CashFX Group sets up BullnBear Pay to pay withdrawals

Typically an MLM Ponzi scheme launches with or switches to cryptocurrency to avoid financial regulation.

Typically an MLM Ponzi scheme launches with or switches to cryptocurrency to avoid financial regulation.

Then there’s CashFX Group who, following two years of ongoing crypto withdrawal problems, have now convinced investors they’ll be paid through a debit card.

CashFX Group is a Ponzi scheme that has thus far received fraud warnings from no less than 18 countries.

Naturally this means they can’t go anywhere near traditional finance using their own company name. Instead CashFX Group has gone the shell company –> dodgy merchant route.

To that end CashFX Group set up the UK shell company BullnBear Pay:

CashFX Group announced BullnBear Pay via a communication sent out on June 18th:

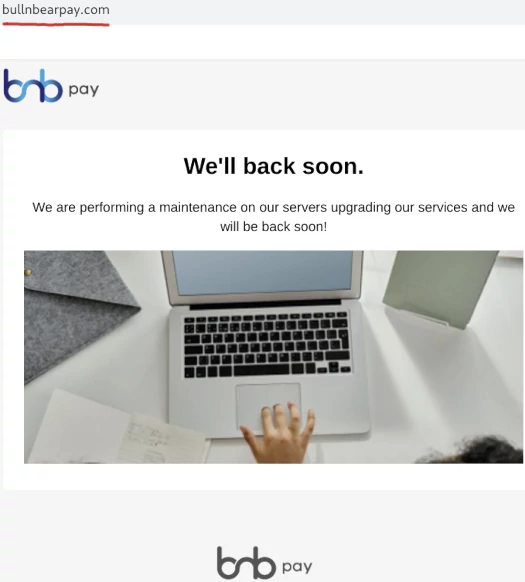

BullnBear Pay is hosted off the domain “bullnbearpay.com”.

BullnBear Pay’s domain was privately registered on April 23rd, 2022. Note however that the BullnBear Pay website only went live last week.

Bull & Bear Payments Ltd “BnB Pay” is a digital banking alternative. We provide our customers with multi-currency payment accounts, in order to facilitate cross border transactions.

BnB Pay is connected to all major payment networks, enabling individuals and companies to transact with their counter parties worldwide, immediately.

As per BullnBear Pay’s website T&C, we learn:

These legal terms (English law applies and disputes will be settled by English courts) are between you and Bull & Bear Payments Ltd.

Bull and Bear Payments LTD is a UK shell company incorporated on June 6th.

Paul Alberto Mendoza of Panama is the Bull and Bear Payments LTD’s sole listed officer. Rather than provide his address though, Bull and Bear Payments LTD was incorporated through an address belonging to a UK incorporation service.

Nothing publicly ties Paul Alberto Mendoza to CashFX Group. Whether he even exists is unclear.

Bull and Bear Payments LTD’s stated nature of business is

66190 – Activities auxiliary to financial intermediation not elsewhere classified

If we scroll a bit further down on BullnBear Pay’s website T&C, we additionally learn;

BnB Pay brings you the app and the website which enable you to access your money. We do not hold your money or provide a card for you to spend your money with.

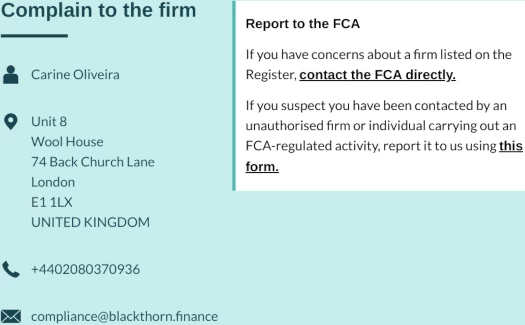

We are authorized agents of Blackthorn Finance Limited, (“Blackthorn Finance Limited”) who provide an e-money account where your funds are held (your account). Your agreement with them is listed here: Blackthorn Finance Limited Terms (http://www.blackthornfs.com/).

