Is United Wealth Education violating the FTC Act?

Back in August BehindMLM covered Financial Education Services’ $324 million FTC settlement.

Back in August BehindMLM covered Financial Education Services’ $324 million FTC settlement.

The settlement pertained to the FTC alleging FES “scam[med] consumers out of more than $213 million”.

On September 27th I received an email from Sue Griffin, representing herself to be VP of Agent Support for United Wealth Education Services, formerly FES.”

As per Griffin’s email;

Hello,

I am the VP of Agent Support for United Wealth Education Services, formerly FES. Please note, the FTC has not ordered the company to close.

Two defendants who have not been associated with the company since May of 2022 were banned from credit repair and operating an MLM.

The company continues to operate on an MLM platform. I would like the opportunity to share some additional information about the settlement with you.

I sent back the following reply later the same day;

FES doesn’t exist anymore, so discussion around it closing is moot. It’s gone.

I had a look on United Wealth Education’s website for BehindMLM’s pending review. I noted UWE fails to disclose company ownership or compensation details to consumers. Both are potential violations of the FTC Act.

Seeing as you’ve offered to share “additional information”, can you please confirm who owns and runs UWE and a copy of UWE’s compensation plan.

Over two weeks have passed and Griffin has failed to reply.

Today United Wealth Education (UWE) came up for review. Unfortunately UWE still fails to provide consumers with basic due-diligence information, leaving them unable to make informed decisions about the company.

Within the context of FES’ recent FTC settlement, today I thought we’d approach UWE’s potential FTC Act violations.

UWE launched following a $1.75 million pyramid fraud fine by the US state of Georgia in 2019, and the lead up to the FTC’s FES fraud lawsuit in 2022.

Today UWE essentially operates as a reboot of FES, minus FES’ co-founder Mike Toloff.

UWE operates from the domain “myuwe.net”, privately registered on February 23rd, 2021.

A visit to UWE’s website reveals the company fails to disclose ownership and executive details.

This by itself is a potential FTC Act violation, but with UWE is crucial given the FES pyramid fraud fine in Georgia and subsequent FTC fraud settlement.

As a potential UWE retail customer, a visit to UWE’s website homepage redirects me to its MLM opportunity.

On this page UWE urges website visitors to “enroll as an Agent”, “start growing your business today” and “learn how to change your financial future forever”.

On face value, UWE’s lack of retail focus on its website is a strong indication the company operates a pyramid scheme. The FTC has previously warned MLM companies without significant retail activity are operating illegally.

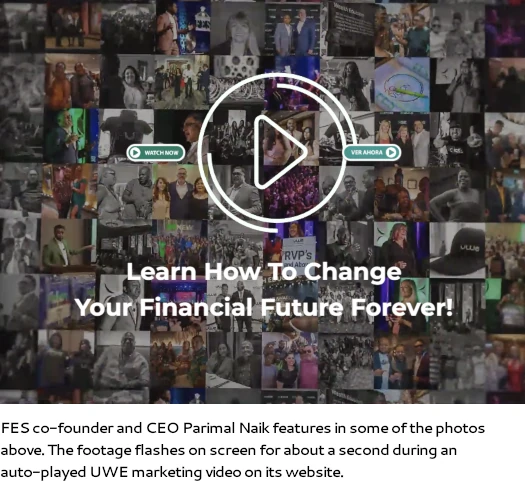

It was only be chance and due to BehindMLM’s coverage of the FES settlement, that I spotted Parimal Naik for a brief second in an autoplayed UWE website marketing video.

Naik co-founded FES with Mike Toloff. Beyond an uncredited split-second appearance in a marketing video, there is no mention of Naik on UWE’s website.

Naik co-founded FES with Mike Toloff. Beyond an uncredited split-second appearance in a marketing video, there is no mention of Naik on UWE’s website.

Whether Naik alone owns and runs UWE is unclear based on the information UWE provides to consumers on its website.

