PTGR AG Review: Professor launches staking Ponzi

PTGR AG operates in the cryptocurrency MLM niche.

PTGR AG operates in the cryptocurrency MLM niche.

PTGR AG’s website domain (“ptgr.io”), was privately registered on January 26th, 2025.

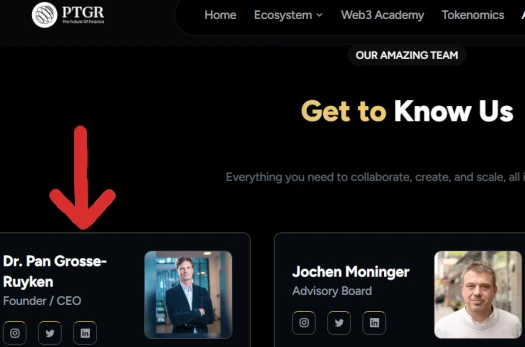

Heading up PTGR AG we have founder and CEO Pan Gross-Ruyken.

Things get a little bit strange here. In addition to running PTGR AG, Gross-Ruyken is also a professor at the Swiss School of Management (SSM), Barcelona:

Gross-Ruyken’s SSM bio acknowledges his role at PTGR AG;

Currently serving as the CEO of PTGR AG in Zug, Switzerland, Dr. Grosse-Ruyken spearheads the company’s focus on digital finance solutions for private and institutional clients.

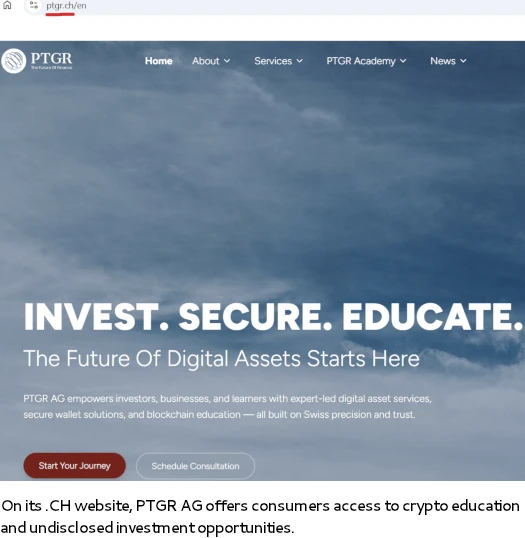

This doesn’t match up with PTGR AG as presented on its .IO domain – but it does match what PTGR AG offers on a second domain, “ptgr.ch”.

PTGR AG on the .CH domain does offer investing services, but its by consultation only. Additionally, general crypto services and consultancy is offered.

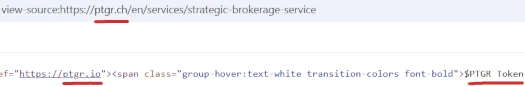

I thought someone might have hijacked the PTGR AG name but, if you click on the “$PTGR token” link at the top right of the PTGR AG .CH website, you get redirected to the .IO domain.

PTGR AG’s .CH website domain was privately registered on June 9th, 2021. The company is named after its founder, Pan Theo Gross-Ruyken.

Putting all of this together, it appears Pan Gross-Ruyken reinvented himself as a crypto bro circa 2021 but continued to work as an academic.

PTGR AG was the usual failed crypto bro scheme (might have even been a COVID-19 project), so now Grosse-Ruyken has added a PTGR token investment scheme.

We’ll delve into the legalities of this in the conclusion of the review.

Read on for a full review of PTGR AG’s MLM opportunity.

PTGR AG’s Products

PTGR AG has no retailable products or services.

Promoters are only able to market PTGR AG promoter membership itself.

PTGR AG’s Compensation Plan

PTGR AG promoters buy PTGR token from PTGR AG. PTGR AG doesn’t disclose how much it is selling PTGR tokens for to consumers.

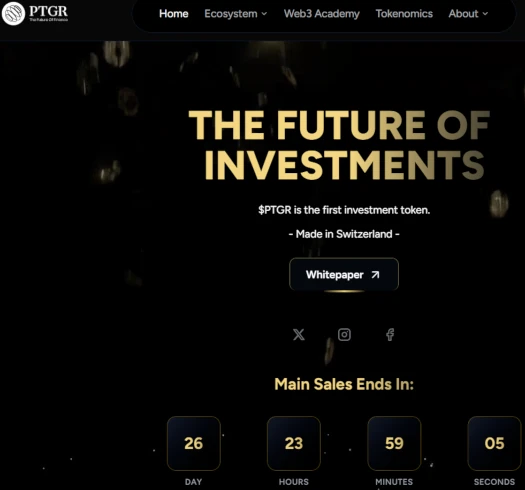

At time of publication, PTGR AG’s website displays a 26 day timer for a PTGR token “main sale”:

Once acquired, PTGR AG promoters invest PTGR into a staking model investment scheme.

