World Financial Group Review: Sprawling financial services

A few weeks back a reader wrote in requesting a review of WealthWave.

A few weeks back a reader wrote in requesting a review of WealthWave.

I went over to WealthWave’s website and was met with a faceless corporation. No readily identifiable products, management or even a business model… was this even an MLM company?

Stock photos, blech. And what the heck is a “HowMoneyWorks company”???

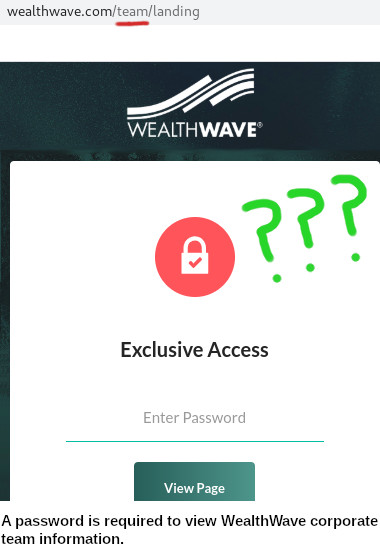

There is a “team” section of WealthWave’s website… but access is password protected (no, seriously).

I was about to write back to the reader to request clarification I had the right company, when I spotted this in the WealthWave website footer;

WealthWave is a financial services marketing company that is associated with World Financial Group, Inc.

I didn’t know it at the time, but I was about to deep-dive into the Wealth Financial Group rabbit hole.

The Company

I put in some good time trying to figure out why WealthWave and “How Money Works” exist. I honestly couldn’t tell you.

I’m not even sure How Money Works is a company, but both “brands” appear to be unnecessary marketing arms for Wealth Group Financial.

Just so we’re clear, there’s nothing wrong with establishing a marketing arm. Both WealthWave and How Money Works only offer vague marketing pitches.

Our slogan is ‘to disrupt the financial industry so families can dream again.’ We’re attracting leaders all across North America who are ready to position themselves to eradicate financial illiteracy and pursue the business and future of their dreams.

That’s nice… but what on Earth is your actual business?

World Financial Group launched in 2001 and is headquartered in the US state of Georgia.

Prior to 2001 World Financial Group operated as World Marketing Alliance (WMA).

WMA was founded in 1991 as Alexander Inc. by Hubert Humphrey, a former Primerica distributor.

On its website World Financial Group refers to itself as a “Transamerica company”.

Transamerica Corporation is a US ‘holding company for various life insurance companies and investment firms’.

Transamerica in turn is owned by Aegon, a “Dutch multinational life insurance, pensions and asset management company”.

Heading up World Financial Group is President and CEO Thomas Dempsey (aka Tom Dempsey).

Other than their names and titles, no information about Dempsey (or any of World Financial Group’s other executives) is provided.

Dempsey (right) joined Transamerica in 2008. He was appointed President and CEO of World Financial Group in 2018.

Dempsey (right) joined Transamerica in 2008. He was appointed President and CEO of World Financial Group in 2018.

As far as I can tell, World Financial Group is Dempsey’s first stint as an MLM executive.

On the regulatory front World Financial Group has had run-ins with FINRA, NASD, the SEC, Missouri’s Securities Commission, Utah state regulators and Arizona state regulators.

In Canada World Financial Group has had run-ins with the New Brunswick Securities Commission, the Manitoba Securities Commission and the Mutual Fund Dealers Association.

This is an particularly high number of regulatory incidents for an MLM company.

Prior to Aegon’s acquisition in 2001, WMA was

- fined $100,000 in 1998 after “clients lost nearly $2 million in unregistered investments”; and

- fined $125,000 in 2000 for “failing to report nearly 900 customer complaints”.

With respect to reviewing WeathWave, to keep thing simple I’m going to be reviewing World Financial Group.

Again, as far as I can tell WealthWave and How Money Works are simply marketing arms of World Financial Group – which itself is a marketing arm for Transamerica.

