UpCapital Review: Boris CEO MLM crypto Ponzi

![]() UpCapital fails to provide ownership or executive information on its websites.

UpCapital fails to provide ownership or executive information on its websites.

UpCapital operates from two known website domains:

- upcapital.tech – privately registered on April 9th, 2025

- upcapital.ai – registered in August 2024, private registration last updated on April 2nd, 2025

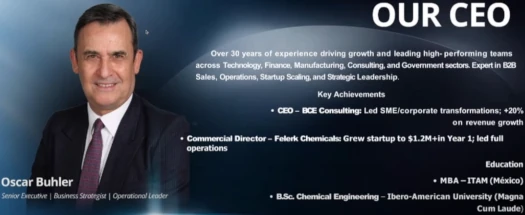

Further research reveals offsite UpCapital marketing material citing “Oscar Buhler” as UpCapital’s CEO:

Buhler doesn’t exist outside of UpCapital’s own marketing, making him a primary Boris CEO candidate.

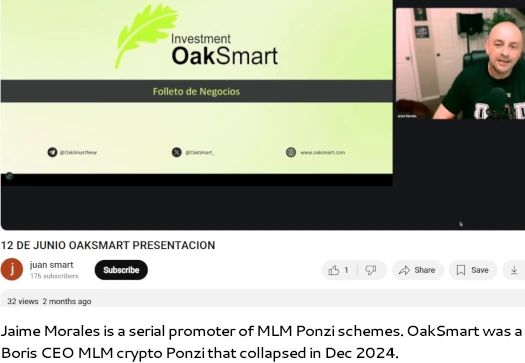

Starting around three months ago, marketing videos featuring Jaime Morales were uploaded to the YouTube channel “Juan Smart”:

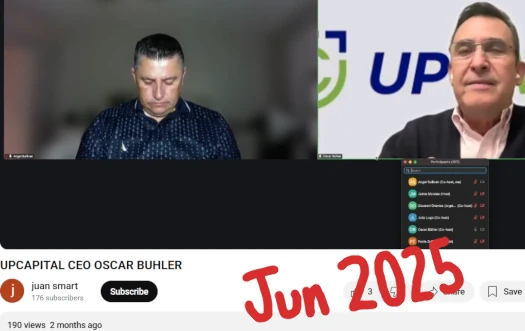

On June 20th a video was uploaded featuring UpCapital’s Oscar Buhler.

Buhler, or the actor playing Buhler, speaks in Spanish. This ties into SimilarWeb tracking 100% of UpCapital’s website traffic from Chile as of August 2025.

While Boris CEO schemes are typically run by eastern European scammers, it’s likely whoever is running UpCapital has ties to Chile and/or other Spanish speaking countries across Central and South America.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

UpCapital’s Products

UpCapital has no retailable products or services.

Promoters are only able to market UpCapital promoter membership itself.

UpCapital’s Compensation Plan

UpCapital promoters invest USD equivalents in tether (USDT). There are nine UpCapital investment tiers, ranging from $100 to $10,000.

UpCapital pays Monday through Friday at a rate of 0.5% to 1% daily.

Note UpCapital caps returns at 300%, which includes MLM commissions. After 300% is reached, reinvestment is required to continue earning.

UpCapital charges a 5% fee on all withdrawals.

The MLM side of UpCapital pays on recruitment of promoter investors.

UpCapital Promoter Ranks

There are seven promoter ranks within UpCapital’s compensation plan.

Along with their respective qualification criteria, they are as follows:

- Rank 1 – generate $5000 in weaker binary team side downline investment volume

- Rank 2 – generate $10,000 in weaker binary team side downline investment volume

- Rank 3 – generate $20,000 in weaker binary team side downline investment volume

- Rank 4 – generate $40,000 in weaker binary team side downline investment volume

- Rank 5 – generate $60,000 in weaker binary team side downline investment volume

- Rank 6 – generate $80,000 in weaker binary team side downline investment volume

- Rank 7 – generate $100,000 in weaker binary team side downline investment volume

A binary compensation structure places a promoter at the top of a binary team, split into two sides (left and right):

The first level of the binary team houses two positions. The second level of the binary team is generated by splitting these first two positions into another two positions each (4 positions).

Subsequent levels of the binary team are generated as required, with each new level housing twice as many positions as the previous level.

Positions in the binary team are filled via direct and indirect recruitment of promoters. Note there is no limit to how deep a binary team can grow.

