MWR Financial Review: MWR Life’s finance subscription goes solo

MWR Financial appears to be a new division of the MWR umbrella of companies.

MWR Financial appears to be a new division of the MWR umbrella of companies.

MWR started off as My Warranty Rewards in late 2013. The company is founded by Jay Tuerk and Yoni Ashurov.

In 2015 My Warranty Rewards was rebooted as MWR Life. In addition to the original warranty plan, MWR Life added several additional phone-based services.

I initially figured MWR Financial was another reboot. MWR Life however is still operating under Yoni Ashurov as CEO.

The primary difference between MWR Life in 2015 and today is that it appears to have switched to the travel niche.

Neither Ashurov or Tuerk are mentioned on the MWR Financial website. And outside of having “MWR” in its name, you’d be forgiven for thinking the two companies aren’t related.

The Florida corporate address provided on both company websites however is the same, confirming MWR Financial is, at least on paper, part of Ashurov and Tuerk’s MWR brand.

Cited as CEO of the company on MWR Financial’s website is Brian House (right).

Cited as CEO of the company on MWR Financial’s website is Brian House (right).

On his LinkedIn profile, House additionally credits himself as a co-founder of MWR Financial.

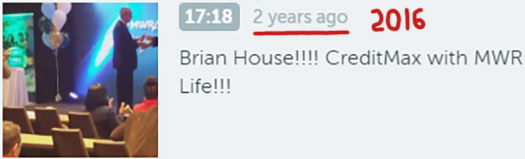

House does have MLM executive experience through Youngevity. The only MWR connection I was able to make pre MWR Financial though was a livestream recorded two years ago:

Note that the stream itself is unavailable so we only have the title above to go on.

The exact ownership structure of MWR Financial isn’t clear, but I suspect Ashurov and Tuerk are unnamed co-founders.

Well they’d have to be, otherwise this is all one unbelievable coincidence.

MWR Financial could of course clarify all of this on their website but for whatever reason have chosen not to.

Read on for a full review of the MWR Financial MLM opportunity.

MWR Financial Products

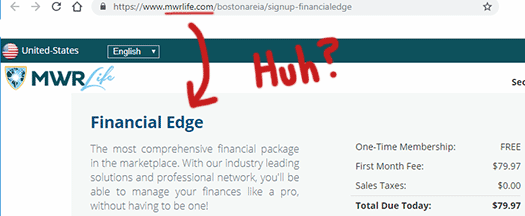

MWR Financial’s only product is Financial Edge, a $79.97 monthly subscription to financial themed services.

Financial Edge is marketed as ‘the most comprehensive financial package in the marketplace’ and provides access to

- CreditMax – credit correct and consulting

- EquityMax – debt management software

- MoneyMax – “provides you with UNLIMITED access to top rated CPA’s and CFP’s” and access to TaxBot

- WealthMax – “financial literacy, education and mentorship program”

- Debt Resolution Center – “offers the most comprehensive solutions for your financial problems”

MWR Financial claim the above services are offered through Diversified Financial Services LLC.

Each Service accessible through the Plan shall be provided by the Service Provider offering that particular Service.

(MWR Financial) is only a Marketing and Administrative Agent for each Service Provider.

The MWR Financial Compensation Plan

The MWR Financial compensation plan revolves around the sale of Financial Edge to retail customers and recruited affiliates.

MWR Financial Affiliate Ranks

There are six affiliate ranks within the MWR Financial compensation plan.