If you have a headache at this point I won’t hold it against you. As a reviewer World Financial Group certainly failed my own personal headache test.

Fair warning though, things only get more complicated from here.

Read on for a full review of World Financial Group’s MLM opportunity.

World Financial Group’s Products

World Financial Group markets “solutions”, including;

- financial strategies

- insurance protection

- retirement strategies

- college funding plans

- business strategies and

- estate preservation

In short a range of financial services. In addition to its parent company Transamerica, World Financial Group works with a number of US and Canadian third-party merchant services providers.

These providers are disclosed by logo on World Financial Group’s website.

Specifics are not disclosed, presumably due to the tailored nature of offered services.

I’m not holding this against World Financial Group, as this is a common issue when it comes to insurance niche MLM companies.

World Financial Group’s Compensation Plan

World Financial Group fails to provide a copy of its compensation plan on its website.

I did manage to track down a copy of an official compensation document from a third-party.

This document is dated 2015 but matches up with snippets provided on World Financial Group’s website (provided in lieu of actual compensation documentation).

Unfortunately the document is vague and missing large sections – namely in terms of explanations and company-specific terminology used.

Despite these obstacles, I’ve done my best to break down World Financial Group’s compensation plan below.

World Financial Group Affiliate Ranks

There are eight affiliate ranks within World Financial Group’s compensation plan.

Along with their respective qualification criteria, they are as follows:

- Associate – recruit three affiliates over a rolling thirty-day period and attend three field training appointments, or generate 20,000 PV over a rolling three-month period

- Marketing Director – maintain three personally recruited affiliates, have five life licensed affiliates in your downline and generate 40,000 GV, all over a rolling three-month period

- Senior Marketing Director – maintain three personally recruited affiliates (one Marketing Director), have ten licensed affiliates in your downline (at least six life licensed) and generate 75,000 GV, all over a rolling three month period, or generate 225,000 GV over a rolling twelve-month period

- Executive Marketing Director – recruit and maintain three Senior Marketing Directors and generate 500,000 GV over a rolling six-month period, or 750,000 GV over a rolling twelve-month period

- CEO Marketing Director – recruit and maintain six Senior Marketing Directors and generate 1,000,000 over a rolling six-month period, or generate 1,500,000 GV over a rolling twelve-month period

- Executive Vice Chairman – recruit and maintain nine Senior Marketing Directors and generate 1,500,000 GV over a rolling six month period, or 2,250,000 GV over a rolling twelve-month period

- Chairman’s Circle – not disclosed

- President’s Circle – not disclosed

PV stands for “Personal Volume” and is sales volume generated by the sale or purchase of World Financial Group’s products.

GV stands for “Group Volume” and is PV generated by an affiliate and their downline.

Note that for the purposes of qualification, up to 50% is counted from an affiliate’s own PV or any one of their downline legs.

Direct Commissions

World Financial Group affiliates earn commissions on their own product sales.

- Training Associates earn 25% to 30%

- Associates earn 35% to 45%

- Marketing Directors earn 50% to 62%

- Senior Marketing Directors earn 65% to 80%

The percentage range is due to some World Financial Group products paying a higher commission than others.

Other than mentioning “fixed: WRL” and a “100% table” with no context, World Financial Group’s compensation material does not go into specifics.

Residual Commissions

World Financial Group pays residual commissions via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

World Financial Group caps payable unilevel team levels at six.

Residual commissions are paid out as a percentage across these six levels as follows:

- level 1 – 10% to 17%

- level 2 – 5% to 8%

- level 3 – 3% to 5%

- level 4 – 3% to 5%

- level 4 – 2% to 3%

- level 5 – 1% to 2%

- level 6 – 0.5% to 1%

The percentage range is due to some World Financial Group products paying a higher commission than others.

