RapidBit Exchange Review: Trading signals “click a button” Ponzi

![]() RapidBit Exchange goes by a number of names, including RapidBitEx, RapidTex, RapidBit LTD and RapidBT Digital Asset Trading Platform.

RapidBit Exchange goes by a number of names, including RapidBitEx, RapidTex, RapidBit LTD and RapidBT Digital Asset Trading Platform.

RapidBit Exchange fails to provide ownership or executive information on its website.

RapidBit Exchange’s website domain (“rapidbitex.com”), was privately registered through an apparent Hong Kong address on May 12th, 2025.

Of note is RapidBit Exchange website’s use of Chinese fonts:

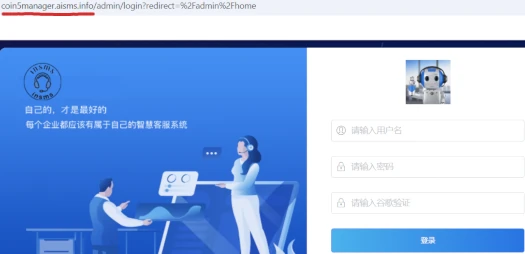

RapidBit Exchange’s official support app is hosted on the subdomain “coin5manager.aisms.info”. If we visit this subdomain directly we find more Chinese:

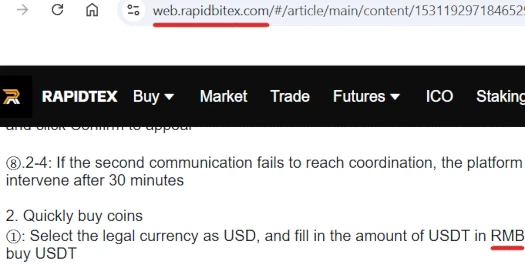

Renminbi (RMB), the official currency of China, is also referenced in RapidBit Exchange’s “how to” guides:

Despite clearly being run by Chinese admins and being barely a few months old, on its website RapidBit Exchange falsely claims its “a top international financial technology group ranked in the top 10 in the world” that’s “headquartered in USA”.

RapidBit Exchange is intertwined with Winchester Community, a “global, collaborative platform” that’s behind the “Darvis System”.

The Darvis System also goes by Darvis Interstellar Capital Alliance and Darvis Strategies LTD. We’ll cover how these entities fit into RapidBit Exchange’s marketing pitch in the conclusion of this review.

Winchester Community has a website set up on the domain “winchesterhs.com”, the private registration of which was last updated on May 14th, 2025.

Through the WayBack Machine we can confirm “winchesterhs.com” was redirecting to an unrelated domain in early 2025. Coinciding with the registration of RapitBit Exchange’s website domain, the “winchesterhs.com” domain was also acquired in or around May 2025.

Winchester Community is purportedly headed up by founder “Walter Cross”:

Despite Winchester Community only being a few months old, “Walter Cross” purportedly founded it back in 2021.

“Walter Cross” of course doesn’t exist, he’s played by a stock photo model.

Here’s the “Walter Cross” model playing a chef:

A doctor:

A physiotherapist:

And so on. Whoever he is, Winchester Community’s founder appears to be some random hired through an agency.

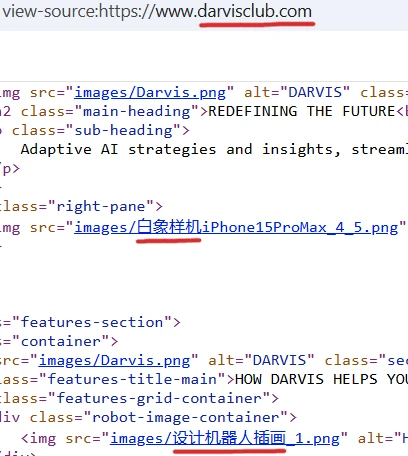

A Darvis System website was put together on the domain “darvisclub.com”, privately registered on July 22nd, 2025.

There’s not much on the website other than a few disabled download links and app design mock-ups.

Naturally in the Darvis System website source-code though we find more Chinese:

Putting all of this together, whoever is running RapidBit Exchange and Winchester Community obviously has ties to China.

And in case it wasn’t obvious, everything on the RapidBit Exchange, Winchester Community and Darvis System websites is baloney.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

RapidBit Exchange’s Products

RapidBit Exchange has no retailable products or services.

Promoters are only able to market RapidBit Exchange promoter membership itself.

