Enigma Network collapses, rebooted as BFX Standard

![]() Enigma Network launched in late 2021. BehindMLM published its Enigma Network review on January 18th, 2022.

Enigma Network launched in late 2021. BehindMLM published its Enigma Network review on January 18th, 2022.

In reviewing Enigma Network, we found an MLM opportunity providing access to an automated trading bot.

Although Dave Wiltz was credited as Enigma Network’s founder and President, J. Joshua Beistle and Doug Wellens were behind the company.

I can’t tell you exactly when Enigma Network collapsed but its official FaceBook page was abandoned in May 2022.

SimilarWeb also tracks negligible traffic to Enigma Network’s website over the past three months.

Enigma Network’s collapse has prompted the launch of BFX Standard, essentially the same scheme with a different name.

Of note is a shakeup of Enigma Network’s corporate lineup, specifically Richard Anzalone.

Anzalone was indicted in 2017 on criminal charges related to Infinity2Global.

Anzalone pled guilty to those charges in May 2022, believed to be around the time Enigma Network collapsed.

Anzalone has yet to be sentenced but, unless he plans to participate from prison, I don’t believe he’s part of BFX Standard.

Another significant event that happened in May was the 2022 Terra/Luna collapse, which led to a ~66% crypto market dump.

Whether that was a contributing factor to Enigma Network collapsing remains unclear.

Enigma Network represented it was based out of Texas. BFX Standard appears to be incorporated as a Wyoming shell company, presumably also run out of Texas.

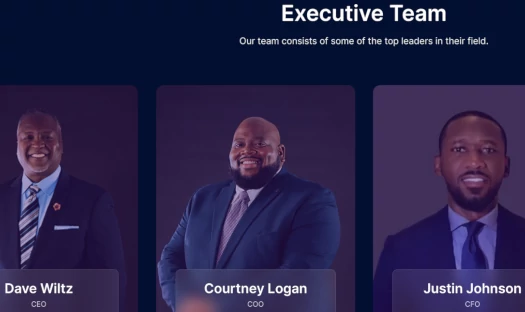

BFX Standard’s corporate lineup is Dave Wiltz as CEO, Courtney Logan as COO and Justin Johnson as CFO.

Courtney Logan rode the personal development grift until he got into crypto circa 2017.

By late 2017 Logan had joined iMarketsLive.

The CFTC fined iMarketsLive for commodities fraud in 2018.

Having learnt everything about forex from a pyramid scheme committing commodities fraud in just a few short months, Logan went on to start selling forex masterclasses.

Under the brands US30 Academy and RFX Academy, Logan charged thousands of dollars for his newly acquired forex expertise.

Today SimilarWeb tracks negligible traffic to both US30 Academy’s and RFX Academy’s websites. This likely led to Logan signing on with BFX Standard.

Of note is RFX Academy being one of Enigma Network’s products and continuing over to BFX Standard.

I wasn’t able to put together an MLM history on Justin Johnson. Like Dave Wiltz, Justin appears to be a nobody prior to BFX Standard.

J. Joshua Beistle’s MLM history of Ponzi and pyramid schemes was covered in BehindMLM’s Enigma Network review.

Curiously, I haven’t seen Doug Wellens in any of BFX Standard’s marketing. I’m not sure if he’s still with the company or if he’s cashed out.

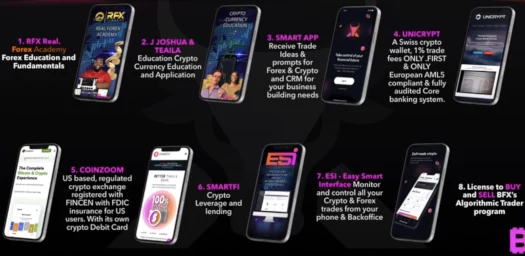

Like Enigma Network, BFX Standard pitches an app-based crypto and forex trading platform, powered by “A.I. algorithms”.

This is from an official BFX Standard marketing video on their website:

Included in our cryptocurrency trading module is a powerful A.I. algorithm, that comes with four years of documented market success and (is) used by a billion dollar hedge fund with striking results.

Naturally, and in violation of securities and commodities law in the US, BFX Standard fails to provide consumers with evidence of its marketing claims.