Once again, other than mentioning “fixed: WRL” and a “100% table” with no context, World Financial Group’s compensation material does not go into specifics.

Business Supervision Commissions

Business Supervision commissions is the name World Financial Group gives to overrides.

That is commissions paid to the first ranked upline affiliates on downline sales.

There are three tiers to Business Supervision commissions:

- Branch Office Supervisors earn 1.25%

- Branch Office Managers earn 5.5%

- OSI Managers earn 1%

No information on these additional ranks is provided.

Bonus Pools

World Financial Group pays an additional 5.75% to 9% of generated company-wide sales volume across three bonus pools.

- 40% of generated volume is placed into a Base Shop Bonus Pool, paid to Senior Marketing Directors and higher (supposedly capped at “top 300 qualifiers” ???)

- 30% of level one unilevel team volume is placed into a Super Base Bonus Pool, paid to Executive Marketing Directors and higher

- 30% of generated levels one to six unilevel team volume is placed into a Super Team Bonus Pool, paid to Executive Marketing Directors and higher

In addition to rank qualification, the following additional qualification criteria must be met for each of the three pools:

- Base Shop Bonus Pool – generate 10,000 PV and maintain three personally recruited affiliates, or generate 15,000 PV with less than three personally recruited affiliates capped at three downlines, or 15,000 GV with less than three downlines

- Super Base Bonus Pool – generate 15,000 PV and 100,000 GV (only counted across level 1 of the unilevel team), note that this criteria is waived for Chairman’s Circle and President’s Circle ranks

- Super Team Bonus Pool – generate 100,000 GV across the first level of your unilevel team, and 500,000 GV across the first six levels

Note that all three pools also require “a minimum 60% Tracked Block of Business”

There’s no explanation for what a “Tracked Block of Business” actually is.

Joining World Financial Group

World Financial Group affiliate costs are not disclosed on their website.

I ran a search and found a number of sources claiming membership starts at $100.

Multiple licenses are mentioned in World Financial Group’s compensation material. The additional costs of licensing should also be taken into consideration.

Conclusion

My review of World Financial Group took a lot longer than it should of, because the company is pretty anti-consumer when it comes to disclosure.

And what makes this particularly infuriating, both as a reviewer and a consumer, is that I know how complicated the MLM financial services niche is.

Perhaps more than any other niche, you need to have as much information about a financial services MLM company to make an informed decision.

If you’re after any detailed information, good luck getting past World Financial Group’s “locate an agent” barrier.

This in fact is the beginning of a marketing funnel, and is testament to an outdated marketing strategy (more on that later).

With respect to compensation, World Financial Group requires recruitment just to earn break into the compensation plan (three recruits for Associate).

Is retail a focus? Not based on World Financial Group’s compensation plan or their website in general.

I did note there’s no retail volume or customer number requirements. Given you need 20,000 PV just to qualify at Associate, I imagine it’s difficult to qualify for commissions solely on your own policy spend.

That said if your three required recruits’ own policy spend volume adds up to 20,000 PV, that paves the way for chain-recruitment.

I can’t stress this enough, World Financial Group need to do a better job presenting their products and business model on their public-facing website.

With respect to offered policies, here I expect some push back due to the highly competitive nature of the financial services industry.

If you do decide to “locate an Agent”, compare what’s on offer with what you’ve got and go from there.

For those of you that go ahead with the business opportunity, if you’re handed a copy of “Six Steps to Building a WFG Business System Manual“, do yourself a favor and toss it.

Seriously. There’s no better point of reference for how outdated World Financial Group’s approach to marketing is.

The manual begins by instructing affiliates on building a prospect list of

people who you can call regarding the WFG business opportunity and the services you offer.

Compiled lists should include “people with whom you have a natural trust and pre-existing relationship” and be no less than 100 names long “to start” with.

If you’re having trouble reaching 100 names, you can try “expanding your warm market” by “friendship farming”.

