ORU Marketplace Review: ORU Ponzi points & pyramid recruitment

The only indiciation as to where ORU Marketplace is incorporated is the following statement on their website;

The only indiciation as to where ORU Marketplace is incorporated is the following statement on their website;

ORU Market, ORU Marketplace, ORU Pay, ORU Chat, ORU Mail, ORU Social, ORU Quantum Widget, ORU Score, Infinity Reward, ORU Rewards, ORU Health, ORU iOS App, ORU Android App, ORU Debit Card, ORU Card, Gizmoh.com are intellectual properties owned by Azteya Ltd and its affiliates. Azteya Limited is headquartered in George Town Grand Cayman.

Azteya Limited has a website but there’s nothing on there other than a login form. As far as I can tell, Azteya Limited is nothing more than a shell company.

There is no legitimate reason for an MLM company to be incorporated in an offshore tax haven.

Heading up Oru Marketplace is “architect” Nick VandenBrekel (right).

Heading up Oru Marketplace is “architect” Nick VandenBrekel (right).

Nick is a seasoned serial entrepreneur, technology and financial services innovator and military veteran.

With over 38 years of experience in myriad aspects of technology, science, finance and business, he has been responsible for, and has contributed to ground breaking technologies in the communications, financial, banking, medical, hardware, software, security, social media and enterprise systems industry.

In his ORU Marketplace corporate vio, VandenBrekel is cited as “a native of the Netherlands”.

Corporate records however suggest VandenBrekel is based out of the US state of Florida.

It follows thus that ORU Marketplace is also likely being operated out of Florida.

Despite the lofty claims made in VandenBrekel’s corporate bio, I believe ORU Marketplace is his first MLM venture as an executive.

Read on for a full review of the ORU Marketplace MLM opportunity.

ORU Marketplace Products

ORU Marketplace has no retailable products or services, with affiliates only able to market ORU Marketplace affiliate membership itself.

ORU Marketplace affiliate membership provides access to a Visa prepaid card, social network, travel discount portal, discount prescription service and an advertising platform.

As per the ORU Marketplace website, the company’s

Visa Prepaid Card is issued by MetaBank, 5501 S. Broadband Lane Sioux Falls, SD 57108, Member FDIC, pursuant to a license from Visa U.S.A. Inc.

The ORU Marketplace Compensation Plan

ORU Marketplace affiliates sign up for $30.94 and then pay $5.95 a month.

Commissions are paid when they recruit others who do the same.

Recruitment Commissions

ORU Marketplace affiliates are paid $10 per affiliate they personally recruit.

A residual $1 recruitment commission is paid on affiliates recruited by personally recruited affiliates (level 2).

Residual Commissions

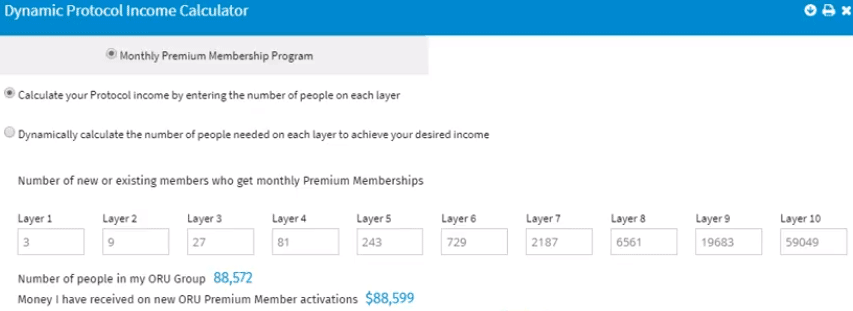

ORU Marketplace pays residual commissions via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

ORU Marketplace caps payable unilevel team levels at ten.

Residual commissions are paid based on monthly fee payments made by directly and indirectly recruited unilevel team affiliates.

For each affiliate placed into the unilevel team that continues to pay their monthly $5.95 affiliate fee, a 25 cent monthly residual commission is paid out.

Joining ORU Marketplace

ORU Marketplace affiliate membership is $30.94 and then $5.95 a month.

