TechVision Review: Euro sec fraud investment scheme

TechVision’s website provides no information about who owns or runs the company.

TechVision’s website provides no information about who owns or runs the company.

Despite claiming it was formed in 2016, TechVision’s website domain registration was last updated in July 2019.

This is likely when the current owner took possession of the domain, as Alexa started tracking traffic a few months later in September.

Supporting this is the shell incorporation of the New Zealand company TechVision Limited on July 26th, 2019.

Long story short, TechVision didn’t exist until July 2019.

Listed as the owner of TechVision’s website domain is Benjamin Lengyel, through an address in Auckland, New Zealand.

Further research reveals this address actually belongs to virtual office merchant Regus.

Benjamin Lengyel doesn’t exist outside of TechVision’s marketing and what appears to be a recently created LinkedIn profile.

Given this, it’s unlikely Lengyel exists outside of TechVision’s New Zealand shell incorporation.

Benjamin Lengyel is played by what appears to be an actor in TechVision marketing material.

The actor has a distinct European accent, suggesting TechVision is in fact a European company pretending to operate out of New Zealand.

The video Lengyel features in is the usual spotless office tour with “paid to look busy” extras.

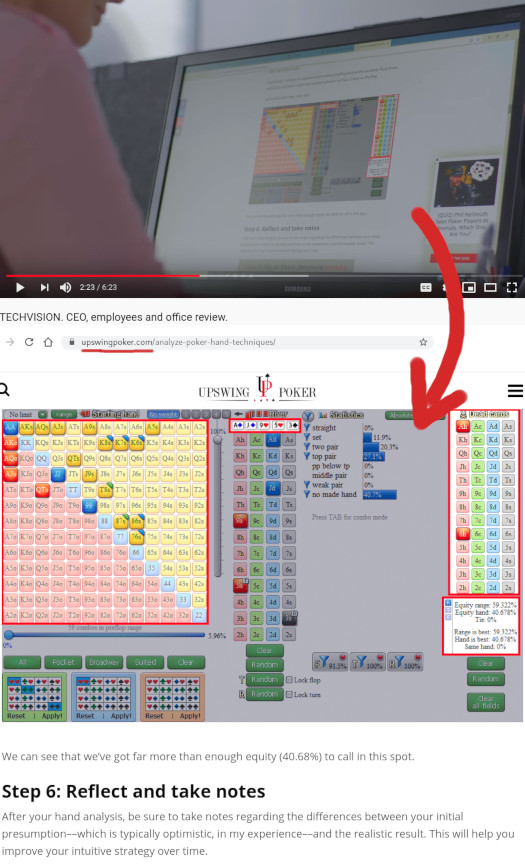

In one scene, a supposed “poker expert” whose supposed to be “implementing (Techvision’s) software”, is just someone pretending to read a public website and doodling with a pen.

One can safely assume what’s shown on the screens of TechVision’s other actor experts is similarly doctored content.

As to where TechVision is actually being run from, one possibility is the Netherlands.

Next month TechVision is gearing up to hold its first “leadership summit” in Uden.

The “main guest” of the event is Christel van Der Steen, credited as “the leading development leader of Techvision in the Netherlands”.

Van Der Steen’s partner (husband?) Ardy van Breugel is also credited as a Netherlands leader.

Van Der Steen’s LinkedIn profile joined TechVision in September 2019. Prior to Techvision Van Der Steen was promoting the FutureNet and Cannerald Ponzi schemes.

Also attending TechVision’s leadership summit is “investor” Klemen Andlovec.

Andlovec began promoting TechVision on YouTube five months ago, which places him also joining in September 2019.

All of this points to TechVision likely being operated out of the Netherlands.

Read on for a full review of TechVision’s MLM opportunity.

TechVision’s Products

TechVision has no retailable products or services, with affiliates only able to market TechVision affiliate membership itself.

TechVision’s Compensation Plan

TechVision affiliates invest funds on the promise of advertised returns.

Below are TechVision’s investment tiers, listed by maturity period:

- First Step – invest $75 to $525 and receive 124% in 20 days

- Quick Step – invest $2275 to $11,500 and receive 145% in 30 days

- Quick Money – invest $13,250 to $23,250 and receive 172% in 40 days

- Steady Job – invest $25,000 to $55,000 and receive 200% 50 days

- Quick Revenue – invest $56,750 to $125,000 and receive 232% in 60 days

- Primary Stability – invest $1000 to $75000 and receive 224% in 80 days

- Primary Currency – invest $10,000 to $55,000 and receive 272% in 85 days

- Primary Revenue – invest $70,000 to $150,000 and receive 306% in 90 days

- Primary Profitability – invest $175,000 to $550,000 and receive 360% in 100 days

- Compounding All-In – invest $100,000 to $500,000 and receive 993% in 190 days

- Compounding Revenue – invest $50,000 to $99,999 and receive 820% in 200 days

- Compounding Apps – invest $15,000 to $49,999 and receive 667% in 210 days

- Compounding Primary – invest $100 to $14,999 and receive 584% in 220 days

TechVision pays returns Monday through Friday.

