Iyovia fails to meet financial obligations, owners MIA

Collapsed billion dollar MLM pyramid scheme Iyovia is failing to meet its financial obligations.

Collapsed billion dollar MLM pyramid scheme Iyovia is failing to meet its financial obligations.

Iyovia customer data is also being deleted and Iyovia co-founders Chris and Isis Terry have gone underground.

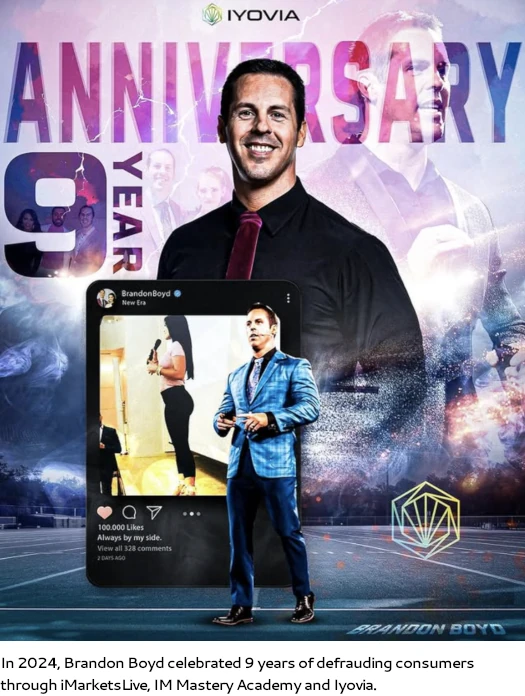

On June 11th Iyovia defendant Brandon Boyd requested “nearly four months to respond” to the FTC’s motion for a preliminary injunction.

Chris Terry, Isis Terry and the Iyovia corporate defendants (aka IML Defendants) joined Boyd’s motion.

The FTC filed its opposition on June 16th;

Defendants have illegally taken over $1.242 billion from over 2.4 million individual consumers since 2018, including over $535 million taken from over 890,000 individual U.S. consumers.

Plaintiffs have already stipulated to, and this Court has entered, an extension providing all Defendants 14 additional days, until June 27, to respond to the PI Motion.

The IML Defendants and Brandon Boyd (“Moving Defendants”) now seek a far lengthier extension of time, requesting nearly four months to respond, or, in the alternative, an additional 60 days.

Moving Defendants fail to provide good cause for why the Delay Motions should be granted.

Boyd and the joinder Iyovia defendants claim they need four months “to rebut the evidence Plaintiffs submitted in support of the PI Motion.”

The FTC argues

most of that evidence comes directly from the Moving Defendants’ own files, which they previously produced to the FTC in response to civil investigative demands (“CIDs”).

Moving Defendants should be well-versed in the experiences of their own customers, and the IML Defendants have access to their own financial data and their customer and salesperson databases.

Emphasising the urgency behind its request for an Iyovia preliminary injunction, the FTC documents years of alleged fraud and deceptive conduct.

Prompt resolution of the PI Motion is necessary to prevent further consumer injury and ensure the preservation of relevant evidence and Moving Defendants’ assets.

Moving Defendants have repeatedly shown disdain for law enforcement and have brazenly continued their unlawful conduct while acknowledging its illegality.

Moving Defendants have sought to evade law enforcement oversight through various tactics, including by changing their scheme’s name and by directing their salespeople to not useIML’s name in their deceptive marketing.

Moving Defendants have repeatedly flouted the law. Without a preliminary injunction in place, it is highly likely that Moving Defendants will continue to engage in illegal and deceptive practices.

Communications between Chris Terry and Jason Brown cited by the FTC indeed paint a damning picture.

In late 2018, shortly after the Commodity Futures Trading Commission announced an administrative action against International Markets Live, Inc. (“IML”) for illegally offering foreign exchange and binary options to retail investors, Defendant Christopher Terry, CEO of IML, informed Defendant Jason Brown “I am gonna come up with a new [company] name… We will restructure the financial side with banks and offshore corp to protect iml…rep[utation] management[,]… new S[ocial] M[edia] on all sites[,] I[nsta]g[ram,] f[ace]b[ook,] Telegram[,]… Merchant [account]s[,] everything… Let me come up with a name and share.”

Later in the same conversation, and after Brown noted that “guys are freaking out about legal,” Chris Terry reiterated: “Rebrand. IML dirty.”

Shortly thereafter, Defendants rebranded IML as “IM Mastery Academy.”

