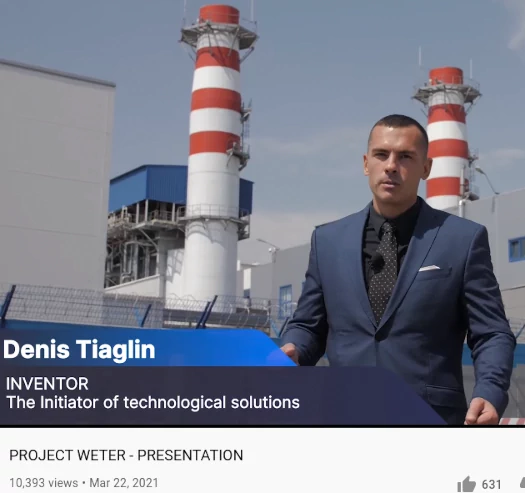

WETER Review: Dennis Tiaglin’s fraudulent investment scheme

WETER is an MLM investment scheme run by Dennis Tiaglin.

WETER is an MLM investment scheme run by Dennis Tiaglin.

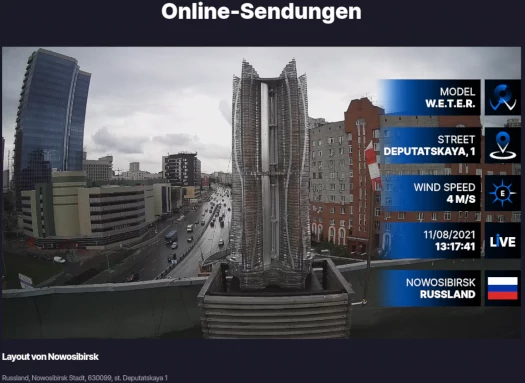

Tiaglin appears to be a Russian national operating out of Novosibirsk.

Based on marketing videos uploaded to its official YouTube channel, WETER also appears to have ties to Dubai:

Any MLM company with ties to Dubai is an automatic red flag. Due to lack of regulation and extradition agreements, Dubai is a safe-haven for scammers.

As far as I can tell, WETER is Tiaglin’s first MLM venture.

Read on for a full review of WETER’s MLM opportunity.

WETER’s Products

WETER has no retailable products or services.

WETER affiliates are only able to market WETER affiliate membership itself.

WETER’s Compensation Plan

WETER affiliates invest in bundles of virtual shares:

- invest $100 and receive 54,278 shares priced at $0.00189 per share

- invest $210 and receive $108,556 shares prices at $0.00189 per share plus 3257 bonus shares

- invest $410 and receive 427,152 shares priced at $0.00096 per share plus 12,815 bonus shares

- invest $1370 and receive 1,798,426 shares priced at $0.00076 per share plus 53,953 bonus shares

- invest $2740 and receive 3,632,380 shares priced at $0.00075 per share plus 108,971 bonus shares

WETER virtual shares are invested in the representation Denis Tiaglin will generate shareholders a passive ROI.

The MLM side of WETER pays on the recruitment of new affiliate investors.

Referral Commissions

WETER pays referral commissions via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

WETER pays residual commissions as a percentage of funds invested across the unilevel team as follows:

- level 1 (personally recruited affiliates) – 10%

- level 2 – 5%

- level 3 – 2%

- levels 4 and deeper – 23% (not a typo)

Joining WETER

WETER affiliate membership appears to be free.

In order to full participate in the attached income opportunity, an initial $100 to $2740 investment in WETER virtual shares is required.

Note that although USD is quoted in WETER’s compensation material, the company only solicits investment in Russian rubles.

WETER Conclusion

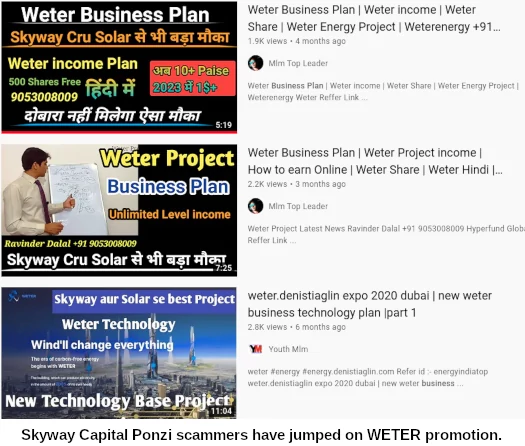

When I began researching WETER, I was struck by similarities to the long-running Skyway Capital Ponzi scheme.

Ties to Russia, “new technology” being used to solicit investment, same color scheme, artistic renderings – I thought I was looking at Skyway Capital’s next chapter.

Not surprisingly, Skyway Capital scammers are out there cross-promoting WETER:

WETER’s ruse is wind turbines in buildings that supposedly generate double the power a building needs:

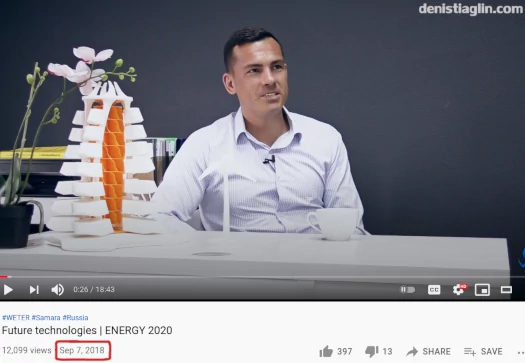

The thing is, Denis Tiaglin has been promoting this concept for at least three years already.

