Cardiffs allege fraud occurred prior to preliminary injunction

![]() Jason and Eungung Cardiff are challenging a previously granted preliminary injunction.

Jason and Eungung Cardiff are challenging a previously granted preliminary injunction.

The injunction is part of the FTC’s case against Redwood Scientific Technologies, which the Cardiff’s own.

On January 13th the Cardiffs and other defendants filed a motion requesting relief from the granted preliminary injunction.

On January 13th the Cardiffs and other defendants filed a motion requesting relief from the granted preliminary injunction.

The argument behind the motion is that the misconduct alleged by the FTC ceased prior to the FTC’s filing.

The alleged misconduct pertains to the sale of TBX-Free, Eupepsia Thin and Prolongz through Redwood Technologies.

In their February 3rd filed response, the FTC claims the Cardiffs are once again lying.

Defendants’ factual assertions, offered through the sworn declarations of Eunjung and Jason Cardiff, are utterly false, as they were selling TBX-FREE, Eupepsia Thin, and Prolongz as late as October 12, 2018, the date of the Court-ordered immediate access of the Redwood Scientific Technologies, Inc. business premises.

The FTC were granted an ex parte TRO on October 10th, 2018.

In addition to lying, the FTC also states the Cardiffs have failed to demonstrate any changing facts or law that warrants the injunction being dissolved.

Instead, they have filed nearly identical declarations in support of their motion in which they brazenly misrepresent facts in an apparent effort to mislead the Court.

This Court has already determined that the Cardiffs are “totally unbelievable.”

The Cardiffs’ declarations only further demonstrate their willingness to lie under oath.

If the Cardiffs’ motion is granted, they will be exempt from paying redress, or having to disgorge ill-gotten gains.

A hearing on the matter has been scheduled for February 24th.

In related news True Pharmastrip was denied its motion to intervene.

True Pharmastrip was used to pay the Cardiffs’ personal expenses and liquidate assets, potentially in violation of the granted injunction.

True Pharmastrip filed an appeal on January 15th.

The court-appointed Receiver has also detailed another recent instance of the Cardiffs attempting to dissipate Receivership owned assets.

The court-appointed Receiver has also detailed another recent instance of the Cardiffs attempting to dissipate Receivership owned assets.

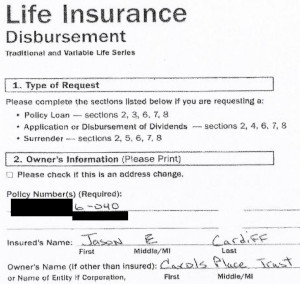

The Receiver has recently discovered that Jason Cardiff (“Cardiff”) has attempted to dissipate receivership estate assets by trying to borrow against the cash surrender value of his personal insurance policy with AXA Equitable Life Insurance Company (“AXA”).

The Receiver had previously (in October 2018) put AXA on notice of this Court’s orders concerning Cardiff.

On January 3, 2020 … a manager/legal assistant at AXA, contacted the Receiver about Cardiff’s request to borrow against Cardiff’s AXA insurance policy, which would – had it succeeded – have dissipated the cash surrender value of that policy.

The Receiver told AXA that borrowing by Cardiff against the policy was prohibited by this Court’s orders.

The amount Jason Cardiff tried to cash out on his December 23rd application was $13,950.

This is the fourth instance of non-compliance the Receiver has informed the court of.

On January 31st the court-appointed Receiver requested permission to sell the Cardiffs Upland, California residence.

Our next update will likely be on or around February 25th, following the scheduled February 24th injunction hearing. Stay tuned…

I wonder how long this will go on. I also wonder if Cardiff spends time in jail when this is all said and done.

What if Cardiff never did anything wrong and now he had to go through all of this and have his businesses stopped for no reason? Would the government reconcile that? I mean his life has been screwed.

I’m not suggesting he is innocent, but would be something if he is.

And what if Cardiff is… batman?

The FTC got an injunction based on evidence. We’re long past pretending there’s no evidence.