Along with their respective qualification criteria, they are as follows:

- Manager – generate and maintain three monthly Customer Points, recruit at least one qualified affiliate and have at least three affiliates on the first level of your unilevel team

- Senior Manager – generate and maintain five monthly Customer Points, maintain at least one personally recruited qualified affiliate and at least three unilevel legs with a Manager in each

- Area Manager – generate and maintain seven monthly Customer Points, maintain at least one personally recruited qualified affiliate and at least three unilevel legs with a Senior Manager in each

- District Manager – generate and maintain nine monthly Customer Points, maintain at least one personally recruited qualified affiliate and at least three unilevel legs with a Area Manager in each

- Regional Manager – generate and maintain eleven monthly Customer Points, maintain at least one personally recruited qualified affiliate and at least three unilevel legs with a District Manager in each

- National Manager – generate and maintain thirteen monthly Customer Points, maintain at least one personally recruited qualified affiliate and at least three unilevel legs with a Regional Manager in each

Retail Commissions

MWR Financial affiliates are paid an $80 customer bonus per retail customer they sign up.

Note if a retail customer cancels after their first month only $40 is paid out.

A residual retail commission is paid out monthly, based on the total number of retail customer subscription an affiliate has active:

- 10 retail customer subscriptions = $25 bonus

- 25 retail customer subscriptions = $75 bonus

- 50 retail customer subscriptions = $200 bonus

- 100 retail customer subscriptions = $500 bonus

Coded Retail Customer Commission

Each retail customer subscription generates an $8 coded bonus.

This bonus is paid out as follows:

- Managers receive up to 25 cents

- Seniors receive up to 50 cents

- Areas receive up to $3.50

- Districts receive up to $4.50

- Regionals receive up to $5.50

- Nationals receive up to $8

When a new retail customer pays their monthly Financial Edge subscription, the system searches upline for a qualified Manager or higher affiliate.

The first affiliate found is paid their maximum rank coded bonus.

The system then searches higher to pay the remaining coded bonus out to.

When a National affiliate is found, they are paid what is left of the $8 coded bonus.

If the first upline affiliate found is a National, they are paid the full $8 coded bonus.

Qualified Qualification

Certain MWR Financial commissions and bonuses require an affiliate to be qualified.

Qualified qualification requires an MWR Financial affiliate to be up to date with membership fees and be generating at least three Customer Points a month.

- purchase Financial Edge as an affiliate = 2 Customer Points

- sell Financial Edge to a recruited affiliate or retail customer = 2 Customer Points

- pay monthly affiliate membership fee = 1 Customer Point

Recruitment Bonuses

MWR Financial affiliates are paid a Momentum Bonus based on the following recruitment criteria:

- recruit three qualified affiliates within your first thirty days and receive $150

- recruit three qualified affiliates who each recruit three qualified affiliates within forty days and receive $450

- recruit three qualified affiliates who each recruit three qualified affiliates within ninety days and receive $900

Expansion Bonus

The Expansion Bonus is paid when downline affiliates achieve Qualified qualification.

If a personally recruited affiliate becomes Qualified within thirty days of signing up, the affiliate who recruited them is paid a $25 Expansion Bonus.

A residual coded Expansion Bonus is also paid out as follows:

- Manager receive up to $10

- Senior receive up to $20

- Area receive up to $45

- District receive up to $55

- Regional receive up to $65

- National receive up to $75

The coded Expansion Bonus pays a maximum of $75.

When a MWR Financial affiliate achieves Qualified status, the system searches upline for a Manager or higher affiliate.

The first found affiliate is paid their portion of the coded Expansion Bonus.

Managers are paid $10, Areas are paid $45, Districts are paid $55 and so on.

What’s left is paid to higher ranked affiliates, until a National affiliate is found and the entire $75 is paid out.

Note that if a National affiliate is found upline, they receive what hasn’t been paid out of the $75 to lower ranked affiliates.

This can be as high as the entire $75 if they are the first upline affiliate found.

Daily Guarantee Commissions

MWR Financial pay a Daily Guarantee commission based on monthly Customer Points generated by an affiliate and those they personally recruit.

