GPayBack Review: GPay token staking model Ponzi

GPayBack fails to provide ownership or executive information on its website.

GPayBack fails to provide ownership or executive information on its website.

GPayBack’s website domain (“gpayback.io”), was privately registered on November 24th, 2023.

Further research reveals a GPayBack marketing video hosted on Simon Stepsys’ YouTube channel:

In the video, Andre Heber is introduced as GPayBack’s founder.

Andre Heber popped up on BehindMLM’s radar in 2016, as owner of the collapsed Infinity DailyWin Ponzi.

Through a convoluted voucher ruse, Infinity DailyWin pitched consumers on a 120% to 135% ROI.

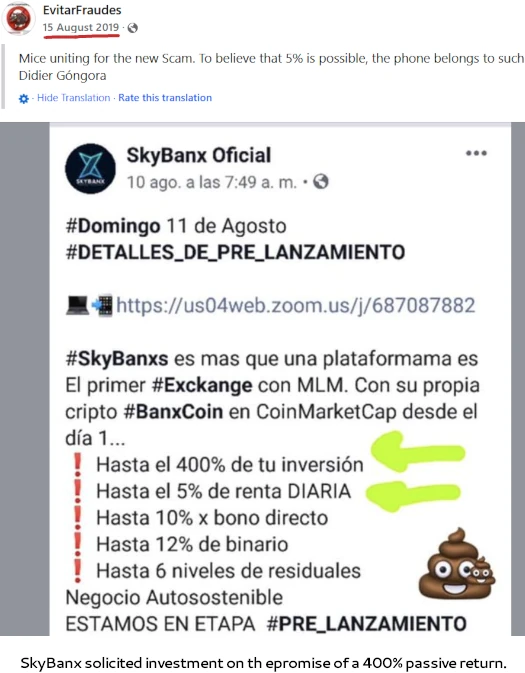

In 2019 Heber resurfaced as CEO of SkyBanx.

SkyBanx was an MLM crypto Ponzi that targeted Spanish speakers. SkyBanx pitched consumers on a 400% ROI, paid out at 5% a day.

Returns were purportedly generated via a non-existent trading bot.

SkyBank ran its fraudulent investment scheme through BanxCoin. Today neither SkyBanx or BanxCoin exist.

In the GPayBack marketing video on Simon Stepsys’ channel, Heber states he “lives in the Caribbean.”

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

GPayBack’s Products

GPayBack has no retailable products or services.

Affiliates are only able to market GPayBack affiliate membership itself.

GPayBack’s Compensation Plan

GPayBack affiliates purchase “packages”. The more spent on a package, the more a GPayBack affiliate can load onto a MasterCard branded debit card.

- Basic – pay $100 and be able to load up to $5000

- Plus – pay $300 and be able to load up to $10,000

- Advance – pay $1000 and be able to load up to $40,000

- Pro – pay $4000 and be able to load up to $90,000

- Elite – pay $10,000 and be able to load up to $500,000

Once the load limit is reached or a year is up, a new package must be purchased to continue earning.

Attached to GPayBack’s cards is an investment scheme.

- GPayBack affiliates receive the equivalent they pay for a package in GPAY tokens

- as users spend money with their GPayBack card, a 5% cashback is paid in GPAY tokens.

GPAY tokens are then staked with GPayBack on the promise of an annual passive return:

- Basic tier affiliates receive 4.75% a year on staked GPAY tokens

- Plus tier affiliates receive 6.25% a year on staked GPAY tokens

- Advance tier affiliates receive 8.25% a year on staked GPAY tokens

- Pro tier affiliates receive 8.75% a year on staked GPAY tokens

- Elite tier affiliates receive 10.25% a year on staked GPAY tokens

The MLM side of GPayBack pays referral commissions on package purchases down three levels of recruitment (unilevel):

- level 1 (personally recruited affiliates) – 10%

- level 2 – 7%

- level 3 – 3%

Joining GPayBack

GPayBack affiliate membership is free.

Full participation in the attached income opportunity requires a $100 to $100,000 package purchase.

GPayBack Conclusion

There are essentially two tiers to GPayBack, both of which circle back to securities fraud.

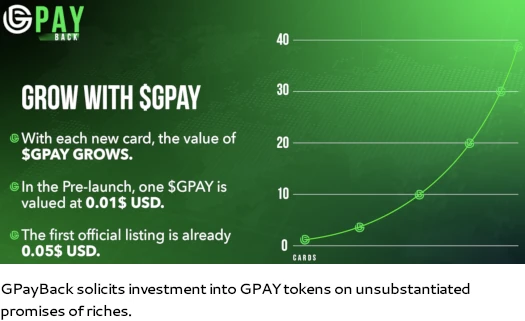

The first tier is “package purchases” are investment upon consideration of corresponding GPAY tokens.

Invest $300 at the Plus tier and receive $300 worth of GPAY tokens. Invest $10,000 at the Elite tier and receive $10,000 worth of GPAY tokens and so on.

The investment loop is completed by staking GPAY tokens (you can’t do anything else with them), on which passive returns are paid.

The GPAY token itself is a BSC-20 shit token GPayBack created and, at time of publication, only exists internally.

BSC-20 tokens can be created in a few minutes at little to no cost.

The second tier of GPayBack is the “cashback” of GPAY tokens corresponding with card spend. As previously stated, GPayback generates GPAY tokens out of thin air on demand, so offering “cashback” doesn’t cost the company anything.

What does cost GPayBack something is paying out ROI withdrawals. As it stands the only source of verifiable income entering GPayBack is package investment.

It doesn’t make any sense to pay $10,000 to load a MasterCard up with $500,000, without the attached GPayBack investment scheme.

Thus it follows that without a verifiable source of external revenue, either completely or in part, GPayBack is recycling package investment to pay GPAY ROI withdrawals.

This is your classic “staking” Ponzi model.

On the regulatory side of things, GPayBack fails to provide evidence it has registered its “staking” investment scheme with financial regulators in any jurisdiction.

This constitutes securities fraud, which tracks with GPayBack running a Ponzi scheme.

On the topic of regulators, I’m also noting GPayBack’s MasterCard offering is extremely suss.

KYC isn’t optional for merchants offering access to MasterCard’s network. GPayBack claiming they can offer MasterCard cards without KYC suggests something extremely dodgy is going on.

Typically when you see MasterCard or Visa cards touted by an MLM company committing securities fraud, access is through a shell company hooked up to a dodgy merchant.

GPayBack don’t disclose how they are offering MasterCard cards but do suggest it is being done through Mexico.

The GP Card is based in Mexican Peso (MXN). Bank commissions are exclusive and determined by the respective institutions.

Should MasterCard investigate, GPayBack’s entire investment scheme falls apart.

Said scheme is also contingent on Google and Apple not detecting or taking action on GPayBack’s verifiable securities fraud.

As with all MLM Ponzi schemes, once affiliate recruitment dries up so too will new investment.

This will starve GPayCard of ROI withdrawal revenue, eventually prompting a collapse.

The math behind Ponzi schemes guarantees that when they collapse, the majority of participants lose money.

One need only look to Andre Heber’s previous schemes, Infinity DailyWin and SkyBanx, to see this in action.