Referral Commissions

TechVision pays referral commissions via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

TechVision caps referral commissions down sixteen levels of recruitment.

How many levels an affiliate can earn referral commissions down depends on how much downline investment volume they’ve generated:

- no requirement – 3% on level 1 (personally recruited affiliates), 2% on level 2 and 1% on levels 3 to 7

- generate $50,000 in downline investment volume – 4% on level 1, 3% on level 2, 2% on level 3 and 1% on levels 4 to 9

- generate $500,000 in downline investment volume – 5% on level 1, 3% on level 2, 2% on level 3 and 1% on levels 4 to 11

- generate $5,000,000 in downline investment volume – 6% on level 1, 3% on level 2, 2% on level 3 and 1% on levels 4 to 13

- generate $50,000,000 in downline investment volume – 7% on level 1, 4% on level 2, 3% on level 3 and 1% on levels 4 to 16

Joining TechVision

TechVision affiliate membership is free.

Participation in the attached income opportunity however requires a minimum $75 investment.

Conclusion

TechVision promises affiliate investors “guaranteed success”.

The Company’s powerful and constantly growing technical and software and hardware resource, showing incredible performance since 2015, combined with a team of professionals in the field of programming, investment-trading analysis and betting, guarantee profit for each TECHVISION Client.

No evidence of TechVision’s software or hardware resources exist. Nor is there any evidence of external revenue of any kind being actually used to pay affiliates.

Furthermore TechVision’s business model fails the Ponzi logic test.

If the company’s owners were able to 124% every 20 days, even a modest capital amount compounded would soon explode.

More importantly, why sell access to these incredible returns for just $75?

On top of all this TechVision is committing securities fraud.

TechVision markets a passive investment opportunity, which for regulatory purposes constitutes a securities offering.

Securities in the Netherlands and New Zealand are regulated by the AFM and Securities Commission of New Zealand respectively.

TechVision provides no evidence it has registered with the AFM, Securities Commission of New Zealand or any other securities regulator.

This means that regardless of anything else, TechVision are illegally soliciting investment in every country they operate in.

While the AFM are unlikely to do anything other than issue a warning, and New Zealand are irrelevant as TechVision doesn’t exist there outside of a shell incorporation, the same is not true of their largest investor market.

At the time of publication Alexa estimates the US is the largest source of traffic to TechVision’s website (38%).

Securities in the US are tightly regulated by the SEC. And no, TechVision is not registered with the SEC either.

So why would a clearly European company, pretending to be a New Zealand company and soliciting investment primarily from the US opt to operate illegally?

As it stands the only verifiable source of revenue entering TechVision is new investment.

Using new investment to pay affiliates returns makes TechVision a Ponzi scheme.

As with all MLM Ponzi schemes, once affiliate recruitment dies off so too will new investment.

The math behind Ponzi schemes guarantees that when they collapse, the majority of participants lose money.

Regarding the conjecture this may be based in the Netherlands:

That Benjamin Lengyel person definitely does not speak English with a Dutch accent.

A search turns up somebody with that name on a Hungarian website: https://szfe.jegy.hu/person/lengyel-benjamin-14348

He gives his occupation as “Színész”, which Google Translate tells me means actor. Based on the two pictures there, and another one on a site selling tickets to a play he appeared in, and comparing them to snapshots from the video, I’m pretty certain it’s him.

Having made the link with Hungary, his accent in the video also matches my, admittedly limited, exposure to Hungarians speakng English.

The bad written English under the Youtube video also doesn’t point to the Netherlands: the mistakes aren’t ones a native speaker of Dutch would make.

Whatever the native language of the writer is, it’s much less similar to English than Dutch is – which Hungarian certainly is, since it’s not even Indo-European.

I don’t think that Dutch couple are at the center of things.

I didn’t think so either, hence I don’t name them as owners.

Bet they know who is behind TechVision though.

The whole office setup is hilariously fake. I particularly like the couple of desks which constitute their “innovative hardware development” department, where it takes three people to loosen a screw on a fan a bit, and then in the next shot fasten it again (one just watches intently, one for some reason has to push down on the top of the fan casing, and one wields the screwdriver, the only visible tool in the department).

The person watching holds a printout of some kind of spreadsheet in his hand, the same spreadsheet from which someone in an entirely different department housed in the same room, the one where where everybody is reading websites about poker, also holds a printout.

