Riman Review: Giant byoungpool personal care

![]() Riman fails to provide ownership or executive information on its website.

Riman fails to provide ownership or executive information on its website.

Riman’s website domain (“riman.com”), was initially registered in 2001. The private registration was last updated on August 28th, 2023.

Further research reveals Riman launched in South Korea back in 2018. The company expanded to the US in April 2023.

Riman is headed up by CEO KyungJung Kim (aka KJ Kim, right). Why this information isn’t disclosed on Riman’s website is unclear.

Riman is headed up by CEO KyungJung Kim (aka KJ Kim, right). Why this information isn’t disclosed on Riman’s website is unclear.

Possibly due to language-barriers, I was unable to put together an MLM history on Kim.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

Riman’s Products

Riman markets a range of personal care products and nutritional supplements.

Personal Care

Riman’s personal care range is formulated around the key ingredient “giant byoungpool” (aka centella asiatica).

As per Riman’s marketing;

Byoungpool, native to southeast countries like Korea, has shown a history of use expanding thousands of years.

It has even been lauded as one of the “miracle elixirs of life”, a status that has withstood the test of time.

Byoungpool is known for its skin regenerating properties, with benefits such as soothing and calming irritated skin, providing intense hydration, and improving the skin barrier.

Riman has invested in developing a specialized, more potent strain of byoungpool, patented as giant byoungpool.

- Vieton Oil Mist – “provides a layer of moisture”, retails at $35 for a 1 fl. oz. bottle (30 ml)

- Active Cream Ex – “enhances skin elasticity”, retails at $60 for a 1.69 fl. oz. tub (50 ml)

- Snow Enzyme Cleanser Ex – “gentle, yet effective cleansing”, retails at $25 for a 4.25 oz. tube (120 g)

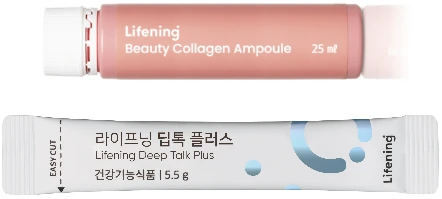

- Beauty Collagen Ampoule – “type 1 Hydrolyzed fish collagen for higher bioavailability”, retails at $90 for a 5 ml bottle

- Purecell Cleansing Oil – “dissolves makeup and oil-based impurities, even sunscreen and waterproof formulas”, retails at $30 for a 4.9 fl. oz. bottle (165 ml)

- Daily Aqua BB – “skin brightening and wrinkle care”, retails at $30 for a 1.05 oz. tube (30 g)

- Vieton Multi Stick Balm – “improves skin radiance”, retails at $25 for a 0.31 oz. bottle (9 g)

- Calming Balance Gel – “comforts and soothes skin, visibly reducing redness”, retails at $35 for a 3.38 fl. oz. tube (100 ml)

- Radiansome100 Microfluidizer Essential Toner – “tones and prepares your skin, allowing products to go on smoother and absorb better, all while creating a protective barrier”, retails at $70 a bottle (size not specified)

- Radiansome100 Microfluidizer Cream – “improves outer and inner skin elasticity”, retails at $90 a tub (size not specified)

- Radiansome100 Microfluidizer Ampoule – “high concentrations of proprietary anti-aging complexes”, retails at $110 a bottle (size not specified)

- 4D Lustre Cushion – “contains oils with a high refractive index, which allows for a reflection of light from any angle on the face”, retails at $50 a unit (size not specified)

- Active Clean-up Powder – “natural enzymes exfoliate without stripping skin”, retails at $30 for a 3.17 oz. bottle (90 g)

- Aqua Protection Sunscreen – “SPF 50+ for protection against both UVA and UVB rays”, retails at $30 for a 1.69 fl. oz. tube (50 ml)

Nutritional Supplements

- Deep Talk Plus – “powerful detox benefits, acts as a prebiotic to aid in gut health (and) strengthens immune system and increases energy”, retails at $68 for a box of 28 single-serve sachets

- Beauty Collagen Ampoule – “type 1 Hydrolyzed fish collagen for higher bioavailability”, retails at $90 for a box of 28 ampoules

Riman’s Compensation Plan

Riman’s compensation plan pays commissions and bonuses on sales volume generated by retail orders and distributor purchases.

Riman Distributor Ranks

There are seven distributor ranks within Riman’s compensation plan.

