iGenius pivots from trading to… selling lab diamonds?

iGenius has revealed plans to sell lab diamonds in 2026.

iGenius has revealed plans to sell lab diamonds in 2026.

Top iGenius promoter Anthony Napolitano claims $25,000 to $30,000 commissions will be offered. Not everyone is happy about the pivot from trading to jewelry though.

At time of publication iGenius doesn’t appear to have acknowledged its pivot from trading to selling jewelry.

As per Napolitano’s previously referenced announcement;

In 2026 we’re gonna be selling physical products, jewelry, uh like every- Like our system is gonna be crazy.

We had five carat diamonds at the event. I’ll send you a video from uh, the event this weekend.

Like we’re, we’ll literally be selling five carat diamonds and making $25,000 [and] $30,000 commissions. Like insane stuff.

Like we’re gonna be doing crazy things that have never been done. But you know, not everyone has that long-term vision.

iGenius’ website still presents a trading MLM opportunity. The last post on iGenius’ official FaceBook page is dated December 16th and pitches a 15% “upgrade” discount.

It’s unclear whether iGenius promoters who might have bought the upgrades knew they were buying into a bait-and-switch.

Kaine Harriott, a former iGenius promoter who is part of GameChangers, is encouraging people to cancel their iGenius promoter membership and join his new company.

Harriot confirmed iGenius’ pivot to selling jewelry on or around December 18th;

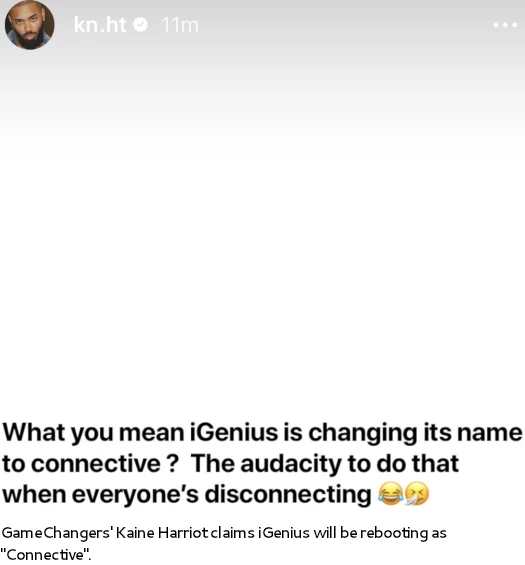

In a subsequent social media post, Harriot suggests iGenius is changing its name to “Connective”.

Historically iGenius has undergone name-changes coinciding with regulatory enforcement actions:

- Wealth Generators rebooted as Kuvera Global preceding a a $150,000 fine from the CFTC in 2018;

- Kuvera Global rebooted as iGenius upon learning of an SEC investigation in 2021.

Neither iGenius, parent company Investview or US regulators have recently confirmed an investigation.

Investview’s last run-in with US regulators was Apex, wherein SEC fraud charges were settled via a $375,000 fine in January 2025.

GameChangers is run by founder Rakan Khalifa and has also been the subject of at least one regulatory fraud warning.

Fraud charges were filed in Poland against GameChangers iGenius promoters in April 2025. In July 2025 New Zealand’s FMA noted iGenius was illegally being promoted in New Zealand through GameChangers.

In addition to regulatory fraud action in Poland and New Zealand, last year Investview settled iGenius related fraud allegations with Ontario and Quebec.

After learning of iGenius’ “Connective” reboot and pivot to selling jewelry, Kaine Harriot began promoting another opportunity.

Every single one of you will pay no enrollment fee in 2026 when we launch.

All you simply must do is email iGenius [and] take your subscription off file. Whatever package you were on there, you will be on here.

So if you are select, you are going to disconnect and now you are on connect.

If you were an elite, you’re gonna move away from that and now you are complete.

Connect, create and complete. Whatever package you were on there, you are on here. Simply cancel your membership there and bring your membership here.

And for $170 you will not pay another dollar to get your same package.

The unnamed company Harriot is urging iGenius promoters to join is Go AI Academy, a new MLM company run by GameChangers founder Rakan Khalifa.

As BehindMLM understands it, Go AI Academy doesn’t have a public-facing website yet. Recruitment and enrolment is being done on a secret platform.

Nonetheless, here’s what we know from Go AI Academy promoter material;

GO AI is a professional online academy that helps you learn how to invest, trade, and grow your wealth. Discover tools, mentorship, and global community designed for long-term success.

Start learning from professionals — unlock your path to smarter investing.

