TGI AG Review: Gold ruse investment fraud

TGI AG, aka Trust Gold International, operates in the gold investment MLM niche.

TGI AG, aka Trust Gold International, operates in the gold investment MLM niche.

The company provides a corporate address in Lichtenstein on its website, however TGI AG doesn’t appear to have any actual ties to Lichtenstein.

Heading up TGI AG we have founder Helmut Kaltenegger.

Other names attached to TGI AG are Michael Ewy (Managing Director) and Katarina Kaltenegger (majority shareholder and Helmut’s wife).

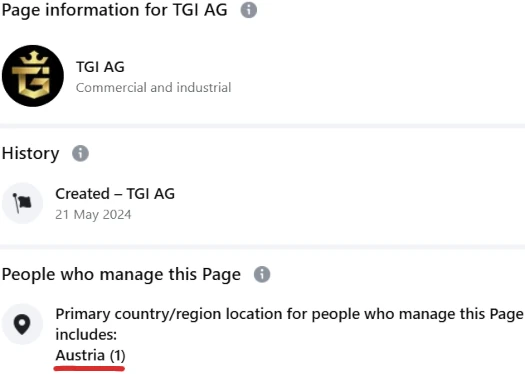

Helmut Kaltenegger appears to be an Austrian national, and it is from Austria that TGI AG is actually run from.

We can further confirm this by examining TGI AG’s official FaceBook page:

TGI AG operates from three known website domains:

- tgi.gold – privately registered on February 24, 2024

- tgi.li – first registered on October 29th, 2020, private registration last updated on an unknown date

- tgi-academy.gold – privately registered on March 13th, 2024

From these registration dates we can surmise TGI AG launched in early 2024.

Prior to TGI AG, Helmut Kaltenegger was running GGMT.

GGMT launched as GGMTrading in 2018 and appears to have collapsed around February 2024. This means TGI AG was launched shortly after GGMT collapsed.

Read on for a full review of TGI AG’s MLM opportunity.

TGI AG’s Products

With respect to its MLM opportunity, TGI AG has no retailable products or services.

TGI AG’s MLM opportunity is funded by fees charged to affiliate investors.

TGI AG’s Compensation Plan

TGI AG affiliates invest funds on the promise of a 2% to 4% monthly passive return, paid out for 36 months.

At the end of the 36-month investment period,

2% is the default ROI rate. It includes a 36% bonus at the end of the 36-month investment period.

4% is paid if a TGI AG affiliate pays a 33.33% fee of the investment amount. A 200% bonus on the 33.3% fee is paid at the end of the 36-month investment period.

Note that with the 4% a month investment plan, it can be cancelled at any month but the TGI AG affiliate loses the 200% bonus.

Also note that a third of the 4% a month payout must be reinvested back into TGI AG. This effectively generates a new 4% a month investment plan.

Although not explicitly clarified, I believe TGI AG takes its 33.33% fee cut out of withheld ROI payments when creating the new 4% a month plans each month.

33.33% fees paid on the 4% a month investment plan are used to fund TGI AG’s compensation plan.

TGI AG pays commissions on 33.33% fees charged via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

TGI AG caps payable unilevel team levels at ten.

Referral commissions are paid as a percentage of 33.33% fees paid across these ten levels as follows:

- level 1 (personally recruited affiliates) – 50%

- levels 2 to 10 – 2%

Joining TGI AG

TGI AG affiliate membership is free.

Full participation in the attached income opportunity requires an undisclosed minimum investment. Whatever the amount invested, a 33.33% additional fee on invested funds is payable.

TGI AG Conclusion

Some things to note right off the bat with TGI AG is that, firstly, it is absolutely a reboot of Helmut Kaltenegger’s collapsed GGMT gold investment scheme.

In a since deleted August 2024 article published by Anwalte, GGMT’s familiar sounding business model is explained;

The Kalteneggers promised customers enormous discounts on the international gold price if they were willing to wait up to three years for delivery.

Promised discounts: The discounts were to be financed with gold from a mine in South America (Aulicio Mining Inc.), which was to be mined with customers’ money.

Anwalte reported GGMT defrauded “approximately 21,000 customers of a total of €34.6 million.”

It appears Austrian regulators are asleep at the wheel with respect to GGMT. A May 2024 article from Kleine Zeitung suggests a GGMT victim filed a lawsuit, however comments from Kaltenegger suggests he settled and possibly paid the victim off.

