Lyoness CEO: “It’s all about positions!”

Earlier this month news broke that Lyoness had begun to actively go after uploaded multimedia footage that made the company look bad.

Falsely claiming copyright infringement, Lyoness filed multiple copyright infringement notices with YouTube who then took the videos down (they have a “no questions asked” policy on copyright infringement complaints, however the complaints can be challenged) .

The two videos in question?

The first is the classic Dragon’s Den appearance by Andy Nyakas, who tries to pitch Lyoness to three “dragons” (venture capital investors).

Painfully awkward to watch at times, Nyakas’ attempt to pitch Lyoness is nonetheless an interesting example of what happens when the often buried Accounting Unit investment scheme within Lyoness is brought out into the open (fast forward to [25:00] for the Lyoness pitch):

The footage above is from Dragon’s Den Canada, with copyright of the show owned by the Canadian Broadcasting Corporation. Curiously, after being previously available the footage also now appears to have been removed from the CBC website itself.

The second is an investigative report from ORF, the Austrian national public service broadcaster.

Following the airing of the report earlier this year, it appeared on YouTube. Shortly after the report was exposed to a wider global audience, once again Lyoness filed copyright infringement notices with YouTube.

Needless to say the ORF report belongs to the ORF broadcasting network, with any claims of copyright infringement from Lyoness being false.

Whereas the Dragon’s Den episode is more like a critical review of your typical Lyoness investor presentation, the ORF report took on an investigative approach and is far more damning.

It should be noted that I had been aware of the report for some time now, but it was only recently that I was able to track down an English subtitled version of the report and thus understand it.

The report begins with some background information on Lyoness’ attempts to whitewash the Austrian media of criticism.

Following critical Austrian media coverage late last year about Lyoness investors losing money and media coverage of the Austrian Corruption Prosecutor suspecting an “illegal pyramid scheme” being operated by Lyoness, the company raised a complaint with the Austrian Media Authority.

Lyoness lost the case.

The report then delves into an expose on Lyoness’ CEO and founder, Herbert Freidl.

Of course when you see Friedl’s messiah like appearance at events that fascinates.

One cannot deny the man has charisma and is a very talented salesman. This influences people’s decision making.

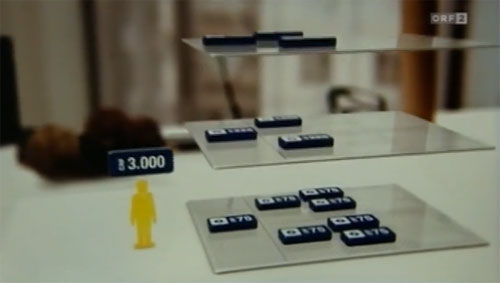

Following a brief explanation of the merchant shopping network cashback scheme bundled with Lyoness affiliate membership, the report then examines the often buried Lyoness accounting unit investment scheme.

An “internally-spread Lyoness video from Switzerland” states

For 3000 Swiss Francs (or 2000 EUR) you can buy into the system.

The more you pay, and the more paying people you bring in, the better. A miraculous multiplication process commences.

What happens if you can’t find people to bring in and invest after you?

“Mr F.”, who does not want to be filmed, has paid Lyoness 6400 EUR for the promise of 60,000.

According to his own administration, Mr F has received about 73 Euros from Lyoness over the last three years.

Mr F. was participating in an “American Billing System”. Through his investments in vouchers (Ozedit: Lyoness loyalty credit), he would benefit from the US market.

When the money never came, Mr. F wanted to consume the value of the vouchers he purchased from Lyoness. However, he finds out that in order to do so, he would need to invest another 120,000 EUR to get the actual vouchers.

The above scenario is the option of Mr F. investing in additional account units in order to satisfy the required number of new investments to trigger a ROI payout on his existing unit investments.

Naturally this makes no sense, as the additional investments will outweigh the ROI paid out. Lyoness affiliates have to find new investor affiliates to put money into account units for the scheme to make sense to an affiliate financially.

And it’s not just affiliates not getting paid, with some in Lyoness management not faring any better: (Bernard Wagner)

I have been laying the ground work for Mr. Friedl. That means that I have increased the sales until they could work independently.

“Work independently” of course means drive enough new investors such that their affiliate recruitment efforts mean that official Lyoness marketing efforts are no longer required to perpetuate the scheme.