GO OS – the first and the only AI-powered trading and investment assistant. Affiliate program for passive income.

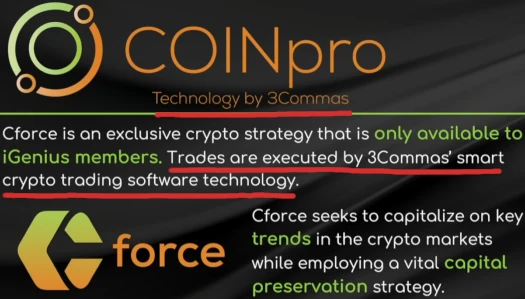

Go AI Academy sounds an awful lot like a clone of iGenius’ unregistered auto trading opportunity. BehindMLM has honed in on iGenius’ Cforce as the root of iGenius’ ongoing fraud.

Through a partnership with 3Commas and Blue Square Wealth, iGenius offered consumers access to automated returns through an unregistered trading opportunity.

It’s unclear whether Go AI Academy will offer automated trading or manual trading signals only.

What is clear is iGenius has had a turbulent 2025.

As early as January 2025 it emerged Be Club was openly raiding iGenius promoters. Earlier this month David Imonitie merged what was left of Nvisionu with iGenius.

Now we have the Connective pivot to diamonds and jewelry, as well as Rakan Khalifa openly raiding iGenius before the official announcement.

I’m also noting what I believe to be recent compliance additions to iGenius’ website. Bizarrely, iGenius now claims to be a “publisher of financial news and information”.

Investview Inc. and its wholly owned subsidiary iGenius LLC (the “Company”), is classified as a publisher of financial news and information and therefore exempt from registration with the SEC.

This is an exemption provided in the U.S. Securities Investment Advisers Act of 1940. We provide financial research and information to the public, but it is completely at the discretion of the individual as to whether they will use the information or not.

The Company delivers trade strategy signals, alerts, research, analysis and convenience tools that are sent to subscribing members via email, mobile app, telegram, website membership and any and all other electronic means.

There is no customization, review or consultation of the member’s personal financial objectives, situation or need. The member is free to act or not to act on the information provided.

United States regulatory as defined by the Securities Exchange Commission and executed by FINRA uses the following criteria to determine eligibility for the exemption:

4. Publishers. Publishers are excluded from the Act, but only if a publication:

(i) provides only impersonal advice (i.e., advice not tailored to the individual needs of a specific client);

(ii) is “bona fide,” (containing disinterested commentary and analysis rather than promotional material disseminated by someone touting particular securities); and

(iii) is of general and regular circulation (rather than issued from time to time in response to episodic market activity).

The Company does not offer automated trade technology. In the past, we offered automated trading as a convenience for FOREX users. The Commodities and Futures Trade Commission reviewed our automated technology and determined that it required a Commodity Trading Advisor.

Since we are committed to providing education and not advice, we entered a settlement on the finding from the CFTC and discontinued the use of automated trade services.

We know automated tools are still available in the marketplace as described below, but we ALSO know promotion or use of this automation requires registration and licensing. We do not provide these services and we caution our customers about these types of automated tools.

Example of Automated Trading: A company or an individual trader issues a trade signal. A person pays the company/trader for their signals. The individual then attaches their MT4 enabled forex account to the provider of the trade signal.

All of this is odd for two primary reasons:

- Investview is already registered with the SEC (but doesn’t disclose its’ unregistered trading opportunities); and

- iGenius’s Cforce service offers consumers access to passive returns through automated trading.

Again, historically Investview has only changed the name of its long-running unregistered trading scheme when US authorities have taken action.

Investview now falsely referring to itself as “a publisher of financial news and information” could be a preemptive response to a pending enforcement action.

Pending further updates on iGenius’ “Connective” reboot and/or Go AI Academy, stay tuned.

David outta be a shamed of himself for selling out of his people to go to Igenuis.

Right before he went to igenuis, he ran a promotion on all the products, acting as if the distributors would qualify for a rank the champion rank in the company if they buy a certain amount of product. But it was a tactic to actually liquidate the company before he switched.

Such a deceiver. Now look … Diamonds. Haha.

If my models are correct, in three to six months, there won’t be any iGenius/Connective distributors to sell diamonds, or coffee, or whatever they’re trying to pivot to. The company will be a zombie MLM shortly.

I have to give some grudging credit to Rakan Khalifa and Kaine Harriott; they figured out that the only way to get rich in MLM is to start one.