The story revolves around an upcoming fraud trial in Vienna following charges against one of his former companies, “GGMT Trading.” Kaltenegger is outraged by the story – and is fighting back.

There is no longer any injured party, no longer any plaintiff.

Despite TGI AG very obviously being a reboot rebranding of GGMT, Kaltenegger insists it isn’t.

The company GGMT Trading has nothing to do with the current company; they are two completely different concepts.

In offering passive 2% to 4% returns each month, TGI AG’s investment scheme constitutes a securities offering.

In Austria securities are regulated by the Financial Markets Authority (FMA). TGI AG fails to provide evidence it has registered its passive returns gold investment scheme with the FMA.

This constitutes securities fraud. Notwithstanding TGI AG is also not registered to offer securities in jurisdictions outside of Austria.

With nothing marketed or sold to retail customers, TGI AG’s MLM opportunity is also a pyramid scheme.

TGI AG maintains it buys and/or trades gold through Gold Crest Refinery, an Indian owned outfit purportedly operating out of Ghana.

The only way to verify this is through audited financial reports filed with the FMA and other financial regulators, which TGI AG has failed to do dating back to GGMT launching in 2022.

As it stands the only verifiable source of revenue entering TGI AG is new investment.

Using new investment to pay ROI withdrawals would make TGI AG a Ponzi scheme.

As with all MLM Ponzi schemes, once affiliate recruitment dries up so too will new investment.

This will starve TGI AG of ROI revenue, eventually prompting a collapse.

36 months is a long time. From the previously cited Anwalte article;

Many [GGMT] customers have been waiting in vain for their gold deliveries for years.

GGMT’s ultimate collapse proved Helmut Kaltenegger’s gold ruse was a sham. TGI AG is more of the same.

Whenever a Ponzi scheme inevitably collapses, the majority of participants lose money.

Helmut Kaltenegger is definitely an Austrian citizen. He was a director of SILVER ACE LIMITED in London, a company that was dissolved in June 2022. At the time, he gave his address in Vienna.

postimg.cc/TpcZbrZw

find-and-update.company-information.service.gov.uk/officers/FZzskQxD-lhGCjlnDXA86GD4imo/appointments

find-and-update.company-information.service.gov.uk/company/12595519

The Instagram account tgi.ag with 266 posts and 2,293 followers also mentions Austria as a location. The username of this account has already been changed once.

postimg.cc/xX4pGgg0

Is Helmut Kaltenegger mentally confused or is he trying to deceive his customers? On the home page of tgi.ag on Instagram, he mentions an address in Vaduz (Liechtenstein).

postimg.cc/5Y7DG1SC

instagram.com/tgi.ag/

I will now also buy gold. Helmut Kaltenegger has convinced me! When the gold is delivered after three years, I’ll be 79 years old and can use it to gild my coffin. 😀

postimg.cc/v12k3PS0

instagram.com/p/DJ9p_zdvw2Y/?img_index=1

postimg.cc/dDVmqs3Z

instagram.com/p/DLacv8gvNQ9/

Helmut Kaltenegger started his (fictitious?) gold trading on the ggmt.at website. GGMT was the abbreviation for Green-Gold-Mine-Trading.

postimg.cc/627q97JL

GGMTrading GmbH, based in Vienna (Austria), was founded in October 2018. The first Managing Director was Katarina Kollarova (now Katarina Kaltenegger). Helmut Kaltenegger became Managing Director of this company in February 2021.

The following screenshot shows that two other companies owned by Helmut Kaltenegger no longer exist. These two companies filed for bankruptcy in April 2014 and September 2018. A company goes bankrupt – the next month a new company is simply founded!

postimg.cc/14zDWNsW

northdata.de/GGMTrading%20GmbH,%20Wien/499770g

The domain ggmt.at was registered by Katarina Kollarova (now Katarina Kaltenegger) in Vienna on August 6, 2018.

postimg.cc/HrCPftS0

The ggmt.at website was first saved in the WebArchive on February 11, 2019 with this imprint.

postimg.cc/Czc34cf5

web.archive.org/web/20190211012132/https://www.ggmt.at/

The ggmt.at website still exists, but cannot be accessed.

postimg.cc/xqfmFNyk

From April 2023, ggmt.at redirected to ggmtrevolution.at with this imprint. The former email address of ggmt.at was still given as the email address.

