OneCoin claims business is an “investment opportunity”

In light of OneCoin not being registered with a securities regulator anywhere in the world, the company has started insisting it’s not an investment opportunity.

In light of OneCoin not being registered with a securities regulator anywhere in the world, the company has started insisting it’s not an investment opportunity.

In a compliance email sent out on July 13th, OneCoin advised affiliates anyone caught promoting OneCoin as an investment opportunity ‘will have their account frozen‘.

In OneCoin’s affiliate backoffice, the company provides affiliates a document titled “How To Develop Your Business”.

On the following pages we provide you with a start-up plan. Follow the steps.

Be patient and do not give up. Only hard work brings reward.

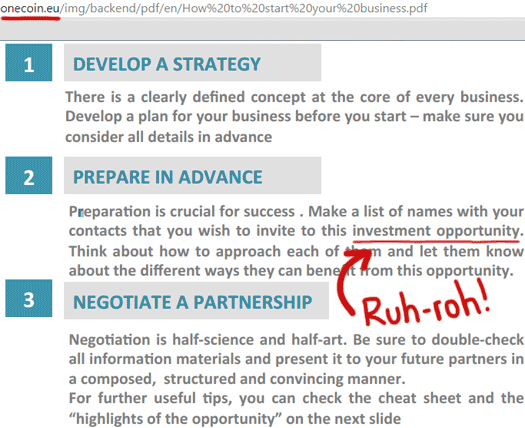

The five-page document starts by advising OneCoin affiliates on how to “start your business”.

Three recommendations on starting a OneCoin business are provided;

1. Develop a strategy

There is a clearly defined concept at the core of every business.

Develop a plan for your business before you start – make sure you consider all details in advance.

2. Prepare in advance

Preparation is crucial for success.

Make a list of names with your contacts that you wish to invite to this investment opportunity.

Think about how to approach each of them and let them know about the different ways they can benefit from this opportunity.

3. Negotiate a partnership

Negotiation is half-science and half-art.

Be sure to double-check all information materials and present it to your future partners in a composed, structured and convincing manner.

As per OneCoin’s July 13th compliance email;

OneCoin is not an investment or “get rich scheme”. OneCoin is a global cryptocurrency committed to servicing the voids in our current global economy.

Any affiliate, no matter what country they’re in, caught advertising OneCoin or One Life as an investment, or a get rich scheme will have their accounts frozen.

While OneCoin affiliates are threatened with accounts being frozen if they mention the word investment, it seems the same rule doesn’t apply to OneCoin itself.

Hahahahahaha!!

EPIC! So glad that this is preserved within the sands of time 🙂

Good work. Again!

Anybody read the About section on OneLife? It’s pretty hilarious.

Why is it restricted to low-cost transactions…hmmmm…I wonder…

Anyways, here is a picture of the OneEcosystem. Investment is so important it’s listed twice.:

oneteamroc.com/en/en/one-ecosystem/

Notice that none of that stuff in the ecosystem is ready for anyone to really use.

SO who cooked up all these slices of the onecoin pie?

They can’t find merchants how are they going to establish use over all those offerings.

How can they find any merchants if their coin is basicly the playmoney within the system.

This ponzi scam has its last day’s counting,so will be a pleasure to watch them sink in all the lies and promises they have made.

Labine freaking out!!

youtube.com/watch?v=CU2Hw8QCTmU

Actually sounds like he’s the only one left whom he’s trying to convince! Same similarities Zeek is having post-factom issues with, it seems.

Also, Labine and I even had an Attorney ready to moderate our scheduled debate yesterday, and Labine called it off at the 11th hour stating that he wants to stop wasting time with haters.

The best way I can compare what we do for Pumpers not already complicit in the crime is that it is like seeing an obviously drunk driver who doesn’t realize how drunk they actually are, entering a thorough way, at Rush Hour. OF COURSE IT IS OUR OBLIGATION TO WARN OTHERS AND REPORT THEM!

@TimTayshun

From the beginning these guys have sold one coin as an investment and that train has left the station. Just saying, “we are selling inv..no no.. its education packages” is like putting lipstick on a pig.

They keep saying, dont get out. Stay in for 2 years. Its like the stock market bla bla…

I mean, why else would someone buy “education packages” if not for the returns. Their US presentations are all about it being investments.

Also, none of these guys seem to have any clue about the actual blockchain technology if you listen to them all the way from the top level. Its all about the money and building the network without any requirement of an actual “REAL” product, one of the main signs of a Ponzi Scheme.

If anyone questions it, they bring up their puppet leaders expertise, how much money everyone is making and how many sheep are in their herd and silence people.

Also interesting how when its pointed out that its their main leaders that are pitching this as investments, Ken chooses to ignore the elephant in the room and bring up the troll argument.

Listen at exactly 2:30 into this video: youtu.be/nX1xlQG6k3M

Tom McMurrain, who is usually VERY CAREFUL to emphasize that Onecoin is NOT an “investment” (but only “education”), directly compares Onecoin’s Ponzi Tokens to Ethereum “Tokens” and states on-the-record that the two are “a form of currency.”

Not going to be able to back off of the “investment” angle after that one, me thinks!

There is a TON of BS in this video, where the convicted felon looks the camera in the eye, but it is just literally IMPOSSIBLE for these guys to talk about or pitch Onecoin as not being an investment. Impossible.

I wish The Economist would come out and straight DENOUNCE THEM. Why not? Any chance of getting some connections there?? How about The Economist do the next exposé? I’ll start looking into that 😉

In the US it doesn’t really matter whether or not they use the term “investment”. There are 2 other issues that they just cannot get around:

1.) OneCoin is a security. That means it must be registered for legal trading of the currency. To sell/trade an unregistered currency is a felony in the US.

2.) Giving financial advice while being paid to give that advice without being licensed is illegal. I am not sure if it is something that can be prosecuted criminally or just a civil case. However, if someone gives illegal financial advice, they will be held liable for any damages caused. If it’s done intentionally, they can be held liable for above the damages they caused.

So anyone involved with OneCoin in the US is committing a felony as long as OneCoin remains unregistered. Then those that are pushing OneCoin and are not licensed to give financial advise are at least committing civil crimes which they will be held financially liable for any damages they cause.

So not only are people risking their freedoms, but also their wealth by pushing OneCoin in the US.

And yes the SEC is fully aware of OneCoin and the people involved. I have met with the SEC and named names. They are being watched.

Ruja explaining the new packages:

youtube.com%2Fwatch%3Fv%3DMjyLThaxbLg&h=XAQHqxTWR&s=1

No mention of additional “education” you get for 118k EUR. But you get 2 million onecoins, lol.

How is that not breaking their own complience rules?