You may think you are too busy to have more friends, but this is the lifeblood of your business.

Once you have established friendships with these new acquaintances, they will be more open to an invitation.

Start with the intent of making new friends, rather than the intent of inviting someone.

That last sentence makes no sense, considering the whole reason someone is friendship farming in the first place is to expand a list of prospects.

And imagine being the poor sap who thinks they’ve made a new friend, only to be hit with a hard “wAnNa JoIn My MlM?” sell.

There are four things to keep in mind, in this order, when casually visiting with someone you just met. This is known as FORM (Family, Occupation, Recreation and Message).

Find something in common with this person. Discover a reason to connect again later. Obtain a business card or contact information.

If they inquire about what you do, give a brief, truthful answer and quickly turn the conversation back to them.

Because y’know, people love realizing their friendship has been abused for potential financial gain.

And as a last resort if you can’t bring yourself to pillage new friends, raid friends of your existing friends (if you have any left at this point).

Another way to build your warm market is through Friendship Borrowing.

Borrowing the warm market of people who already know and trust you is known as Friendship Borrowing, or the process of getting quality referrals.

Even though you don’t know them, these people are considered your warm market because you are “borrowing” the trust they have in their friend who referred them.

If you manage to somehow not send everybody you know running off screaming, here’s where World Financial Group’s “we’re not providing you with any specifics” approach comes into play.

Don’t get into extensive questions and answers.

For you, as a new associate, it’s premature to offer extensive answers as you may not know all the information, instead let them hear it from WFG’s experienced leadership.

In fact World Financial Group refers to having enthusiasm, creating curiosity about the business and attempting to answer questions as a “scenario of disaster” (page 14).

Avoid the Scenario of Disaster. If you start answering too many questions, it takes the edge off the prospect’s curiosity.

Honestly if you can’t answer questions about the products and services you’re marketing, maybe marketing isn’t for you.

And if that’s by design on behalf of the company you’re working with, demand better.

I could go on and on about the disaster that is World Financial Group’s “system manual”…

Just because someone has been contacted and declines does not mean you should never contact them again about the opportunity.

It stands to reason that the more times you make contact, the more they’ll learn bout WFG, and the greater the likelihood he/she will say yes to your invitation.

…but I’m going to leave it there. I’ve covered up to page 17 of the manual, there’s another forty-one pages to go through (god help you).

Oh and in case your wondering, the words “retail” and/or “customer” don’t appear anywhere in the fifty-eight page manual.

And remember, this is officially how World Financial Group recommends affiliates build their business.

What initially struck me as odd is that neither Transamerica or Aegon appear to be small corporations. Throw in World Financial Group being around for almost two decades now, how is it their approach to marketing feels so outdated?

While the obvious answer is poor management, I’m going to hypothesize it might have something to do with Transamerica’s financial services background.

When I’m considering a financial service or product (bank account, credit card, loan etc.), who is running the financial institution isn’t part of my research.

I want to know policy details, what I’ll be up for and, if possible, experiences from other customers.

From that perspective I totally understand why World Financial Group is set up the way it is. I’m not saying it’s a desirable approach, just that I get it.

The problem is World Financial Group itself isn’t a financial services company – it’s first and foremost an MLM opportunity.

That needs a personal touch, which as I hope I’ve demonstrated by now, is non-existent.

From the moment you try to understand what World Financial Group offers as an MLM company, you’re funneled into a horrendously outdated marketing system.

If you make it through that, you’re then expected to then adopt said system and cannibalize your own friends and family, their friends and family… and so on and so forth, until presumably someone punches you in the face and brings you back down to Earth.

Pending a complete overhaul of how World Financial Group approaches its MLM opportunity, starting with its website, consumer disclosures and extending through to their recommended marketing practices, I’ll leave you with this…

If anyone befriends you and then hits you with a “system manual” World Financial Group opportunity invitation;

For your own sake, run.