The funniest thing I spotted is at 5:27. There is a screen showing what is so obviously a joke “system monitor” mockup (why on earth would anything real be all in green on black?) that I zoomed in a little.

It has nonsense like gauges for “fatuous radiometry salinization” and “thermometric projectile synergism” on it. A bit further down, one can read, amid a list of meaningless technical-looking junk, “ALL_YOUR_BASE”, “ARE_BELONG”, “TO_US”.

I quickly found it with Google: it’s an old joke screensaver, Retro SciFi Green, of which a long demonstration can be seen here: youtube.com/watch?v=GPQhIrp1AJ4

Just after that, at 5:30, there’s an equally silly screen with lots of obviously fake gauges (some labelled “PRESSUREGUAGE”). Another Google search led me to the source of that, too.

It’s something put together with this: videohive.net/item/hud-ui-infographics-pack-800/19616723

A pack of ready-made graphics to quickly cobble together fake user interface screens.

The people pretending to be analysts or programmers or something by engaging in continuous high-speed pseudo-typing is also very funny. It’s the standard way movies and TV always show “hackers”.

Although I have to admit: they did put a bit more effort into it than a lot of these fake videos. They certainly hired a lot more extras than is usual.

Fake? Pssh… I don’t sit down to a hand of poker unless I’ve thoroughly checked the “fatuous radiometry salinization” and “thermometric projectile synergism” of the table.

You don’t?

All your base are belong to us if from a badly translated Jap game. Someone made it into a meme video and it was a meme before memes were memes (mid to late 90s).

I guess he does exist in real life?

This what I found in opencorporates:

opencorporates.com/companies/nz/7629937/filings

I think NZ are as diligent as the UK when it comes to shell incorporation data.

The name is Hungarian and there is an actor and a member of the band “Hello Hurricane” from Budapest. Don’t know if they are one person.

Allegedly, the CEO is the same guy as the World Way Capital CEO but I’m too bad with faces to decide either way. Different beard and haircut throwing me off there.

I agree about the hilarious video. Comically bad, really.

If anyone with good enough eyes and a large screen can zoom in on the door at 18 secs, it might reveal where the video was recorded. My intel says Eastern Europe.

I’m not good with faces either, but that’s what computers are for.

Luckily, of the three pictures of the Hungarian actor I found, two have him looking straight at the camera, and one has him in left profile – so put together the equivalent of a police mugshot. Those two same angles occur with the guy in the video. I took snapshots of those, and made semi-transparent versions, which I scaled and superimposed (this doesn’t require specialist software, I simply used LibreOffice Draw). They’re an absolutely perfect match, face-on and in profile, except for the haircuts and some facial hair. Even without the added facts of the name, and the accent, and that he’s an actor, I’d be 99.9% certain it’s the same man, unless they are twins.

It just seems a bit strange that a hired actor would use his real name (or at least his real stage name) for a scam like this. But maybe he isn’t hired help: he could be a full participant, there’s no reason an actor couldn’t try his hand at this for real, perhaps believing his professional skills would help in pulling it off.

Like you, I had high hopes for that door at 00:18, and squinted at the word in red for quite a while. (That’s vital in such video sleuthing: don’t get distracted by what they want you to see, look at details in the background.) Alas, there’s a lot of motion blur in the shot, and I couldn’t make it out. Your comment made me give it another try, and I noticed they have a 2K version available. I downloaded that, and stepped through the bit frame by frame. It’s still very blurry, but I thought I could make out something like “PREVISER”, which I couldn’t make sense of.

Google didn’t seem to help, until I thought of clicking on Images. Suddenly, there I spotted a crystal-clear version of what is on that door: it’s the logo of a business consultancy firm from Tallinn, Estonia, which also has offices in Finland: http://www.previser.fi. The logo on the door is a slightly different version from the one on the website, but the same one as on their LinkedIn page.

The video was definitely made in the building in Estonia (174 Vabaduse puiestee, 10917, Tallinn), not the one in Finland: the clincher is the train yard which you can see through the windows, which is also visible on Google Street View. (I don’t think there’s a link with that Previser company other than using office space in the same building.)

Isn’t this fun?

Very nice, PassingBy.

Yes, this was made at Manta Maja/Hammerhub. See also

mantamaja.ee/en/gallery/

so in conclusion, techvision is a fraud company??????? and an MLM company???

they did not have a reliable resources and an owner that is legit. so they’re scammer?????

omg i just put 75usd in that company, although it’s just a small amount but it still money *crying*

I can’t tell if those questions are rhetorical or not.

Is there a site where you can report online scams?

I was naive and now I’ve lost a lot of money, and besides, the site has stopped working at all. Do you have any idea?

You can report TechVision to your local authorities but there’s no guarantee that’ll go anywhere.

If you’re in the Netherlands your best bet is hunting down TechVision’s leaders and demanding your money back.