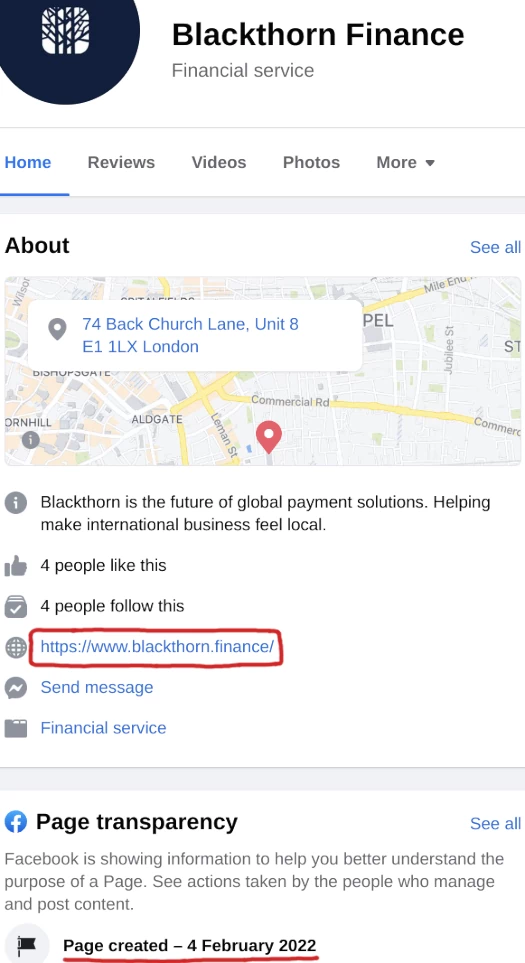

BlackThorn Finance Limited’s website domain was registered in September 2020.

Blackthorn Finance Limited is an authorised payment institution and regulated by the Financial Conduct Authority (FRN 927408) under the Payment Services Regulations 2017 (PSRs).

And this appears to be the dodgy merchant CashFX Group is hoping to issue Mastercard debit cards through.

Except here’s where things get a little strange. Well, more strange.

“Blackthornfs.com” might have been registered in 2020, but the current website didn’t go live until November 2021.

Furthermore, if you click on the provided FaceBook link on Blackthorn Finance’s website, you’re taken here:

That’s a different domain, and the FaceBook page was only set up a few months ago in February?

A visit to Blackthorn Finance at “blackthorn.finance” reveals an identical page design to “blackthornfinancefs.com”.

One is a copy of the other and I believe the latter, CashFX Group’s dodgy page, is the copy.

This is based on:

- a link to “blackthorn.finance” in CashFX Group’s “blackthornfs.com” source-code (see above)

- “blackthornfs.com” not having an SSL security certificate set up (unsecured finance services websites haven’t been a thing for years)

- provided Blackthorn Finance details in the FCA database not pointing to CashFX Group’s “blackthornfs.com” domain (see below)

One thing that doesn’t add up is CashFX Group’s “blackthornfs.com” providing the same app links as Blackthorn Finance’s “blackthorn.finance” website.

Seeing as CashFX Group affiliates are being directed to sign up through “bullnbearpay.com” though, perhaps they figured it doesn’t matter.

Presently I can’t confirm or deny a link between “blackthornfs.com” and “blackthorn.finance” with absolute certainty. Based on what information is available though, it seems CashFX Group has set up a clone site.

Which begs the question who then is providing the Ponzi scheme with merchant access to MasterCard?

Of concern are CashFX Group affiliates being instructed to provide KYC details to BullnBear Pay:

This opens the door for identity theft, as well as using KYC to further manipulate withdrawals.

We know the money isn’t there, so none of this really makes any sense.

Which might be why BullnBear Pay could already be over:

Pending any further updates, stay tuned…

Update 28th June 2022 – BullnBear Pay’s website is back online. References to BlackThorn Finance have been scrubbed.

A week is plenty of time to set up new shell companies in the UK, so presumably that’s what’s happened.

