Investview settles iGenius fraud with Ontario & Quebec

Investview has settled iGenius securities fraud related allegations with Ontario and Quebec.

Investview has settled iGenius securities fraud related allegations with Ontario and Quebec.

As disclosed in Investview’s 2024 10-K Annual Report filed with the SEC;

During 2024, we received a letter of inquiry from the Ontario Securities Commission (“OSC”) in which they questioned whether iGenius was engaged in securities activities without being registered under their securities act.

Specifically, the OSC identified concerns that iGenius was selling ndau – which they considered an investment contract – and also noted that they had concerns about certain third-party product offerings and access to market experts that were made available to iGenius customers.

Even though we believe that our iGenius business fully complies with all applicable securities laws, due to the immaterial scope and scale of our operations in Ontario, Canada, we elected to settle the matter with the OSC without the need to engage in a protracted and costly legal dispute.

Rather, we agreed with the OSC to conclude the inquiry by implementing a geoblock throughout Ontario such that no Ontario-based customers would be able to access any of the disputed product offerings.

Later in 2024, we and one of our independent distributors received an enforcement action from the financial regulators in Quebec, Canada, known as the Autorité des marchés financiers (the “AMF”), in which they challenged certain inappropriate marketing communications they characterized as “inappropriate” made by this particular distributor, and as well alleged that iGenius was inappropriately engaging in regulated securities activity without being appropriately registered to do so in Quebec.

In discussions with the AMF, it became clear that the focus of their inquiry was on certain “touting” of financial results by this particular distributor which we concluded was unauthorized and in violation of our own internal policies and we terminated the distributor.

As well, the AMF raised concerns about certain “robotic” trading platforms that were made available to iGenius customers through third-party products that iGenius makes available to its subscribers.

Even though we believe that our iGenius business fully complies with all applicable securities laws, due to the immaterial scope and scale of our operations in Quebec, Canada, we elected to engage in settlement discussions with the AMF without the need to engage in a protracted and costly legal dispute.

In addition to the termination of our distributor, we have reached a tentative understanding in principle with the AMF by which we offered to institute in Quebec the same type of geoblock that we implemented in Ontario, as well as agreed to pay a CAD $15,000 fine.

The parties are negotiating the terms of a written settlement agreement, and the agreement is still subject to AMF approval.

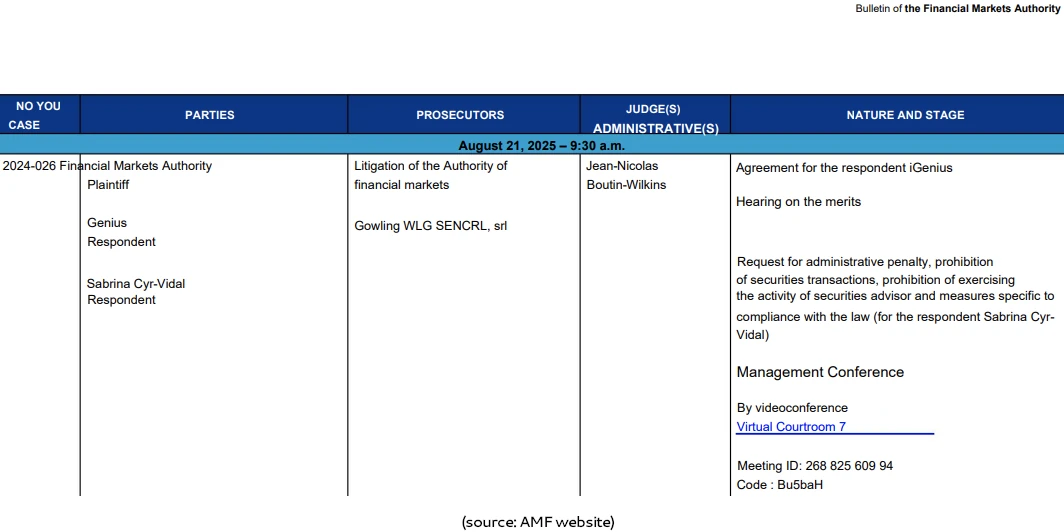

I wasn’t able to find any official documentation from Ontario but for Quebec it appears a Management Conference is scheduled for August 21st (click to enlarge):

The hearing pertains to the AMF’s

request for an administrative penalty, a prohibition on trading in securities, a prohibition on carrying out the activity of a securities advisor, and measures specific to compliance with the law.

The monetary fine seems a bit low but hopefully the iGenius website block means no more Ontario or Quebec residents are defrauded.

More recently, iGenius received a pyramid fraud warning from Poland. Whether Investview discloses UOKiK’s warning in its second 10-Q for 2025 remains to be seen.

Update 5th February 2026 – The referenced terminated iGenius promoter in Investview’s SEC filing is Sabrina Cyr-Vidal.