CashFX Group’s dodgy KYC shell merchant busted

As part of its ongoing campaign to deny affiliate withdrawal requests, CashFX Group recently implemented KYC.

As part of its ongoing campaign to deny affiliate withdrawal requests, CashFX Group recently implemented KYC.

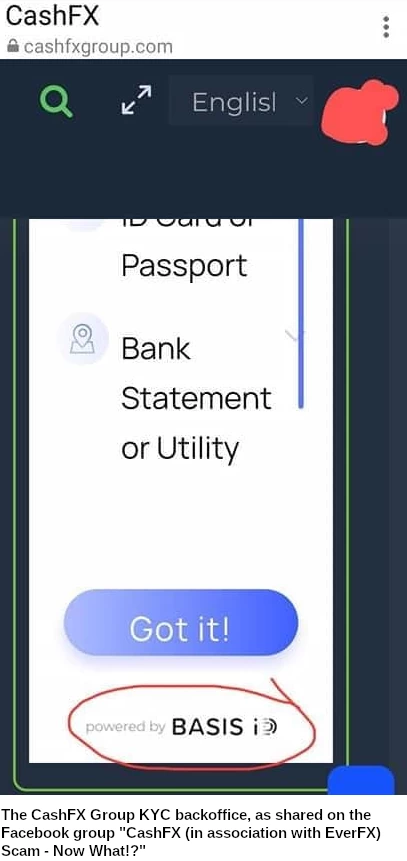

CashFX Group represented on its website that it had implemented KYC software from the third-party merchant Basis ID.

Naturally this was done through a dodgy shell merchant, with Basis ID having no idea their software had been attached to a Ponzi scheme.

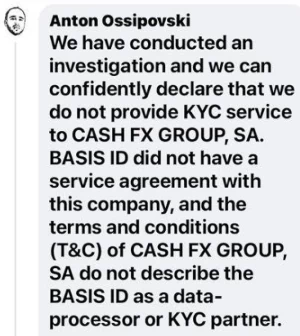

A request for clarification from Basis ID resulted in a response from Chief Marketing Officer Anton Ossipovski.

A request for clarification from Basis ID resulted in a response from Chief Marketing Officer Anton Ossipovski.

We have conducted an investigation and we can confidently declare that we do not provide KYC service to Cash FX Group, SA.

Basis ID did not have a service agreement with this company, and the terms and conditions (T&C) of Cash FX Group, SA do not describe the Basis ID as a data-processor or KYC partner.

During the investigation, we found out which company transferred its verification tools to Cash FX Group, SA.

This is strictly prohibited by the Basis ID service agreement.

At the moment the verification capabilities are disabled, and the company that violated the terms of the contract has already received claims and a notice of the start of taking measures against it.

We see as our goal the fight against fraud and (are) completely on the side of the victims of Cash FX Group, SA.

Ossipovski invites anyone who provided identification documents prior to CashFX Group being cut off, to contact Basis ID for clarification.

Whether CashFX Group finds a dodgy KYC merchant replacement, or comes up with a new withdrawal denial ruse remains to be seen.

The take-away here is CashFX Group can’t sign up under its own name with a reputably KYC solution provider, because CashFX Group itself would fail KYC.

Update 11th August 2021 – Following this disaster launch, CashFX Group has informed affiliates it is pausing its KYC roll out.

Imagine implementing KYC to meet “anti money laundering requirements”… and then having to use a shell company because you know you’d fail a KYC check by the KYC company.

LAWL.

Oh man,what a whammy.

Good to see companies also taking a stand against such nonsense.

I spent just a few minutes looking into Basis id and I certainly would NOT trust them with my docs… just saying!!!…

Good on Basis Id for showing such integrity. Sometimes you forget there are still good companies out there.

This shit-show lurches from one crisis to the next.

Give it up Huascar, shut this rubbish down already.

And don’t think trying to find another KYC company is going to help. We’ll jump all over that one too.

Lolz.