- 9 Group Customer Points = $5 a day

- 36 Group Customer Points = $20 a day

- 150 Group Customer Points = $30 a day

- 300 Group Customer Points = $50 a day

- 550 Group Customer Points = $100 a day

- 1100 Group Customer Points = $150 a day

- 1750 Group Customer Points = $200 a day

- 2750 Group Customer Points = $300 a day

- 4250 Group Customer Points = $500 a day

- 9250 Group Customer Points = $1000 a day

The above amounts are “paid as a topup against the previous month’s

earnings, inclusive of Luxury Vehicle Club bonuses”.

Note that no more than one third of the monthly Group Customer Point amount can come from any one unilevel leg.

To qualify for Daily Guarantee Commissions, an affiliate must recruit and maintain three qualified affiliates and one retail customer subscription.

Check Match Bonus

MWR Financial pay a 25% check match on residual commissions earned by personally recruited affiliates (excluded Daily Guarantee commissions).

Presidential Bonus

Area Manager and higher ranked MWR Financial affiliates qualify for the Presidential Bonus.

The Presidential Bonus is paid out monthly, based on Customer Point generation by an affiliate and their personally recruited affiliates.

- 225 Group Customer Points a month = $500 bonus

- 750 Group Customer Points a month = $1000 bonus

- 1750 Group Customer Points a month = $2500 bonus

- 3750 Group Customer Points a month = $5000 bonus

- 7500 Group Customer Points a month = $10,000 bonus

- 11,250 Group Customer Points a month = $15,000 bonus

- 18,750 Group Customer Points a month = $25,000 bonus

- 37,500 Group Customer Points a month = $50,000 bonus

- 75,000 Group Customer Points a month = $100,000 bonus

A 50% match is paid on the Presidential Bonus.

25% is paid to the first Presidential Bonus qualified affiliate.

The other 25% is paid to the first upline Presidential Bonus qualified affiliate earning a higher tier of the bonus.

Note that up to 33.3% of required group Customer Points can be sourced from any one unilevel leg.

Car Bonus

Senior Manager and higher ranked affiliates can qualify for a monthly Car Bonus payment as follows:

- generate and maintain 200 group Customer Points a month = $500 Car Bonus

- generate and maintain 500 group Customer Points a month = $1250 Car Bonus

- generate and maintain 1750 group Customer Points a month = $3000 Car Bonus

Note that up to 33.3% of required group Customer Points can be sourced from any one unilevel leg.

Joining MWR Financial

MWR Financial affiliate membership is $99 and then $40 a month.

Affiliates who don’t pay the $40 a month fee are only paid non-MLM retail commissions.

Conclusion

I’m not really sure why MWR Financial exists.

MWR Life very much presents itself as a travel niche MLM company, based on their Travel Advantage VIP membership.

There’s no mention of the financial subscription on the front-end website.

Dig a little deeper though and, at least as of October 23rd, you’ll find MWR Life are still selling Financial Edge:

If I can subscribe to Financial Edge through MWR Life, why does MWR Financial exist?

Then there’s the whole “Financial Edge provided by a third-party merchant” thing.

Financial Edge is billed as a collection of services provided by Diversified Financial Services LLC. No information about Diversified Financial Services is provided.

My own research lead me down a wormhole of inactive LLCs, and that was only in Florida.

Key to Financial Edge being truly independent is Brian House having nothing to do with Diversified Financial Services.

And on that I’m not really sure.

House’s history directly ties him to services very much like what are offered through Diversified Financial Services.

From January 1991 to December 2016, House ran My Financial Advantage as Founder and CEO.

On House’s LinkedIn profile, My Financial Advantage is described as a

complete financial solutions company offering credit restoration, debt elimination & unlimited financial advice on demand.

Sound familiar?

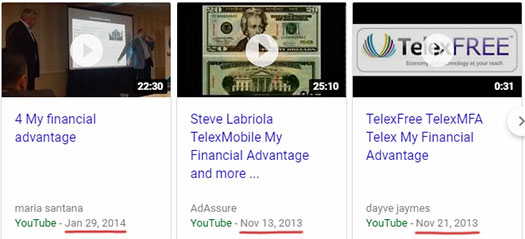

Oh and fun fact, back in 2013 My Financial Advantage was pitched to TelexFree investors, who collectively would go on to lose over three billion dollars to the Ponzi scheme.

