CBM Global Review: Matrix-based Ponzi shrouded in secrecy

CBM Global’s website provides no information about who owns or runs the business.

CBM Global’s website provides no information about who owns or runs the business.

The CBM Global website domain (“cbmglobal.io”) was registered on April 4th, 2018.

Force International is listed as the domain owner, through an address in Antwerp, Belgium.

The CBM Global Terms and Conditions states that CBM Global is

owned by Force International CVBA.

Force International also operates under the following brand names:

CBM Global, TradeLand, MicroMaxCash, TradeUnity, Nexitrade, WhiteRavenFX, Brandologic, VAIOX, CherryFile, IrisCall, The People’s Web, Eticketbooker.

Websites are provided for each of these entities, however each website is dead traffic-wise (Alexa “unranked”).

Furthermore while some of the domains are aged, they all appear to have been acquired in mid 2018.

I picked three at random and found:

- BrandLogic’s website domain registration was last updated on July 20th, 2018

- Trade Unity’s website domain registration was last updated on August 30th, 2018

- Micro Max Cash’s website domain registration was last updated on July 20th, 2018

This is presumably when whoever is Force International itself bought the domains.

Force International’s own website was initially registered in January, 2016. The domain registration was last updated on January 13th, 2019.

Force International’s website does list a management team, although something is off about each of Force Management’s listed executives.

They seem to exist in that they each have digital footprints (there are multiple photos of each person associated with various online profiles), but I can’t find anything concrete on the company itself.

Force International as a business is dead, its website has no traffic. Furthermore the website states Force International has something to do with telecommunications and business tools.

Force International is a young startup, taking its first big steps in the technology sector.

Force consists of different business units, embracing all kinds of industries.

Both internal and external projects are being worked out to the letter until they’re ready to conquer the market

CBM Global doesn’t feature on the site as a “product”, nor does it fit into the business description above.

There is definitely something weird going on here.

Read on for a full review of the CBM Global MLM opportunity.

CBM Global Products

CBM Global has no retailable products or services, with affiliates only able to market CBM Global affiliate membership itself.

The CBM Global Compensation Plan

CBM Global affiliates invest in 50 EUR in positions, which purportedly derive a return through “forex cashback”.

Forex cashback is purportedly generated through Nautilus EA, an automated forex trading bot.

Each 50 EUR position invested in provides a CBM Global with licenses.

- invest €50 to €350 EUR and receive licenses for €5 EUR each

- invest €750 to €1550 EUR and receive licenses for €4.50 EUR each

- invest €6350 EUR and receive licenses for €3.50 EUR each

- invest €12,750 EUR or more and receive licenses for €3 EUR each

Licenses are tied to withdrawals. Without a license affiliate’s cant withdraw, and so new licenses must be eventually invested in.

Attached to this is a matrix system, which I believe is based on held licenses (i.e. a matrix position effectively costs €3 to €5 EUR each).

In a nutshell, new and existing affiliates invest and CBM Global pays existing affiliates with licenses/positions a ROI.

CBM Global do not disclose the matrix size they use to track ROI payments.

Joining CBM Global

CBM Global affiliate costs are not provided on the company’s website.

Minimum investment appears to be €50 EUR, with ongoing investment required for withdrawal eligibility.

Conclusion

CBM is definitely one of the stranger MLM opportunities I’ve researched.

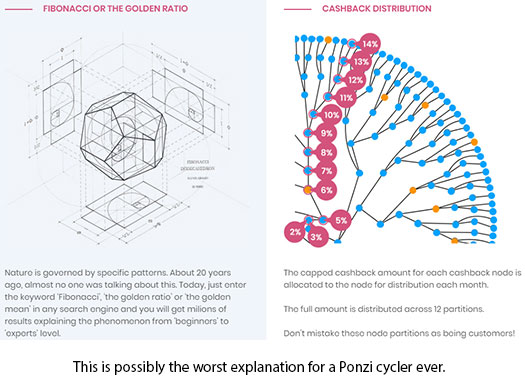

Instead of just being honest and upfront about their matrix-based scheme, the company attempts to wow potential investors with waffle about “clustering”, fibonacci sequences and “cashback algorithms”.

Fibonacci is the basis for calculating the only irrational number in existence called Phi (1.61803398875..). Dig a little deeper, and you will discover that Phi is the basic frequency for all life on earth and matter in the universe.

So, it goes without saying, if you come up with growth patterns that don’t emulate nature, you are ‘going against the grain’.

CBM’s cashback matrix is perfectly modelled [sic] on the Fibonacci sequence.

It took us 4 years to create a software program efficient enough to cope with masive [sic] data. We don’t know any other company in the world that was capable of making it.

Ditto paying matrix cycler returns;

Whether on the fund, or managed account, your capital is traded with automated trading software.

It places trades and therefore generates volume expressed in “lots”.

For each round traded lot (when the trade is closed) a commission, or rebate in forex terms, is generated.

