DAOversal claims it purchased HyperTech victim details

Back in March the Australian Securities Commission issued fraud warnings against HyperTech Group and several associated companies.

Back in March the Australian Securities Commission issued fraud warnings against HyperTech Group and several associated companies.

One of the companies was DAOversal, who now claim their only association was the purchase of HyperTech Group victims details.

Through HyperTech Group, fraudsters Ryan Xu and Sam Lee ran a series of MLM cryptocurrency Ponzi schemes.

The last official HyperTech Group launch was HyperNation, which collapsed in May 2023.

Ryan Xu went into hiding in 2022. Xu is suspected to be hiding in Dubai but has not publicly been seen or heard from since.

Sam Lee (right), also hiding in Dubai, continues to defraud consumers through various MLM crypto Ponzi schemes.

Sam Lee (right), also hiding in Dubai, continues to defraud consumers through various MLM crypto Ponzi schemes.

The latest Sam Lee scam is Boomerang Trade, fronted by Indian national Shavez Ahmed Siddiqui.

Danny DeHek, the Crypto Ponzi Scheme Avenger, has been keeping up to date with Boomerang Trade developments on YouTube.

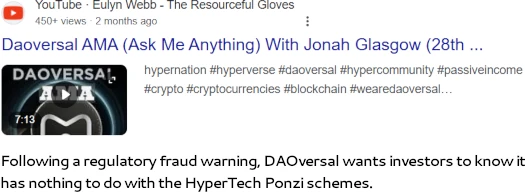

ASIC cited DAOversal and DAOversal LTD in their HyperTech Group fraud warning.

Four months later, DAOversal addressed its association with securities fraud in a May 30th Telegram post.

Dear DAOVERSAL Community Members,

In light of recent discussions and articles that have misinterpreted our actions and intentions, we wish to address and clarify these matters directly:

1. Clear Distinction from Hyperverse: DAOVERSAL operates independently of Hyperverse and its associated entities.

We have no operations in Australia, nor have we had any form of collaboration or contact with Sam Lee. Our brand and operations are uniquely ours, established over two years ago.

2. Data Acquisition Clarification: The data from the former hyper community was acquired as a one-time enhancement to our database, initiated well after our platform was fully operational.

This was an isolated action and should not be viewed as an indicator of any partnership or ongoing relationship with past entities.

3. Voluntary Support through TFA: The Targeted Financial Assistance (TFA) was provided as a voluntary initiative to support individuals affected by the failure of Hyper, which is unrelated to DAOVERSAL.

This support was offered from a place of community solidarity, not obligation, and should not be misconstrued as us taking on any liabilities from Hyper.

This was carried out to support the community and support the Daoversal ecosystem, and ofcourse out of the graciousness of our hearts.

4. Commitment to Decentralization and Platform Integrity: Our platform is built on the fully decentralized DAOT token.

We have renounced all ownership rights, ensuring that no additional tokens can be minted or assets are frozen without consensus. This step underscores our commitment to transparency and trust.

5. Ongoing Development and Improvement: We are dedicated to continuously developing the DAOVERSAL platform to deliver a superior experience for all our users.

We are moving forward with initiatives that underscore our dedication to our community’s success and well-being.

We appreciate the ongoing support and trust of our community as we navigate these challenges and misconceptions. Together we are committed to maintaining the integrity and progressive growth of DAOVERSAL.

Regardless of what is being written and being said, Daoversal is here to stay!

Thank you for standing with us.

Sincerely,

The DAOVERSAL Team

Notably, DAOversal don’t explain how they bought HyperTech Ponzi victim details from Sam Lee without having “any form of collaboration or contact with Sam Lee”.

Funnily enough, DAOversal’s “Targeted Financial Assistance” scheme directly ties it to Sam Lee.