No word on whether that was factored into My Financial Advantage’s “financial solutions” for those that signed up.

If I didn’t know any better, Diversified Financial Services is just My Financial Advantage with a new name.

But, like I said, I wasn’t able to independently confirm so take it for what it is.

Moving on to MWR Financial’s compensation plan, I have mixed feelings about the implementation of retail.

First and foremost I have to question that if Financial Edge as a retail subscription, why did MWR Life change focus?

MWR Financial have made some great efforts to encourage retail sales, including upfront, coded and sliding-scale retail commissions and bonuses – but all of that is let down by the company’s qualification criteria.

3 Customer Points, all of which can be self-purchased.

2 points for maintaining a Financial Edge subscription and 1 point for continuing to pay your $40 a month affiliate fee.

That’s all that’s initially required to qualify for MLM commissions.

Ranking up in the MWR Financial compensation plan introduces recruitment requirement and higher Customer Point amounts.

The problem is the higher Customer Point amounts can be satisfied via recruitment. 2 points per personally recruited affiliate signed up to Financial Edge if I’m not mistaken.

This signing up for Financial Edge and then recruiting affiliates who do the same means an MWR Financial affiliate can ignore retail altogether.

It drags the opportunity into pyramid scheme territory. And the only reason for that is if Financial Edge isn’t viable as a standalone retail subscription.

As a prospect MWR Financial affiliate, try paying for Financial Edge for three months before committing as an affiliate.

It’ll cost you the same as an affiliate anyway, so you’re not losing anything by doing so.

If after three months as a retail subscriber you’re satisfied you can market Financial Edge to other retail customers, proceed.

If not… well, you have your answer.

Update 4th May 2024 – BehindMLM published an updated MWR Financial review on May 3rd, 2024.

Great review. I was introduced to MWR Financial by ryan gunness who is the creator of the MLM Recruitg On Demand system.

I’ve been told via Ryan that Brian House is not connected with Ashurov or Tuerk on MWR Financial and is the sole owner / founder of MWR Financial – which seems a bit odd that his Linked In profile lists himself as “Co-founder” as you pointed out.. Must be more to the story here.

As far as the retail side goes… I know they way they are promoting it is each rep must have at least 1 retail customer in order to qualify for the daily pay… So agree with you on their efforts to stress retail…

The pricing of the product with credit restoration alone seems within the ball park… The few companies i found on Google page 1 are offering credti repair for from $60 to $99 per month – MWR Financial Edge is $79.95… Thought that was a plus as far as MLM products go.

As the CEO & Co-Founder of MWR Financial, I would like to take a minute to address all of the above.

Let me start by saying that any confusion on the part of the editor or information unable to be obtained through his/her research could have very easily been resolved by a simple phone call to myself or our corporate staff.

With that said, I hope this provides some clarity.

1) MWR Financial is a totally separate entity from MWR Life. My company (Diversified Financial Services, LLC) began offering our Financial Edge Membership to MWR Life members in January of 2017.

After 8 months, myself, along with Yoni Ashurov the owner of MWR Life, decided to create a stand alone company called MWR Financial where I own the service side and run the company, while he continues to own and run MWR Life.

This decision was made due to the fact that the services we offer were strong enough to stand on their own, while also providing a clear identity of what each company has to offer.

In regards to Jay Tuerk, he is not an active partner in either of the 2 companies.

2) Yes, I did own a company called My Financial Advantage which was an affiliate based program/company offering similar services to what you now see in Diversified Financial Services, LLC.

However, the change in name was due to contracting purposes and branding for what you now see offered in MWR Financial, which is much more diverse and comprehensive.

This was also done to avoid confusion for the field force in regards to their marketing efforts. My Financial Advantage was also never contracted with TelexFREE.