When it was time for me to benefit from this work, I was simply removed from the company.

The above is from former Lyoness management, Bernard Wagner, whose payments were withheld by the company in 2008.

The ORF report claims that Wagner has known Friedl ‘from previous companies operating similar systems for a few years. That is, to profit from the payments of subsequent participants’.

I believe it was in June when I suddenly stopped receiving commission.

I saw one of the two structures I had built was completely taken away from me by Lyoness. Which is something they claimed could never happen in this system.

Reading between the lines, “structures” of course refers to an account unit investment chain, with new investments at the bottom feeding returns owed previous investors at the top of the chain.

The “lifeline” of Bernard Wagner? Recruiting new members who in turn convince new people to make down-payments.

In the 22nd week of 2008, Wagner had 68,000 participants under him. One week later, merely 38,000 were left.

“Now the amount would have to be about 1.4 to 1.5 million, over which I should receive commissions”.

Wagner estimates that had Lyoness of not terminated his affiliate downline, he’d be making approximately “somewhere between 50 and 100 thousand euros per month”.

Wagner is now suing Lyoness in an attempt to recover his lost commissions. Additionally two other former Lyoness managers are also suing the company for 1.5 million euros in unpaid commissions.

Our case is definitely not a unique incident. It is

Lyoness’ strategy to let people build their networks for them, and then let them drop as a rock without paying them.That is one of the pillars the company is built on.

Personally I have no sympathy for Wagner or his lost income but his insights into the workings of Lyoness, specifically what he did in order to generate commissions (returns) are insightful.

One of the long-standing facts about the Lyoness income opportunity is that any affiliate who wishes to generate a substantial income from the opportunity inevitably has to participate in the AU investment scheme.

Often this is dismissed by new affiliates professing the merits of Lyoness’ merchant shopping network, however, in addition to simple common-sense, analysis of the 2012 Lyoness Income Disclosure Statement blows this facade out of the water.

And then of course there’s the blunt admission from CEO Hubert Freidl himself, who when “educating” Lyoness affiliates in Bulgaria in his pre-messiah days stated:

My goal is to make you achieve your wishes, dreams and goals.

It’s all about positions, positions, positions, positions.

By making downpayments one can acquire positions in the Lyoness system.

I don’t go out to merely register someone, it’s not about registering people for the cashback card. Then I could as well just register you at the nearby swimming pool.

The “positions” Freidl is referring to is of course the account units Lyoness affiliates purchase in order to kick start their involvement in the AU investment scheme.

Units are able to be created via shopping at Lyoness merchants, however as the 2012 Lyoness Income Disclosure Statement figure shows, this activity is dwarfed by affiliate’s directly investing in accounting units themselves.

ORF sought a response from Lyoness regarding Freidl’s comments and was given the following statement by Mathias Vorbach, Head of Communications:

I can’t comment on the video as I haven’t seen it myself.

However, I can’t imagine that Mr. Friedl has said anything that contradicts the philosophy of Lyoness.

The ORF report closes out with a statement from the Association for Consumer Information (VKI), who have ‘investigated the terms and conditions of Lyoness‘ after receiving ‘numerous complaints from consumers‘.

Appearing on camera, Peter Kolba from the Association explains

We have tried very hard but we do not understand the terms. We are convinced they are incomprehensible, especially for the average consumer.

We were very surprised to find 61 vague and inexplicable clauses. We had never seen so many incomprehensible clauses in one contract.

Additionally, the contracts signed by the members contain many clauses the violate the applicable Austrian legal requirements.

Therefore the VKI has filed a lawsuit against Lyoness, through which we want to force Lyoness to stop using these clauses. As well as, most importantly, prohibiting them from relying on the content of those contracts that were signed earlier.

This confusion is carried over to Lyoness’ operations around the globe, with the company being notoriously recognised as having one of the most complicated and convoluted compensation plans in the industry.

This largely contributes to the repeated instance we see here at BehindMLM where new Lyoness affiliates, unable to grasp or simply unaware of the account unit investment scheme at the heart of the company, launch into lengthy tirades of justification using the largely irrelevant merchant shopping network.

To date the BehindMLM Lyoness review has attracted over 1000 comments, with not a single Lyoness affiliate able to explain or justify the existence of the affiliate-funded AU investment scheme that generates the bulk of revenue for the company.

