Financial Education Services Review: $715 commission on $499 sale?

Financial Education Services operates in the financial services MLM niche. The company provides a PO Box address in the US state of Michigan on their website.

Financial Education Services operates in the financial services MLM niche. The company provides a PO Box address in the US state of Michigan on their website.

Heading up Financial Education Services are co-founders Parimal Naik (CEO) and Mike Toloff (President).

According to Naik’s LinkedIn profile, Financial Education Services was initially launched as VR Tech back in 2004.

According to Naik’s LinkedIn profile, Financial Education Services was initially launched as VR Tech back in 2004.

To the best of my knowledge, Financial Education Services is the first MLM venture Parimal Naik and Mike Toloff have operated.

Read on for a full review of the Financial Education Services MLM opportunity.

Financial Education Services Products

Financial Education Services’ flagship product is their Protection Plan, of which credit repair is the primary advertised service.

The FES Protection Plan is a powerful program which encompasses many of our unique financial products.

Unlike any other financial service on the market, the FES Protection Plan is designed to cover all aspects of your financial portfolio.

Services advertised as part of the Protection Plan include:

- credit education

- credit builder

- credit attorney

- smart credit

- FES Debt Zero

- Lifelock

- Financial Lockbox

- life insurance

- FES Travel

- MyCare Plan

- discount shopping

- FRL Family Mint

- RX Discount Card

The life insurance appears to be provided by Symetra Insurance Company. No specific information on any of the other services offered is provided.

Financial Education Services charge $188 and then $89 a month for the Protection Plan.

Note however that the Financial Education Services compensation plan states the plan costs $499 (as of April 2018).

Other services advertised on the Financial Education Services website include:

- MyCare Plan – will and trust planning package, retails at $499

- LifeLock – identity theft protection, retail cost not provided

- Secure Card – a “Platinum MasterCard with a credit line based on a security deposit rather than on a credit score”, $49 annual fee

- Smart Credit – credit report with money manager, retails at $14.95 a month

- Merchant Services – credit and debit card payment services, retail cost not provided

- Ultra Score – credit potential guide, retails at $149

- Rent Reporting – offers to build credit score through rent payments, upfront retail costs are $25 to $145 and then $6.95 a month

To the best of my knowledge all of Financial Education Services’ offered services are provided by third-party companies.

The Financial Education Services Compensation Plan

The Financial Education Services compensation plan pays commissions on the sale of advertised third-party services.

Financial Education Services Affiliate Ranks

There are nine affiliate ranks within the Financial Education Services compensation plan.

Along with their respective qualification criteria, they are as follows:

- Agent – sign up as a Financial Education Services affiliate and maintain a personal protection plan subscription

- Field Trainer – generate $1600 GV a month

- Senior Field Trainer – generate $5000 GV a month

- Sales Director – generate $10,000 GV a month

- Regional Sales Director – qualification criteria not provided

- Executive Sales Director – qualification criteria not provided

- Ambassador – qualification criteria not provided

- Regional Ambassador – qualification criteria not provided

- Executive Ambassador – qualification criteria not provided

GV stands for “Group Volume” and is sales volume generated by an affiliate’s downline.

Commission Qualification

To qualify for commissions, each Financial Education Services affiliate must maintain a Protection Plan subscription.

Direct Commission

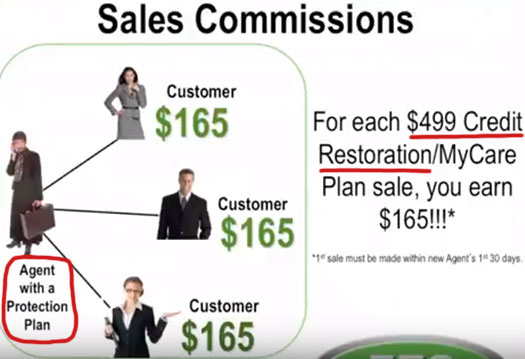

Financial Education Services affiliates are paid a $165 commission per $499 service sold.

Note that an affiliate’s first sale must be made within their first 30 days.