postimg.cc/21F2w6tw

web.archive.org/web/20230629063458/https://www.ggmtrevolution.at/impressum

In September 2021, the company Aurum Pflegemanagement GmbH, founded in June 2015, was renamed GGMT Revolution Vertriebs GmbH with headquarters in Vienna. The managing directors are Katarina and Helmut Kaltenegger.

postimg.cc/tsHCwhdF

northdata.de/GGMT%20Revolution%20Vertriebs%20GmbH,%20Wien/436213s

At times (from December 2022 to April 2024), ggmtrevolution.at also redirected to ggmt.world.

postimg.cc/CngSX0kS

web.archive.org/web/20240424102151/https://ggmt.world/

The domain ggmt.world was registered on June 2, 2022 by GGMT Revolution Vertriebs GmbH in Vienna and updated on June 2, 2025. However, this website is currently not available.

postimg.cc/kDRyybnx

Stefan Roth, a German serial fraudster with various addresses in Germany and Switzerland, uploaded this English video to his YT channel on April 26, 2019.

postimg.cc/3dCcQck8

youtube.com/watch?v=5TxQEl9KNYQ

Only 50% discount? Too little. I’ll look for another dealer. 😀

Continuation.

Helmut Kaltenegger registered a fourth GGMT website on May 5, 2020:

ggmtrading.eu

The registrant was GGMTrading GmbH in Vienna.

postimg.cc/ppb67nBt

whois.eurid.eu/en/search/?domain=ggmtrading.eu

ggmtrading.eu redirected to ggmt.at.

web.archive.org/web/20211129214137/https://www.ggmt.at/

The ggmtrading.eu website still exists, but is not accessible.

Today’s TGI AG, based in Vaduz, Liechtenstein, was founded in October 2020 as M.R. CAPITAL AG.

In September 2023, this company was renamed GGMT Revolution AG.

In March 2024, the company was renamed TGI AG.

The Managing Director Michael Ewy (full name Michael Peter Ewy) is a German national.

postimg.cc/m1WHNhmy

northdata.de/TGI%20AG,%20Vaduz/FL-0002.646.647-1

and

moneyhouse.ch/de/company/tgi-ag-73503169

Michael Ewy describes himself as an LL.M. on LinkedIn.

postimg.cc/pmbDYG6t

linkedin.com/in/michael-ewy-ll-m-0936a0b6/?originalSubdomain=ch

Sören Haag from Hildesheim in Germany massively advertises the former GGMT scam of Helmut and Katarina Kaltenegger (formerly Katarina Kollarova) and Alexander Scheller on his website.

The following photo shows from left to right: Helmut Kaltenegger – Sören Haag – Alexander Scheller – Katarina Kaltenegger.

postimg.cc/6TfW0wf0

passiveportfolio.de/sachwert/ggmt/

Note. The videos linked under the photo are unfortunately no longer available or accessible.

Sören Haag‘s former registration link my.ggmt.at/register/id=112250 now redirects to my.tgi.li.register with the same sponsor code.

postimg.cc/MnBcYNPm

This is further proof of the fact that the GGMT scam was simply renamed TGI.

Sören Haag‘s incomplete contact details.

postimg.cc/F1kCV0kv

passiveportfolio.de/sachwert/ggmt/

Sören Haag on Facebook.

postimg.cc/SXzVfhjr

facebook.com/soerenhaag

PS: I have not yet checked what role the above-mentioned Alexander Scheller plays today.

Why is the domain tgi.li offered for sale?

postimg.cc/hfBX8CLT

whois.domaintools.com/tgi.li

and

sedo.com/search/details/?language=us&domain=tgi.li&partnerid=55490&origin=partner

The tgi.li website has significantly more visitors than the tgi.gold website.

postimg.cc/5jRVbj00 and postimg.cc/hX0Z43rr

“tgi.li” is working here.

The renowned German magazine “DER SPIEGEL” published the following article on the GGMT scam in May 2020.

postimg.cc/wt8L1hqj

spiegel.de/wirtschaft/unternehmen/gold-kaufen-ggmt-der-traum-vom-gold-fuer-alle-a-71dec309-fac8-40d3-8917-52962592153f

Unfortunately, the article can only be read in full by subscribers. I will try to obtain a copy.

