Vault27 Review: “Soft KYC” staking MLM crypto Ponzi

Vault27 fails to provide ownership or executive information on its website.

Vault27 fails to provide ownership or executive information on its website.

Vault27’s website domain (“vault27.net”), was registered in February 2023. The private registration was last updated on January 5th, 2025.

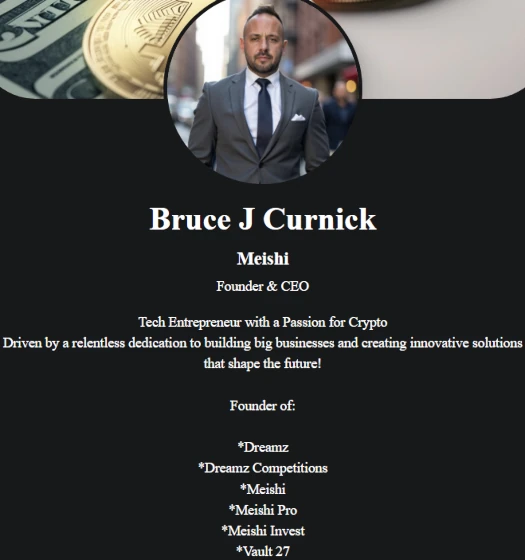

Further research reveals Bruce John Curnick citing himself as Vault27’s founder and CEO:

Curnick claims to be a South African living in the UK.

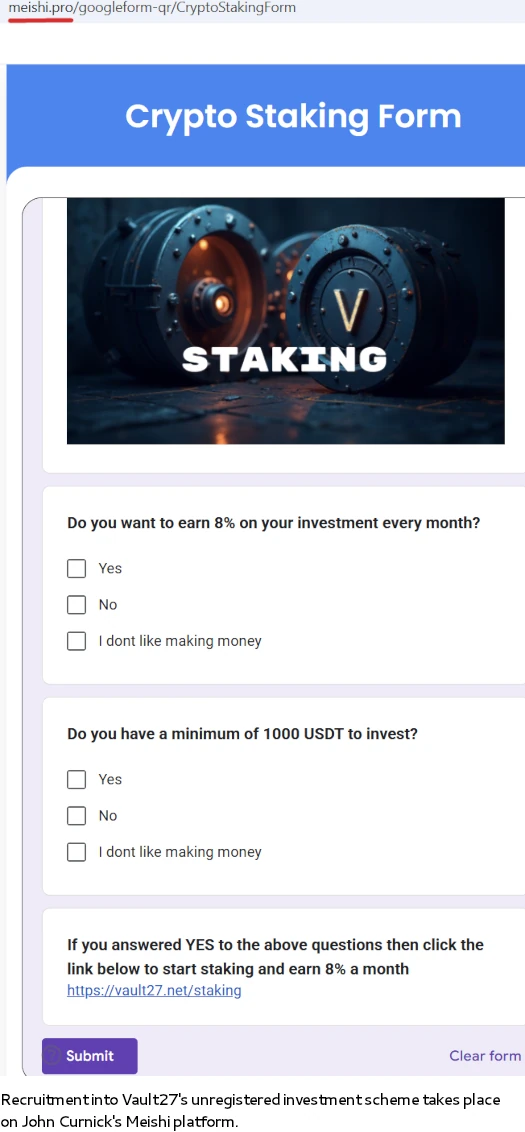

In addition to Vault27, Curnick is behind Dreamz and Meishi.

Dreamz appears to be an MLM opportunity attached to Meishi, a paid LinkedIn style directory.