Customer Acquisition Bonus

If a Financial Education Services affiliate recruits a new affiliate who goes on to generate $399 within their first 70 days, the recruiting affiliate receives a Customer Acquisition Bonus.

The Customer Acquisition Bonus is based on rank:

- Agent – $100

- Field Trainer – $160

- Senior Field Trainer – $240

- Sales Director – $380

- Regional Sales Director – $430

- Executive Sales Director – $480

- Ambassador – $510

- Regional Ambassador – $530

- Executive Ambassador – $550

A residual Customer Acquisition Bonus is paid via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

The residual component of the Customer Acquisition Bonus is paid via a coded rate.

First, when an affiliate in the unilevel team makes a sale, they are paid their Customer Acquisition Bonus rate based on their rank (see rates above).

If that affiliate is not an Executive Ambassador, the system searches upline (higher up the unilevel team) for a higher ranked affiliate.

They receive the difference paid between their rank and that of the affiliate who made the same.

If the found affiliate is not an Executive Ambassador, the system then searches higher.

The difference paid at each rank continues to be paid out until an Executive Ambassador is found the entire $550 per sale is paid out.

E.g. a downline Sales Director makes a sale.

They receive their $380, leaving $170 to be paid out.

The system searches upline and a few levels up finds an Ambassador ($510 rate).

The system pays this Ambassador $130 ($510 minus $380 already paid out), and continues to search farther up for either a Regional Ambassador or an Executive Ambassador.

If a Regional Ambassador is found first ($530 rate), they are paid $20 ($530 minus the $510 already paid out).

The system then searches higher for an Executive Ambassador, who receives the final $20 of the total $550 Customer Acquisition Bonus.

If an Executive Ambassador is found first ($550 rate), they are paid $40 ($550 minus the $510 already paid out) and the system stops searching.

R&R Club

Financial Education Services affiliates who have a recruited downline of at least 500 affiliates with active personal protection plans, qualify for R&R Club bonuses.

These include:

- a monthly Audi car payment

- one-time cash bonuses

- upgraded monthly Audi car payment

- a monthly house payment

- a monthly retirement bonus

- additional cash bonuses

Note that specifics regarding the R&R Club are not provided in the Financial Education Services compensation plan.

Joining Financial Education Services

Joining Financial Education Services costs either $249 or $199 and then $89 a month (Protection Plan).

Considering a Protection Plan subscription is required to qualify for commissions, why there’s a $249 affiliate membership option is unclear.

Conclusion

There’s a bit of a disconnect between Financial Education Services compensation plan and offered services.

The compensation plan is very much geared toward sale of $499 service sales, which as far as I can tell is only the My Care will and trust planning package.

The compensation plan cites a $499 credit restoration service, which on the My Financial Education Services website is only $188.

I had considered maybe credit repair was bundled with My Care, however there’s no mention of credit repair on the My Care product service page. Not sure what the story is there.

In any event, Financial Education Services is pretty much a middle-man company connecting retail customers and affiliates with third-party services.

Retail is possible, however with affiliates forced to buy a service subscription to qualify for commissions, I’m not convinced it’s a focus.

Financial Education Services’ Income Disclosure Statement for 2017 certainly isn’t convincing.

According to the IDS, a whopping 95.6% of all Financial Education Services affiliates are at the Agent rank.

Of this 95.6% of the total affiliate-base, just 26.6% are qualified to earn commissions.

Company-wide, just 29.5% of Financial Education Services affiliates are qualified to earn commissions.

Why are less than a third of Financial Education Services affiliates paying for a service they have to sign up for just to earn commissions?

I believe the answer may lay in pricing.

One thing that struck me as odd in the Financial Education Services compensation plan was that it was entirely geared toward making $499 sales.

Once made, the compensation plan pays $165 upfront and then up to $550 residually.

That’s $715 paid out on a $499 service sale (I have no idea about the other services because the compensation plan only appears to pay out on $499 accumulated sales).

One possibility is that Financial Education Services are passing along some of the commission they receive, but still… if $715 is paid out on a $499 retail cost – what is the actual value of the service?