The German serial scammer Mario Emmrich, who is hiding in Dubai, also advertises the TGI scam on his emmrich.consulting website. I already mentioned this in this comment in October 2024:

https://behindmlm.com/mlm-reviews/cryptex-review-daily-roi-smart-contract-ponzi-scheme/#comment-486613

postimg.cc/MXgCw8FJ

emmrich.consulting/#TGI

After numerous lies about the supposedly “fantastic TGI Gold Business”, Mario Emmrich links to emmrich.tgi.gold. There he presents himself with a large photo, e-mail address and telephone number.

postimg.cc/9zzBpR1c

tgi.li/partner/emmrich-consulting-fzco?utm_campaign=112162&utm_medium=salespartner-package&utm_source=qr-code

Some quotes from the tgi.li/partner website.

postimg.cc/cKZt6HFq

Three examples described on the tgi.li/partner website.

postimg.cc/Tp4ZR5Yw

tgi.li/partner/emmrich-consulting-fzco?utm_campaign=112162&utm_medium=salespartner-package&utm_source=qr-code

Quote from the review.

So that no one doubts that this gold mine in South America actually exists, the domain aulicio-mining-inc.com was privately registered on August 2, 2019 and updated on August 3, 2024.

postimg.cc/4H1HCGXp

I can see at first glance that there is something wrong here. Quote from the aulicio-mining-inc.com website.

postimg.cc/rKjqcy3Y

aulicio-mining-inc.com/

If a company claims to have 17 years of experience, why has it only had its own website for 6 years?

Is it usual for a company based in Guyana, South America, to list Austria and a telephone number from Germany in the domain registration?

Is it usual for a company based in Guyana, South America, to have their domain hosted on a server in Germany?

postimg.cc/ykmkRz5F

The contact details on aulicio-mining-inc.com include an address, a telephone number and an e-mail address from gmail.com. Is this common in South America? The address given is not Georgetown, but East Bank Demerara.

postimg.cc/z3HGKR3m

Also, the aulicio-mining-inc.com website is not secure. Only http, not https.

postimg.cc/56J2Hh2c

The German “Stiftung Warentest” (Foundation for Product Testing) published the following article on March 19, 2025.

postimg.cc/CzC9v1p1

test.de/TGI-AG-Vorsicht-vor-Goldkauf-mit-Rabatt-6205443-0/

The domain goldcrestrefinery.com was registered privately on March 31, 2019 and updated on April 1, 2025.

postimg.cc/N2jRzzmJ

Who manages this refinery?

postimg.cc/7bhCj7jW

goldcrestrefinery.com/about.html

Two photos allegedly show the team of this “refinery”, but no names are mentioned.

postimg.cc/Y4SkjNNc

Of course, this dubious website lacks a full imprint. It only mentions Accra as the location, an email address and a telephone number from Ghana.

postimg.cc/QVjLMJjf

goldcrestrefinery.com/contact.html

Helmut Kaltenegger claims on LinkedIn that TGI AG was founded in 2020.

postimg.cc/0MG29mqb

linkedin.com/company/tgi-ag/about/

That is not factually correct. I described this in detail in comment #5.

Two names are mentioned in the imprint on the tgi.li. website.

postimg.cc/xcg8kBFg

tgi.li/impressum

This information is no longer correct! Prof. Dr. Nicolas Raschauer, an Austrian citizen, is no longer a member of the Board of Directors. This was noted in the commercial register on June 11, 2025.

postimg.cc/TK9V3krX

moneyhouse.ch/de/company/tgi-ag-73503169

The life of Nicolas Raschauer is described in detail on Wikipedia. As a professor and jurist, he may have realized that his membership of TGI AG was a wrong decision that will cause lasting and permanent damage to his reputation.

postimg.cc/ygGRgx6m

de.wikipedia.org/wiki/Nicolas_Raschauer

Bernd Seligmann from Kiel in Germany has been massively promoting the TGI scam on his goldwert-plus.de website since April 2024.

postimg.cc/ygx90h45

Bernd Seligmann’s second website goldwert-plus.com, which was privately registered on May 28, 2024 and updated on May 27, 2025, redirects to goldwert-plus.de.

postimg.cc/hQhccrQS

Bernd Seligmann links to four websites, three of which we already know.

goldcrestrefinery.com – tgi-academy.gold – tgi.li

The goldenempirelegacy.com website mentioned here is new.

postimg.cc/XZ7y0KJJ

The domain goldenempirelegacy.com was registered privately on November 11, 2021 and updated on November 11, 2024. Global Empire Legacy Holding is named as the domain holder.

postimg.cc/zHg1bQdf

The goldenempirelegacy.com website from Accra in Ghana contains considerably more information than the goldcrestrefinery.com website from Accra. Numerous people are named and shown, as well as these contact details.

postimg.cc/z3BQd4Fb

goldenempirelegacy.com/contact/

Bernd Seligmann‘s complete imprint.

postimg.cc/VSV5Q3pG

PS: I cannot judge whether there is a connection between TGI AG and Golden Empire Legacy Limited.