The ORF report, which I believe aired earlier this year, can be viewed below in its entirety (to turn subtitles on, first click the “cc” icon in the top right of the video and then the big “EN” box in the middle):

Do you think Lyoness will go the way of Zeek Rewards and Profitable Sunrise? Meaning do you think they will be shut down for being a scam.

I personally don’t think so… Their shopping incentive program works. All they have to do is chop off the “down payment to AU” thing and they’ll be perfectly legal, IMHO, of course.

So if they shut the whole thing down, that’s because they *want* to f*** all the merchants and all the people who had already put money in.

Recently I wrote an article on my blog entitled:

“WHY NETWORK MARKETING COMPANIES SHOULD BE GOVERNMENT LEGISLATED”

My blog post seems to be relevant particularly in the case of what seems to be revealed in the video featured on this subject!

Here are my thoughts I welcome yours!

Not that it matters now, but Lyoness should give Mr. Nayakas the boot for “misrepresentation” and for sweating profusely during his spiel.

Maybe next time they can send the CEO of Lyoness to the Dragon’s Den to “correct some misunderstandings” made by Mr. Nayakas.

@DaveP: What for? They’d eat him up alive even if the presentation was given by the CEO himself.

Lol. I know. That episode would’ve been worth watching too. Can you imagine?:

Nayakas: “Gentlemen/madam, this is the head and CEO of Lyoness Mr. Hubert Friedl himself. He will no doubt give you guys a much better explanation about Lyoness than I ever could and I’m confident you will all change your minds about not providing the capital I requested. Take it away, Friedl.”

I don’t think you can “take the 5th” across the pond. 🙂

(for non-US folks… “take the 5th” means invoking the 5th Amendment in the US constitution, the right to not self-incriminate)

Dear Mr. Chang,

The Dragons’ Den video was not removed from the CBC website, but due to the public nature of their broadcasting corporation, the video is only viewable for a limited, Canadian audience. This policy is enforced through an IP-check.

The ORF Report episode, however, was removed from the ORF website.

We are happy you are spreading our message, yet it could have been nice to acknowledge our hard work by including a link to our blog.

Thanks,

The Lyoness Complaint Centre

I think you got me confused with Oz.

Thanks for the Wikipedia link. I found it indirectly by searching for “Lyoness Complaint Centre”.

https://en.wikipedia.org/wiki/Lyoness

You’re very welcome.

– K. Chang:

Our apologies, don’t know why we thought you were the driving force behind this website.

I used the Wikipedia-link to find some of the local information for Norway (through a “Company structure” link in Wikipedia).

Lyoness Norway AS

Org. number: 898 800 342

Founded: 02.08.2012 (August 2nd 2012)

Owner: Lyoness Europe Ag

CEO: Terje Duesund (07.02.2013)

Former CEO: Marko Sedovnik, Ptujska Cesta 42, Slovenia

Board:

Marko Sedovnik, Ptujska Cesta 42, Slovenia (Chairman)

Monika Murarova (Member)

Terje Duesund (Member)

Terje Duesund has been involved in a couple of MLM/NWM

* Natures Own / Natures Scandinavia AB (1997-2002)

* Synkronice, Distributor Presidential Team (2010-2012)

Lyoness in Norway

Lyoness has probably been tried introduced in Norway earlier, but the introduction has failed.

I have found a request to the Gaming Board dating back to May 2011 (Case no. 2011/1340). After that it was quiet until July 2012, October 2012, March 2013.

– M_Norway

If you want to see who has been working for Lyoness in Norway (or any country for that matter), have a look here:

http://cc-lyoness.blogspot.com/2013/06/the-no-comment-facts-series-3.html

– M_Norway

I cannot seem to locate the application to the ‘Lottstift’ you’re referencing; where did you find it?

Thanks.

@Antilyoness

Lottstift.no is the address to “Lotteri and Stiftelesestilsynet” (“Norwegian Gaming and Foundation Authority”). I haven’t used that website.

oep.no is about “Offentlig Elektronisk Postjournal” (“Public Electronic Post Journal”), an online database containing letters to and from government agencies. It’s a searchable database for different cases or different companies, or other types of searchable keywords.

* Most of the “anonymous tips” are sealed and protected from the general Right to Insight, so it didn’t offer anything valuable except a list / dates / titles.