Along with their respective qualification criteria, they are as follows:

- Planner – sign up as a Riman distributor

- Manager – refer and maintain three retail customers and generate 3000 PGV over a rolling three-month period

- Senior Manager – maintain three retail customers and generate 6000 PGV over a rolling three-month period

- Team Leader – refer and maintain five retail customers, recruit three Senior Managers or higher, have a total of ten Managers or higher in your downline (max five from any one leg), and generate 50,000 GV over a rolling five-month period (max 20,000 PV and up to 25,000 GV from any one recruitment leg)

- Director – maintain five retail customers, develop three recruitment legs with a Team Leader in them and generate 600,000 GV over a rolling six-month period (up to 300,000 GV from any one recruitment leg)

- Senior Director – maintain five retail customers, develop two recruitment legs with a Director or higher in them and generate 300,000 GV a month (restricted to GV generated by personally recruited and second level Directors and higher (max 100,000 GV from a second level Director))

- National Director – maintain five retail customers, develop four recruitment legs with a Director or higher in them and generate 500,000 GV a month (restricted to GV generated by personally recruited and second level Directors and higher (max 250,000 GV from a second level Director))

To count towards rank qualification, referred retail customers must have made a purchase in the qualifying month.

PV stands for “Personal Volume” and is generated via retail sales and a distributor’s own orders. Riman states PV is calculated at “about 90% of the dollar value” spent.

PGV stands for “Personal Group Volume”. PGV is PV counted from a distributor’s PV and that of their personally recruited distributors.

GV stands for “Group Volume”. GV is a Riman distributor’s PV and that of their entire downline.

Retail Commissions

Riman pays commissions on sales volume generated by retail customer orders.

- Planners earn a 10% retail commission rate

- Managers earn a 25% retail commission rate

- Senior Managers earn a 30% retail commission rate

- Team Leaders and higher earn a 45% retail commission rate

Distributor Rebate

Riman distributors receive a rebate rebate on sales volume generated by their own product purchases.

- Planners are eligible for a 10% rebate

- Managers are eligible for a 25% rebate

- Senior Managers are eligible for a 30% rebate

- Team Leaders and higher are eligible for a 45% rebate

Referral Commissions

Riman pays a 45% coded residual commission on all personally recruited distributor sales volume.

- Planners earn 5% (pays nothing if referred distributor is Team Leader or above)

- Managers earn up to 25% (reduced to 5% on recruited Managers)

- Senior Managers earn up to 30% (reduced to 5% on recruited Managers and Senior Managers)

- Team Leaders and above earn up to 45% (not specified but assumed to reduce to 5% on recruited Managers, Senior Managers and Team Leaders)

The coded nature of referral commissions sees higher ranked distributors paid the difference between their rate and lower ranked distributors (i.e. the difference percentage is passed up until the full 45% available is paid out).

Residual Commissions

Riman pays residual commissions via a unilevel compensation structure.

A unilevel compensation structure places an distributor at the top of a unilevel team, with every personally recruited distributor placed directly under them (level 1):

If any level 1 distributors recruit new distributors, they are placed on level 2 of the original distributor’s unilevel team.

If any level 2 distributors recruit new distributors, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

- Senior Managers earn 5% on every unilevel team leg, up until a Senior Manager is found in each leg

- Team Leaders and earn 45% on every unilevel team leg, up until a Team Leader is found in each leg

- Directors earn the same as Team Leaders plus a bonus 1% up until a Director is found in each leg, and 0.5% on a second Director

- Senior Directors earn the same as Team Leaders plus a bonus 1.5% up until a Senior Director is found in each leg (also a 0.5% difference on downline Directors)

- National Directors earn the same as Team Leaders plus a bonus 2% up until a National Director is found in each leg (also a 1% difference on downline Directors and 0.5% on Senior Directors)

Note that Riman’s compensation plan doesn’t specify whether Team Leaders and higher earn residual commissions (although I’m assuming they do).

Matching Bonus

Team Leader and higher ranked Riman distributors can qualify for a Matching Bonus on commissions paid to downline Team Leaders.

- 50% of rebate and retail commissions is counted

- 100% of referral commissions is counted

To qualify for the Matching Bonus, a Team Leader must generate 10,000 GV (GV is counted up until a Team Leader or higher is found in each unilevel team leg).

Once qualified for, the Matching Bonus pays :

- Team Leaders a 15% match on the first Team Leader or higher in a unilevel team leg and 10% on the second and third Team Leaders

- Directors a 15% match on the first Team Leader or higher in a unilevel team leg, 10% on the second and third and 5% on the fourth

- Senior Directors earn a 15% match on the first Team Leader or higher in a unilevel team leg, 10% on the second and third and 5% on the fourth

- National Directors earn a 15% match on the first Team Leader or higher in a unilevel team leg, 10% on the second and third and 5% on the fourth to sixth

Note the Matching Bonus is only paid out on downline Team Leaders and higher who also qualify for the Matching Bonus.