The CBM CashBack Matrix algorithm is a self-sustainable system that can provide an additional benefit, even if there would be only one customer, thanks to the Profit Overflow aspect.

All you really need to know is that “CBM” stands for “cashback matrix”, and through a matrix CBM Global are simply recycling newly invested funds to pay existing investors.

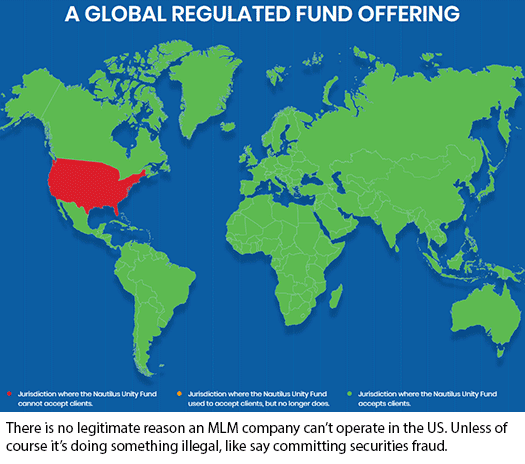

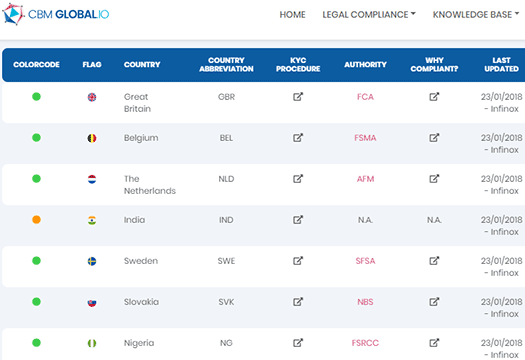

In an attempt to feign legitimacy, CBM Global provides a “legal compliance” section on their website.

Evidently the company is terrified of being investigated and shut down by US authorities.

The same section of the website provides supposed “why we are complaint” reasoning for every other country.

No matter which company you select, the “why compliant?” reasoning provided is the same.

CBM is a Product under management of the alternative investment platform Tradeland.

Associate Representative Asset Management Provided by ForexMan.

CBM & TL are Brand and Business Units of Force International.

This of course meaningless pseudo-compliance waffle.

Securities are regulated in most countries by a financial regulator. If CBM Global has not registered itself to do business with this regulator, they are operating illegally.

Listing three shell companies as evidence of compliance is… well it’s like me trying to convince you an orange is healthy because the sky is blue.

With respect to Nautilus EA forex trading, it’s all bullshit as far as I can tell.

MicroMaxCash, one of the other shell companies Force International supposedly owns, lists the following investment opportunities on their website:

- Unity Max Child EA – invest €1000 EUR or more and receive a monthly ROI of up to 15%

- Unity Max RA – invest €10,000 EUR or more and receive a monthly ROI of up to 6%

The Unity Max is an automated trading robot that uses the principles of a grid trading system on a swing type trading basis.

It has proven to be successful, not only in the 16 year back test results, but also in more than 2 years or live trading.

If the people behind Force International had a bot was generating returns of up to 15% a month for 16 years, they’d easily be the richest people on the planet by now.

Yet here we are.

CBM Global is just another attempt to sell the same forex trading Ponzi cycler scam to a new set of people.

Once affiliate recruitment and investment in €50 EUR Nautilus EA “licenses” dies off, CBM Global will be unable to meet its ROI obligations.

Being a matrix cycler, most of the funds will be transferred to the admins via preloaded admin positions.

CBM Global will also keep funds attached to stalled matrix positions when it collapses.

Other than a few early adopters, Ponzi math guarantees everyone else loses out.

I think CBM is a fair company. You can talk directly with the owner behind the business.

The money is installed by a regulated A Book broker named Infinox. So you Always have complete control about your own money.

CBM is not between you and your own money which is on the account of the broker.

CBM only takes care of the matrix and licenses which you can buy for only 5 euro or less.

You can always withdraw your money directly by the broker which has a garantee for 500.000 GBP per client. So the money is Always save.

The information in this article is not correct. So People, inform your self good.

Matrix Ponzi schemes aren’t fair. They suck your money and pay it to the admin(s) and top recruiters.

Not the same as CBM Global being registered. They control your money.

Infinox is a red herring. You put your money under CBM Global’s control.

Lots of copy/paste from other bad review sites here. If you you had done proper investigation you’d have learned this can’t be a ponzi cause CBM is not holding your money, the money is put on a segregated Barclay’s bank account through Infinox. infinox.com/en/about-us/

The cash back is paid from small percentages of the trading fees CBM collects.

Other company’s involved are lmax about and forexmax.

It’s absurd to assume these FCA regulated and licensed companies as well as the Barclay’s Bank would get involved with CBM if this was a scam in some way.