Conclusion

ORU Marketplace initially launched on or around January 2017, if not earlier. The original concept heavily pushed ORU Marketplace’s social network.

That flopped and so now ORU appears to have rebooted itself with a not-so-publicized focus on unregistered securities.

Before we get into that though, by paying out commissions on ten levels ORU Marketplace is very much an MLM company.

Yet despite the obvious, ORU Marketplace goes hard on the “we’re not an MLM company” denials.

Warning: Insane level of pseudo-compliance waffle jargon ahead…

Is ORU an MLM company?

The ORU Market is not an MLM ( Multi Level Marketing, also known as Direct Sales or Network Marketing) Company.

ORU Market is an Enterprise Software and Information Technology company that offers its software capabilities by subscription to its members on a non-exclusive license basis.

In a typical MLM company the company distributes its own products through a network of distributors who earn income from their own retail sales of product and from the retail sales made by the distributors direct and indirect recruiting of others.

A broader definition would be any marketing program in which the participants pay money to the the owner or promoter of the program in return for which the participants have the right to:

(a) recruit additional participants, or have additional participants placed by the promoter or any other person into the program participant’s downline, tree, cooperative, income center, or other similar program grouping;

(b) sell goods or services; and

(c) receive compensation, in whole or in part, based upon the sales of those in the participants downline, tree, cooperative, income center or similar program grouping. That is MLM defined.

ORU Market does NOT:

– charge a facilitation fee to its members

– get paid by its members for any rights to refer other members to the ORU Market

– pay compensation based upon sales of members

– place members anywhere into a program

– get paid for recruitment of members

– receive commissions based on the participation of its members

ORU Marketplace charges affiliates $34.94 to sign up and then $5.95 a month, so the above claims by the company are outright lies.

ORU Marketplace’s compensation plan has nothing to do with retail sales. 100% of commissions paid out are tied to affiliate recruitment and continued payment of affiliate fees.

In MLM this is known as a pyramid scheme, hence ORU Marketplace’s desperate denials.

Desperate denials don’t change the fact that ORU Marketplace uses an MLM compensation plan and therefore is very much an MLM company though.

Behind ORU Marketplace’s pyramid scheme front-end appears to be yet another entry into the MLM cryptocurrency niche.

If you scroll down the ORU Marketplace website and click on “Manage ORU Quantum”, you’re presented with the following graph:

As per ORU Marketplace’s website, ORU Quantum is ‘the official community currency of the ORU Market‘.

From the screenshot above, ORU Quantum looks like an internal exchange for ORU points.

ORU is not publicly tradeable and exists solely inside ORU Marketplace itself. That is to say that if ORU Marketplace collapsed or was shut down by regulators tomorrow, ORU points would cease to exist.

In this sense ORU functions more as Ponzi points, with ORU Marketplace dictating the price its affiliates can buy and sell points at.

So why would regulators want to shut this down?

By offering points affiliates can invest in and later cash out at a higher value set by the company, ORU are offering affiliates an unregistered security.

ORU Marketplace affiliates invest in ORU points, ORU Marketplace increases the internal value of the points and affiliates who’ve invested can then cash out.

This is entirely passive on behalf of the affiliate, who relies on ORU Marketplace to arbritrarily set the internal ORU value as they see fit.

In order to operate legally in the US ORU Marketplace would need to register their securities offering with the SEC.

As I write this neither ORU Marketplace or Nick VandenBrekel are registered with the SEC.

This means that irrespective of anything else, ORU Marketplace is operating illegally in the US.

Delving further into ORU points, withdrawals are possible for as long as new affiliates are willing to invest.

And with new investment literally being used to pay existing affiliate returns, ORU Marketplace thus functions as a Ponzi scheme.

Both ORU Marketplace’s pyramid membership fee commissions and ORU points returns are dependent on perpetual recruitment of new ORU Marketplace affiliates.

Once recruitment dies, monthly fees stop getting paid and ORU Marketplace affiliates won’t be able to cash out their ORU point balances.

