CrossTrade Capital Review: The #1 best investment platform?

![]() CrossTrade Capital provides no information on its website about who owns or runs the business.

CrossTrade Capital provides no information on its website about who owns or runs the business.

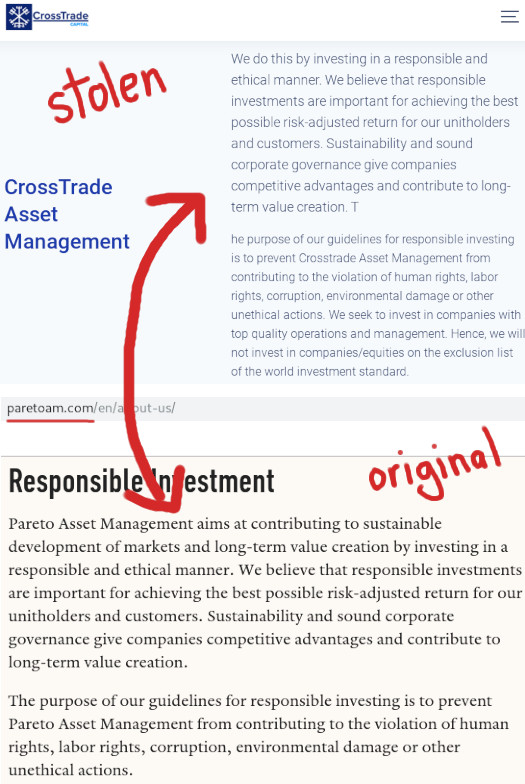

Copy in the “about us” section of CrossTrade’s website is stolen from Pareto Asset Management:

As far as I can tell, Pareto Asset Management is an unrelated company that has been around for some time.

CrossTrade Capital’s website domain (“crosstrade-uk.com”) was first registered in 2005.

The domain registration was last updated on January 18th, 2019, and lists Schilov Andre as the owner.

The address used to register the domain is a residential apartment in New York City (US).

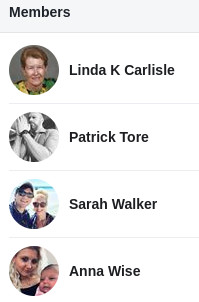

CrossTrade Capital’s official Facebook group has four admins; Linda K Carlisle, Patrick Tore, Sarah Walker and Anna Wise.

CrossTrade Capital’s official Facebook group has four admins; Linda K Carlisle, Patrick Tore, Sarah Walker and Anna Wise.

Throughout 2019 Linda Carlisle was promoting various cryptocurrency schemes. MyAddsUp for example is a 154% ROI AdPack Ponzi scheme.

Carlisle also promoted R Network and more recently, what appears to be a reboot of the failed MLM social network Tsu.

Patrick Tore identifies himself as CrossTrade Capital’s Chief Trader.

Tore’s Facebook account was created in August 2019 and only features CrossTrade Capital marketing material – so we’re not sure if he’s an actual person.

Sarah Walker claims to be a “team leader” at CrossTrade Capital. Not really sure what her MLM history is, although she does also claim to be a marketing consultant at Coca-Cola on Facebook.

Anna Wise was promoting “an investment that shaped my life financial” [sic] earlier this year, but has since deleted any reference to it.

Read on for a full review of CrossTrade Capital’s MLM opportunity.

CrossTrade Capital’s Products

CrossTrade Capital has no retailable products or services, with affiliates only able to market CrossTrade Capital affiliate membership itself.

CrossTrade Capital’s Compensation Plan

CrossTrade Capital affiliates invest $100 or more on the promise of a 10% weekly ROI, paid out for 12 months (~520%).

Referral Commissions

CrossTrade Capital pays referral commissions via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

CrossTrade Capital caps payable unilevel team levels at ten.

Commissions are paid out as a percentage of funds invested across these ten levels as follows:

- level 1 (personally recruited affiliates) – 10%

- level 2 – 10%

- levels 3 to 10 – 2%

Shareholder Bonus

In addition to referral commissions, CrossTrade Capital offers guaranteed income through the Shareholder Bonus.