We have met Humphreys’ before as Hegemon Group International (HGI) which you did review.

The Wikipedia page remark from TransAmerica corporate heavily suggests that not all was up and up at WFG before TransAmerica bought selected pieces of it and forbade Humphreys from competing for a number of years.

Thank you for doing a review of these guys! They are absolutely everywhere in my area, and I’ve been approached many times by “agents” who pretend to care about helping you and your family… until they find out you have no interest in joining their business – then they disappear.

They hate when I ask “so what makes your services better/different than the insurance/financial agents from other companies, you know, the ones who actually do this for a living and got a really good education to be successful in what they do.”

Yeah, they get really offended and can’t answer why – usually get the generic “oh, but we care about your family and their financial wellbeing”. Then if you bring up this is nothing but an MLM…. heads explode.

In order to be successful with this company, you have to build a team underneath you… sounds awfully familiar.

I have NEVER met anyone in this company who has become successful in just selling insurance policies and/or financial packages, they all have built “organizations” in order to make money. Yeah, no thanks….

Recently my friend was job hunting. He had a few interviews with a charismatic owner of an insurance company. This guy spent a lot of time on the phone with my friend.

Very generous of the owner of a company, plus he must be really impressed with my friend’s resume. (He does actually have an impressive resume)

I smelled a rat with some of the language sounding familiar, and I started googling. One name led to another, and I eventually got to WFG buried deep in the name chain.

The “owner” was nothing more than a WFG MLM recruiter pretty high up with stage performances and all.

The “owner” had previously asked, during the “interviews“, for some personal information to run a “background check”. “Background check” were his words. This, before I alerted my friend it was MLM, and before he informed the “big shot owner” he wasn’t interested. There’s more…

Two days after declining the “opportunity”, my friend got an email welcoming him as a new WFG affiliate. That “owner” NEVER mentioned WFG to my friend. I did.

The forms were also docu-signed fraudulently. My friend did not pay the $100, and he never signed or agreed to joining anything.

Something fishy going on regarding upline recruiting numbers – not to mention the signing of names fraudulently without consent.

@Char

Sounds like they might be overdue for an FTC investigation if that’s widespread.

We had looked at this at RealScam a while back. I don’t know that any concerns or conclusions have changed for agents or consumers.

realscam.com/f9/world-finance-group-transamerica-also-calls-itself-revolution-financial-management-3698/?highlight=WORLD+FINANCIAL+GROUP

Very well written reply and investigation.

Thank you for the painstaking time in writing this ‘review’. I give you a 5 out 10. The people adhering to your recommendations on ‘running’ are your responsibility.

Ask people, what circumstances would inspire thousands of people join this firm? If you are open minded, you may learn that this company provides a solutions to those circumstances.

The successful in this firm tend to be well educated career professionals. Doctors, Scientists, Engineers, Attorneys, other business owners, as well as those that have deep support from their peer associations.

I’m a senior broker in this firm. My wife and I quit our jobs 7 years ago, we are able to achieve time and financial freedom. We support our parents as well our children.

You write articles that look credible. But. After reading the misinformation. I learned that you are the real scammer in disguise as a hero to the average person. I don’t believe you’ll have the guts to post this response.

People like you don’t belong in the business world like many that are recruited into our business. To find that gem, you have to dig through dirt.

As crude as this may sound. No business can be successful on the backs of people who don’t work and don’t add value. If you don’t contribute. You don’t matter.

Outside of cults people do as they please.

You didn’t address anything in the review except the last sentence, instead you went after the author. How… telling.

From my own research, constant regulatory run-ins and based on the experience of others, some pretty deceptive marketing practices.

Cool. So how many retail customers do you have on active policies vs. recruited affiliates?

Yeah in case it wasn’t abundantly clear, I’m not trying to get into World Financial Group. And if this is some reverse-psych bullshit from your “system manual”, that garbage won’t work here either.