As with Enigma Network, the automated trading side of BFX Standard is also powered by the company’s undisclosed algorithms:

BFX members can choose to participate in daily market trades developed by this amazing A.I. technology.

In what appears to be an attempt at pseudo-compliance, BFX Standard has affiliate investors swipe on an app to initiate automated algorithm trading.

This is not the equivalent of manually acting on a received trading signal. It’s turning an automated trading bot on and off.

From the same BFX Standard prelaunch event that Courtney Logan spoke at, J. Joshua Beistle touted a 268% annual ROI through his trading algorithm.

Let’s take a look at where we are for … 2021. We’re up between 135% and 147%.

Now, this is all what I call simple returns. I want to show you now what happens with compounding.

If you continually trade the up or down amount, that’s compounding, you’re going to see that 147% for last year actually goes up to 268%.

If we look at compounding …. starting January 1st of last year through to today’s date, you’re up about 640%.

Beistle claims his trading bot is “up 70% year to date for 2022”.

Again, no evidence by way of audited financial reports are provided.

The rest of BFX Standard’s offering is padding around their automated trading app platform.

Here At BFX Standard, You Will Have The Opportunity To Meet With Real Educators In Real Time According To Your Schedule, Which Will Help Supplement Your Academy Experience And Education.

We Offer A Variety Of Cryptocurrency And Forex Education.

Our Trained Professionals Allow You To Peek Over Their Shoulders During Market Hours In Live Training Sessions, Making It Extremely Easy For You To Follow Along From The Comfort Of Any Smart Device.

Another component of BFX Standard is what appears to be a partnership with SmartFi.

On their website SmartFi advertises a 12% annual ROI on invested cryptocurrency.

SmartFi is not registered with the SEC.

This year in particular US authorities have gone after crypto investment schemes committing securities fraud. Notable examples include BlockFi and Nexo.

I haven’t seen anything specific on BFX Standard’s compensation plan. They did mention “daily and weekly pay”, so I believe it’s not substantially different to that of Enigma Network (scroll down to “Enigma Network’ Compensation Plan”).

As to BFX Standard pricing, again I haven’t seen that disclosed.

For reference, Enigma Network charged

- $99 for four months access to the forex or crypto bot;

- $999 for annual access to the forex or crypto bot; or

- $2499 for annual access to the forex and crypto bot

Enigma Network affiliate membership was $15 a month with a possible mandatory $60 initial spend.

Despite offering passive returns through A.I. trading bots, neither BFX Standard, Dave Wiltz or J. Joshua Beistle are registered with the SEC.

In offering passive returns through forex trading, BFX Standard is also required to be registered with the CFTC.

BFX Standard is not registered with the CFTC.

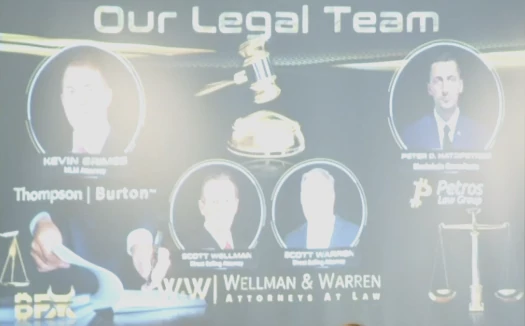

For their part, BFX Standard corporate appear well-aware of regulatory legal requirements.

When BehindMLM reviewed Enigma Network, the company was represented by Wellman and Warren.

With BFX Standard the company has expanded its legal team:

Addressing legal compliance, David Wilx had this to say at a BFX Standard event, believed to have been held in late September:

We’ve layered ourselves with lawyers. We have our compliance over here. We have the team.

And we’re gonna follow it to the “T” because we want to make sure that everything we do is legal across the board.

After Wilx spoke, Courtney Logan gave his take on BFX Standard’s compliance;

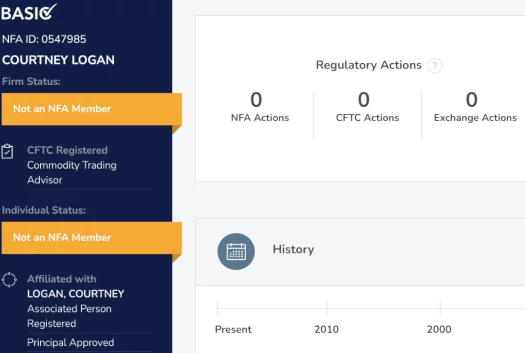

So my background is in law. I’m a forex trader. I have a Series 3, a Series 34 and I have another licensed CTA.