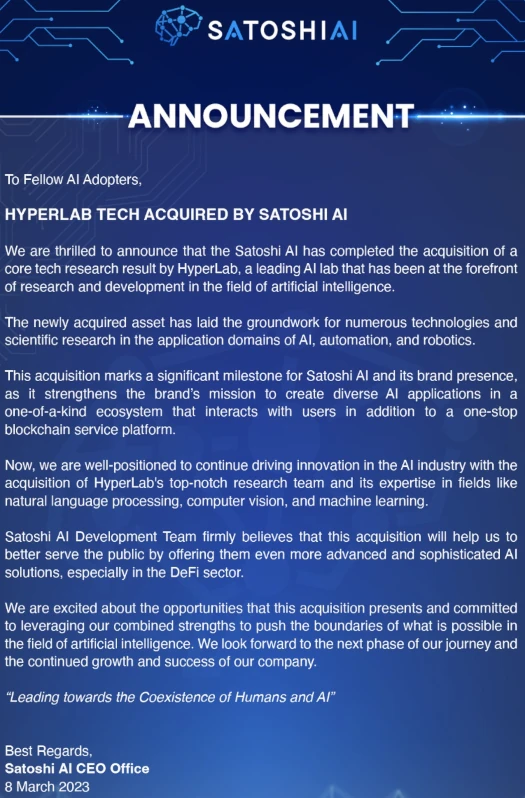

The TFA initiative, originally dubbed Focused Repayment Assistance, or FRA, by DAOversal partner Satoshi AI, earlier this year, is first-of-its-kind in the Web3 space, designed to assist members of the beleaguered Hyper Community, which had a number of crypto projects that had met an untimely demise following the actions of unscrupulous Community “Leaders,” as outlined in the Hypernation Community Review Report.

The TFA empowers members to begin to reclaim their assets thought lost in Hyper, offering options both to passive and active members alike.

Satoshi AI was the “AI grift” branding Sam Lee came up with to reboot the collapsed HyperNation Ponzi scheme under.

So we have Sam Lee –> HyperTech Group –> Satoshi AI. Satoshi AI is a DAOversal “partner” but uh, Sam Lee purportedly has nothing to do with DAOversal.

Righhhhhhhhhh………t.

In a nutshell, DAOversal is a typical crypto node investment scheme dressed up as a metaverse game.

Planetary Nodes have the ability to sell parcels of land within their Planets, generating revenue from these transactions.

Different levels of land produce resources of varying levels. Higher level land yields more abundant resources, allowing you to obtain greater returns and benefits.

If DAOversal’s “web3 gamification” jargon makes your eyes glaze over, all you need to know is DAOversal investors invest in node positions and collect passive returns.

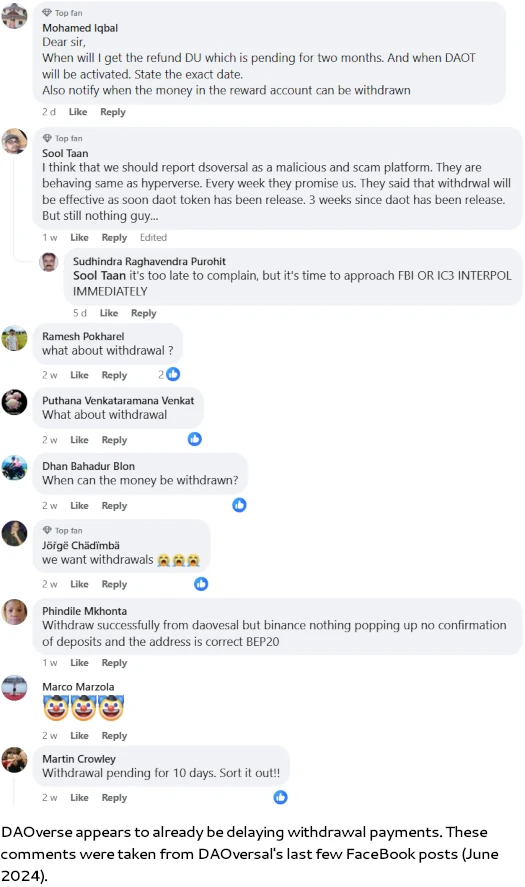

Returns are paid in DAOversal’s DU stablecoin, which investors can cash out as long as there’s greater fools to dump DU onto.