Leadership Achievement Score Incentive

Directors and higher generate Leadership Achievement Points as follows:

- 1 point for each unilevel team leg with a Director or higher in it

- 2 points per Director in a unilevel team leg

- 3 points for a Senior Director in a unilevel team leg

- 4 points for a National Director in a unilevel team leg

The Leadership Achievement Score Incentive is made up of 1% regional Riman sales volume.

The Leadership Achievement Score Incentive is calculated and paid out monthly.

Joining Riman

Basic Riman distributor membership is $20.

Basic Riman distributor membership is $20.

New Riman distributors can also opt to sign up with a “Starter Kit”:

- EX Line Starter Kit – $335

- Starter Kit Plus – $1116

- Starter Kit Premium – $1661

The difference between Riman’s Starter Kits is bundled products.

Riman Conclusion

Riman’s nutritional supplements feel like an afterthought to its personal care range. I think it’s obvious the supplements were tacked on post launch at some point.

Riman’s personal care range is formulated around centella asiatica, otherwise commonly known as asiatic pennywort.

In traditional medicine, C. asiatica has been used to treat various disorders, dermatological conditions, and minor wounds, although clinical efficacy and safety have not been scientifically confirmed.

To get around asiatic pennywort being readily available across Asia, Riman has come up with its claimed “more potent” strain.

I can’t speak to whether that makes much of a difference, owing to Riman failing to provide peer-reviewed studies pertaining to their developed strain.

That said I didn’t find Riman’s pricing to be outrageous. As you’d expect though, there’s a plethora of centella asiatica personal care products out there.

Given Riman’s pricing, probably worth trialling a few products first before jumping into the MLM opportunity.

This brings us to Riman’s compensation plan. Although Riman is less than ten years old, its compensation plan feels like it was developed in the 1970s.

It’s overly complicated, there’s catches and gotchas baked into everything, and the general sense I got was as much as possible has been done to screw over lower ranked distributors. To the benefit of course of those at the top.

Instead of incentivizing where the majority of Riman’s distributors are likely to rank (the first few ranks), distributors are punished.

Retail commissions are bizarrely tiered based on rank instead of retail volume. Whether a distributor generates $100 or $1000s of monthly retail orders, they lose out unless they rank up.

This requires large amounts of GV. That’s not an issue if the majority of GV is retail volume, but again we’re backed to lower ranked Riman distributors being penalized.

Other rank criteria is equally as strange. This is from the qualification requirements for Manager;

Accrue 3,000 BP in your Personal Team in the most recent 3 months. Personal Team consists of you and the Planners you personally sponsor (1st level).

– All volume generated directly from your Customer Sales will count toward the position’s qualification.

*Up to 1,500 BP (50% of the qualification) is eligible for the position’s volume requirements generated by the Planners you sponsor in your 1st level.

Generate 3000 GV between you and your personally recruited Planner or higher ranked distributors… but only 50% is countable from personally recruited Planner or higher ranked distributors.

That leaves a Manager ranked distributor having to generate 1500 PV (retail sales plus their own purchases).

Don’t get me wrong, limiting recruitment volume is great but this is only the second Riman distributor rank.

Riman’s rank progression scaling is completely off and sets up the majority of Riman distributors to fail.

Elsewhere there’s genuine attempts to encourage retail sales.

Riman’s retail customers are also rewarded with “reward points” based on how much they purchase. Reward points can be put towards future product orders.

Riman also encourages retail sales by policing potential inventory loading.

If your monthly personal purchases exceed $1,000, you must provide proof of customer sales on 70% of purchases above $1,000.

If the requirement is not fulfilled by the end of the following month from the purchase date, you will not be allowed to make future purchases until the requirement is satisfied.

Assuming the policy is actually enforce, this stops Riman distributors from just inventory loading the required 1500 PV at Manager. But why is this a thing to begin with?

In putting together my Riman compensation analysis I had to continuously flip back and forth all over the place.

Things didn’t make sense and I lost count of how many times I had to go back and check some obscure restriction to make sense of something else that, for no particular reason, tied into a previously covered commission or bonus (breaking down rank requirements was a nightmare).

I feel that in order for Riman to be taken seriously outside of Korea, the company needs to scrap its current compensation plan. Get rid of all the restrictive penalties, catches and gotchas on every commission and bonus and just simplify things.

Paying out the full retail commission amount across all ranks would be another step in the right direction.

Also upgrade the Riman English website to bring it in line with FTC Act regulatory standards.

Riman’s executive, compensation plan and associated joining cost details are hidden from consumers. This is a major red flag in and of itself.

Without a serious compensation rework, regardless of what products Riman is marketing the MLM opportunity isn’t worth considering.