFFERENT distribution of receivership assets than net loss.

This is to say that the way distributions are calculated changes the meaning of “paid in full.”

As you say the total amount of losses won’t change” but the amount distributable to Class 3 will depending on the calculation method.

Further external information.

No Link: jha.com/us/blog/?blogID=2299

Pretty sure there won’t be a separate receiver. There wasn’t one in the Madoff case. Irving Piccard did it all… all the banks and related entities for helping the Ponzi along, lack of due diligence, AND clawback lawsuits against every net winner, got 2 BILLION back from one, IIRC.

Though I can’t remember when he made the distribution… was it a part of SIPC administration?

through a chapter 7 conversion maybe?

Both methods will distribute the SAME AMOUNT, but they will distribute the amount differently among the investors. So both methods will distribute exactly the same amount to a whole class of unsecured creditors.

None of them will get more money to distribute than the other.

@andrew

Possibly. First time I’ve seen a Ponzi work its way through the bankruptcy system so I’m not entirely sure.

Correct me if im wrong OZ, but isnt the goal of a chapter 7, to liquidate the estate to pay the creditors?

But i guess the main question is. What is the ultimate goal at the end of the day with the money already seized and to-be seized???

That it is, how do we get there though?

Darr and his team are doing stuff behind the scenes but nothing is being communicated publicly.

I get the sensitivity of the respective civil and criminal cases against the company, but that then comes back to why on Earth do we have three actions taking place simultaenously. It just feels like a bit of a mess.

You have said that a “whole class of unsecured creditors” won’t “get more to distribute than the other.”

Since unsecured creditors do not distribute under any circumstance I have no idea what you are talking about and will forgoe any further discussion of the topic.

The rising tide distribution method will reduce the amounts payable to Class 3 creditors and preserve assets for payment to the Class 4 creditors. Since the amount payable on Class 3 claims is reduced by amounts received from Zeekler pre shutdown it can do otherwise.

Right now Telexfree top leaders are already taking position in a new ponzi Costa started. This pyramid is a new Telexfree plan.

They are communicating by Facebook inbox messages.

In the next few days the affiliation system will be open to public.

And as i said before, Facebook is the great partner they have to sell this stuff.

These scams are spreading much quicker than the Big 1918 Spanish Flu Pandemic !!

The TOTAL AMOUNT will be the same for both methods. The calculation will be different. The amount distributed to individual net losers will be different (in most cases).

The amount won’t be reduced, it will only be calculated differently.

* “Rising Tide”: Gross investments = 100%. Max distributable amount to net losers = Gross investments minus withdrawals.

*”Net Loss”: Net investments = 100%. Max distributable amount to net losers = Net investments.

Nope. The Rising Tide method does not yield the same results as the Net Loss method. They are two different approaches, using two different formulae and they yield two different results. To contend that they do is pretty much illogical nonsense….mathematically speaking.

Further external information.

No Link: jha.com/us/blog/?blogID=2299

The Rising Tide and Net Loss method of calculations do more than reshuffle money between Class 3 recipients. They also effect the total amount that is payable to the class.

Per the Rising Tide method:

The more withdrawals class 3 made, the less it is entitled to receive from existing Receivership assets.

You use internet sources, while I use my own brain.

Both methods will need to operate correctly for ANY amount to make sense. So you will need to test your source for potential flawed ideas.

That part seems to be correct. “Net loss” will only focus on the net loss, and distribute pro rata.

That logic seems to be half truth (but his calculation later in that post is correct).

The logic there was correct.

His logic is correct.

The 3 investors had a total investment of $450,000.

Amount withdrawn = $90,000

Amount recovered = $60,000

SUM = $150,000 = 33.33% of the total investment

Investor C will first receive $30,000 (to be equal with investor B). Then investor B and C will share the remaining $30,000 (to make them both come closer to investor A). So investor C will receive $45,000, investor B will receive $15,000, investor A will receive nothing.