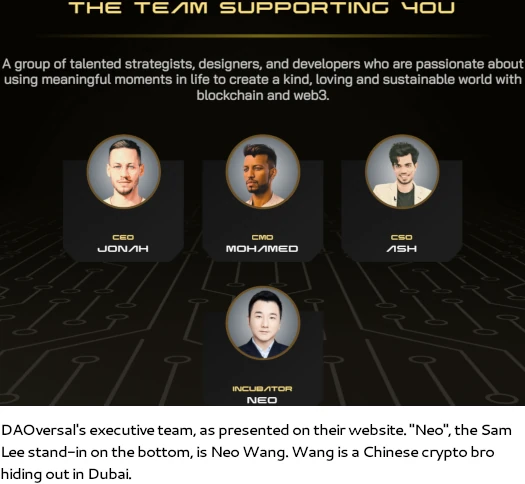

DAOversal is run by Jonah Glasgow, a Canadian crypto bro with the usual string of failed crypto grifts under his belt.

DAOversal is run by Jonah Glasgow, a Canadian crypto bro with the usual string of failed crypto grifts under his belt.

As of May 2024, SimilarWeb tracked top sources of traffic to DAOversal’s website as Italy (32%), the US (28%), the UK (16%) and Switzerland (7%).

In addition to Australia, DAOversal isn’t registered to offer securities in any of these countries. DAOversal and Glasgow also aren’t registered to offer securities in Canada either.

The SEC filed suit against Sam Lee and two associates on HyperTech Group related fraud charges in January 2024.

Lee was also indicted that same month, again on HyperTech related fraud charges.

As previously stated, pending his arrest Lee remains a wanted fugitive hiding in Dubai.

Of note is a large percentage of HyperTech Group Ponzi victims being US residents. If DAOversal purchased HyperTech Ponzi victim details and pitched DAOversal’s node investment scheme to them, that explains the US website traffic.

More importantly, it also means DAOversal is continuing to defraud US residents where Sam Lee and HyperTech Group left off (putting aside Lee’s continued efforts to defraud consumers through various other MLM crypto Ponzis).

From ASIC’s warning we can confirm DAOversal is on the regulatory radar. Whether US and/or Canadian authorities take further action remains to be seen.

I have a photo of the directors of DAOversal running a zoom meetings in the same offices as a ViDiLOOK. I have exactly the same wallpaper I sent it to Garrett Blakeslee, he confirmed they were operating out of the same building in Dubai. Garrett worked in that office for five months.

We also found crypto transfers from HyperOne to DAOversal. I believe they will operate out of the same building I even know the address of the building I’ve been told that WEWE Global also use their development services.

Sam Lee, Max and Peter and 25% of the company the other 25% holder I don’t know yet.

It’s just rinse and repeat and start over. I also believe that HyperTech Group still running the show I’ve got a video with 20 of them sitting in a board meeting in Hong Kong after they moved shop from Australia.

Dubai having “scam in a box” factories has probably been a thing for a while. Only hiccup is finding someone from the west to fly over and front the scam.

They frauded a lot of people out of their hard-earned money. Daoversal just blocked all users and can non of us enter our accounts. Money just gone!

No so called customer services. It is as if nothing ever existed.

They are all part of pigbutchering and should come to justice! I hope they get their day and real hard!

My question is why don’t more people come forward and fight these fraudsters! They are already judged by God Almighty and will go to hell for doing this.

Daoversal is an extension and continuation of the Sam Lee/Hypertech group ponzi enterprise which has stolen thousands of people’s personal finances under the lies of 1x, 2x, 3x ROI.

People from so many countries globally were convinced by friends and relatives to buy memberships, attend daily Zoom meetings and convinced that the Hyperverse, StableDao, and Daoversal wanted to help make people rich. All were lies.

I have been lied to and chastised by these people in telegram chats to stop complaining about not getting my $3,300 return of my retirement money I trusted in Hyperverse which was moved over to StableDao promise then Daoversal promise and now Daoversal has dropped and denies the promise of return and claims they had nothing to do with Hyperverse victims of Sam Lee’s fraud.

our KYC data is being used by this global fraud crypto scammers and US SEC regulators will hopefully prosecute the remainder of these ponzi scammers.

For victims like myself my money invested will never be seen again after three years of being defrauded.

THEY STOLE MY MONEY

I’m one of Hyperves Victim.