RapidBit Exchange’s Compensation Plan

RapidBit Exchange promoters invest tether (USDT). This is done on the promise of “an overall asset return between 200% and 1000%”.

Returns are paid in WINH token, a token created by RapidBit Exchange that is worthless outside of its investment opportunity.

Invested USDT is locked up for fourteen months. If a promoter opts to withdraw invested funds before this period, a 50% fee is charged.

RapidBitExchange also charges a 10% fee on withdrawals. This is masked as “a donation to a charitable organization.”

RapidBit Exchange don’t disclose affiliate commission rates but they are typically paid down three levels of recruitment (unilevel):

Joining RapidBit Exchange

RapidBit Exchange promoter membership is free.

Full participation in the attached income opportunity requires an undisclosed USDT investment.

RapidBit Exchange Conclusion

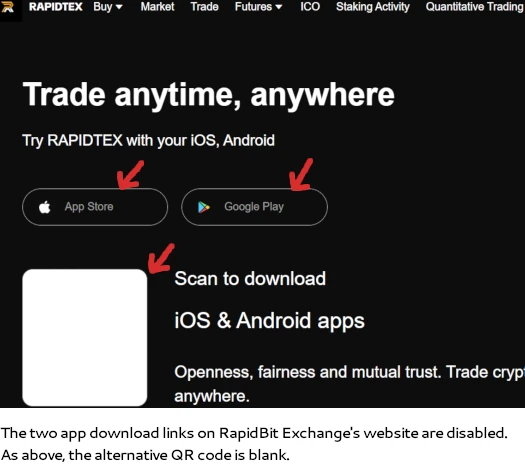

RapidBit Exchange is yet another “click a button” app Ponzi scheme. Although gaining access to its app is a bit of a chore.

Typically “click a button” Ponzi apps must be sideloaded. On RapidBit Exchange’s website though, app links are disabled:

Onboarding of new investors instead appear to be done through contracts made with Winchester Community:

Or more specifically, Darvis Strategies LTD (Party A) and RapidBt Digital Asset Trading Platform (Party C). “Party B” is the potential investor.

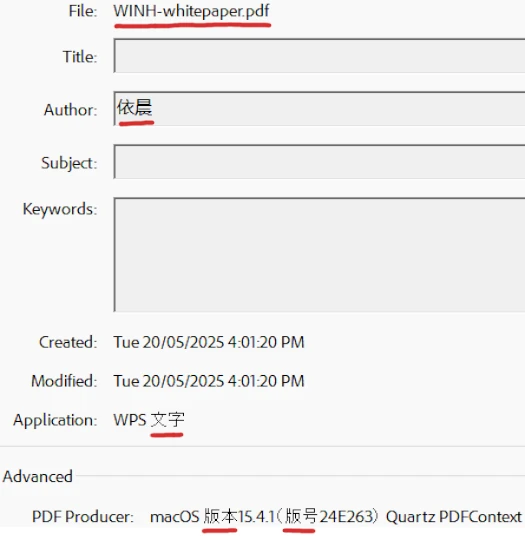

Winchester Community investor contracts are authored by “Nico Loh”, using a Chinese-language version of WPS Office.

In the example contract above, a potential investor is required to hand over 7800 USDT, after which

Party A will grant Party B theQuantum Synergy Investment Pact — Novice Tier Partner.

This tier offers exclusiveprivileges such as priority platform access, enhanced AI analytics, specializedsupport, and premium profit optimization tools, all designed to elevate PartyB’sreturns under the Darvis Interstellar Capital Alliance PAC.

That’s a fancy way of saying “access to our Ponzi app”.

Once access to the RapidBitExchange is obtained, the fake trading signals ruse begins.

Trading signals are fed to RapidBitExchange through Winchester Community. This typically place in a dodgy Telegram group but, given Winchester Community’s website has a separate login feature, the signals could be fed through Winchester Community’s website itself.

Either way, RapidBitExchange promoters take the provided signals and feed them back into the Ponzi app. This requires “clicking buttons”, hence the term “click a button” app Ponzi.

The usual set up is the more is invested the more fake trading signal buttons have to be clicked in the app. Given Winchester Community promoter contracts specify a fixed USDT amount, this might be reduced to just clicking one button a day.

Additional points of interest is Winchester Community providing potential investors with a WINH token whitepaper.