Is that why the majority of Financial Education Services affiliates aren’t paying for services (even though they have to for commission qualification)?

And if your own affiliates aren’t paying, why would retail customers?

I know I wouldn’t buy something if I knew 100% of what I was paying went straight into the pocket of the person selling it to me.

First thing I’d do is question the value of the product, work out what it’s actually worth and set about purchasing it elsewhere close to the actual cost.

Simply put: From a retail perspective Financial Education Services doesn’t make much sense.

And for a company calling itself Financial Education Services, the company sure does a poor job of educating potential visitors as to the finer financial aspects of its business opportunity.

The remedy of all of this would be greater disclosure on the Financial Education Services website.

Where does the money go, how much and to whom.

Given VR Tech launched fourteen years ago and this is where we’re at today though, don’t hold your breath.

Update 15th January 2021 – The state of Georgia has fined Financial Education Services $1 million for running a pyramid scheme.

Update 1st June 2022 – The FTC has sued Financial Education Services.

The regulator alleges FES is a $467 million dollar pyramid scheme.

Update 6th August 2024 – Financial Education Services has settled with the FTC for $324 million.

This article is very inaccurate and misguided. It’s been 4 years since the Protection Plan is $188 instead of 499.

The titles mentioned above are long gone. The compensation plan is extremely lucrative. The best I have seen so far.

Stop writing false articles to destroy. Financial Education Service is one of the absolute best Network Market.

It’s changing so many lives and bank accounts with a service that people love.

I think the word you’re looking for is “outdated”.

That said;

It’s entirely not my problem if Financial Education Services are misleading the public with out of date compensation plans.

The date this review was published is clearly present under the title. If you missed those very obvious numbers perhaps a career in financial services isn’t for you.

It doesn’t bode well when an MLM company changes its compensation plan within six months of us publishing a review. Nonetheless I’ve flagged this review for an update.

proof? verifiable, non scam proof that is.

Financial Education Services came up for an updated review today and after putting some research in, I have no idea what Jocelyn is talking about.

Financial Education Services fails to provide a copy of their compensation plan on their website.

On the official Financial Education Services website there’s a compensation plan video dated April 2018.

https://www.youtube.com/watch?v=qpkvj3e025c

At [1:50] into the video you can see the Credit Restoration and MyCredit plans are $499 retail.

I believe I might have even crosschecked my breakdown of the Financial Education Services compensation plan with this video prior to publication.

In any event the April 2018 video is from Financial Education Services corporate. I’m not aware of any updates since then and FES don’t provide any on their website.

There doesn’t appear to be any need for an updated review at this time.

The info in this review is outdated. No worries it happens. Great company with great services.

Anyone can check the YT link I provided and see the compensation plan information is current.

Funny how nobody can seem to provide “updated” information hey.

I’ve got someone trying to recruit me for this company… sounds too good to be true.

All the information I have received thus far just screams Ponzi scheme and all of the videos I have seen are ALL the same.

Seems like people with a camera and a script …..

it’s funny that people who are not even apart of this company are experts in this company (LOL) they are they same types of lookie-loos and stay on the couch tire kickers!!!!

people that don’t actually pull the trigger on anything and wonder why they only have a 9-5 (JOB) =just over broke.

it CAN’T be a PONZI SCHEME because they actually sell a service that being credit repair and monitoring (Ozedit: recruitment spam removed)

I guess other’s just enjoy being a slave to their job and boss they are the same people who DESERVE to STAY POOR AND BROKE !!!

Here comes another new recruit with a fresh copy of “MLM cliches 101″…

What’s funny about it? Doing due-diligence before joining any MLM opportunity is responsible business.

We don’t actually mention Ponzi scheme in our review, but the notion that attaching a product/service to a Ponzi scheme makes it any less of a Ponzi scheme is false.

If one have done there research the one would know thay the actual facts are as such.

The my care plan which if purchased without the protection plan is $ 499, but if the protection plan is purchased which is $188 and within the protection plan you will receive the my care plan which is $188.