That company used our affiliate program with My Financial Advantage as one of their product offerings, but they were merely an affiliate, just like the hundreds of others that promoted our services.

When we found out about their legal issues and what they were doing to mislead the public, we immediately terminated their affiliate agreement.

Our staff supported their field force that chose to promote the program through trainings and presentations, just like we did with all affiliates and as you displayed in the videos above, but we had no corporate affiliation or partnership with TelexFREE.

3) In regards to Youngevity, I have never been a part of Youngevity’s Corporate staff.

I was a Vice-Chairman Marketing Director with a company called Financial Destination Incorporated (FDI) and one of their top money earners through their network, which was bought by Youngevity.

My company QCS, Inc was also a service provider for FDI that provided what was then referred to as the CreditTRAX division of their membership, which was a d.b.a. of QCS, Inc and what you now see as the CreditMAX division of Diversified Financial Services, LLC through MWR Financial.

I know that sounds confusing, but that’s how it transpired. LOL. I actually had no contractual obligation with Youngevity to continue providing CreditTrax to their members, but remained a service provider, until they made the decision to release Bill Andreoli as their President.

At that time, I made the decision to focus on and enhance my Financial Solutions company at the request of several former FDI members, so that it could be offered through a network marketing platform.

This lead to starting Diversified Financial Services, LLC and what is now recognized as the Financial Edge membership provided through MWR Financial.

4) As for your interpretation of our compensation plan, it is outdated and not entirely correct. Please feel free to review the correct version via the opportunity section of our website.

I would also like to mention that everything in our comp plan is vetted by our attorneys prior to implementation.

We do not question their opinion or interpretation of mlm law, instead we make sure to abide by it, in order to protect our opportunity, as well as those that choose to represent us.

We also do not pay any commissions to our field force, unless generated through customer acquisition and qualification. In other words, no commissions are ever generated for just recruiting and are only triggered when an active customer is obtained.

I think this addresses everything above, but if you or your staff have any further questions, please feel free to reach out to me at anytime.

I would also like to add that even though there is some inaccurate or potentially misleading information in your article, I appreciate what you do to inform and protect our industry from companies that may not choose to do things the right way.

With that said, have a blessed day.

Sincerely,

Brian T. House

CEO/Co-Founder

MWR Financial

Our reviews are written from the point of view of a member of the public doing their due-diligence.

If I have to call up the CEO of a company just to get basic due-diligence information, that’s a failure the company needs to address.

So it’s a *winkwink nudgenudge* “totally separate entity”. Common ownership means the two companies are tied.

Which presumably was governed by a contract. There’s no sugar coating the fact greed took precedence over due-diligence when you let TelexFree sign up.

They weren’t exactly some unknown company. And as evidenced in the review, My Financial Advantage TelexFree marketing was widespread.

Did you return the money you made off TelexFree Ponzi victims?

Thanks for the heads up. I’ll flag this review for an update.

Me: I just addressed them publicly here and I have no issue with providing this information to anyone, just like I did with you.

I would also mention that having the ability to call and discuss this with me personally is probably not an offer you would get from most CEOs, but I was willing to extend you that courtesy.

However, as I addressed above, the 2 companies were separated to avoid confusion and to establish their own identities. Posting irrelevant information on our site or anywhere else, would just add confusion and defeat the purpose of the separation in the first place.

Me: No “winkwink nudgenudge”. I just explained that they we were tied originally and separated the 2 companies later. What part of that is a winkwink nudgenudge?

They weren’t exactly some unknown company. And as evidenced in the review, My Financial Advantage TelexFree marketing was widespread.

Me: No greed involved, just business and we let lots of people sign up as affiliates, not just TelexFREE or its members.

I was unaware that we needed to do a background check on every affiliate and my company had no way of knowing they were a Ponzi Scheme, just like we didn’t know what all of our other affiliates did in their day to day jobs/businesses either.