- Share Class A – generate a downline of one hundred active investors and receive $312.50 a week ($15,000 annually)

- Share Class B – generate a downline of three hundred active investors and receive $625 a week ($30,000 annually)

- Share Class C – generate a downline of six hundred active investors and receive $937.50 a week ($45,000 annually)

- Share Class D – generate a downline of one thousand five hundred active investors and receive $2083.335 a week ($100,000 annually)

An “active investor” is a CrossTrade Capital affiliate who has a current investment of at least $100 paying returns.

Joining CrossTrade Capital

CrossTrade Capital affiliate membership is free.

Full participation in the attached income opportunity however requires a minimum $100 investment every 52 weeks.

Conclusion

On its website CrossTrade Capital claims to be the “#1 best investment platform”. The company represents it generates external revenue through asset management.

In addition to copy on CrossTrade Capital’s website being stolen from another company, no evidence of any asset management is provided.

Nor is there any evidence CrossTrade Capital uses any other source of external revenue to pay affiliates.

In the words of CrossTrade Capital’s official Facebook group admin Anna Wise;

Furthermore CrossTrade Capital’s business model fails the Ponzi logic test.

If the company is generating returns upwards of 10% a week already, what do they need your money for?

As it stands the only verifiable source of revenue entering CrossTrade Capital is new investment.

The use of new investment to pay existing investors a 10% weekly ROI makes CrossTrade Capital a Ponzi scheme.

It’s worth noting that of CrossTrade Capital’s four Facebook group admins, two are based out of the US.

Neither CrossTrade Capital, Linda K. Carlisle or Sarah Walker are registered to offer securities in the US.

At the time of publication, Alexa estimates 40% of traffic to CrossTrade Capital’s website originates out of the US.

As with all MLM Ponzi schemes, once affiliate recruitment dies down so too will new investment.

This will starve CrossTrade Capital of ROI revenue, eventually prompting a collapse.

The math behind Ponzi schemes guarantees that when they collapse, the majority of participants lose money.

You said:

I was asked so sign up with MAU but I never funded it. I have no idea what AdPack is.

You said:

I have not signed up with RNetwork. As for TSU, I sign up for most things that are free just to see what will happen…

Other than that, you are often full of crap anyway.

As for Cross Trade, only time will tell.

You were promoting MyAddsUp and R Network on Facebook. But please, carry on lying.

I switched up the R Network sentence as I appear to have begun typing signed but switched to promote.

Time will tell what exactly? CrossTrade Capital is a Ponzi scheme now. It was a Ponzi scheme ten minutes ago. And it will still be a Ponzi scheme X days from now.

In be4 the purge:

@linda…simply looking at your Facebook page posts, it certainly appears you are a career scammer of failed opportunities!

What opportunities will you be advertising in in 2020?

This site is a scam. They are not paying the withdrawals. You can request to withdraw, you will not receive it.

My contract with them would be due in November 2020. They just sent an email saying they will extend it to April 2021. This doesn’t make sense in business.

They will not reply to your support messages.

They disable commenting under every single post on their Facebook group.

Do not invest in this company.

Same here like will, They dont pay out.

no reply from support. this is a Big scam.

Correction, since the pandemic they have not been giving 10%. They lowered it to about 3% if you reinvest your profit but if you withdraw it, they give you about 1%.

So you would opt to just reinvest but last Nov I wanted to test it and made 4 withdrawals which are very small and until now they are all pending.

I have not received a single penny nor have they replied to my messages to support.

They also moved my October maturity of 52 weeks to sometime in April. My 2nd one is maturing this Feb 2021.

They introduced the $940 plan for 8-12% for existing Basic plan holders sometime late last year and I guess they are the only ones that are getting paid especially if they bring in referrals but the original clients who did not invest more are being disregarded.

Sounds like CrossTrade has collapsed then.

My Brocker fees became due in November at >$8k. I paid the fee in. Now they are giving me run around regards reactivating my account.

No response to emails. Phones don’t work. Theyve made off with $120k, between my partner and I.

Lets find a platform where we can come together to discuss possibilities of a class action suite. They are not registered with FCA.