DAO1 drops decentralization ruse with “DAO1 Lite”

Although it’s obvious who created, owns and runs DAO1, central to marketing is the false narrative that DAO1 is decentralized.

Although it’s obvious who created, owns and runs DAO1, central to marketing is the false narrative that DAO1 is decentralized.

Rather than just be honest and transparent, DAO1’s owners and executives are presented as “advisors”:

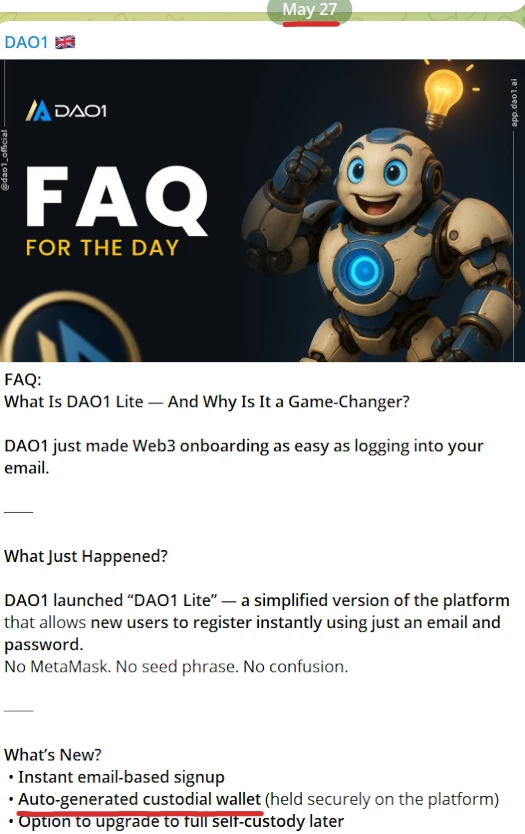

While that marketing ruse holds tight, DAO1 has somewhat dropped the decentralized investment ruse by launching DAO1 Lite.

Desperate for investors amid ongoing regulatory scrutiny in the US and fraud warnings from Australia and New Zealand, DAO1 Lite is claimed to “eliminate entry barriers”.

This makes it easier than ever to onboard new users who are brand new to crypto.

Instead of having to hook up their own crypto wallets to invest, through DAO1 Lite consumers can now sign up with “just an email and password”.

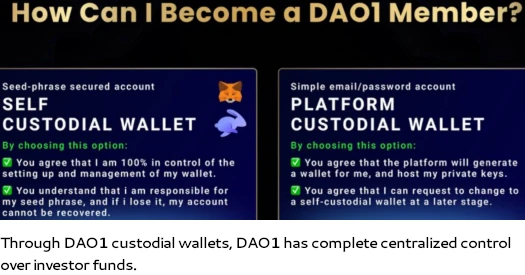

On the money side of things, DAO1 handles all transactions through an “auto-generated custodial wallet”.

If you’re not familiar with crypto jargon, a custodial wallet

is one where your assets are held in custody for you. This means a third party will hold and manage your private keys on your behalf.

In other words, you won’t have full control over your funds – nor the ability to sign transactions.

The “third-party” with DAO1 Lite is DAO1, i.e. owner Josip Heit and friends.

DAO1 Lite’s launch makes it even harder to clear the Howey Test, a central point of contention between Apertum Foundation and the Texas State Securities Board.

The crypto side of DAO1’s unregistered investment scheme is run through Apertum, the same individuals are behind both companies.

With DAO1 taking control of investor funds through DAO1 Lite, the “common enterprise” prong of the Howey Test becomes even more concrete.

The U.S. Supreme Court’s Howey case and subsequent case law have found that an “investment contract” exists when there is the investment of money in a common enterprise with a reasonable expectation of profits to be derived from the efforts of others.

DAO1 investors were already investing tether (USDT) into DAO1 as a common-enterprise. The automation of investment directly into DAO1 just further centralizes the unregistered investment scheme.

As we saw in the lead up to GSPartners’ collapse in late 2023, DAO1 appears to have entered the “rolling discounts” phase (click to enlarge):

Increasing the risk to consumers, when DAO1 and Apertum inevitably collapse like predecessors GSPartners and G999, funds held in DAO1 Lite custodial wallets disappear with the company.

Advisors, whahahahahaha.

@Oz – any idea if “investors” have to do KYC? Or if its region blocked?

Mr Heit – advisor. Realises that his name is too toxic and liable to use as CEO. On the other hand is too narcissistic to run things from the shadows. Wants belly rubs and attention.

I didn’t see anything about KYC changes or unblocking the US.

He still thinks he is a valuable BRAND. His trustness Josip hahaha.

What are you all talking about? You mean you don’t sit around all day advising smart-contracts (you created)?

Cmon now. Who among us hasn’t advised mathematical equations?