Transparency and Ponzi schemes don’t go hand in hand, so it’s unlikely CashFX Group will make any new dodgy companies they’ve set up public.

BullnBear Pay is still requesting CashFX Group affiliates send in personal information for KYC.

That was already risky. Now that CashFX Group is openly flouting financial laws in the UK, the risk associated with handing over these details to parties unknown has increased.

Same as cloud token scam, they work with shell company and encourage you to apply debit card.

Who knows how many debit card they will get after the application? Maybe 5?

They may send you one and the rest they can use for cash out @ atm or shopping without limitation. Or even buy something from black market.

Mendoza is head of international sales for Alchemy Markets, which has a shared director/probable owner as Blackthorn Finance, I’ve also heard Alchemy is the broker for the CFX never-ending beta copy trading.

Also the fs.com site just has the Blackthorn.finance website in a frame – easily prevented from happening if they don’t own it, but I believe they do.

That’s interesting. I can’t come up with a reason for CashFX Group providing the “FS” domain instead of the main one.

CastleRockFX is the actual broker to be more precise, but they are just claiming it’s a trading name and some other bs at the bottom of the CRFX website

Shell companies for days. Always the case when you hear “debit card” from an MLM Ponzi scheme.

Just makes no sense to go from crypto to debit card. It’s always done in reverse because of financial blacklists catching up.

I mean geez, how crap is your MLM Ponzi if you can’t even run it in crypto?

The FCA says Bull and Bear Pay would need to be listed on their website as an authorised agent. They are not (of course)

Now Blackthorn needs to make a decision whether or not to disown Bull and Bear Pay. Their MasterCard licence is on the line.

This is a question rather than a comment.

What will you actually print when MasterCard is fully integrated and CFX members are accessing funds? Will someone promise to eat their hat live please? I want a front row seat! 🙂

Blackthorn have said they are nothing to do with it and will put out a statement. Let’s see.

This isn’t some “never been done before” thing. Any MLM Ponzi scheme that bangs on about a debit card is using shell companies hooked up to some dodgy merchant.

The lol here is CashFX Group has collapsed properly last November when they first shut off withdrawals. Going the shell company –> dodgy merchant route doesn’t materialize money for investors to steal out of thin air.

One reason to leave the blockchain behind is so we can’t all laugh at ROI/withdrawal deficit spiralling further out of control.

So WHO will eat their hat LIVE? Dont all volunteer at once… 🙂

Brain damage confirmed.

Suzie – is there no lie that’s too big? Are you that stupid? Surely not.

yep I have been with cfx for a long time and smelt a rat when nov and oct payments were asked to cancel pendings and reapply them to Jan.

since then only one payment has been recieved and still owed 106k. I know I will never see it.

they keep shifting the goal posts and people keep blikers on and still getting people to spend good money.

Why are they still roping people in? Because they refuse to thing they are wrong and keep bringing in people to loose good money.

Lol,shame what an imbecile. But it’s an easy bet to take.. with a caveat.

CashFX making debit card payments…legally..

Since they are 100% Illegal – I can’t lose.

You can eat your hat with salt and pepper Suzie.

Why the hell has this ‘company’ not been shut down yet? CFX is such an obvious Ponzi scam, even a blind man could see that.

I have requested 2 payouts this year ( Feb & May ) and still i have not seen a dime. This card crap is exactly that – crap.

There is zero regulation here at all. The FCA & Police should be rounding up all the guys here in the UK promoting this rubbish as they’re clearly in on it with the CFX mob.

The excuses got worse and worse over the months and yet here we are talking about some phantom card that will end up seeing everyone getting ripped off even more! Run a mile guys or you’re going to regret it.

Over to you Panama and Dominican Republic.

You are invited to come back and tell us how you enjoyed losing your funds when (not if) this scam completely exit scams.

This is where things get even more interesting. This Mendoza character is tied to CastlerockFX platform as well:

linkedin.com/in/paul-mendoza-283157125/

Danny Frederick failed at this. He fails at everything but try’s to act successful. He is now pushing the scam Digital Wealth Pros scam.

