Seokore Review: Task based “click a button” app Ponzi

Seokore fails to provide ownership or executive information on its website.

Seokore fails to provide ownership or executive information on its website.

Seokore operates from two known website domains:

- seosms.com (marketing website) – first registered in March 2023, private registration last updated on December 17th, 2024

- seokore.com (also h5.seokore.com, app websites) – privately registered on August 3rd, 2024

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

Seokore’s Products

Seokore has no retailable products or services.

Affiliates are only able to market Seokore affiliate membership itself.

Seokore’s Compensation Plan

Seokore affiliates invest tether (USDT). This is done on the promised of advertised returns:

- SK1 – invest 50 to 500 USDT and receive 2% to 2.1% a day

- SK2 – invest 500 to 2000 USDT and receive 2.3% to 2.5% a day

- SK3 – invest 1000 to 5000 USDT and receive 2.7% to 3% a day

- SK4 – not disclosed

- SK5 – not disclosed

- SK6 – not disclosed

Seokore pays referral commissions on invested USDT down three levels of recruitment (unilevel):

- level 1 (personally recruited affiliates) – 13%

- level 2 – 4%

- level 3 – 2%

Joining Seokore

Seokore affiliate membership is free.

Full participation in the attached income opportunity requires a minimum 50 USDT investment.

Seokore Conclusion

Seokore is yet another “click a button” app Ponzi scheme.

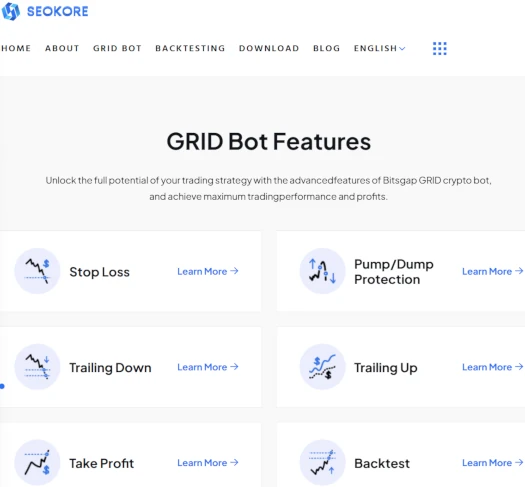

Seokore’s task ruse is baloney about a “grid bot”:

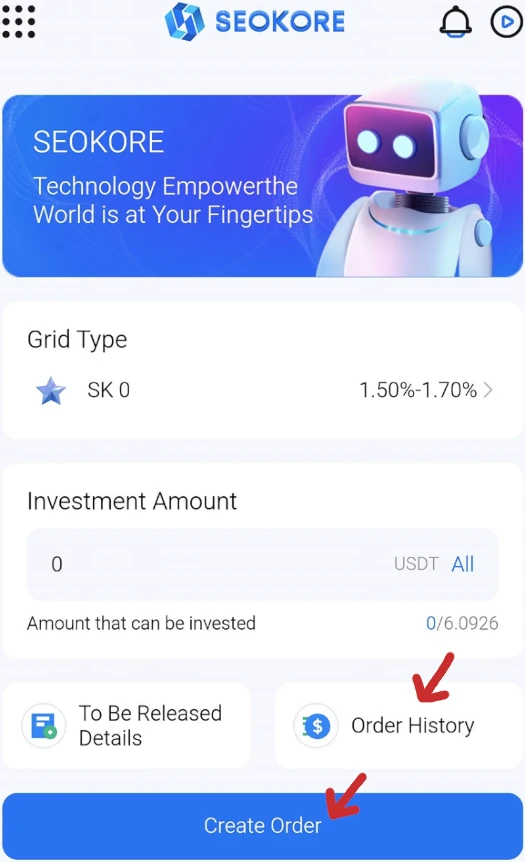

On Seokore’s app website however, we can see it’s just a typical “placing orders” task scheme:

Placing orders corresponds with Seokore affiliate investors logging in to “click a button”.

The more they invest, the more buttons need to be clicked each day.

Clicking buttons as required qualifies Seokore investors for daily returns as advertised.

Beyond that clicking a button inside Seokore does nothing, there is no external revenue. All Seokore does is recycle newly invested funds to pay earlier investors.

Examples of already collapsed “click a button” app Ponzis using task-based ruses are AI Robots, Gucci VIP and Car USDT.

Since 2021 BehindMLM has documented hundreds of “click a button” app Ponzis. Most of them last a few weeks to a few months before collapsing.

“Click a button” app Ponzis disappear by disabling both their websites and app. This tends to happen without notice, leaving the majority of investors with a loss (inevitable Ponzi math).

In the lead up to a collapse, “click a button” Ponzi investors also tend to find their accounts locked. This typically coincides with a withdrawal request.

As part of a collapse, “click a button” Ponzi scammers often initiate recovery scams. This sees the scammers demand investors pay a fee to access funds and/or re enable withdrawals.

If any payments are made withdrawals remain disabled or the scammers cease communication.

Organized crime interests from China operate scam factories behind “click a button” Ponzis from south-east Asian countries.

In September 2024, the US Department of Treasury sanctioned Cambodian politician Ly Yong Phat over ties to Chinese human trafficking scam factories.

Through various companies he owns, Phat is alleged to shelter Chinese scammers operating out of Cambodia.

Regardless of which country they operate from, the same group of Chinese scammers are believed to be behind the “click a button” app Ponzi plague.