AFAIK we have the hearing today, June 2nd is apparently gone and now October. 10am Texas time is 5 hours away from now. Will try the Zoom details and see if it works then.

I made a fake account. I get blocked if I use a VPN that locates me in the states. I then changed to another position and it works, but the next step requires KYC (selfies with an ID card). You also need to click a declaration block confirming you are not a resident of the US or Canada.

Here I was thinking I could just use an email and password like they said.

Oz – is Heit expected to attend in-person today to the hearing?

No that was the June 2nd now October hearing (no idea bout June 6th ???).

If today goes ahead I expect this will be a legalese-heavy duking out between Heit’s attorneys and the TSSB. Probably won’t be a long hearing.

Sorry I made a mistake on my prior post. I meant to say June the 2nd is still showing! I don’t see a date change on the docket for that. There were no new filings too to indicate a definite date change AFAIK.

We have the Zoom details for June 2nd as well. If the hearing shows up on the calendar then see if the Zoom details work when the time comes.

Per “312-25-16274 with Attachment” filed on the 8th of May (order consolidating cases)

It would seem that the May 27 hearing is moved forward to June 2 (but log in and check anyway). We still don’t know yet if the case will be continued or not, but I suspect we will know within the next day or two (prior continuations came within a day or up to 4 days later – and we have to factor in Memorial Day yesterday).

If the original hearing was for June 2nd and that’s now a pre-hearing conference, then the final hearing has been continued (to October or otherwise).

Maybe that’s what they’ll be squabbling about on June 2nd, how long the continuance is for. Although that doesn’t explain why there’s a hearing calendared for today.

Thats a fair point. Maybe the idea was to hash out any issues on the first day of the hearing – but I can now understand why the TSSB doesnt think there is enough time in the 3 days they had initially allocated…

However, Im hoping there is something today.

Australian DAO1 meetings demand registered Zoom accounts with full names displayed, cameras on, and the name of whoever referred participants to the meeting.

It’s a honeypot for law enforcement surveillance, with recorded names, faces, and connections providing opportunities to investigate participants’ bank accounts and financial activities, then freeze their accounts.

9:58am Texas time:

Not expecting anything to start but will leave it running till 10:10am local time or so.

@Oz – there is a new filing from the respondents complaining about having to review almost 2000 exhibits and providing a long list of objections to each exhibit they don’t fancy. (However we can’t see what the exhibits are).

If the first day of the hearing is about arguing all the issues, good luck getting anything else done.

Complaining about exhibits would be a pre-trial issue. By the time the trial rolls up all these disputes are typically resolved.

*I know it’s not technically a trial. “Final hearing” or whatever SOAH calls it.

Their sites appear to have gone down, error 525 from Cloudflare. Seems to have been unavailable for 4+ hours now.

@A.W. Nothing to worry about. They may have needed some performance upgrades to their bot:

if market_direction == “up”:

status = “good”

else:

status = “bad”

josip_preference = “green” # not red

print(f”up = {status}, down = { ‘bad’ if status == ‘good’ else ‘worse’ }”)

print(“Josip need green, not red.”)

Noting DAO1’s websites are back online.

It’s a circus. Participant bank accounts frozen after zoom meetings, websites offline following a court hearing and now shitcoins have appeared on the apertum blockchain, notably Trumpet of Patriots (CLIVE), Martene Walrus (WALRUS) and MoneySmart (ASIC).

There’s some jolly jokers out there.

Some folks I know created those shitcoins. What was particularly satisfying was seeing a recorded meeting of Heit where he is asked what he think of the new Martene Walrus coin.

Confused, Heit then smiles and in the thickest Borat accent you can think of says “very nice!”

This sounds like coinception to me. I understand that they are creating their own coins under APTM.

Do people buy coins directly from the creators? Or is there a similar subscription mining thing going on? Does Martenes coin have its own website?

Are the coins in the room with us right now?

If it’s the same setup as other shitcoin factories, you click a few buttons and generate a coin/token out of thin air.

Heit’s financial interest is collecting transaction fees in APTM.

I was contacted by it’s so called Visionary leader Bhadra Ranchod via my LinkedIn. He saw me posting some articles about AI crypto tokens.

I have a website and am reporting about crypto projects etc giving reviews news and updates. He contacted me and was looking for a collaboration.

He sent me a presentation, who he called the CEO in the presentation said he is an advisor I was like did I hear it wrong. But I didn’t really mind.

I have checked Behindmlm just to see if any updates about anything nice. Only to find this review. It’s really hard to tell what’s scam and what’s not now days. Alot is happening

I didn’t know they have a past that is also bad like this.

Thx OZ for this review.

Your my guy

Apertum Foundation is looking for a puppet CEO in… Austin, Texas (home of the TSSB):

linkedin.com/jobs/view/chief-executive-officer-at-apertum-foundation-4307826303

That’s Dirc Zahlmann’s LinkedIn account but I take it this is some weird marketing stunt.