You can tell he is missing some chromosomes because his eyes are too far apart.

Please do a report on Digital wealth Pros and 10x failure Danny Frederick – his my capture page digital wealth pro site (Ozedit: link removed)

Digital Wealth Pros isn’t MLM.

When you go onto Blackthornfs.com website it comes up as not secure in the address bar which means it doesn’t have an active SSL certificate.

As it is linked to CFX it is obviously dodgy but putting your personal details into an unsecured site is crazy anyway.

Another last minute attempt to keep the faith and delay longer.

People keep saying will lose funds, I and many others only invested 300 dollars.

If I eventually lose that, it isn’t life changing. Everything in life is a risk.

(Ozedit: derails removed)

Ponzi copium doesn’t work. If it did you wouldn’t be here trying to justify getting scammed.

Also you don’t get to speak for other CashFX Group investors. Keep your copium fantasies to yourself kthx.

Bull&Bear aren’t listed as agents of Blackthorn & I think that this is a smoke screen.

BnB just isn’t authorized with Blackthorn (check the FCA) & folks believed what they read. I don’t see any reason to think that Blackthorn has any involvement here – It just all seems to point to BnB defrauding people & Blackthorn not being involved at all.

Just folks saying they are affiliated with people they’re not and everyone now pointing fingers down the chain rather than where the real issue is at (BnB pay)

To be fair oz, not trying to justify being involved in a “scam”. All I know is, I am happy with it due to my low risk amount, which I am happy with. My personal choice. (Ozedit: derails removed)

Whether you’re happy with scams or not is neither here nor there.

Also if you want to discuss eVeRyThInG iS a PyRaMiD! do it somewhere else. It has nothing to do with CashFX Group being a Ponzi scheme in which the majority of investors are guaranteed to lose money.

Imagine how deep in the Pyramid Scheme cult mindset you have to be to equate a pay-to-play scam where majority of people lose money with a company where everybody that works there gets paid without needing to deposit money so the earlier joiners could get paid

Less huffing paint please,your coping mechanism for theft is actually depressing

I respect your opinions, have an awesome day and weekend ahead Oz.

Forget opinions, respect the facts.

Fact: CashFX Group is a Ponzi scheme.

Fact: Math guarantees the majority of participants in Ponzi schemes lose money.

Show me proof please.

I’d say Pauls mindset isnt the worst UNLESS he actively recruited people to it. It’s one thing throwing money at a gamble, and then theres exploiting peoples trust.

CashFX’s business model:

https://behindmlm.com/mlm-reviews/cash-fx-group-review-200-to-400-roi-trading-bot-securities-fraud/

If you want to challenge the facts, your next comment will include audited financial reports.

The thing is its all very complex but if you join the dots ull find that Blackthorne is connected to Bnb and Alchemy Markets.

It takes a lot of scrolling but u find the directors are all linked by tons of different shell companies.

It’s quite exhausting but tho theres not a direct link with Mendoza to Blackthorne, if you go back through the daisychain of companies…. you’ll come across one that has both mendoza and the director of Blackthorne together.

Thanks Thomas

I have recruited 3 people (one relative and 2 friends).

Specifically told them not to put in more than they can afford to lose, as everything is a risk and no guarantees. I also promised I would refund them if they lost it (all put in 300 dollars), which I would honour.

I have been in it approx 18 months and upgraded to 2k contract so far (without using any more of my own money).

As a footnote I’m not interested in arguing with people on social media, I dont see the point.

Eh,no.

You participating in a scam at BEST allows it to survive that much longer and scam more people.

Worse is you withdrew more than you put in – that’s then stolen money.

Worst is recruiting actively and doing the above as well.

I swear the amounts of copium you scudsuckers consume to allay your consciences is astounding.

This much is obvious,though you don’t even grasp what the actual point is – hilariously.

Of course you’re not interested in arguing; you lose every argument. Yet it’s you arguing “Show me proof, please,” so climb down from your faux high horse.