This is done on the promise of a passive return, determined for how much a PTGR AG promoter invests:

- invest 5000 to 10,000 PTGR and receive 1% to 2.5% annually

- invest 10,001 to 50,000 PTGR and receive 2% to 5% annually

- invest 50,001 to 100,000 PTGR and receive 3% to 7.5% annually

- invest 100,001 to 250,000 PTGR and receive 4% to 10% annually

- invest 250,001 to 500,000 PTGR and receive 5% to 12.5% annually

- invest 500,001 or more PTGR and receive 6% to 15% annually

PTGR AG’s MLM opportunity pays on recruitment of promoter investors.

Unfortunately PTGR AG hides its MLM compensation plan specifics from consumers. This is all that’s disclosed on PTGR AG’s website;

Earn rewards each time a direct referral makes a purchase or participates in staking.

Continue earning as your referrals invite others (multi-level rewards).

Joining PTGR AG

PTGR AG promoter membership is free.

Full participation in the attached income opportunity requires a minimum 5000 PTGR token investment.

The cost of acquiring 5000 PTGR tokens is hidden from consumers.

PTGR AG Conclusion

PTGR AG offers a simple “staking” model Ponzi, riddled with problematic disclosure failures.

PTGR token itself appears to be an ERC-20 shit token. These can be created in a few minutes at little to no cost. It’s a give that PTGR is worthless outside of PTGR AG itself.

To that end PTGR AG represents it generates external revenue through its PTGR AG crypto services and “strategic investments”:

5% of revenues generated from PTGR AG’s educational services directly fuel our tokens Buy & Burn mechanism.

25% of profits from $PTGR AG’s strategic investments are distributed directly to $PTGR Community.

As of September 2025, SimilarWeb was tracking ~140,000 monthly visits to PTGR AG’s .CH website. This sounds promising but 100% of that traffic originates from Ethiopia.

PTGR AG doesn’t appear to have any direct links to Ethiopia. Nor does it strike me as a country that would be that interested in what PTGR AG offers on its .CH website.

I can’t definitively say what but something fishy is probably going on there.

As for PTGR AG’s “strategic investments”, PTGR AG fails to provide any verifiable evidence of such investments.

Such verifiable evidence would be audited financial reports filed with regulators. In Switzerland this is would be the Swiss Financial Market Supervisory Authority (FINMA).

SimilarWeb also tracked 100% of PTGR AG’s .IO website traffic from Ethiopia as of September 2025. Securities in Ethiopia are regulated by the Ethiopian Capital Market Authority.

By failing to register with financial regulators in jurisdictions it operates and is soliciting investment in, PTGR AG is committing verifiable securities fraud.

Disclosure failures, including what PTGR token is being sold for and MLM compensation details, may additionally violate consumer protection laws.

Whether the Swiss School of Management are aware one of their professors is running an unregistered fraudulent investment scheme is unclear.

PTGR AG represents SSM is one of its “trusted partners” on its website:

As it stands, the only verifiable source of revenue entering PTGR AG is new investment.

Using new investment to pay PTGR token withdrawals would make PTGR AG a Ponzi scheme.

As with all MLM Ponzi schemes, once promoter recruitment dries up so too will new investment.

This will starve PTGR AG of ROI revenue, eventually prompting a collapse.

Math guarantees that when a Ponzi scheme collapses, the majority of participants lose money.

From April to June 2025, the ptgr.io website also had 100% visitors from Ethiopia.

postimg.cc/zLwrcgWV

Could this article from August 23, 2025 explain the connections?

postimg.cc/pyChc5Vx

ptgr.ch/de/events/ptgr-hosts-exclusive-ico-training-addis-ababa

If PTGR was running marketing events in Ethiopia that would definitely account for the website traffic.

So basically Pan Grosse-Ruyken found a bunch of gullible saps in Ethiopia and is milking them. And when that runs out, kaboom.

CEO Dr. Pan Theo Grosse-Ruyken reports regularly from Ethiopia on LinkedIn. Here are just three examples from this week.

postimg.cc/mh6t4NQh

postimg.cc/479Vk7jK

postimg.cc/dL7nQ3dj

linkedin.com/company/ptgr/posts/?feedView=all

PTGR AG with only 32 followers on Facebook.

postimg.cc/dLbLcvzd

facebook.com/profile.php?id=100088835256574

PTGR AG with 70 posts and 655 followers on Instagram. The account has been around since August 2022, and the username has already been changed three times. The oldest post is from April 29, 2025. How many posts from August 2022 to March 2025 were deleted, and why?

postimg.cc/bd3qR8yJ

instagram.com/ptgr_ag/

PTGR AG on YouTube. The channel contains only five old videos from January to March 2023 and has only nine subscribers.

postimg.cc/HJPtX8qr

youtube.com/@ptgr_ag/videos

PTGR AG has had an account on X with 1,329 followers since July 2025.

postimg.cc/QVkfyP3w

This post from October 8, 2025 is funny. 🙂

postimg.cc/dZqjFsY6

x.com/ptgrtoken

What is an investment token? Who can explain it to me?