Having failed to establish who owns or runs UWE, next I moved on to the company’s products.

UWE markets a “protection plan”, “cards”, “will & trust” and “loan products” on its website.

UWE’s protection plan is provided by United Credit Education Services, or UCES. UCES operates as a faceless company attached to a PO Box in Michigan.

If there is common ownership between UWE and UCES, this is not disclosed on either company’s website.

No retail pricing for UCES’ protection plan is provided on UWE’s or UCES’ website.

The “cards” section of UWE’s website pitches “secured” credit cards issued by Synovus Bank.

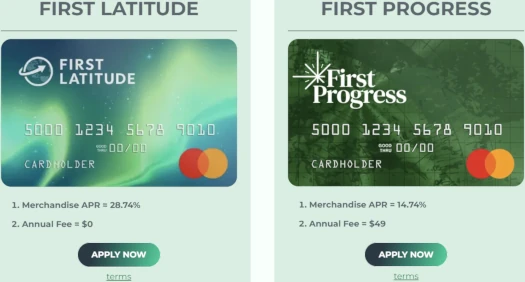

There are two card options available:

UWE’s offered secured cards are branded “First Latitude” and “First Progress”. No information about either entity is provided.

First Latitude has its own website. It again presents as a faceless company with no ownership details disclosed.

UWE also offers unsecured credit cards. No retail pricing is provided.

UWE’s “will & trust” offering is marketed as “MyCare Plan”. A “create now” button on the MyCare Plan section of UWE’s website redirects visitors to UWE’s “contact us” website form.

No retail pricing for UWE’s MyCare Plan is provided.

Finally we have the “loan products” section of UWE’s website.

UWE apparently offers business loans through a non-disclosed entity. No fees are disclosed. Clicking buttons to “apply for funding” redirects potential retail customers to the “contact us” form on UWE’s website.

Having failed to establish retail pricing for UWE’s products, beyond two third-party offered secured credit cards, I moved onto UWE’s compensation plan.

Well, I tried to. Not surprisingly, UWE fails to provide consumers with compensation documentation on its website.

In summary;

- UWE fails to disclose ownership or executive information to consumers, including a prior regulatory fine in Georgia and $324 fraud settlement with the FTC

- all visitors to UWE’s website homepage are redirected to the MLM opportunity (Agent sign up)

- ownership of United Credit Education Services no disclosed

- ownership of First Latitude and First Progress is not disclosed

- retail pricing isn’t disclosed for nearly all of UWE’s offered products and services

- UWE fails to provide consumers with compensation documentation

All of the above constitute potential violations of the FTC Act (disclosures).

And this isn’t some sort of negligent oversight. When an UWE executive reached out to me I asked them point blank to disclose who owns and runs UWE, and for compensation documentation.

Two weeks later and counting I have received no reply.

Potential FTC Act violations aside, if I was evaluating UWE as part of my BehindMLM research it’d be a solid avoid.

Consumers should avoid any MLM company that fails to provide them with ownership, executive, product (including pricing) and compensation details.

If a company ignores simple due-diligence requests, then they have a lot to hide from the public. They’ve got a lot of “funny stuff” going on, and companies like this need to be avoided like the Bubonic Plague.

I have been an independent agent of UWE and a Protection Plan customer for over 12 years. Our owner is publicly known and our compensation plan is made available through our independent agents.

There is absolute transparency and great customer service since I have been here.

I would not have erased over $1.3 million dollars of debt, learned how to raise and maintain my credit score, created my estate documents, I ultimately would not have started saving and managing money with purpose had it not been for this company.

My entire family is financially secure because of UWE and UCES. The company has a simple mission to help families reach their financial goals beginning with becoming financially literate. Blessings, Love, and Grace!

An MLM company hiding its compensation plan from consumers is the opposite of transparency. It is also a violation of the FTC Act (disclosures).