If you equate funding criminal activity with “everything is a risk,” you are a hopeless case.

Good luck with your “everything is a risk” story when your friends and relative demand their money back from you.

Thats fine as i said.

Bore off.

TL;DR: Paul is fine with Ponzi schemes and financial fraud so long as it’s he and his friends stealing money.

Noted and, as requested, we can move on.

I had a friend link me to Bull and Bear and try to recruit me to invest so I did some digging myself – I think this Paul Mendoza is a red herring as the companies that are setup are all done so in the past month.

Even the other company purportedly to Paul Mendoza is registered just a week and a bit before and it smells like a shell corp.

Blackthorn Finance seem to just be some payments company but I checked their authorised agents on the FCA website and nowhere does it say Bull and Bear not CashFX on there so they could have just faked that too at this stage.

I gave Blackthorn a call and asked about their virtual cards and they say they don’t even offer that.

I encourage people to have a look into this as the agents for Blackthorn on the FCA website as CashFX and Bill and Bear don’t even exist.

Weirdly though, the address that Bull and Bear advertise and have on companies house is almost the same as the Blackthorns old address where they appeared to move from in around October 2020 (companies house filing on Blackthorn) and 19 Leydon Street seems to be a hairdressers but 13 Leyden Street appears to be where Blackthorn and Alchemy Markets used to be until they moved.

As such, if the addresses on Companies House for Bill and Bear seem to point to what appears to be some shop and not an “authorised agent” of some small tier payments provider, I think they’re trying it on and the shell companies don’t exist.

Don’t take my word for it, go to the FCA website and search for Blackthorn and go to the section saying “ Appointed representatives and agents” and expand it. It’s halfway down the page.

They have to publish any authorised agents in advance so the fact there is nothing aside from some (frankly F tier) names in banking. The very weirdly named “Key to Pay”, “FX PIG” and “Muniy” which all appear to have been on there since 2020 but nothing since.

What is weird though is there is another Blackthorn Finance Ltd registered under the number 747680 for 13 Leyden street that appears to have been cancelled from 2020 so I think this is all a game of craps.

Keep people focussed on the digging details into some finance company that hasn’t got their paperwork in even a basic of structure and then while people focus on that, you can extort more cash from people.

As an amusing side note blackthorn isn’t even a bank – they can’t even hold money. With that said, they sponsor Watford football club so I have no idea what to think!

Given your hard work tracing all this, I think they has just found some shitty finance company with a confusing structure to pin things on so they can distract people on that rather than the main scam being propagated.

My main concern is while we focus on all that, what else are they doing given there’s evidently still a marketing effort to push this pyramid.

Article updated to note BullnBear Pay website is back.

Evidence scrubbed because Ponzi scheme.

Yeh also worth noting the bullnbear website contact form leads to a 404 error.

The fact they removed all info about Blackthorn is such a massive red flag but the die hards now just believe it never said Blackthorn and we all made it up.

I’ll take that bet Suzie. If you can prove there is a legitimate trading fund behind CashFX, with an auditable accounting record, that account balances are an accurate reflection of trading profits, that the Binance account where 5500 bitcoin have been sold finances this fund, that payouts are made using bitcoin purchased from this fund or that the accounting of payouts is an accurate reflection of trading profits, that the significant bitcoin reserves held by wallets and not traded are part of the investment strategy, that the large bitcoin payouts to the main players are legitimate commissions…

Basically if you can prove that these impossible profits are actually real, then I will invest under you and you can get my commission.

Because this is just a fraction of what doing due diligence is and nobody in CashFX has ever been able to show it is a legitimate trading fund, they just repeat the same old BS and that they’ve been paid so it must be legit (which is absolutely no proof of legitimacy).

I’m with CFX and I think they SCREWED ME! I invested $40K, and lost it all!!!!

Cashfx is simply a scam. People invested and when they wanted withdrawal, months have passed with all manners of gimmicks (8 months).

A telegram group was created whereby you have the right to only write something positive about the scammer. If you do otherwise you will be removed.

