X365 Review: AI grift MLM crypto “staking” Ponzi

X365 fails to provide ownership or executive information on its website.

X365 fails to provide ownership or executive information on its website.

X365’s website domain (“x365.ai”), was first registered in 2023. The private registration was last updated on February 26th, 2025.

Additional domains associated with X365 include:

- x365.gg – privately registered on February 10th, 2025

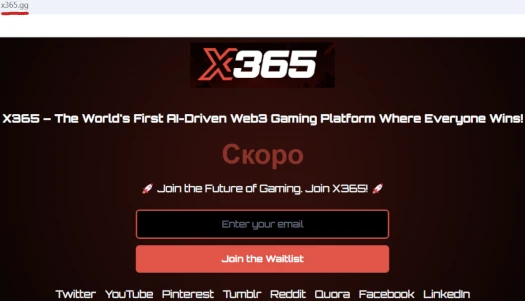

- fx365.pro – privately registered on February 11th, 2025

Over on X365’s official YouTube channel we find AI-generated marketing videos. This is typical of scammers hiding ownership of an MLM company.

Update 15th May 2025 – X365’s official FaceBook page is managed from India:

This strong suggests whoever is running X365 is based out of India. /end update

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

X365’s Products

X365 has no retailable products or services.

Affiliates are only able to market X365 affiliate membership itself.

X365’s Compensation Plan

X365 affiliates invest in the company’s X365 token. This is done on the promise of passive returns, derived through a staking investment scheme.

X365’s staking investment scheme sees affiliates invest in X365 token, park the tokens with the company and receive additional X365 tokens.

The rest of X365’s compensation plan doesn’t exist yet, so we’ll cover that in the conclusion of this review.

On the MLM side of things, X365 pays referral commissions down ten levels of recruitment (unilevel):

Structure: 10-level referral system with lifelong income.

Specific details are withheld from consumers. All we do know is there’s a 1% to 2% match on staking returns paid across the unilevel team (appears to be 10 levels).

Joining X365

X365 affiliate membership appears to be free.

Full participation in the attached income opportunity requires an undisclosed minimum investment into X365 token.

X365 Conclusion

X365 presents itself as your typical AI grift scam:

AI is at the heart of X365.ai’s platform. Their system uses federated learning with differential privacy, allowing AI models to improve without compromising user data.

As far as I can tell, X365’s only use of AI is to bot its website visits and social media profile engagement.

The gist of the X365’s presented business model is ramming AI into a bunch of revenue ruses that don’t exist yet.

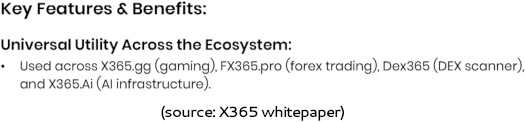

X365 Gaming is supposed to generate revenue through unregistered gambling. As of May 2025, here’s how X365 Gaming is going:

FX365 is supposed to be a typical passive returns forex bot investment scheme. As of May 2025, here’s how FX365 is going:

Dex365 is supposed to be some liquidity pool nonsense that magically generates revenue.

X365 coin holders can participate in liquidity pools and yield farming to earn additional rewards.

Providing liquidity to the ecosystem helps maintain stability and offers members extra passive income on top of staking rewards.

Breaking down the crypto bro jargon:

- “participating” and “providing liquidity” = investing

- “yield farming” = receiving passive returns in X365 token

Dex365 doesn’t have a website, it’s even more vaporware than X365 Gaming and FX365.

From its non-existent revenue ruses, X365 pitches consumers on revenue sharing:

50% of profits from all sub-projects distributed to staked holders via smart contracts.

There’s also a vague pitch for NFT shenanigans:

Multi-X returns (5-20x), with top Associates becoming “Sharks” earning bonuses (e.g., NFTs).

Presumably commissions on the non-existent side of X365 pay out via the same ten-level deep unilevel team.

With no verifiable source of revenue, all we have is X365 paying returns in X365 tokens.

It should be noted part of X365’s fraud is baloney about “quantum mining”. In reality X365 token is generated by the scammers running X365 pushing a button – nobody is mining anything.

The only actual money entering X365 is new investment from affiliates. Thus it follows that all X365 does is recycle new investment to pay X365 withdrawals (back into cryptocurrency that can actually be cashed out).

On the regulatory side X365 fails to provide evidence it has registered any of its passive returns investment schemes with financial regulators in any jurisdiction.

As with all MLM Ponzi schemes, once affiliate recruitment dries up so too will new investment.

This will starve X365 of ROI revenue, eventually prompting a collapse.

The math behind Ponzi schemes guarantees that when they collapse, the majority of participants lose money.

Update 15th May 2025 – X365’s official YouTube channel has been terminated.

This review originally linked to one of X365’s “baloney quantum mining” marketing videos. As a result of X365’s YouTube channel being terminated, I’ve disabled the previously accessible video link.

Russian or Russian-speaking scammers.

On the X365 Gaming screenshot, the word in red reads “Скоро” (Skoro) – Russian word meaning “coming soon”.

I was going to make a note of that, the website alternates “coming soon” in different languages.

Whoever is running X365 isn’t a native English speaker though. The language in the linked AI marketing video is atrocious.

Review updated to note X365’s official YouTube channel has been terminated. Also based on its official FaceBook page, X365 appears to be run by Indian scammers.