The whitepaper itself isn’t of interest, it’s full of the usual (probably) AI-generated meaningless crypto jargon, but it does give us more links to Chinese scammers:

Winchester Community’s WINH whitepaper was authored by “依晨” on May 20th, 2025, using Chinese PDF software run on a Chinese language version of macOS.

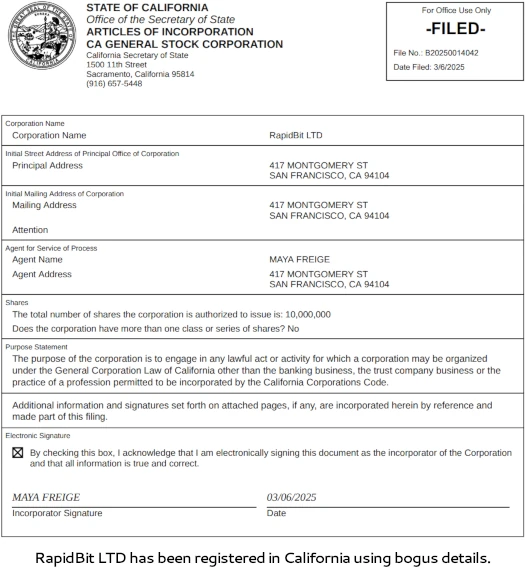

Also as part of efforts to dupe US investors, RapidBit LTD was registered as a Californian company on March 6th, 2025.

“Maya Freige” likely doesn’t exist or is a patsy identity. The provided San Francisco address belongs to a Planet Fitness gym.

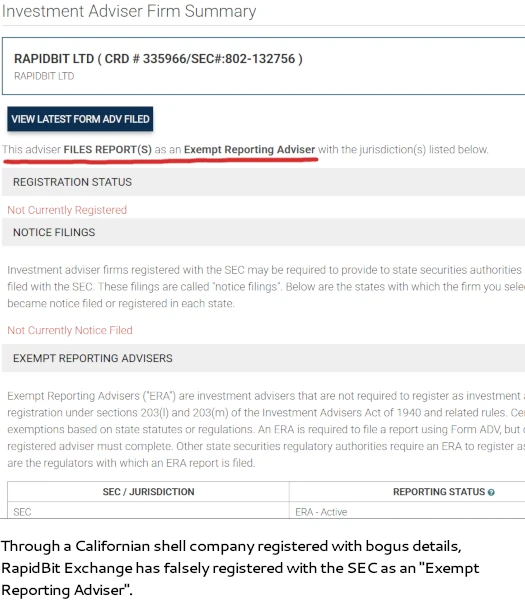

Having registered a shell company with bogus details, RapitBit Exchange’s admin(s) then used it to register for an SEC filing exemption:

This is solely to create the illusion of RapidBit Exchange operating legally within the US.

Putting aside all the fraud and misrepresentations we’ve already covered, the relevant financial law governing RapidBit Exchange’s investment scheme is the Securities and Exchange Act.

RapidBit Exchange promoters invest USDT (an investment of money), into Winchester Community (a common enterprise), on the promise of passive returns (an expectation of profits), purportedly derived through an AI trading bot (derived via the efforts of others).

In brackets above are prongs of the Howey Test, which is used to establish whether an investment contract exists. Not surprisingly, RapidBit Exchange’s investment scheme satisfies all prongs of the Howey Test.

Under the Securities and Exchange Act, RapidBit Exchange is required to register its securities offering with the SEC. Instead of doing that, the scammers behind it have created a Californian shell company and registered as an “exempt reporting advisor”.

This is fraud in and of itself, notwithstanding RapidBit Exchange offering unregistered securities to US residents constituting securities fraud.

In addition to being required to register with the SEC and periodically file audited financial reports, RapidBit Exchange generating revenue via trading requires it to register with the CFTC (FINRA).

RapidBit Exchange has a FINRA CRD but it has registered only in the capacity as an exempt reporting advisor with the SEC. This constitutes commodities fraud.

Despite claiming the Darvis System is a “cutting-edge AI-driven trading solution”, for some reason RapidBit Exchange and Winchester can’t execute trades on their own. Instead they inexplicably opt for the ruse of sharing trading profits with randoms over the internet.

If that business model makes no sense it’s because it doesn’t. Why get randoms to click a button in a dodgy app when you could just execute the trades yourself?

In reality clicking a button inside RapidBit Exchange’s app does nothing. All RapidBit Exchange does is recycle newly invested funds to pay earlier investors.