For saying the truth that you have not received payment and it is a suspicion that you are dealing with scammers.

It is a pity that what a blind man can easily see there are so many big eyed people that cannot. Simply cashfx is a scam and the people behind it are criminals to say the least.

It is maybe scam, maybe not, the bank BnB is for sure, but i only invest 300$ in CFX, and while growing in contract i have taken out 900$, so im at the profit site and can not complain, for me it is free money.

i have only gain profit, yes it takes month, and if we read and listen, you would know why, but i do not know what to Think anymore, i just let the ride go as it go, it can keep moving up, ore it can Fall and break, im still out whit profit.

CashFX is a Ponzi scheme.

…you expect anyone to believe you’ve withdrawn 300% when CashFX Group withdrawals have been disabled for a year? Sorry for your loss.

OZ, im not sure you read what i am texting, but it is okay, some people will only see negative things in everything, and it is okay, as i say, i only put in 300$, no more, but i have taken out 900$, so my friend, it is not a loss, it is all a win in my case.

and if (and i do not say i do) i get money out in the future too, it is all free money and profit, and i have not lost a cent, all the money they Trade whit and pay to ME, it is all free money.

As long i am on the + side whit money and Got my money back, then i do not give a shit if they shut down ore what the f*** happen, cause i earn on it by doing nothing beside being patient

No I definitely got it. You’re a special snowflake claiming a 300% cashed out ROI when nobody else, even CashFX Group’s leaders, have been able to cash out for a year.

Riiiiiiiiiiiiiiiight. One can only assume you’re talking about investing years ago, which I mean why bother pretending this is anything recent?

That you’re a scumbag with bankrupt morals has been been made abundantly clear.

OZ, are you retard ore something?

Last whitdraw was for me in May this year, and yes it toke 3 month to get it and it was 400$.

(Ozedit: derails removed)

You’re either full of shit or in that group of small investors temporarily getting paid in the hope you’ll go off and recruit new victims.

Be thankful you didn’t invest a lot or have a substantial amount to withdraw.

Bottom line: Whether you managed to steal a few hundred out of it or not, CashFX Group is a collapsed Ponzi. Hopefully you didn’t reinvest what you withdrew.

Also if your last withdrawal was $400 and it was in May, presumably the other $500 was last year before the October collapse.

Realistically you’re probably overall in a loss given crypto dropping from $60,000+ to what it is now.

You’d have made more working one a day a fortnight slinging burgers. Turn up that copium though.

Jesper,

IF you took out more than you put in, you took someone else’s money. You didn’t “make” anything.

That you have written you are happy some other poor person who also believed in this also “invested” underlines the fact you are happy to take someone else’s money under the cover of a ponzi scheme. In some places, that’s called complicity. Have a great day.

I do not care if it is other people’s money, when you work (Ozedit: derails removed)

but just a wuestion, cause i have seen a lot of scems before, and they all got turn down whitin 2 years, so why is CFX not?

what makes it still runniing and still pay out small amounts?

i do not know if other people join ore not, if they do, there must be something they beleive in ore else they would not do it.

1. Investing in Ponzi schemes isn’t work. Equating it to work is a false justification of financial fraud.

2. CashFX Group collapsed in October 2021. There’s been a few reported selected payments to new’ish investors and only small amounts. This is to keep the illusion CashFX Group hasn’t collapsed going.

3. The reason CashFX Group hasn’t just exit-scammed completely is because it’s too big for regulators to ignore. Once those investor complaints start flooding in that’s a bottle Lopez can’t put the cork back in.

He and his fellow CFX insiders are going to spend the rest of their lives looking over their shoulders or in prison. That’s a strong motivator.

4. People join Ponzi schemes to steal money. It’s not complicated.

Interesting set of discussions.

How to bnb card transfer to another bank account or traditional bank account.

That sounds like an attempt to withdraw. CashFX Group disabled withdrawals in late 2021.

You invested into a Ponzi scheme and your money is gone. Sorry for your loss.