Our interests were strictly based on providing the service requested by the clients they referred.

Me: We didn’t have to, because we were a totally separate company that was not a party to what they did and we also provided and completed the services purchased through us for each client they referred, even long after they were gone and accused of being a Ponzi Scheme.

Me: I’m not sure what your intentions are with this commentary and out of respect for everyone’s opinion and our field force I felt compelled to reply. However, I’m also not sure any response I could give you no matter how forthcoming or truthful would make a difference.

I have attempted to answer your comments and concerns in an honest, respectful manner, only to be met with a condescending attitude that does not reciprocate the same level of respect.

With that said, should you wish to continue this conversation any further, I would request that you afford me the same respect, that I have shown to you.

Sincerely,

Brian T. House

CEO/Co-Founder

MWR Financial

Well somebody did, because it wasn’t on the MWR Financial website when I researched the review.

The *winkwink nudge nudge* is that common ownership selling the same products is separation in name only.

If I started BehindMLM2 covering the MLM industry, sure I can go around pretending it’s a completely separate website and technically I’d be correct. But obviously I’m being disingenuous.

Sure you did. If I could work out TelexFree was a Ponzi scheme based on publicly available information in July 2012, anyone could have.

I’d also wager given the level TelexFree was marketing My Financial Advantage it’d have had to have popped up on your radar. This wasn’t some random affiliate signing up and making a few sales.

As for a background check, how many months was TelexFree a My Financial Advantage affiliate?

Not getting the response you’re after has nothing to do with respect. As far as I was aware this was an honest, respectful conversation.

Anyway I don’t want to get hung up on TelexFree. The fact of the matter is My Financial Advantage turned a blind eye to TelexFree’s Ponzi scheme, so long as the money rolled in.

This continued until TelexFree’s mounting regulatory problems became to big to ignore. Ignorance, willful or otherwise, is not an excuse.

It is what it is. On your information about the comp plan having changed since six months ago, I’ll be publishing an updated review when MWR Financial comes up.

Is this or is this not someone from My Financial Advantage corporate speaking at an official TelexFree event and urging Ponzi investors to sign up?

youtube.com/watch?v=Dg96drQ3ywQ

Sheeeeet. If I signed up as a My Financial Advantage affiliate, you gonna send someone from corporate to my house to personally recruit for me?

Just another affiliate we knew nothing about. Bitch please. Tubby has has nothing but dollar signs in his eyes.

That event was from late 2013/early 2014, by which stage regulatory action against TelexFree was well underway in Brazil.

Don’t expect respect if you aren’t willing to first give it. You can start by dropping the attempted whitewash of the corporate relationship between My Financial Advantage and TelexFree.

Again, I have already stated my position on all of the matters above and you can see it as you wish.

As for your B—- please comment, I’m not your b—- and that’s exactly the lack of respect I was referring to and now you can add unprofessionalism, which will get you no further online discussion from me, after this reply.

As for the video you posted, yes that was one of our company representatives at a TelexFREE meeting and you can insinuate or believe whatever you want, but we had no clue TelexFREE was a Ponzi Scheme, just like the numerous other people that were scammed by them, including the people in that room and when we found out, we immediately terminated their affiliate agreement.

Apparently all of the people in that room did not do their due diligence either. We also did meetings for other companies that marketed our program all across the country from various different industries, not just TelexFREE.

I would also add that we continued working for the people they referred, many of which continued as affiliates with My Financial Advantage and marketed our services after the demise of TelexFREE. honoring our agreement with them individually.

As for your Dollar signs comment, yes we are in business to make money, but more importantly to help people. I was unaware that that was wrong and if so, your comment would indicate you don’t believe it’s right for any company to make a profit and you choose to bash those that do.

The difference is whether you are providing value to the people that choose to purchase your products/services. We provide value and help people!