You sound like a well-balanced individual who has really thought out their priorities in life. Have a nice day.

Senior Marketing Director,

I found your painstaking reply to the review of World Financial Group a 1 out of 10, and I am being generous with my rating. Rather pathetic attempt to discredit the review and the author.

You had a golden moment to debunk the review with facts. Facts that would prove the review was inaccurate, but instead you did the typical personal hit piece. This is SOP for those that don’t have the “facts” on their side.

For if you were truly “proud” to be a part of World Financial Group, you would have posted under your real name, not a moniker. It is one thing to “claim” you are a senior marketing director, but another to “prove” it, which you didn’t do.

But here’s your chance to redeem yourself. Do come back and post real facts disproving the review since you claim it is all false. You do have the facts to do so don’t you?

Somehow I don’t think we will see you gracing us with your presence anytime soon. But thanks for the entertainment value of your post. I needed a good laugh so thank you.

7 years and only Senior Marketing Director. You’d think he would have made Executive Vice Chairman at least.

If first argument out of your mouth is an ad hominem, you’ve already lost, as you consider that your best shot, and it’s a red herring.

You don’t have any facts or logic to argue with. Tsk, tsk.

Job title inflation has been going on for donkeys’ years but the concept of a business where everyone above entry level is a director is pretty hilarious.

In the UK, every single “director” would have to be registered on Companies House; corporate law states that every director of a company must be registered. There’s no concept of “director in name only” in law.

This dovetails with Char’s experience of a friend being wooed by an “owner” who was in fact no such thing.

People that highlight an overly complex business model with overly complex fee ridden products aren’t digging through the dirt?

No business save perhaps MLM where customers are led to believe they are business owners. That’s what the 100 names prospect list is all about. Don’t have to be Kreskin to know who the first name on that list is with any MLM.

So you are in the Trumpian school of argument… You call everything you don’t agree with “fake news” then start to sling mud.

At least SOME Trumpians offer some “alternative facts”. You can’t even do that.

The 341 complaints on the BBB site is a fascinating read. This entry sound familiar?

bbb.org/us/ga/johns-creek/profile/business-opportunities/world-financial-group-inc-0443-13003100/complaints

And WFGers probably thought they were punished for being “helpful”!

But then, MLM is never known to respect boundaries, eh? It’s too bad they, being totally tone-deaf and in their own reality-bubble, will fail to see impersonating someone’s signature, even digital, is fraud.

One of the “financial professionals” at wealthwave also happened to claim victimhood in a cloud mining mlm that recently exit scammed.

What is a “financial professional” doing investing in an unregistered investment company?

Withdrawing ponzi payments from downline deposits and then pretending to be a victim is a dirty way to pay the mortgage…..

I call bullshit that any successful professional is quitting their career to join WFG and sell sketchy overpriced financial services. I will give you this, though, “…deep support from their peer associations” has a nice ring to it. I assume you mean “warm market”? In other words, make guilt-sales to people you know?

What is it, senior broker, or senior marketing director? They are hardly the same job title. And you did not quit your job, you changed jobs. Big deal; people do that all the time.

If you have financial freedom, why are you still working as a senior broker marketing director whateveryouare?

They’ve recently started flooding Lunchclub (a networking website) which has previously been pretty free and clear of them.

They have no financial education and claim to guarantee $0 tax financial guidance. No legitimate tax professional will ever guarantee any strategy that has a $0 tax due at the end. They just won’t.

Here are some of the WealthWave names you might want to be aware of: Denaye Austad, Cameron Berry, Kenneth Westervelt. They also use gmails instead of an actual domain address.

I hate to badmouth anyone who relies on gmail but for these folks to claim to be well off financially and not be able to get even a simple domain email address is very shady.

Thank you for this review and for the ppl who commented. I too know a MLM when I hear one. Your review confirmed it.

I did some digging to find this read…. Glad I did!

Via email (unconfirmed):