You obviously don’t know how CFX works, You can take out more that you put in as that person did. That is how invested money works.

All the complainers have obviously been in or set up similar schemes in the past and have failed so now having a go at a scheme that is still working for many people.

Cool story bro. CashFX Group is still a Ponzi scheme.

Imagine running around the internet pretending CashFX Group didn’t collapse a year ago.

Sorry for your loss.

You clearly don’t have an idea either if this is your explanation for their failed scam.

Nah, I don’t get caught by obvious scams, i’m not an imbecile.

Oof, you’re late chief, this one stopped paying everyone but the fluffers a year ago.

Your “many” people are a handful of promoters and shills fishing for donations to cash out their bags.

I’m in for about 15mths now , did two upgrades, and going for my 3rd nx yr….didn’t ask about a w/draws, but did see the bnb card offer. which bought me here. will get more info.

You invested into CashFX Group 15 months ago and haven’t tried to withdraw anything?

You’re in for a rude shock…

You’re in for the letdown of a lifetime.

i have been told to read the terms and conditions when stating that i am concerned about the nopayments for over a year !!

nd its always those that are testing the next phase .. the copy trading that say that its a lower vibration to complain .. we are called complainers … yet theres no official complaints procedure….

i joined hoping for money , and find myself in a load of spiritual bullshitbeing spoon fed … keep the faith … are u with us or againstus…. its all about higher energies coming to play … do u know anything about buisness, companies etc….

i am disgusted and really dont know how to put a stop to this . how do thee people get to continue ? where do we go if we are done with this bullshit.

i deeply regret giving any of my info to bnbpay ..bullshit n bullshit dont pay and i realise if they do pay from cfx its someother poor innocent persons money … so i havent lost a fortune… but i wont be remeaining for the next bullshit phase 2 copytrading !!!

oh my god … i really believed huaskar is a decent guy … 🙁 what other mlms in the past has he ran i wonder ?

CashFX Group is a collapsed Ponzi scheme committing securities fraud. You go to the SEC.

Expensive schoolfees unfortunately.

I am glad I got my money out right before the collapse. Same goes for that stupid Qubitec ponzi or whatever its called.

Never again!

I just wish these guys would get hits put on them. Fingers crossed. I would do if myself it jail was not a possible consequence. Morally I could care less offing these folks.

Sorry for everyone’s loss. I got plain lucky and got the remainder of my money out literally weeks before withdrawals stopped.

Hey Oz, I’ve been following behindmlm over the past couple of weeks and have been both amazed and shocked with the history.

I’ve been receiving messages from the Global power team telegram, and they’re stating that several members have recently received A2PC withdrawal.

Also, Dano has confirmed that A2PC is hours from being launched? Now I’ve got about a 10% confidence level that the new P2C will actually launch and continue to operate. Also, about the same hope that CFX will pay back it’s members in full.

But it’s confusing when you hear that several members are being paid, and the new platform is launching?

Phil.

They need investment and/or people to not report them. The more carrots that can be dangled the longer the delay

Pyramids always crumble the same way

Ok, but eventually, cashfx will simply shut completely down and disappear with several million dollars. What is the point of postponing or dragging this company out with more effort and expense starting up P2C and rolling out this debit card? There will still be the risk of several members reporting them if they exit now or in the future? I’m so confused. Either way, people could report them now or later.

Why run for 20 years when you can run for 10?

There is very little expense to whitelabelling a solution and having people pay for it themselves

Suzie I’m really sorry for your and everyone elses loss and that no hats were eaten.

Thanks for all your comments. Disgusted with the whole CashFX experience… an expensive learning process.

No way in hell are they getting my details for KYC!!

Oz,

My apologies for necroing this, but in your copious amounts of spare time, you should consider making a “Best of BehindMLM” board/post.

I nominate Martin’s post #72 for a first round.

Lol, surely it’s more rewarding to unexpectedly run into the funny as you browse around :D.

None of the “baby’s first Ponzi” comments on any of our larger scam reviews age well.

An Aged like Milk hall of Fame will be hilarious though