If making money off of that is wrong then I guess we are wrong, at least in your eyes, but not the people we serve or that support us. My companies have serviced over 100,000 clients over the years maintaining a stellar reputation in the process and I take great offense to the way you are attempting to spin the truth in order to boost your sites ratings.

This is the type of online rhetoric that can hurt good people and good companies. If your intention is to educate and inform people then I would recommend you also point out the good we are doing, instead of trying to portray everything as bad or accuse us or any other company of knowingly doing something wrong, without knowing the facts.

With that said, if you would ever like to do an interview with me in person, instead of making derogatory comments and insinuations from behind a computer, please let me know. I would be more than willing to provide you with clarity on anything you would like to know about me or my companies.

Have a great day and God Bless!

Sincerely,

Brian T. House

CEO/Co-Founder

MWR Financial

All good here. I’m not the one writing novels to try and explain away getting into bed with TelexFree.

Readers can watch the video and draw their own conclusion as to why a financial services company didn’t spot a $3.6 billion dollar Ponzi scheme.

All the best.

So MWR Rewards came up for a review update today.

I just finished going through the comp plan and literally the only difference was rank removal from the car bonus.

Had Brian just mentioned that back on April 24th, it’d have taken me 2 minutes to update the review.

Anyway, I’ve updated the car bonus qualification by removing the rank requirements.

Seeing as that’s the only change and minor, the rest of the review stands as accurate (as of the date of this comment).

Hello how are you doing today sir? Is your company registered with the BBB and if so what was the rating?

Thank you so very much for time and have a productive day.

Surely the BBB website has a search function? Just punch MWR Financial into it.

The long response the Mr. House gave was probably really not intended to explain away his involvement with Telexfree, but rather a deflection of your deeper question of ownership which he conveniently did not respond to in the sappy novel he wrote.

Notice how carefully he chooses his words here….mentioning that Ashurov OWNS MWRL, and he(house) runs MWRF ….never explicitly says he owns MWRF, and never explicitly says Ashurov doesn’t own MWRF. They took some time to write that paragraph.

After 8 months, myself, along with Yoni Ashurov the owner of MWR Life, decided to create a stand alone company called MWR Financial where I own the service side and run the company, while he continues to own and run MWR Life.

He simply says he owns the service side which was always his relationship with the company from the beginning.

This by far is the funniest and interesting review you’ve done on a mlm company.

Sure theres always bad to mlm companies like they’re are to every company, but man that CEO was bouncing around the truth.

HOW MUCH DOES THE ENTIRE MWRFINANCIAL MAKE PER YEAR OR VALUE OF THE COMPANY. EXAMPLE 5MILLION, 2MILLION ETC.

That’s a question for MWR Financial. It’s not a public company so why would we have this information?

Oz – I appreciate your review and agree it may be good to try out the service FIRST as a customer to see how it is and if it is worth it.

I may actually do this myself as I am interested in their service. $79.95 comes across a little steep, but it depends on the value truly received from the service.

As an affiliate (or whatever they call it), they pay out $40 initially when someone signs up for the $79.95 service (not bad), but then only $10 a month moving forward (fairly low in my opinion).

Brian House’s responses seemed straight forward to me and I thought it was good for him to correct some things he thought were incorrect/misleading.

If the service has value (not sure yet) then it is not a “scam”. It may be possibly overpriced (typical with network marketing so they can pay $ up the food chain).

As I have no mortgage anymore (no need for EquityMax) and excellent credit (no need for CreditMax), I am more interested in WealthMax and how they help those that wish to invest and build wealth. I can see how these other services could be beneficial to others.

If I decide to sign up for the service and try it, I will report back my findings here on the value vs. cost.

They only have a 3-day cancel policy, which isn’t really much time to delve into the services so I may have to bite the bullet on the entire $79.95, even if I don’t see the value (that would be unfortunate).

Do any readers have any reviews on the WealthMax part of the service?

I don’t review stand-alone services offered within MLM opportunities.

That said a 3 day cancel window isn’t confidence inspiring.