BitMart restricts APTM token trading in Lithuania

Following a complaint asserting Apertum Foundation’s APTM token isn’t MiCA compliant, BitMart has restricted trading activity in Lithuania.

Following a complaint asserting Apertum Foundation’s APTM token isn’t MiCA compliant, BitMart has restricted trading activity in Lithuania.

Here at BehindMLM we typically only see MiCA cited in Ponzi exit-scams. While it has nothing to do with fraudulent MLM investment schemes per say, MiCA is an actual European law that applies to crypto assets.

The Markets in Crypto-Assets Regulation (MiCA) institutes uniform EU market rules for crypto-assets.

The regulation covers crypto-assets that are not currently regulated by existing financial services legislation.

Key provisions for those issuing and trading crypto-assets (including asset-reference tokens and e-money tokens) cover transparency, disclosure, authorisation and supervision of transactions.

The new legal framework will support market integrity and financial stability by regulating public offers of crypto-assets and by ensuring consumers are better informed about their associated risks.

APTM is a “crypto-asset” token used to defraud consumers through DAO1, an unregistered MLM investment scheme (ref regulatory warnings from Australia and New Zealand).

Both Apertum Foundation and DAO1 are effectively owned by Josip Heit.

Seeking clarification on “possible [MiCA] infringements” related to APTM trading, a BehindMLM reader filed a complaint with the Bank of Lithuania.

Following an internal investigation, the Bank of Lithuania appears to have confirmed MiCA violations and taken action to prevent APTM trading in Lithuania.

Presently, CoinMarketCap lists four exchanges APTM is traded on; MEXC, BitMart (dba UAB GBM Global), LBank (dba UAB LBank Exchange) and P2B (dba UAB Partida).

P2B is credited with processing 75.48% of APTM trading volume.

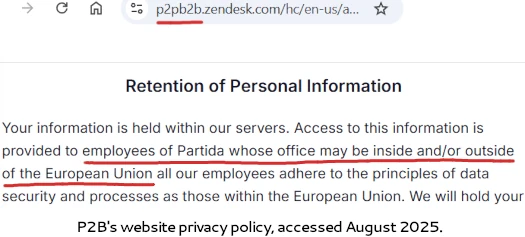

Today there is no mention of UAB Partida on P2B’s website. Partida is however still cited as the company’s name in P2B’s website linked privacy policy:

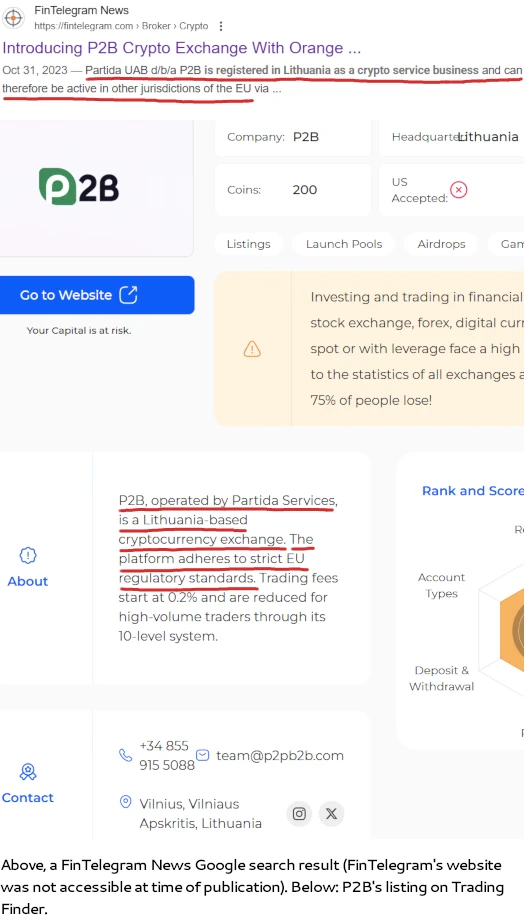

Up until very recently P2B hung its legitimacy on UAB Partida (aka Partida Services) in Lithuania:

Possibly related to increased regulatory scrutiny (the British Columbia Securities Commission issued a P2B investor warning in late 2023), P2B now cites a slew of associated shell companies in its website Terms of Use;

These Terms of Use contain an electronic agreement between you (hereinafter the “User”) and the P2B operators, including the companies TECHTONIC SOFTWARE S.A., SMART DIGITAL SOLUTIONS LIMITED, DIGITAL ONE SOFTWARE LIMITED, P2B SOLUTIONS LLC, other parties that run P2B, including but not limited to legal persons, unincorporated organisations and teams that provide P2B Services and are responsible for such services, hereinafter collectively the “P2B”), that applies to your use of this website, all services, products, and content provided by P2B.