“Weaker binary team side volume” refers to investment volume generated on the binary side with less volume. Note which side of the binary team is calculated to be “weaker” can change from day to day.

Referral Commissions

UpCapital pays a 12% referral commission on USDT invested by personally recruited promoters.

ROI Match

UpCapital pays a ROI match via a unilevel compensation structure.

A unilevel compensation structure places a promoter at the top of a unilevel team, with every personally recruited promoter placed directly under them (level 1):

If any level 1 promoters recruit new promoters, they are placed on level 2 of the original promoter’s unilevel team.

If any level 2 promoters recruit new promoters, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

UpCapital caps the ROI Match at seven unilevel team levels.

The ROI Match is paid out daily as a percentage of returns paid out across these seven levels, based on how much an UpCapital promoter invests:

- invest $100 to $500 and receive a 7% ROI match on level 1 (personally recruited promoters)

- invest $1000 and receive a 7% ROI match on level 1 and 4% on level 2

- invest $2000 and receive a 7% ROI match on level 1, 4% on level 2 and 3% on level 3

- invest $3000 and receive a 7% ROI match on level 1, 4% on level 2, 3% on level 3 and 2% on level 4

- invest $5000 and receive a 7% ROI match on level 1, 4% on level 2, 3% on level 3, 2% on level 4 and 1.5% on level 5

- invest $7000 and receive a 7% ROI match on level 1, 4% on level 2, 3% on level 3, 2% on level 4, 1.5% on level 5 and 1% on level 6

- invest $10,000 and receive a 7% ROI match on level 1, 4% on level 2, 3% on level 3, 2% on level 4, 1.5% on level 5, 1% on level 6 and 1.5% on level 7

Rank Achievement Bonus

UpCapital rewards promoters for qualifying at Rank 1 and higher with the following one-time Rank Achievement Bonuses:

- qualify at Rank 1 and receive $500

- qualify at Rank 2 and receive $1000

- qualify at Rank 3 and receive $2000

- qualify at Rank 4 and receive $4000

- qualify at Rank 5 and receive $6000

- qualify at Rank 6 and receive $8000

- qualify at Rank 7 and receive $10,000

Joining UpCapital

UpCapital promoter membership is free.

Full participation in the attached income opportunity requires a minimum 100 USDT investment.

UpCapital Conclusion

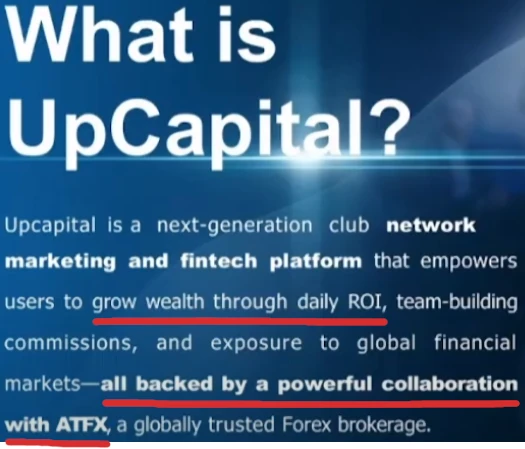

UpCapital represents it generates external revenue via forex trading:

UpCapital fails to provide verifiable evidence it generates external revenue of any kind.

Instead, UpCapital represents legitimacy via a purported business partnership with ATFX:

ATFX represents itself to be a “global leader in online trading”. ATFX represents it has registered with regulators in several countries on its website. Chile is not one of these countries.

Furthermore what licenses ATFX has or doesn’t have is irrelevant to UpCapital. UpCapital offers consumers a passive returns MLM opportunity. This constitutes a securities offering.

UpCapital’s securities offering requires it to register with financial regulators in every jurisdiction it solicits investment in. UpCapital fails to provide evidence it has registered with Chile’s Financial Market Commission, or indeed financial regulators in any jurisdiction.

This means that, at a minimum, UpCapital is committing securities fraud. Such to the extent UpCapital is using ATFX to defraud consumers, this could put ATFX’s own regulatory registrations at risk.

As it stands, the only verifiable source of revenue entering UpCapital is new investment. Using new investment to pay ROI withdrawals would make UpCapital a Ponzi scheme.

As with all MLM Ponzi schemes, once promoter recruitment dries up so too will new investment.

This will starve UpCapital of ROI revenue, eventually prompting a collapse.

Math guarantees that when a Ponzi scheme inevitably collapses, the majority of participants lose money.