Direct link to oep.no/simplesearch/english:

http://www.oep.no/search/simpleSearch.jsp?lang=en

1. Enter “2011/1340” in the search box (or “Lyoness”)

2. “Norwegian Gaming and Foundation Authority” in the next box (drop down list)

3. “All years” (radio button)

4. “Search”

Optional:

5. Sort documents by “Doc no.”

6. You can click on any of the documents in the list to expand the information about that single document.

7. You can also order insight into documents, simply by providing a valid e-mail address. Most documents here are sealed, they are “anonymous tips” protected by §24. Even if a few of the documents are available, I don’t believe they are of any particular interest or worth spending any time on.

8. Available documents are typically about letters to and from parties, plus Right to Insight claims/denials.

Knowing that the database exists and can be used is actually of more interest than the current documents in this case. It will eventually contain important information.

@Antilyoness

I have browsed through around 60-70% of the material, but without checking each and every link.

I can potentially “spread the word” (or a part of it) to “targeted audiences” in Norway, e.g. to news reporters in online newspapers or a similar audience (bloggers, etc.).

An audience like that will typically do its own investigation, with a main focus on the local rather than the global market. That type of audience has different needs than an ordinary audience, they are information PROVIDERS rather than USERS.

USEFUL MATERIAL

* The subtitled ORF report can be used, as an overview

* some of the background information can be used, e.g. the “Lyoness History 1994 – 2011” pdf

* “Dragon’s Den” can be used

* “Julian Hosp webinar” can be used

* a few of the other articles can probably be used, e.g. about the Quality Austria / TÜV certificates, or about the position system itself.

LOCAL MATERIAL

I will need to add some local sources on my own …

* the oep.no results

* company info for Lyoness Norway AS

* background info for Terje Duesund, CEO Lyoness Norway AS

* some of Lyoness own material

E.G. I checked the local Merchant list, checking Merchant ID for 20 out of 48 merchants. They have 2 different types of ID Numbers, a 449-serie for Global merchants and a 459-serie for local ones.

For some of the global merchants, it simply can’t have been motivated by potential sales to that local market. It’s probably about investments in a new Lyoness market rather than about expanding their own markets.

TYPES OF MATERIAL

The reporter type of audience will typically be looking for official and ORIGINAL material, e.g. company registry records, court documents and similar types of official material. And I can’t drown them in material either.

That’s my primary audience this time. If you can add / point out material like that then please do it. That audience has a “Professional Code of Ethics” to follow, typically about being balanced, fair and factual.

nj.no/no/Journalistikk/Etikk/Var_Varsom-plakaten/Code+of+Ethics+of+the+Norwegian+Press.b7C_wZHU0V.ips

The blogger type of audience will probably cover a wider range of different subtypes. It’s not my primary audience this time.

THE METHOD I WILL USE

1. I will post information in an existing forum thread, one that is showing up in search results for “Lyoness” when searching from Norway. People actively searching for information will find it.

I had to use an indirect method here, linking from a “general pyramid scheme” thread to a Lyoness specific one.

2. I will also need to send some information to the correct authority, the “Norwegian Gaming and Foundation Authority”, to make sure that authority can give some clear answers to my primary audience. That’s the primary source they will check, the most official one.

I have sent SOME information, mostly official information.

@Antilyoness

TAX EVASION

One of the comments to the “Lyoness Maze” article mentioned sales taxes / VAT …

Gift cards are technically “containers for unfulfilled transactions” rather than “products” or “services”.

* an empty giftcard is a product, a plastic card

* a loaded giftcard is about unfulfilled transactions (no VAT), relatively similar to a debit card

* Jeanette Hayworth linked to some tax rules in the Lyoness review here, post #401.

I have asked a few questions about 1099 or similar tax forms. Lyoness did send out tax forms in the US (according to its own GTC), but most Eastern European participants will normally try to avoid questions about taxes.

* If you’re looking for tax evasion, it’s more likely to be found in yearly personal income tax reports in SOME countries, than in VAT / sales tax.

OTHER DISCUSSIONS

We have also had “MLM commissionable?” discussions about giftcards.

* Most people will compare them to “money on a card” = “EQUAL to money” = NOT COMMISSIONABLE in MLM.

* I believe the “unfulfilled transactions” definition is the most correct one.

TRADE = “exchange of values”, e.g. between seller and buyer.

“Unfulfilled transaction” = an agreement between seller and buyer about a DELAYED transaction. Unfulfilled transactions are relatively normal in business.