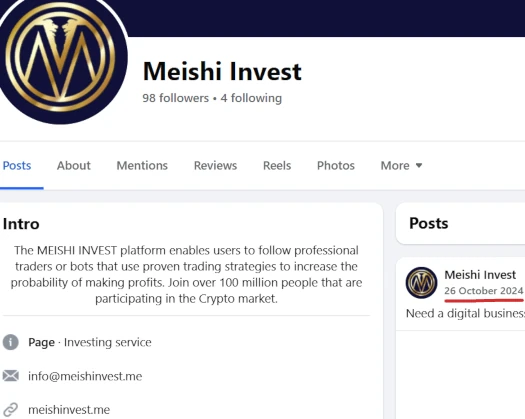

Part of Meishi was Meishi Invest:

Meishi Invest was an unregistered crypto investment scheme that was abandoned in late 2024.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

Vault27’s Products

Vault27 has no retailable products or services.

Promoters are only able to market Vault27 promoter membership itself.

Vault27’s Compensation Plan

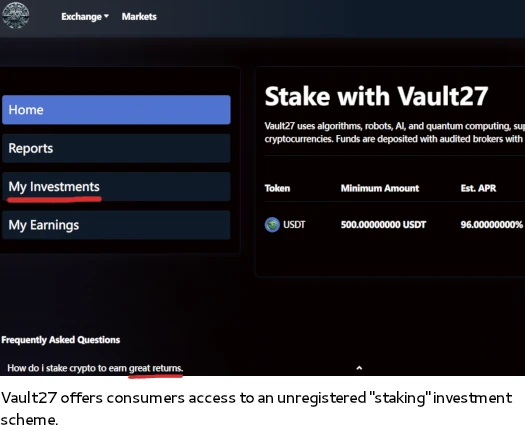

Vault27 promoters invest 500 to 1,000,000 tether (USDT). This is done on the promise of a passive 8% monthly return.

The MLM side of Vault27 pays on recruitment of promoter investors.

Referral Commissions

Vault27 pays referral commissions on invested USDT down three levels of recruitment (unilevel):

- level 1 (personally recruited promoters) – 1.2%

- level 2 – 1%

- level 3 – 0.8%

Trade Commissions

If Vault27 promoters trade on the company’s internal cryptocurrency trading platform, the following commissions are paid on fees:

- level 1 – 1.2%

- level 2 – 1%

- level 3 – 0.8%

Joining Vault27

Vault27 promoter membership is free.

Full participation in the attached income opportunity requires a minimum 500 USDT investment.

Vault27 Conclusion

Vault27 is an unregistered MLM crypto investment scheme utilizing the staking model:

Vault27 represents it generates external revenue via a number of ruses:

Vault27 fails to provide verifiable evidence it generates external revenue of any kind.

Such evidence would be audited financial reports filed with regulators. This is a legal requirement, without which Vault27 is committing securities fraud.

Vault27 fails to provide evidence it has registered its passive returns investment scheme with financial regulators in any jurisdiction. In the UK, where John Curnick claims he is based, this would be the Financial Conduct Authority.

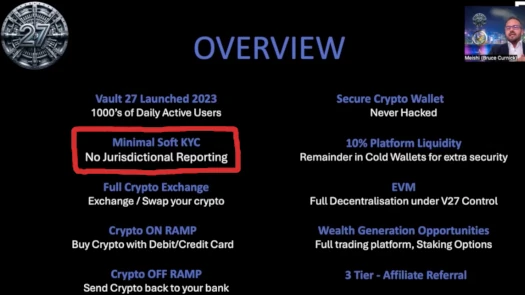

Instead of registering with financial regulators, one of Vault27’s selling points is “minimal soft KYC” with “no jurisdictional reporting”:

In addition to outright violating financial laws in multiple jurisdictions, Vault27’s “soft KYC” facilitates money laundering, tax fraud and general financial fraud.

As it stands, the only verifiable source of revenue entering Vault27 is new investment.

Using new investment to pay ROI withdrawals would make Vault27 a Ponzi scheme.

As with all MLM Ponzi schemes, once promoter recruitment dries up so too will new investment.

This will starve Vault27 of ROI revenue, eventually prompting a collapse.

Math guarantees that when a Ponzi scheme collapses, the majority of participants lose money.

Looking at Bruce Curnick’s Instagram, he was a car salesman in South Africa.