The end-result?

A model prototype on Tiaglin’s website:

The camera angle makes it look like a scale building. If take a closer look though you’ll notice its actually just a tiny model sitting on the rooftop of another building.

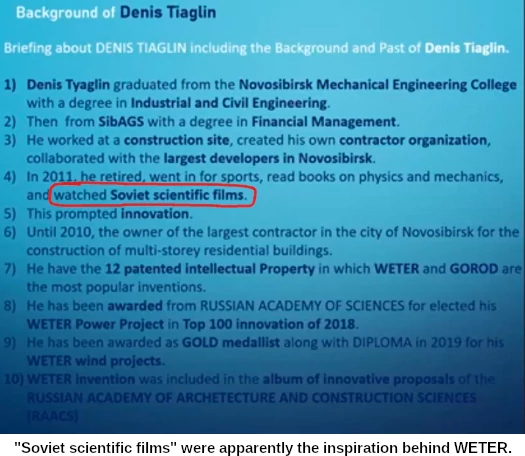

One reason Tiaglin hasn’t been able to get WETER off the ground might be because apparently he came up with the idea after watching some movies.

I’m not going to get into the technicalities of Tiaglin’s design because, for the purpose of evaluating WETER, it doesn’t matter.

Through WETER, Tiaglin is soliciting investment in virtual shares.

This is a clear securities offering and neither Tiaglin or WETER are registered to offer securities in any jurisdiction.

Namely Russia, Vietnam and Nepal, who Alexa currently ranks as the top three sources of traffic to Tiaglin’s WETER website. India gets a special mention too, as most of the recent WETER marketing appears to be targeting Indians.

Regardless of the merits of Tiaglin’s design, WETER is engaged in securities fraud. This is not only illegal but also raises the question of, if Tiaglin’s power generation design was viable, why would he resort to fraud to market it?

Tiaglin refers to WETER as “corporate crowdinvesting”. This doesn’t change what it is; an unregistered securities scheme.

Whether Tiaglin goes the Ponzi route when the time comes to pay investors it’s too early to tell. Certainly WETER currently has no source of revenue other than new investment.

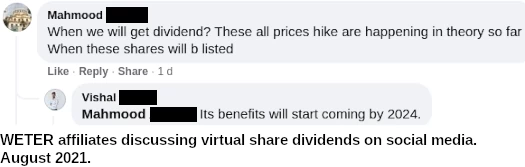

The bad news for WETER affiliate investors is that there won’t be any returns for a few years.

WETER affiliates on social media are touting a 2024 ROI commencement date.

The cynic in me puts for the following: Tiaglin came up with his power generation design and tried to shop it around to credible investors.

Nobody was interested and so he’s milking the marketing for as much as he can through virtual shares.

Come 2024, 2025, 2026 or whenever, WETER recruitment will have long dried up and the plan is to hope everyone forgets.

As we’ve seen with Finiko, people who fall for fraudulent Russian investment schemes have no recourse when they collapse.

WETER won’t play out any different.

Just a few obvious thoughts:

1. Build a few of these things together and RIP the ones not on the outside getting any wind. Or a developer comes along and builds high-rise nextdoor.

2. There’s a reason they don’t build wind farms in the middle of cities.

3. RIP birds and other flying animals/creatures.

Offhand, I’d say the chance of birds getting chewed up by those turbines is about on par with their chances of getting squished by a runaway Sky Way String Transport Car. Since both are entirely fanciful scams, there is no avian peril from them.

They can’t even keep their own fantasies straight. They create conceptual renderings that are completely at odds with their video’s narration.

The latter mentions (in heavily accented English) heights of “up to 160 meters” while the former shows fancifully stratospheric creations (see the 3rd mini-slide under the “WETER Conclusion” section, above).

Who needs rockets when you can take an elevator in one of those super-towers straight up to low-Earth orbit?

As Oz says in point #2 of the above comment, there’s a reason wind farms are out on open plains or hillsides and not in the middle of cities. City structures play havoc with wind patterns, lowering wind energy and raising the cost per watt several-fold.

Wind turbines involve gigantic pieces of equipment; not the sort of thing that can be easily trucked down Fifth Avenue. The whole idea is inane.

Without technology patent be given in nations.applied Patentvin 75nationsis true .s true.

Example.skyscapper buildings sell also o virtual Selling of space of 100th floor on starting foundation.

But weter is patentee Technology. Only after 1st pilot project at Dubai completed. Weter sell licences of his technology.

The technology is bullshit. You invested in a Ponzi scheme.

Sorry for your loss.

This Project is Scam! I have investing all money and they are not giving it back already for 9 mounts.

Denis Tiaglin paying for Pr from investors money and Living in Dubai. He don’t have any education and so many criminal cases in Russia he spend a lot for his promo.