Under a video on the YT channel GGMT GmbH (not an official channel!) from November 1, 2018, the customer Jörg Saathoff wrote three years ago:

postimg.cc/5jvPBcz5

youtube.com/watch?v=6TCXAaL7TEE

The same comment under two other videos on the same channel. The anonymous operator of the channel never responded to the comments.

youtube.com/watch?v=iPjXbolT5mU

youtube.com/watch?v=OK39SJRX7Yc

Addition to comment #3.

Three people were named and shown on the former ggmt.world website.

postimg.cc/qt1crTFK

web.archive.org/web/20221220123933/https://ggmt.world/

Apparently the authorized signatory Herbert Müllner is still part of the team, because he was present in this TGI AG video from May 23, 2024.

postimg.cc/qzbxrHZy

youtube.com/watch?v=Ki0wmOgTQNg

Herbert Müllner can also be seen briefly in this very short video from April 6, 2025.

postimg.cc/0M9qsSbt

youtube.com/watch?v=-z7_mclNgIA

The former director Mario Steinriegl from St. Pölten in Austria is no longer mentioned.

The YT channel TGI-AG currently contains 295 videos since April 2024 and has 2,830 subscribers.

postimg.cc/qg8jKFDC

youtube.com/@TGI-AG

The official GGMT YT channel no longer exists.

youtube.com/channel/UCHDWENMkpnqPk4kaNaGdhxg

The official Facebook account GMMT Revolution with 84 followers still exists, but has not been updated since February 16, 2024.

postimg.cc/Yj4S9SYq and postimg.cc/DShfBdD8

facebook.com/GGMTRevolution

On Facebook there was a link to the ggmtrevolution.at website. This website is currently not available.

The domain ggmtrevolution.at was registered with complete data by Katarina Kollarova (now Katarina Kaltenegger) in Vienna (Austria).

postimg.cc/7Jxvkfnn

The following screenshot from the former ggmtrevolution.at website shows Helmut and Katarina Kaltenegger in the foreground. In the background are Herbert Müllner, authorized signatory, and Veronika Stadler, assistant to the management.

postimg.cc/mzpkzfpM

web.archive.org/web/20230629063324/https://www.ggmtrevolution.at/

Helmut Kaltenegger and Veronika Stadler in a TGI-AG video from October 24, 2024.

postimg.cc/DSKbrh53

postimg.cc/BPKGpdpd

youtube.com/watch?v=HnbkBv7hWPk

Veronika Stadler is allegedly responsible for ensuring that TGI AG’s customers receive their purchased gold after three years.

Over the years, we’ve seen branded rented office buildings, branded flags, branded mugs, branded dubious debit cards… but I don’t think we’ve ever seen a Ponzi scheme mascot, complete with outfit.

“P-O-N-Z-I, you ain’t got no alibi… Goooooo securities fraud!”

Eastern European Boris CEOs, eat your heart out.

Wow! I am thrilled! Katarina and Helmut Kaltenegger claim in a video from July 31, 2025 that their gold mine in Guyana contains 45 tons of gold! Maybe even more.

postimg.cc/Mct103Kh

youtube.com/watch?v=Hehpf2oFU58

There was one word missing from this exciting gold announcement: “fools.” Then it makes sense. I am sure it was just a typo.

The website projekt-2030.de advertises, among other things, the dubious TGI AG.

postimg.cc/sM85QK2r

projekt-2030.de/affiliatepartner/

The projekt-2030.de website has been online since December 23, 2024, and is run by three people.

postimg.cc/zLvbjhVk

projekt-2030.de/ueber-uns/

Of these three founders, we know Nadja Krämer. She was involved in the Robex AI scam as Head of Robex Academy. I have already mentioned her in several comments on the subject of Robex AI.

postimg.cc/8JC2s1Xc

https://behindmlm.com/companies/robex-ai-collapses-withdrawals-disabled/

On November 25, 2024, Nadja Krämer invited people to a Robex AI Zoom event on Instagram for the last time.

postimg.cc/Cz1LCHRr

instagram.com/p/DCzDxIusFy2/

The imprint on projekt-2030.de names Heiko Liese as the responsible person and Sehnde, a town in Lower Saxony near Hanover, as the location.

postimg.cc/rDfXT0g3

projekt-2030.de/impressum/

Something’s not right here. The phone number listed in the imprint isn’t from Sehnde, but from Bad Kissingen in Bavaria. And who lives in Bad Kissingen? Not Heiko Liese, but Nadja Krämer.

postimg.cc/2V5gw8Cx

Nadja Krämer’s website nadja-kraemer.de has been unavailable for many months.