In part of providing services, related to Special Tokens (virtual currency wallets services for Special Tokens, depositing/withdrawing/trading of Special Tokens, etc), the Website/Platform is managed (and the appropriate services are provided) exclusively by the company FINPEAKS LLC in accordance with its Terms of Services.

No additional information about these companies is provided.

CoinMarketCap currently credits LBank with processing 8.49% of APTM trading volume.

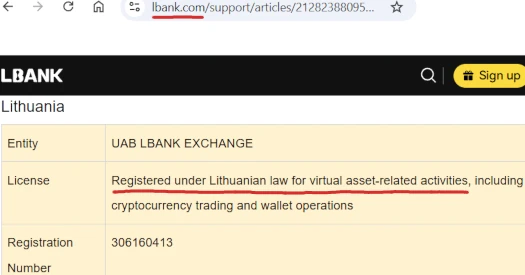

On its website, LBank cites UAB LBank Exchange as part of its “commitment to global regulatory compliance”:

The Bank of Lithuania confirmed P2B and LBank are presently not registered to operate legally in Lithuania;

Both UAB Partida and UAB LBank Exchange are not authorised to provide services related to virtual-asset activities in Lithuania, that is, these companies are not registered VASPs and have not obtained a CASP license from the Bank of Lithuania.

“VASP” stands for “virtual-asset service provider”. “CASP” stands for “crypto-asset-service-provider”.

Crypto exchanges with a VASP license are able to operate in Lithuania up until the end of 2025, wherein they must have a VASP license as part of MiCA to continue operating legally.

CoinMarketCap currently credits MEXC with processing 6.82% of APTM trading volume.

MEXC is well-known to financial regulators, with fraud warnings already issued by Japan, Ontario, Malaysia, Spain, Hong Kong, Quebec, British Columbia, Austria, the UK and Germany.

The Bank of Lithuania confirmed MEXC is not registered to operate legally in Lithuania;

The companies operating under the names P2B and MEXC are not registered in Lithuania.

P2B was also referenced again by name (I’m not 100% sure if “the companies” refers to the new P2B shell companies).

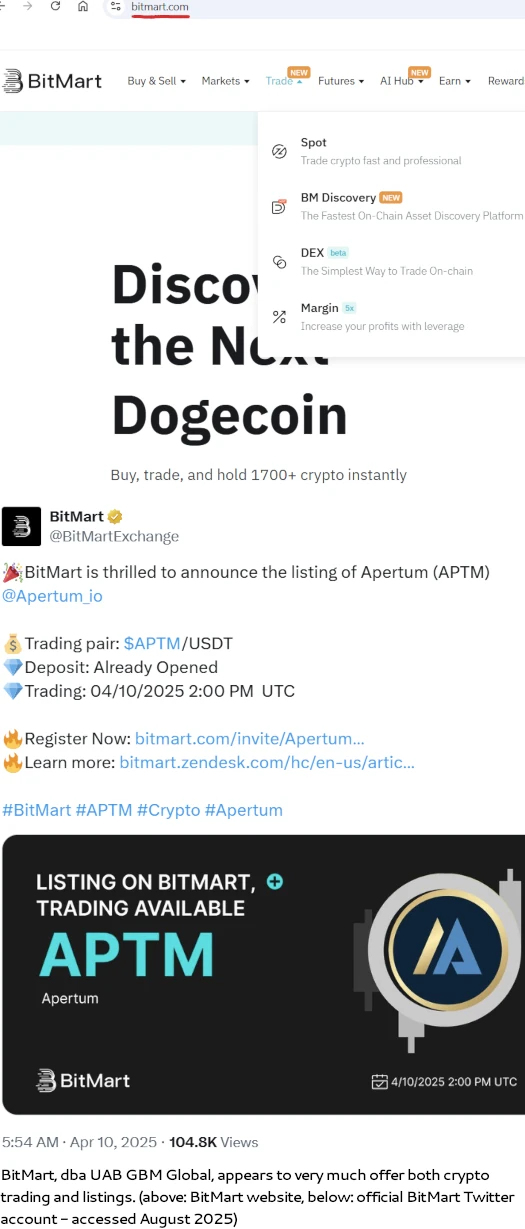

Finally we have BitMart, dba UAB GBM Global. CoinMarket currently credits BitMart with 9.21% of APTM trading volume.