* Investor A had already recovered 40%

* Investor B has recovered 20%+15% = 35%

* Investor C has recovered 35%

* The distributed PERCENTAGE in the first distribution is 35% ($150,000 / $450,000, rather than $60,000 / $360,000).

* The “Net Loss” method would have reported a distibution percentage of 16.67% ($60,000 / $360,000).

That method will work for ANY amount. If a logic doesn’t work for ANY amount, then the logic is probably flawed.

His logic was correct. It says exactly the same as I said. I have only checked the MATH and LOGIC, but I didn’t find anything at the first look about “more money to distribute”.

Your source didn’t say anything about that?

I have carefully checked the MATH and LOGIC (in the most relevant parts of the source), and your source supported my version more than it supported your version.

The $90,000 withdrawal was withdrawn from the TOTAL INVESTMENT $450,000. You can subtract it from that amount, but you can’t subtract it from the net loss of $360,000 (because then the method will fail).

Correction to post #37 (currently waiting for moderation).

The distributed percentage was incorrectly estimated there.

* Investor A had recovered 40% of his total investment.

* Investor B recovered 30% (corrected from 35%)

* Investor C recovered 30% (corrected from 35%)

* Distribution reported = 33.33% (corrected from 35%)

* The “Net Loss” method would have reported 16.67% distribution ($60,000 / $360,000).

Exactly WHERE do you feel it will be correct to subtract the $90,000? There’s basically 2 different options.

Option 1:

$360,000 minus $90,000 = $270,000 to distribute to those 3 creditors before they have been paid in full.

Option 2:

$450,000 minus $90,000 = $360,000 to distribute to those 3 creditors before they have been paid in full.

Option 1 subtracted the $90,000 from the net loss. Option 2 subtracted the $90,000 from the total investment.

Option 1 will affect the total amount distributed to that class of investors. Option 2 will give a similar amount as the “Net Loss” method.

I believe you have demonstrated that Option 1 (rising tide) requires less of the Receivership’s assets ( $270,000) to satisfy the Class 3 creditors than would be the case under the net loss method – option 2 ($360,000)

Both were “Rising Tide”, but with different types of logic for the $90,000 amount.

But you have indirectly answered the question with “Option 1” as your choice. Now it’s time to TEST how that method will work on ANY AMOUNT, to see if it makes any sense. We can use the example from YOUR source to test it?

* Investor A invested $150,000 – withdrew $60,000

* Investor B invested $150,000 – withdrew $30,000

* Investor C invested $150,000 – withdrew nothing

* Money recovered by the Receiver = $360,000 (changed amount)

You can test your Option 1 on that example, to see if it makes any sense? Here’s half of the solution:

1. Investor C will first receive $30,000 (same as B have recovered)

2. Investor B and C will then receive $30,000 each (same as A)

Each investor have now recovered $60,000 each = 40% of their investments. Remaining money to distribute among those 3 investors will be either Option 1 ($180,000) or Option 2 ($270,000). Only one of those options will make any sense = Option 2.

3. Investor A, B and C will now receive $90,000 each (option 2).

* Investor A has now recovered $60,000 + $90,000 = $150,000 = 100% of his total investment.

* Investor B has now recovered $30,000 + $30,000 + $90,000 = $150,000 = 100% of his total investment.

* Investor C has now recovered $30,000 + $30,000 + $90,000 = $150,000 = 100% of his total investment.

With your Option 1, those 3 investors would only have recovered 80% of their total investments.

…. in which case Class 3 would have been “paid in full” as calculated by using the rising tide method and 20% of the estate assets still remain available to pay Class 4 claims.

Which Class 4 claims? Nobody have mentioned anything about other creditors here. You can’t add some imaginary ones, that idea will only make it become more vague.

80% != “paid in full”. Your logic will prevent those 3 credtors from being paid in full even when the money is available for distribution.

Your source didn’t support your idea either.