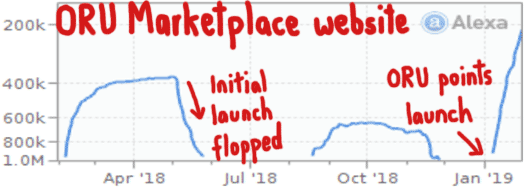

As per the ORU points chart screenshot provided above, ORU Marketplace appears to have launched their ORU points scheme in a few weeks ago.

This coincides with renewed marketing efforts, as well as Alexa traffic estimates for the ORU Marketplace website:

Regardless of whether the SEC goes after ORU Marketplace, the math behind pyramid and Ponzi schemes guarantees that the majority of participants will lose money.

Sounds like that gold site, Karatbars.

does anyone know ORU’s office address in Florida?

DOCUMENT# P16000080056 Entity Name: ORUMARKET INC.

Current Principal Place of Business:

7232 W. SANDLAKE RD SUITE 303

ORLANDO, FL 32819

Current Mailing Address:

7512 DR PHILLIPS BLVD 50-308

ORLANDO, FL 32819 US

Name and Address of Current Registered Agent:

VANDENBREKEL, NICHOLAS

(Mailing address above)

This document is now out of date as many of the things stated in it are no longer part of ORU.

What, ORU’s Ponzi has already collapsed?

Feel free to specify what’s out of date…

Oru does not require any investment to share in revenues and is reliably paying daily to all who register.

It is a work in progress and the video sharing platform and ride share concepts offer EXTREME value to those who choose to benefit as these projects roll out to common usage.

Whether you need to invest or not doesn’t change the Ponzi points business model. Any withdrawals are still funded by subsequent investment.

ORU Marketplace is going on a year now. It’s not a work in progress, you just joined late. Sorry for your loss.

I noticed the strange spelling of the name, for someone who is claimed to be “a native of the Netherlands”.

The normal Dutch spelling is “Van den Brekel”. Perhaps he deliberately changed the spelling to cover his tracks, because a google search for “Nicholas Van den Brekel” instead of “Nicholas VandenBrekel” gives quite different results.

I didn’t look into anything in great detail, but I did find signs of a business career curiously lacking from his ORU bio, with links such as this:

scamwarners.com/forum/viewtopic.php?p=125183

That’s about a New Zealand-based company owned by him called First Excelsior Limited (incorporated March 2012, struck off September 2013).

There was also a UK company with the same name registered by Van den Brekel around the same time (incorporated September 2012, application for voluntary dissolution June 2014).

A registration in Curacao was also involved somewhere. From a quick glance, it seems to have had something to do with providing bank-like financial services, with questions being raised about the required regulatory compliance.

(BTW: according to that UK registration, he was still a Dutch citizen as of 2012, although Florida-based.)

His ORU bio does mention, without any specifics, a company called Sequiam Corporation.

About that, we can find the following in a 2006 disciplinary proceedings report from the National Association of Securities Dealers (US), regarding the sale of Sequiam shares, a penny stock, by a broker called Anthony Cipriano:

Brekel Group was yet another company set up by Van den Brekel.

To say the least, this suggests that his career as a “serial entrepreneur” might be the due to most of his businesses not being very successful.

I did have to laugh at the way he trots out “graduating” from what he refers to as the “OPS School Royal Netherlands Navy”, where he “specialized in naval communications and then continued into technology systems development”, as if that’s some kind of prestigious institute of higher education and research.

That school (now the Dutch-Belgian Operational School, in his time probably still Dutch-only) simply trains navy technical personnel. IOW: he was probably trained as a radio operator.

ORU is 100% a scam. Their promo video claims their platform will quickly replace ebay, uber, skype, and expedia (among others) – which is bait for simpletons who think those massive companies can be overtaken simply by offering a new market player.

VandenBrekel’s accolades are completely false as well. They claim he invented the Soniccare toothbrush and several other bogus accomplishments that are quickly debunked with a quick Wikipedia search; as well as, claiming he is a billionaire, but he’s not on the Forbes list.