iGenius promoter fined $15,000 CAD in Quebec

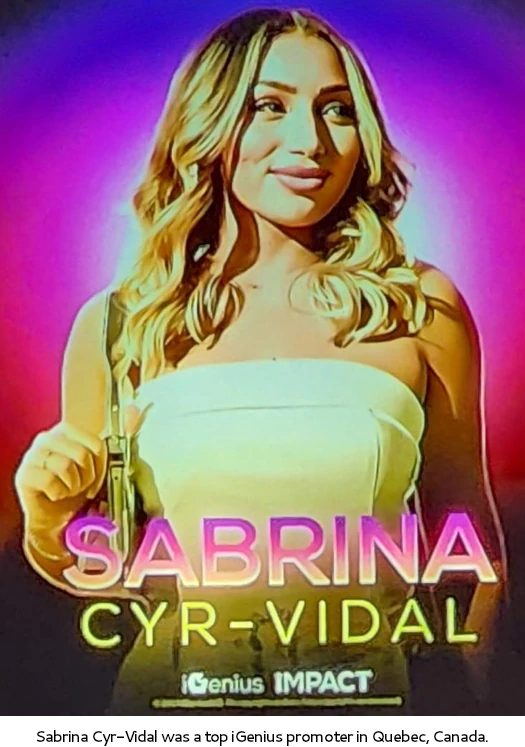

Sabrina Cyr-Vidal has been fined $15,000 CAD for promoting iGenius in Quebec.

Sabrina Cyr-Vidal has been fined $15,000 CAD for promoting iGenius in Quebec.

As disclosed in parent company Investview’s SEC filings, Quebec’s Autorité des marchés financiers (AMF) initiated securities fraud proceedings against iGenius and Cyr-Vidal in 2024.

Later in 2024, we and one of our independent distributors received an enforcement action from the financial regulators in Quebec, Canada, known as the Autorité des marchés financiers (the “AMF”), in which they challenged certain inappropriate marketing communications they characterized as “inappropriate” made by this particular distributor, and as well alleged that iGenius was inappropriately engaging in regulated securities activity without being appropriately registered to do so in Quebec.

Investview settled with the AMF in 2025. The settlement saw Investview agree to pay a $15,000 CAD fine and block Quebec residents from accessing iGenius.

Cyr-Vidal was singled out by the AMF as a top iGenius promoter targeting Quebec residents.

The AMF accused Cyr-Vidal of

having conducted or assisted in conducting a distribution without a prospectus and of having acted as a broker or advisor without being registered as such.

Promoting unregistered securities is typically also illegal in jurisdictions where offering unregistered securities is illegal.

Cyr-Vidal didn’t contest the AMF’s charges, leading to a Tribunal decision approving sanctions on December 5th, 2025.

Given Sabrina Cyr-Vidal’s acquiescence to the introductory pleading filed against her, the Financial Markets Tribunal (TMF) prohibited her from engaging in any activity related to securities transactions. It also prohibited her from acting as a broker or investment advisor.

Finally, the TMF imposed an administrative penalty of $15,000 on Ms. Cyr-Vidal.

For their part, iGenius immediately threw Cyr-Vidal under the bus after the AMF made contact.

From Investview’s previously cited 2025 SEC filing;

In discussions with the AMF, it became clear that the focus of their inquiry was on certain “touting” of financial results by this particular distributor which we concluded was unauthorized and in violation of our own internal policies and we terminated the distributor.

Cyr-Vidal doesn’t appear to have promoted iGenius’ unregistered investment schemes any differently than promoters elsewhere in the world.

Following Investview’s run-in with Canadian authorities and coinciding with a $4 million pyramid scheme fine from Poland last month, iGenius is being rebooted as Connective.

Connective will see Investview pivot from securities and commodities fraud, to selling diamonds and nutritional supplements.

In any other context, Cyr-Vidal would be referred to as the “fall guy.”

Which is kind of dumb because Ontario went after Investview too. They didn’t have anyone to throw under the bus there fortunately.

@Oz, oh but they did and chose not to! At the time both founders of the future GO AI were Ontario residents Rakan Khalifa and Kaine Harriott (who subsequently moved to Dubai).

These guys were the money in iGenius and the syndicate couldn’t afford to lose them (though they ultimately did anyway).