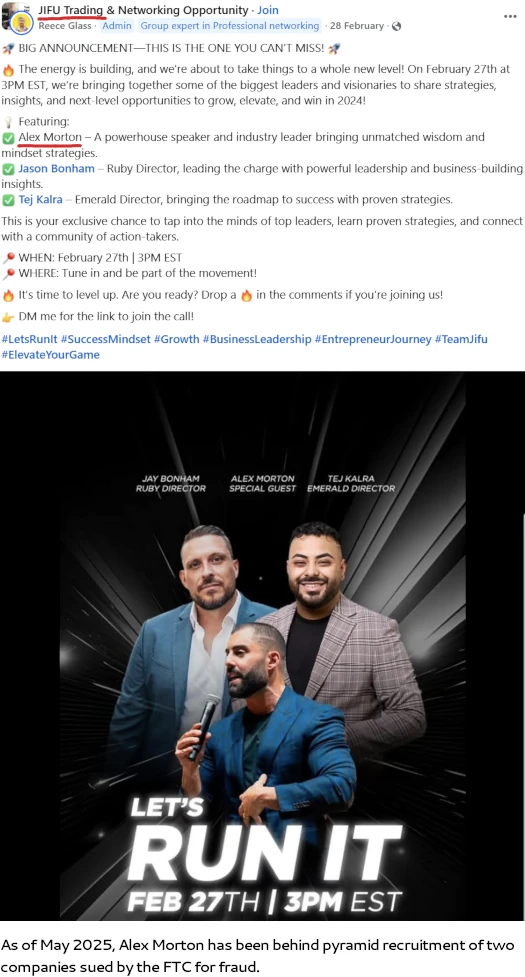

The FTC also correctly points out that Boyd and a number of former Iyovia scammers have moved on to Jifu.

Defendant Boyd is continuing to sell through another multi-level marketing program the same trading training services that he offered through IML.

On YouTube, Boyd writes “we have partnered with Jifu and all of our teaching and trainings will be there.”

Boyd is joined by Iyovia defendant Alex Morton and other former Iyovia promoters.

While the FTC hasn’t publicly announced anything, it’s expected should the same fraud that took place at Iyovia continue over at Jifu, at some point a regulatory enforcement action will commence.

Finally with respect to the preservation of evidence, the FTC states;

The IML Defendants have publicly stated that they are deleting consumers’ data.

Within weeks of Plaintiffs’ filing this action, IML informed consumers that the company was suspending its operations and would be deleting consumers’ data.

Despite repeated requests by Plaintiffs to ensure that relevant evidence is preserved by the IML Defendants, their counsel has only provided the inadequate statement that “corporate defendant International Markets Live, Inc., dba Iyovia (“IML”) is aware of the retention obligation.

One of the arguments the Iyovia defendants have raised against the granting of a preliminary injunction is that Iyovia shut down last month.

Moving Defendants argue that, because IYOVIA appears to be shutting down, the FTC cannot obtain a preliminary injunction under Section 13(b) of the FTC Act.

In response the FTC states the “Moving Defendants are wrong.”

The Ninth Circuit has concluded that Section 13(b) merely requires the FTC to establish that the unlawful conduct is likely to recur in order to obtain relief.

The record here is replete with evidence that Moving Defendants are likely to continue in their brazenly unlawful conduct. And [the FTC] filed this case while IYOVIA was still conducting its unlawful scheme.

And it’s not just consumers having been screwed over in the past by the Iyovia defendants. The FTC notes and provides evidence of Iyovia’s current failure to meet existing financial obligations.

Since IML announced it was no longer operating, Plaintiffs have begun receiving reports that the IML Defendants are not honoring their financial obligations.

For example, two consumers have reported that they did not receive refunds from IML that they were entitled to.

Another individual, who worked as a translator for IML, has stated in a sworn declaration that he has not been paid for recent work he did for the IML Defendants.

Instead of meeting its financial obligations, the FTC opines

defendants Chris and Isis Terry have a track record of using corporate funds to fund their luxury lifestyle.

This ties in with reports received by the FTC pertaining to “IML and Isis Terry are not responding to repeated queries about unpaid obligations”.

The FTC hopes that a preliminary injunction against the Iyovia defendants will

- dampen continued efforts to defraud consumers through Jifu;

- ensure evidence required to be preserved is preserved (customer data etc.);

- preserve assets the FTC believes are being dissipated; and

- prevent ongoing harm to consumers

Moving Defendants are … incorrect in stating that Plaintiffs will suffer “little to no prejudice” should the Court grant the Delay Motions.

Preliminary relief, including the installation of a monitor to review Defendants’ marketing claims, is necessary to prevent

continued harm to consumers.

A decision the Boyd’s four-month delay to respond to the FTC’s motion for a preliminary injunction remains pending.

Update 25th June 2025 – No update on Boyd’s four-month delay motion but we do have news of two settlements on the horizon.

Alex Morton is currently engaged in settlement negotiations with the FTC. In a June 23rd filing, Morton’s attorney stated he and the CFTC are “actively working towards a final resolution of this matter”.

Similarly defendants Matthew Rosa, Jason Brown and their company Global Dynasty Network are in settlement negotiations.

Settlement approval is expected by August 11th, after which a Status Report must be filed if approval has not yet been reached.

Update 22nd July 2025 – The court has stayed “all deadlines between the FTC and State of Nevada and Brandon Boyd until September 13, 2025”.

The above order was issued on July 16th. On July 14th the parties informed the court that a settlement between the FTC and Boyd had been submitted for Commissioner approval.

The owners have gone MIA. Methinkst that is not a huge surprise! I could’ve told you that they would take off with that Pot o’ Gold. That’s the way it usually goes down!

Until they’re caught and reported to the U.S. for sentencing.

Article updated on pending Iyovia fraud settlements.

Alex Morton seems to be making appearances at Zinrai as well now. Looks like a lot of the usual suspects have jumped ship to Zinrai now

Brandon Boyd has folded. A settlement was submitted for FTC Commissioner approval on July 14th.