Dot Dot Smile blames COVID-19 pandemic for collapse

Dot Dot Smile has filed its Chapter 11 Plan.

Dot Dot Smile has filed its Chapter 11 Plan.

The December 2nd filing provides insight into how and why Dot Dot Smile collapsed.

In 2020 Dot Dot Smile (the “Debtor”) recorded $15 million in revenue. Then the COVID-19 pandemic happened.

Unfortunately, inventory shortages caused by the COVID 19 pandemic impacted DDS’s ability to recruit and build new teams under the MLM model and, after unsuccessful attempts and obtaining financing, the Debtor borrowed from Merchant Cash Advance lenders and increased its orders for product.

By the time the new inventory arrived, demand under the MLM model had waned, a result of the difficulties associated with the MLM business model during the pandemic.

Tellingly, Dot Dot Smile doesn’t mention retail sales. As noted in BehindMLM’s July 2019 Dot Dot Smile review, distributors having to blindly purchase product

is a terrible method of distribution for affiliates, as it assumes retail customers will buy anything.

As with LuLaRoe, Dot Dot Smile is incentivized to keep this model. It gives the company a convenient out if a product line flops, as opposed to have to own up to creating designs that nobody wants.

You can’t sell the random patterns we sent you? Well obviously you’re just not trying hard enough.

In an attempt to save the business, Dot Dot Smile canned its MLM opportunity in May 2022.

In the end this didn’t pan out;

As a result of these challenges in the retail clothing environment, DDS’s cash flow was impacted resulting in lawsuits and collection efforts by the Merchant Cash Lenders and an eviction lawsuit filed by the owner of the Debtor’s Riverside location.

Dot Dot Smile’s recorded gross revenue for 2021 was $16 million. That plummeted to just $3 million in 2022.

Looking forward, Dot Dot Smile claims it intends to settle its debts by

Looking forward, Dot Dot Smile claims it intends to settle its debts by

transitioning a low over-head, online business model and will fund the Plan principally via online sales.

Jeffrey E. Thomson and Nicole Thompson shall remain the co-Managing Members of the Debtor.

Nicole (the founder of the business) will remain the president of DDS and shall earn a salary of $100,000 per annum. Jeffrey will remain the Chief Executive Officer of DDS and he will earn a salary of $100,000 per annum.

Assets held by Dot Dot Smile top out at just over $4 million.

The current market value of the Debtor’s inventory is $4,000,000 (if sold in the ordinary course of the Debtor’s business).

The Debtor estimates that the value of its website is $5,000 and estimates that the value of its trade name Dot Dot Smile, LLC to be $100,000.

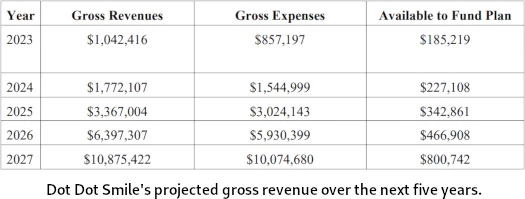

If everything goes according to plan, here’s Dot Dot Smile’s projected revenue over the next few years:

There’s no specific timeline but voting on Dot Dot Smile’s Plan will now be voted on.

Pending the outcome of that vote, which I believe will take place in Q1 2023, the court will either approve or reject the plan.

Update 3rd July 2023 – A few recent Monthly Operating Reports were filed last month.

A June 30th filed report details Dot Dot Smile’s financials for May 2023:

- Dot Dot Smile currently has six employees

- $64,034 is held in Dot Dot Smile’s accounts with an additional $95,549 cash on hand

- $92,733 was received for May 2023, $61,218 was attributed to expenses generating $31,514 positive cashflow

- $479,630 is claimed to be owed to Dot Dot Smile

I think that they overestimated the value of their website by $5,000.

They’ve also overestimated the value of their trade name by $100,000.

Article updated with May 2023 Dot Dot Smile financials.