“Option 2” was the ONLY option that made any sense when tested on the amount of $360,000. So that idea is probably the correct one. “Option 1” would have failed to pay the creditors in full.

Post 31

That’s right. The distribution scheme pays the Class 3 in higher priority but still leaves something (more contingent) for the Class 4 vendor claims.

M_Norway: “Option 1″ would have failed to pay the creditors in full.

Option 1 pays in full whatever the rising tide method calculates the person is owed

That’s why I pointed out that nobody has mentioned any other creditors (in the example we have used to test the different versions).

We have used the example in the source YOU decided to link to. It didn’t mention anything about other creditors. You brought in that example to explain how the “Rising Tide” method worked, and I accepted that explanation. But I analysed it first before accepting it, and it supported my version more than it supported your’s.

Post #31 is about something else, so it’s not very relevant.

“Rising Tide” must make some sense to the CREDITORS. Creditors would never have accepted your version, because it’s “harmful to the whole group of creditors”. It will steal from one whole class of creditors and give to another class (or in some cases give it to the Receiver).

You will have great difficulty explaining your “Option 1” logic, while my logic easily can be explained.

[My version]

The total investment from those 3 net losers was $450,000. Their total withdrawals were $90,000.

Subtracting $90,000 from the $450,000 will reflect the reality:

Total investment $450,000

– withdrawals $90,000

—————————

= net loss $360,000

—————————

[Your version]

Your version will try to subtract an ADDITIONAL $90,000 from the total investment. It will reflect “constructed theories” rather than realities:

Total investment $450,000

– withdrawals $90,000

– constructed theory $90,000

————————————

= result of constructed theory $270,000

————————————

I’m pretty sure you won’t be able to reasonably explain what those ADDIITIONAL $90,000 are about. They have already been subtracted one time. The second subtraction simply won’t make any sense.

This source has BOTH methods explained in detail, both the “Net Loss” method and the “Rising Tide” method, both explained with graphs, tables and text:

NOLINK://www.abiworld.org/committees/newsletters/cftf/vol10num3/slice.html

[Rising Tide”]

The source has used the same logic as I used (in post #37) with multiple distribution rounds, where the first round will try to raise creditors with no withdrawals up to a higher level, the next round will include some of the creditors with low withdrawals, etc., until all the recovered funds have been distributed.

It also explains the principle of fairness to the creditors.

Very good. The graphs and explanations are clear and illustrate your point.

As a test of how pure the intentions of this “ad hoc committee” are, it would be interesting to see how many of the “ad hoc committee” are net winners.

Also, it would be nice to cross check this list of 95 “victims of the TelexFree fraud” with the list of 20 or so creditors released in the original Bankruptcy filing, although, I don’t think there will any matches since most of those 20 have already made a ton of money and are keeping low.

I think that the claim made by the 95 victims is valid and, if the judge listens to them, then it will help all net losers of this fraud.

Even if all 95 members of this committee are net losers and true victims, there is still the question of predatory lawyering practices. Is the law firm just positioning itself to get a good chuck of any recovered funds?

As has been mentioned before on this forum, there have been instances of lawyers in Brazil and Dominican Republic who are just trying to get their hands on the TelexFree estate under the pretense of protecting victims.

I think one such lawyer or representative of a group of victims posted here on Behindmlm.com a little while back but was quickly called out for it.

Generally an Official Committee is comprised of a half dozen or so of the largest creditors, but to the extent the 20 largest listed by Greenburg Trauer in the BK filing are actually family members or promoters whose claims are based on unpaid “winnings” I think they will all be eliminated from consideration. Where then are the largest?

Some may be among the 95 ad hockers, and if so they deserve to be considered for Committee membership. At least they have their head in the game.

Article updated with news of a corrected objection filed.

The “ad hoc committee”, after holding discussions with Trustee Stephen Darr’s office, are now referring to themselves only as creditors.

Also clarification on whether or not the ninety-five signed investors are net-losers.