Kenny Nordlund confirms ongoing Crowd 1 payment delays

![]() As has been made painfully obvious over the past few weeks, there’s only one reason an MLM Ponzi scheme stops paying out.

As has been made painfully obvious over the past few weeks, there’s only one reason an MLM Ponzi scheme stops paying out.

This can manifest itself first with withdrawal delays, but that’s not always the case.

Crowd1 is one MLM Ponzi that’s first ran into withdrawal delays in 2020.

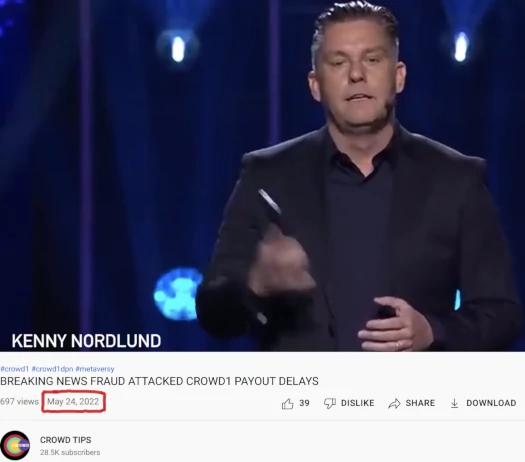

Apparently the problem has gotten so bad that it prompted a response from Crowd1 executive Kenny Nordlund.

Rather than just admit new investment has dried up, Nordlund blames fraud.

Kenny Nordlund was appointed President of Crowd1 mid to late 2020 (I might be slightly off).

Nordlund has been scamming people through MLM Ponzi schemes for years.

Nordlund has been scamming people through MLM Ponzi schemes for years.

He is best known in the MLM industry for being a top earner in the notorious OneCoin Ponzi scheme.

After OneCoin collapsed, Nordlund followed Udo Deppisch into Anthony Norman’s Wantage One Ponzi mess.

When that fell apart Nordlund migrated over to Crowd1 in early 2020. He joined the executive team later in the year.

In an undated “AGL meeting” audio clip uploaded to YouTube on May 24th, Nordlund confirms Crowd1 “has some and have had some delays of payments.”

We are online and of course in this industry we do get a lot of frauds, we get a lot of fraud attempts.

And when we close one door, people find a new door. They open a new door, and it’s something we’re constantly working on. And it’s something unfortunately that (laughs), a lot of times affects their own people.

And what I mean by that is there is frauds being done. Something that is being manipulated, basically in our compensation plan in different ways – which is not OK.

We’ve been hit by that. We’ve gone through it multiple times during the years.

Crowd1’s solution is purportedly a “new IT system”, supposedly rolling… well, at some point.

We have a new system that’ll be rolling out in the IT.

And that is when, and we will have and of course (laughs), we will not tell you all of this, because then people will try to open new doors.

I’m not telling you guys that you will do that, but there is people that are constantly working on fraud on the system.

Nordlund goes on to explain that positions with Crowd1, suspected of committing fraud, will be “coming into kind of the compliance department”.

The positions will be locked for payouts during an investigation.

In other words, Crowd1’s “new IT system” is an excuse to lock investor accounts it feels are, or at least trying to, withdraw too much.

It’s one way to manage delayed withdrawals but ultimately still a band-aid solution.

Even if you buy into Nordlund’s nonsense, an account capable of withdrawing enough out of Crowd1 to create cashflow issues, isn’t a new overnight account.

It’s been built up over time – and that’s who Crowd1 is targeting.

Lets say there is somebody defrauding the system.

Let’s say it affects two hundred, and there’s a thousand people in there.

So basically, that means maybe two hundred gets paid. Two hundred have done something, and you have eight hundred people that are affected by the fraud without having done anything.

This of course makes delays. It makes frustrations, and people think, “Oh they’re not paying because of this, they’re not paying because of that” and so on and so on.

Everyone that’s been to Dubai has seen we’re expanding. We’re not going anywhere.

With this function … this should actually speed up the payment process very very quickly. And I think you will start seeing y’know, within days how … any payment delays are speeded up.

Nordlund warns that if “fraud” continues, Crowd1 as a business is put at risk. A bit rich, considering Crowd1 is by definition a fraudulent business itself.

One thing I’m not personally clear on is this sounds like the latest withdrawal delays are affecting recruitment commissions.

This would be a new development, as the withdrawal delays documented in 2020 pertained to ROI payments. Recruitment commissions, paid in bitcoin, were working fine and, as far as I know, haven’t had any issues.

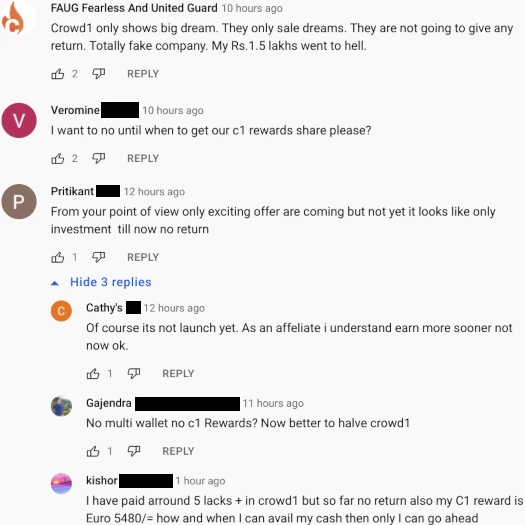

Comments left on the YouTube video suggest Crowd1 hasn’t addressed ROI payment issues since 2020.

This would mean they’ve just been stringing investors along with recruitment commissions.

If those are now also experiencing problems, such that Crowd1 has to introduce shady restrictions, well I’m sure you can put two and two together.

Video from February 2021:

share-your-photo.com/27d9fc70ce

youtube.com/watch?v=5L-yjcDbS40

The only comment below this video:

Video from May 2016:

share-your-photo.com/740a0e9fad

youtube.com/watch?v=471c732CVZg

It’s pretty clear Nordlund doesn’t believe his own BS. Those oddly-timed nervous laughs are pretty telling.

Any executive of a genuine company that was being hit by a string of thefts would not be chuckling at his own impotence to stop it, or rambling about some secret new IT solution (more nervous laughter).

He’d be calling the authorities to report it. But we all know that’s not gonna happen.

@Oz, I have a couple of minor typos to report:

1) there a missing word in the opening sentence. There should be an inclusive pronoun (and comma) after the word “to” (e.g., “to everyone,” or “to anyone,”).

2) “addressed” is spelled “addresse” just before the YouTube comments screen shot.

You have to remember Nordlund fled to Dubai to live with the rest of the Crowd1 scammers.

Calling the local authorities probably redirects to the local Dominos.

Thanks for catching the typos.

Andreas Heuer from Germany writes:

share-your-photo.com/46284b74a1

youtube.com/watch?v=2RIwhgy8Rd8

Andreas Heuer:

share-your-photo.com/137c86fbaa

PS: Like OneCoin, CROWD 1 scammers work with KYC and gift codes.

to comment no #5:

now they are a full investment program with planet IX and Metaversy.

they dropped all tangible services to go into the easy money.

Not really worth a write up but this headline from BFH got a chuckle out of me today:

Might as well rename it to the Ponzi Association of the United Arab Emirates. That’s unfortunately all MLM is in the ME.

A “Provisional Member”? They don’t suck enough right now and need to try harder?

I imagine UAE DSA membership is like lay-by. You pay some

bribesfees now, somebribesfees later.Eventually you’ve paid enough

bribefee installments and they make you a fully-fledged crime syndicate partner.