Did the DSA know AdvoCare was going to screw over distributors?

It’s been just under three weeks since AdvoCare announced it was ditching it’s MLM business model.

It’s been just under three weeks since AdvoCare announced it was ditching it’s MLM business model.

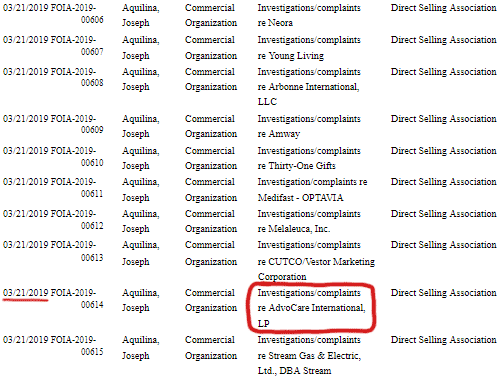

As part of my ongoing search for answers, I came across an archived Freedom of Information Act request list from the FTC.

Did the DSA know AdvoCare was going to screw over its distributors in advance?

Between October 1st, 2018 and April 30th, 2019, the FTC responded to twenty-four DSA FOIA requests (not all are shown below):

The AdvoCare FOIA request was marked closed (responded) on March 21st.

Each request is submitted by Joseph Aquilina and seeks information on “investigations/complaints” regarding a specific MLM company.

Joseph Aquilina is the DSA’s “ethics and compliance” attorney.

In AdvoCare’s bombshell May 17th announcement, the company cited “confidential talks with the” FTC as the reason it was ditching its MLM business model.

To date there has been no public announcement or acknowledgement from the FTC regarding these alleged talks.

For the FTC to approach AdvoCare, there had to have been an investigation beforehand.

In their FOIA FAQ, the FTC states their goal to respond to requests is “approximately one month”.

FTC investigations take time. Meaning there’s a high probability the DSA had a heads up on an FTC investigation into AdvoCare.

Seeing as AdvoCare are a DSA member, there’s obviously communication back and forth between the two companies.

How much did the DSA know? I can’t say for sure.

As far as I can tell, the DSA has failed to issue any public statement regarding AdvoCare’s May announcement.

While I can’t say I know what the FTC and AdvoCare were talking about with certainty, the company getting rid of its MLM business model suggests there wasn’t enough retail activity within the company.

This would not only be against the DSA’s code of ethics (I know, I know, don’t laugh), but also something their new Direct Selling Self-Regulatory Council should have picked up?

the DSSRC was launched by the DSA on January 4th, 2019. It’s a “self-regulatory program” that promises to “monitor the entire U.S. direct selling industry”.

The DSSRC is a third-party, self-regulatory entity created as a result of deliberations of DSA’s leadership, and dialogue with the Federal Trade Commission (FTC) to increase the oversight of the direct selling industry.

Supposedly, the DSSRC is to conduct “independent investigations” and report “unresolved violations of non-compliant companies to the Federal Trade Commission.”

Will my company’s plan be reviewed?

Yes, however, the frequency of the reviews of companies is still being determined.

If AdvoCare’s business model was problematic such that the FTC launched an investigation and stepped in, why didn’t the DSA or DSSRC pick up on it?

And if they did, why didn’t they take any action?

Since publishing its own policies and procedures on January 14th, the DSSRC has been publicly dormant.

As a DSA member AdvoCare pays the organization fees, so uh… yeah.

Perhaps it wasn’t in the DSA’s best interests to give AdvoCare distributors a heads up their incomes were about to be obliterated (I know, I know, ethics… stop laughing).

With respect to AdvoCare’s conduct towards its distributors, what’s done is done.

Distributors are abandoning ship and MLM attorney Kevin Thompson reckons AdvoCare are sending out threatening letters.

From an academic perspective, the pressing issue is whether or not the DSA has details on the FTC’s investigation into AdvoCare.

And if they don’t, why not?

According to the FTC, an investigation into AdvoCare wouldn’t fall under their rules for exemption.

Investigatory records compiled for law enforcement purposes.

Unless perhaps there’s a pending AdvoCare law enforcement action coming that we don’t know about.

One final word, while I’m sure some of you are considering blaming the DSA for potentially not giving you a heads up – don’t.

The DSA is and always has been beholden to its members. MLM companies pay the DSA’s bills, not distributors.

As distributors of DSA member MLM companies, it’s important to remember they’re not looking out for you.

As this case might yet prove, the DSA’s obligations to its members might very well extend to information suppression – even if over 100,000 AdvoCare distributors get screwed over in the process.

Pending the FTC, AdvoCare or even the DSA revealing just what the heck is going on here, stay tuned…

In KT’s Facebook post defending distributor’s ability to build for other companies he says….”and argue that the contract is unenforceable because AC was operating as an “unviable” business model.” [according to the FTC]

And what “business model” would THAT be?!

According to one of my sources the FTC was looking at advocare primarily due to the Class Action / Retail issues. They didn’t take enough early action to segregated distributors from customers like other companies have and were caught with their pants down.

That said the whispers in the background are that they have enough brand equity to stick with D to C (direct to consumer) and/or take a crack at getting the products on shelves via a wholesale model.

The same source stated that the FTC is looking at 20 other companies in a similar boat (not enough retail sales).

Alot of the folks jumping ship are heading to ID Life (some of the big 6 figure earners) and a few other companies and pretty much within a day of jumping ship got the threatening letters. It will be interesting to see if they litigate.

Disclosure – I am *not* an advocare rep, but I do know many and have personal connections with a few 6 figure earners who got blindsided.

Mike,

Do you know what other 20 companies? Can you name some?

I will check with my source this week next time I see him and see if he’s comfortable with me mentioning names. Most of the names mentioned to me were all product based mlm’s with purchase / volume components to their comp plans.

Most that I recognized the main questions that came to mind were

1) Would people buy the products if there wasn’t an mlm plan

2) Percentage of retail and customer accounts vs distributor accounts

I know a few on the list are definitely offside on #1.

And the FTC hits keep coming. Expect more folks to jump ship in other companies.

You gotta be yuuuge like Amway to survive the hits for many years.