In the Web Archive, nadja-kraemer.de was last saved on June 16, 2024, with this imprint.

postimg.cc/BtLGbNtJ

web.archive.org/web/20240616060442/https://nadja-kraemer.de/impressum/

In the so-called “Academy” at projekt-2030.de, Heiko Liese and Nadja Krämer offer 10 training courses ranging from €100 to €10,000. An example.

postimg.cc/D4mWMzkk

projekt-2030.de/starte-dein-projekt/

German serial fraudster Richard “Richy” Wiehler, who currently lives in Romania, is once again promoting the TGI scam on Instagram.

postimg.cc/t7g8jQ10

instagram.com/richywiehler/

postimg.cc/XBVZd5jN

instagram.com/p/DSU35jYji10/

Richard “Richy” Wiehler also uploaded a short TGI video to his YouTube channel Clever investieren with 36 subscribers yesterday.

postimg.cc/kV3zW2X0

youtube.com/watch?v=22IfmLEq5Xg&list=PLXky7Mz5AerU4QGwKfAJoZ69-5lKOl67Y&index=22

BehindMLM readers know Richard “Richy” Wiehler in connection with the Bytnex/Cryptex scam. I mentioned him, among other things, in this comment:

https://behindmlm.com/mlm-reviews/cryptex-review-daily-roi-smart-contract-ponzi-scheme/#comment-488902

A photo of Richard “Richy” Wiehler.

postimg.cc/qt0sLVt5

For the TGI scam, Richard “Richy” Wiehler created a second Telegram channel on November 19, 2025.

postimg.cc/3WZ4mSmt

t.me/s/TGIGoldUpdates

His older Telegram channel with 1,247 subscribers is t.me/s/cleverinvestierenInfo, where he is extremely active, as the following figures show.

postimg.cc/fVBGCkGV

t.me/+R4K6ifhk1FZp6n-A

This information is no longer correct. On December 17, 2025, it was publicly announced that Michael Ewy is no longer Managing Director at TGI AG. The new Managing Director is Roman Kaltenegger.

postimg.cc/DShzDB5Y

postimg.cc/w11wCQvb

northdata.de/Kaltenegger,%20Helmut,%20Wien/_p5421686532341760

On the tgi.li website, Michael Ewy is now referred to as Head of Compliance.

postimg.cc/mzkfJFvL

The entire TGI AG team (from left to right).

Herbert Müllner – Katarina Kaltenegger – Helmut Kaltenegger –

Roman Kaltenegger – Michael Ewy

postimg.cc/Vd6rg7Zs

tgi.li/ueber-uns

Herbert Müllner, CFO and member of the Board of Directors, also runs several of his own companies in Austria, such as GoldCard Handels GmbH and Gold Crest Trading GmbH.

postimg.cc/9RGSvQry

northdata.de/M%C3%BCllner,%20Herbert,%20Magersdorf/16sn

Katarina & Helmut Kaltenegger created an Instagram account in June 2025.

postimg.cc/QFSfwNcm

instagram.com/diekalteneggers/

Post from December 14, 2025.

postimg.cc/62W1T2wS

instagram.com/p/DSPl4TGCJFR/

This account lists Austria as its location and has 461 followers. The username for this account has been changed twice.

An Instagram account with the same name, created on December 14, 2025, describes itself as a fan club for Katarina & Helmut Kaltenegger, lists Brazil as its location, and has only 8 followers.

postimg.cc/yD33Msgg + postimg.cc/V0ML7LHC

instagram.com/diekalteneggers_/

TGI AG has had its own Instagram account since May 2024 with 4,406 followers. The address in Vaduz (Liechtenstein) is given, but Austria is listed as the location in the description. In addition, the username of this account has been changed once.

postimg.cc/ZBx8sfrK

instagram.com/tgi.ag/

Mario Emmrich is promoting TGI gold using an EMail address of the domain name (removed)@TGI.GOLD

Clearly part of the Scam founders.