Margin Secure Lending Review: “Blockchain lending” Ponzi

Margin Secure Lending fails to provide ownership or executive information on its website.

Margin Secure Lending fails to provide ownership or executive information on its website.

Margin Secure Lending’s website domain (“marginsl.com”), was privately registered on April 19th, 2023.

On its website, Margin Secure Lending claims to be

Asia based and deals with Global participants.

Margin Secure Lending’s official FaceBook group is adminned by “Hu Ming”, a recently created dummy account.

If we look at Margin Secure Lending’s presentation properties, we learn the author is Panashe Alphonce Chigodora.

If we look at Margin Secure Lending’s presentation properties, we learn the author is Panashe Alphonce Chigodora.

Chigodora is a “crypto enthusiast” from Africa.

According to his FaceBook profile, Chigodora is originally from Zimbabwe but lives in South Africa.

This tracks with the majority of Margin Secure Lending promoters appearing to be from Africa.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

Margin Secure Lending’s Products

Margin Secure Lending has no retailable products or services.

Affiliates are only able to market Margin Secure Lending affiliate membership itself.

Margin Secure Lending’s Compensation Plan

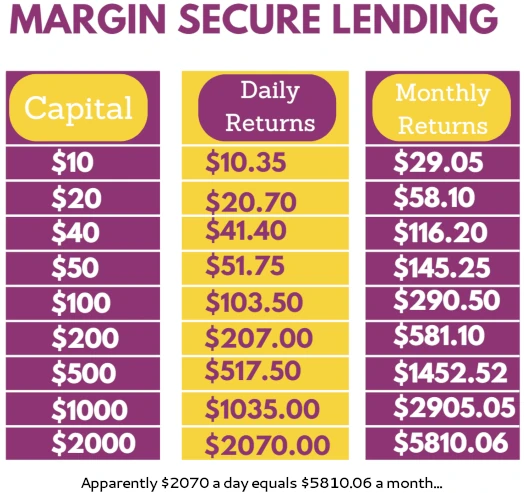

Margin Secure Lending affiliates invest $10 or more in tether (USDT). This is done on the promise of an “up to” 3.5% daily return.

Margin Secure Lending pays referral commissions on invested tether down three levels of recruitment (unilevel):

- level 1 (personally recruited affiliates) – 15%

- level 2 – 7%

- level 3 – 3%

Joining Margin Secure Lending

Margin Secure Lending affiliate membership is free.

Full participation in the attached income opportunity requires a minimum $30 investment in tether.

Margin Secure Lending Conclusion

Margin Secure Lending claims to generate external revenue via “blockchain lending”.

MSL is a blockchain lending platform that provides a secure and transparent lending experience.

The ruse is Margin Secure Lending generates fees from lent out crypto, which is used to fund returns.

There is no evidence of Margin Secure Lending being engaged in lending, or any other source of external revenue.

Furthermore, Margin Secure Lending’s business model fails the Ponzi logic test.

If Margin Secure Lending was already lending out crypto and generating 3.5% a day, what do they need your money for?

As it stands the only verifiable source of revenue entering Margin Secure Lending is newly invested funds.

Using newly invested fund to pay an “up to” 3.5% daily return makes Margin Secure Lending a Ponzi scheme.

With nothing marketed or sold to retail customers, referral commissions on invested funds adds an additional pyramid layer to the scheme.

Margin Secure Lending’s fraudulent business model is punctuated by Panashe Chigodora being your typical crypto bro.

Behind Panashe Chigodora you have the usual string of failed crypto projects and shitcoin plugs. Him hiding his involvement in Margin Secure Lending casts further doubt on the company’s claims.

As with all MLM Ponzi schemes, once affiliate recruitment dries up so too will new investment.

This will starve Margin Secure Lending of ROI revenue, eventually prompting a collapse.

The math behind Ponzi schemes guarantees that when they collapse, the majority of participants lose money.