* Most bills you receive in the mail will have 8-14 days delay in payment.

* Most transactions on the internet will accept cash (Credit Card) payment, and the seller will send you the products within a few days.

This post and comments section gets my vote as the best blog on MLM ever. I have been highlighting this scam to the people I have come in contact with, but as usual, the blinkers are on the religous tone of their spiel is overwhelming.

Just a thought: In many countries where VAT is in force, the sale of a gift card is regarded as a full sale from VAT purposes and companies account for it upfront. Not that it is particularly important in the big scheme of things.

What is exceeding obvious is that the cash rewards on the premium members are funded and dependent on new recruits.

We are designed to have a “balanced audience”, i.e. neither a typical “anti scam audience” nor a typical “pro MLM audience”. It’s rather about “looking for factual info audience”. But the audience will balance itself in different directions, depending on the material.

I covered that in post #18, but I haven’t exactly studied the rules. Jeanette Hayworth linked to TAX rules, not to VAT rules.

* Selling a giftcard generates a taxable event, i.e. a revenue for the company selling it.

But none of us are “experts” on tax or VAT. We have simply covered the topic as a part of the normal discussion here, without digging too deep into tax rules.

VAT

A giftcard isn’t a product or service in itself. VAT is typically about products or services, Value Added Tax.

* Some products or services can have different VAT than others, e.g. printed newspapers in Norway has zero VAT (a type of indirect press support, to protect local newspapers and “number 2 newspapers”).

* Some districts can have lower VAT than normal, e.g. Svalbard and Jan Mayen have zero VAT, Northern Norway has reduced VAT, while the rest of the country has 25% VAT.

I posted the conclusion for that logic in post #18:

COMMISSIONABLE IN MLM?

We have also had discussions about that, whether or not giftcards and down payments legally can generate commissions in MLM. Most people think it’s “money over money”, i.e. commissions on monetary transactions rather than bona fide sales = not commissionable in MLM.

I believe giftcards can be commissionable when they are SOLD, but most MLM experts have the opposite opinion.

By balanced means that you deal in facts and that is why it works. Big claims require big evidence not more BS.

VAT and income tax are one way to get a government to take notice, but everyone is ultimately responsible for their own taxes. Another method to highlight the money laundering function gift cards provide. Washing cash on a grand scale!

There is also organized crime legislation which would work wonders if the powers at be pulled their finger out their butts.

I have sent off a few notes to some key individuals I am close to or have access to in my country, I will update you as to the reponse I get.

Here’s an example:

If Lyoness has an agreement with Walmart about 5% commission on each giftcard it sells, it will order 100 empty giftcards ($0 or a minor shipping fee). When a Lyoness member order a $500 giftcard, Lyoness will activate/”load” that single giftcard with $500 value.

* 95% of the $500 will be sent to Walmart, $475

* Lyoness will keep its 5% commission, $25

If it sells 100 giftcards like that per month, it will earn $2,500 in gross commission, taxable as “sales commission” rather than as “product sales”.

WalMart is the one selling products and services, so any VAT will have to be paid by WalMart. It will only receive 95% of the $500 value in cash. VAT has to be calculated from the 95% OR from the actual sale.

I don’t think that is the what they do it. I have spoken to a number of large retailers that sell to Lyoness (note SELL TO, not PARTNER WITH – there is NO due diligence done and I have triple confirmed this)

Walmart or others issues preloaded cards (nice round numbers) and discounts the invoice to Lyoness. They don’t give a commission back after the client actually spends in store.

Now different countries handle that tax calc different and it is not really relevant to the scheme being run. There is no way the sales tax can be dodged either way.

Please contact me….I have extensive internal Lyoness Americas information…..It is a SCAM here in the USA also…

@ExCorporate

Feel free to send what you have via the contact form (attachments fine).

Or if it’s just information you could just leave it as a comment.

@ExCorporate

Hi

please send me details to my email (Ozedit: email removed)

Thank you.

Kind regards

Nilesh

I never received anything IIRC so I wouldn’t hold my breath Nilesh.

@Oz

I’ve heard from several other Lyoness-bloggers that they had been contacted with a similar offering of ‘sensitive insider information’, but they never heard back when they contacted this person.

@M_Norway

You seem to know a lot about Lyoness in Norway. Any idea whatever happened to the investigation there?

Probably someone harvesting emails then.

Affiliate crusader superheroes!