RapidBit Exchange is part of a group of “click a button” app Ponzis that have emerged since late 2021.

Examples of already collapsed “click a button” Ponzis using the same trading signals ruse include MTS Foundation, QTCPCoin and Finopta.

Since 2021 BehindMLM has documented hundreds of “click a button” app Ponzis. Most of them last a few weeks to a few months before collapsing.

“Click a button” app Ponzis disappear by disabling both their websites and app. This tends to happen without notice, leaving the majority of investors with a loss (inevitable Ponzi math).

In the lead up to a collapse, “click a button” Ponzi investors also tend to find their accounts locked. This typically coincides with a withdrawal request.

As part of a collapse, “click a button” Ponzi scammers often initiate recovery scams. This sees the scammers demand investors pay a fee to access funds and/or re enable withdrawals.

If any payments are made withdrawals remain disabled or the scammers cease communication.

Organized crime interests from China operate scam factories behind “click a button” Ponzis from south-east Asian countries.

In September 2024, the US Department of Treasury sanctioned Cambodian politician Ly Yong Phat over ties to Chinese human trafficking scam factories.

Through various companies he owns, Phat is alleged to shelter Chinese scammers operating out of Cambodia.

Myanmar claims to have deported over 50,000 Chinese scam factory scammers since October 2023. With “click a button” app scams continuing to feature on BehindMLM though, it is clearly not enough.

In late January 2025, Chinese ministry representatives visited Thailand. The stated aim of the visit was to tackle organized Chinese crime gangs operating from Myanmar.

In early February 2025, Thailand announced it had cut power, internet access and petrol supplies to Chinese scam factories operating across its border with Myanmar.

As of February 20th, Thai and Chinese authorities claim ten thousand trafficked hostages had been freed from Myanmar compounds.

Also on February 20th, five Chinese crime bosses were nabbed in a wider raid of four hundred and fifty arrests in the Philippines.

On March 19th it was reported that, despite the recent raids and arrests, “up to 100,000 people” are still working in Chinese Myanmar scam factories.

As of April 2025 and in response to a crackdown across Asia, newly opened Chinese scam factories have been reported in Nigeria, Angola and Brazil.

Myawaddy is an area in Myanmar along the Thai border. Myawaddy is under the control of the Karen National Army (KNA).

The KNA, led by warlord Chit Thu (right) and sons Saw Htoo Eh Moo and Saw Chit Chit, protect and profit from organized Chinese criminals running “click a button” Ponzi scam factories.

On May 5th the US imposed sanctions on Chit Thu (right).

On May 5th the US imposed sanctions on Chit Thu (right).

The Treasury said the warlord, Saw Chit Thu, is a central figure in a network of illicit and highly lucrative cyberscam operations targeting Americans.

The move puts financial sanctions on Saw Chit Thu, the Karen National Army that he heads, and his two sons, Saw Htoo Eh Moo and Saw Chit Chit, the department said in a statement, freezing any U.S. assets they may hold and generally barring Americans from doing business with them.

Britain and the European Union have already imposed sanctions on Saw Chit Thu.

A May 25th report cites Myanmar and Loas as having “towering scam economies”. Cambodia however is reported to be a hotspot for Chinese criminal activity.

Cambodia is likely the absolute global epicentre of next-gen transnational fraud in 2025 and is certainly the country most primed for explosive growth going forward.

Cambodia is becoming the centre of an exploding global scam economy driven primarily by Chinese organised crime.

Chinese gangs are reported to operate in Cambodia under the protection of unnamed local politicians.

In June 2025, Amnesty International claimed Cambodia’s government was

“deliberately ignoring” abuses by cybercrime gangs who have trafficked people from across the world, including children, into slavery at brutal scam compounds.

The London-based group said in a report that it had identified 53 scam centres and dozens more suspected sites across the country, including the Southeast Asian nation’s capital, Phnom Penh.

The prison-like compounds were ringed by high fences with razor wire, guarded by armed men and staffed by trafficking victims forced to defraud people across the globe, it said, with those inside subjected to punishments including shocks from electric batons, confinement in dark rooms and beatings.

In July 2025 Cambodia arrested over 1000 cybercrime suspects. Twenty-seven of those arrested were members of Chinese criminal gangs.

Regardless of which country they operate from, ultimately the same group of Chinese scammers are believed to be behind the “click a button” app Ponzi plague.