I was just here to give education and then as I got to learn Dave and I got to learn the team, that kinda grew, because of my legal background, into becoming a consultant for the company.

“Series 3” and “Series 34” refer to NFA exams administered by FINRA.

Logan isn’t NFA registered but, as of April 2022, is registered with the CFTC as a Commodity Trading Advisor.

Logan’s registration is as a sole proprietor and has nothing to do with BFX Standard. Furthermore, the trading side of BFX Standard is run by J. Joshua Beistle, not Logan.

I am bringing up Logan’s CFTC registration though because a few weeks ago he shared this on Instagram:

Between his CFTC registration and Series 3 exam score of 97% score on regulations (Logan failed this particular test sitting), plausible deniability goes out the window.

Getting back to Logan’s compliance talk;

And one of my roles was to help ensure that the foundation from a legal perspective was intact, in order to ensure that we had a compliant company. And that was a lot of work.

One of the things that we did, was we went out and we got help.

When you don’t know exactly what to do, you go hire law firms. And you go hire advisors to assist and aid you.

One of the law firms that we went and got is Armstrong Teasdale. You can Google them. You can look them up.

More specifically, the reason I engaged with Armstrong Teasdale is because they have a partner, who’s one of the head lawyers at the firm, who was the director of the SEC for the state of Missouri. Who is one of the lead counsels for our legal team.

That was very important for me because we’re in blockchain. We’re in crypto. And as some of you know, maybe you don’t know, the SEC is the regulatory agency over a lot of the cryptocurrency that’s out in the current space.

So we went and got a firm. More importantly we went and got the lawyer that used to run an entire state of the SEC.

And they’re also helping us with our CFTC work, which is the work done on the forex side.

But we didn’t stop there … we don’t have one lawyer that does it all. We have a team of lawyers that do different things for us.

We have trademark attorneys. We have trust lawyers. We have Kevin Grimes who’s our FTC attorney, who’s helping us ensure that our direct sales model is legal and compliant.

We also have Strong & Hanni out of Utah, who are also FTC attorneys as well. That are helping us to ensure that our direct sales model is compliant.

This is important to me as a lawyer. It’s very important to me as an ex-prosecutor.

Because the one thing I don’t want to happen, is I don’t want us to start down this road of what we believe to be a really, really awesome company, and it gets shut down.

As previously stated, BFX Standard isn’t registered with the SEC or CFTC.

Instead of registering with financial regulators, filing audited financial reports and operating legally, BFX Standard pretends it’s not doing the thing it’s doing:

If BFX Standard’s compensation plan differs substantially from Enigma Network, BehindMLM will consider publishing a standalone review.

Failing which, whether BFX Standard lasts longer than Enigma Networks’ ~6 months remains to be seen.

Update 8th October 2022 – Some further details on the cost and compensation side of BFX Standard:

- $150 to sign up for a “Technology Pass”, then $60 a month.

- Affiliate members is $150 and then $75 a month

- 3 months crypto or forex trading bot access is $299

- 12 months crypto or forex trading bot access is $999

- 12 months crypto and forex trading bot access is $2499 (4 automated trading accounts)

- commissions are paid on bot subscriptions from retail customers and recruited affiliates

- 3 month pays $60, $999 annual pays $200 and $2499 annual pays $500

- everything else appears to be the same as Enigma Network

Update 7th February 2025 – While BFX Standard’s website is still online, as of February 2025 it features Nvisionu branding:

Nvisionu is an IM Mastery Academy spinoff run by David Imonitie.

There is no mention of BFX on Nvisionu’s own website so the exact nature of the relationship between the two companies is unclear.

They’ve now partnered with NVisionU.. yet another MLM Scamming company. From the looks of it NVisionU is pushing their “Crypto Algorithm” as a way of passive income for it’s clients

Looks like NVisionU is also listed in BehindMLM so I thought it would be important to add that they’re hiding because of the thugs that run the BFX company..

So, they decided to partner with NVisionU instead… brilliant