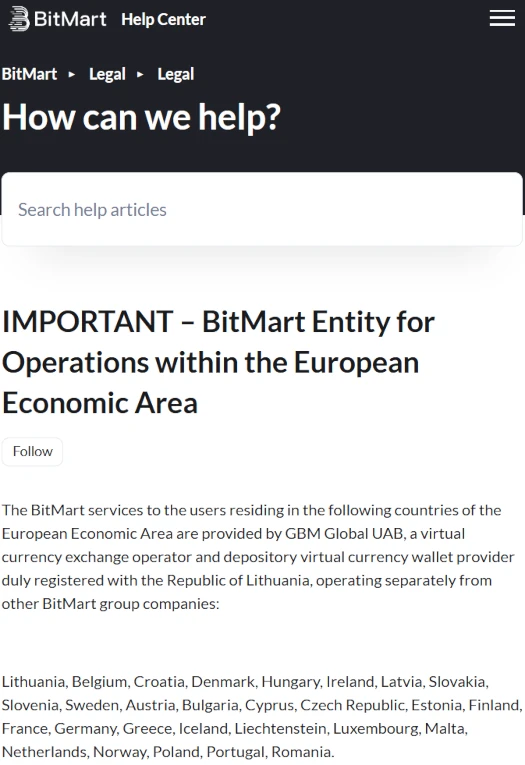

In its website “help center”, BitMart pegs its European Economic Area legitimacy to UAB GBM Global:

The BitMart services to the users residing in the following countries of the European Economic Area are provided by GBM Global UAB, a virtual currency exchange operator and depository virtual currency wallet provider duly registered with the Republic of Lithuania, operating separately from other BitMart group companies:

Lithuania, Belgium, Croatia, Denmark, Hungary, Ireland, Latvia, Slovakia, Slovenia, Sweden, Austria, Bulgaria, Cyprus, Czech Republic, Estonia, Finland, France, Germany, Greece, Iceland, Liechtenstein, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania.

According to the Bank of Lithuania however;

Based on the information obtained, UAB GBM Global operates as part of the global BitMart group and provide virtual currency exchange services and custodial services for virtual currency wallets within the Republic of Lithuania and to clients from the EEA, at the clients’ own initiative.

However, based on the information received, UAB GBM Global does not conduct crypto-asset listings and does not act as a trading platform operator or token issuer.

UAB GBM Global doesn’t have its own website. The flow of client funds on the backend is murky but, as far as I can make out, everything operates from BitMart’s website.

Which makes BitMart representing to the Bank of Lithuania that it “does not conduct crypto-asset listings and does not act as a trading platform operator” odd.

It also probably explains why, despite apparently lying about what it does, BitMart also confirmed to the Bank of Lithuania that it was “restricting” APTM trading in Lithuania.

Nevertheless, after the inquiry from the Bank of Lithuania and taking into account that the token and its materials may have been accessible to users in the Republic of Lithuania, UAB GBM Global informed the Bank of Lithuania that it has taken measures to restrict access to APTM tokens for its clients.

I couldn’t find a public statement from BitMart confirming the restriction.

As it stands, APTM cannot be legally traded on any crypto exchange in Lithuania. With MiCA applying uniformly across all European Economic Area countries, this raises broader concern about whether APTM can be legally traded elsewhere in Europe too.

As of July 2025, SimilarWeb was tracking 47% of Apertum Foundation’s website from Germany. 45% of DAO1’s website traffic is also from Germany.

Germany is of course within the EEA, meaning APTM trading must comply with MiCA to be legal. If APTM trading currently does not comply with MiCA in Lithuania, then…?

MiCA compliance in Germany is overseen by BaFin. BaFin is also responsible for securities regulation, which would apply to DAO1’s unregistered investment scheme.

Whether BaFin takes action against Apertum Foundation’s APTM token for MiCA violations or DAO1 for securities law violations, remains to be seen.