So looks like someone did not thoroughly do there research. Yes FES is helping many people change their lives and bank accounts.

So product A is $499 by itself.

Or you buy product B for $188 and pay $188 for Product A?

Conclusion: Financial Education Services’ My Care Plan is grossly overpriced at $499. Nobody except Financial Education Services affiliates are going to pay for it.

Can’t verify your pricing claim though, because as of the date of this comment Financial Education Services

1. continues to fail to provide a copy of their compensation plan on their website;

2. continues to fail to provide retail pricing for any services on their website.

This is not how a legitimate MLM company presents itself to potential retail customers.

Um, sorry folks, but FES is outdated.

Let’s look at facts. As an agent, you make pennies on the dollar. You have no access to your clients credit reports nor do you have access to the progress of their credit repair.

FES offers ZERO software access or tracking capabilities for their agents. They are still MAKING the client do all of the work and mail out letters.

Sorry, but if you are still having to mail out dispute letters, you are about a decade behind the times.

There is no tech being used here. No client contracts. No protection of income for the agents. Nothing.

Having said that, they sell Koolaid more than anything. You can hype this opportunity up all you want, but it falls flat.

Look at their 2017 income breakdown. MOST agents are making under the avg income level for the avg American. They offer no affiliate income opportunities either for their agents.

Another sign that the higher ups just have no vision. Pass on this opportunity.

Stay away from agent Bruce Rochester, and his wife.. they’re 2 heartless, soulless , deceiving human beings..

Just to clarify some confusion above regarding the MyCare Plan

You stated:

That is incorrect. This is how it actually works:

A. If all you need is the MyCare Plan and nothing else, then buy it a-la-carte for a one time cost of $499

B. Alternatively, you can get 12 valuable services (including the MyCare Plan included at no additional cost) when you subscribe to the Protection Plan membership, which costs $188 to start plus $89 for each additional month that you keep the membership

I get it, $499 may seem expensive to a lot of people for estate planning documents, but I know plenty of estate planning attorneys who charge $5,000 to $6,000 for similar docs.

I still advise my clients to have an attorney review them, but $200 to $300 for attorney review theseis still a lot cheaper than $5,000 for that same attorney to draw up similar docs for you when you show up empty handed…

Sign up for $188, get the $499 product and cancel after first month. Total price paid for $499 product = $188.

What am I missing here?

This all such bs I’ve been this company for quite a bit and I must say nothing but great things have been happening for me since I enrolled.

I love absolutely everything about this business. And I dont regret nothing one bit you must remember this is your own business we franchise from f.e.s so you get what you put in.

I’ve never met someone who is a business owner who has gotten rich over night it dedication that puts you through this and faith like i said this is your personal business so however you work or the effort you put is what shows!

Sorry you gave up so fast maybe entrepreneurship just isn’t for you! And correction it’s only 188 to start than 89 monthly.

once the client is satisfied with there overall report they may feel free to cancel whenever the want with no penalties!

My score has went up within the first 14 days. I’ve been in the business for some quit while with other companies and this is by far the best company I’ve came across since I’ve started my entrepreneur journey.

Wouldnt leave for the life of me!

Bit naive to write off other people’s experiences just because you haven’t personally experienced it.

You sound like your typical overly enthusiastic new recruit. Good luck with that.

Not a good look:

law.georgia.gov/press-releases/2019-07-19/carr-illegal-credit-repair-operation-pay-1m-penalty

Wow, how did that one slip under the radar?! Thanks!

I wouldn’t outright say this is a scheme but Everything FES told my wife to do were basic credit restoration steps that can be achieved by self if you read up the credit process.

I am still looking to get more reviews about spirassp a credit repair that got my wife and I out of bankruptcy. Go with a company that works for you.

It’s vindicating reading every pyramid scheme’s reviews post-collapse and seeing that it was predicted,and the victim-hivemind was in full defense right till the end

You like to do that, too? I’m here for the same reason. Another winning call for Oz. (What’s his record now, 1289-0?)