That’s not how things work They are required by law and for their own good name to do thorough due diligence

Why don’t you just get in contact with the CBM people if you don’t understand how the system works, you can call them, Email them or reach out to them in their Facebook group.

There are no secrets with CBM, on the contrary its all very transparent and the founders organize public meet-ups on a regular base.

I think you’ll find it’s the other way around. I only publish original content here.

What does that have to do with anything? You deposit the money with CBM Global, that’s the end of it. What they do or don’t do with the money doesn’t negate using the money to pay returns.

Prove it with audited accounting and legally required regulatory filings.

Legitimacy by association doesn’t work. It doesn’t matter who or who isn’t involved, a Ponzi scheme is a Ponzi scheme.

New investors dump money into CBM Global and they use that money to pay existing investors. What’s to know?

It’s not a ponzy, do you your own research for God’s sake

Not the same as CBM Global being registered. They control your money.

Nope every CBM client opens his own account with Infinox, goes through their KYC and deposits money on their account. CBM does not control it.

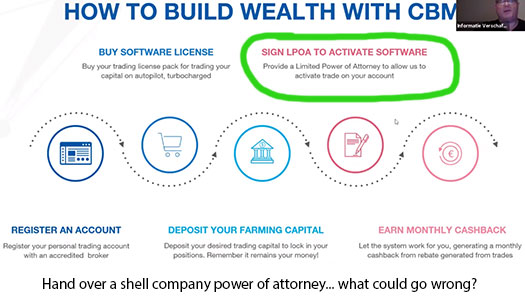

You sign a LPOA to allow the Asset Manager ForexMax to execute trades on your behalf. CBM has absolutely nothing to do with what happens with your capital.

I did. That’s why I can confidently state CBM Global is a Ponzi scheme.

Why else would they hide from the SEC in the US and not be legally registered to offer securities?

What does or doesn’t happen with third-party companies has nothing to do with CBM Global running a matrix cycler Ponzi scheme.

Also you state you can’t obtain any of your money without buying new licenses, this is another falsehood.

Both the cash back bonus and affiliate bonus can be withdrawn without any requirements.

The funds on the infinox trading account are under your own control and can be withdrawn whenever you feel like.

No you don’t…the money goes to your Infinox account, and so do the trading profits

Have you tried asking the company before smearing them? m.facebook.com/1645187125563641

Like US is the only country with financial oversight, remember where the last bank crisis started? lol

I don’t know what prevents CBM from taking in US customers . again, ask them.

What I do know is they’re allowed to accept customers from any other country in the world…

Force International is (Ozedit: not CBM Global. Derail removed)

No you didn’t. You’r only assuming stuff but you don’t even know how it’s all set up. You also neglected to ask the company for info you lack and claims you doubt.

This entire review is based on false assumptions.

I hope people reading this will take it upon themselves to investigate this business opportunity and draw their own conclusions.

And? What are you not understanding here. How CBM Global runs their Ponzi scheme is irrelevant.

Securities fraud and operation of a Ponzi scheme (rigged trades) is what matters.

Yo? When asked for audited accounting and legally required regulatory filings, you provided CBM Global’s Facebook page.

Whatever bullshit CBM Global has on their social media pages is not a substitute for regulatory filings and legally required filed disclosures.

Thank you for confirming CBM Global is not registered to offer securities in any jurisdiction and is committing securities fraud.

Nobody said it was. But it is the strictest. The only time an MLM company that claims to be operating legally excludes the US, is when they’re doing something illegal (securities fraud).

Again, how a scam is set up is secondary to securities fraud and Ponzi issues.

I hope people reading this ask CBM Global why they’re committing securities fraud.

The company can make whatever claims they want. If there’s no regulatory filings they’re operating illegally and bullshitting you.

No I didn’t. Learn to read.

They are also under the control of CBM Global, or you wouldn’t be getting any returns.

One doesn’t cancel out the other so it’s an entirely moot point with respect to CBM Global committing securities fraud.

It’s an Belgian company, so it’s normal to start in Europe and not in the US. If you think Europe is less strict I guess you don’t know the world outside of the US at all.

Also, Belgian companies are registered in the “staadsblad” and that is the only way to know if it is a legal company. Force International was registered in 2016, and yes the website is from that year too, but who cares?

ejustice.just.fgov.be/tsv_pdf/2016/02/09/16021124.pdf

I am researching about the system myself at the moment, and for now there is one thing I’m sure of, and that is that the system is completely legal and like ‘CBM Client’ states, they cannot get to your money at all except for the licenses you have to buy, for a minimum of €25 and not €50 like you stated, and if you don’t want to invest more in the licenses you don’t have to.

I don’t know what to think about this license part, it also feels wrong to me, but a cost of 25 euro to be able to use the system is actually very cheap.

I also talked to people inside the system and have seen deposit and redraw histories for the past year and this all looks fine to me.

So my conclusion for everyone that read this review, don’t base your decisions on it. But on the other hand I’m not convinced about the system myself yet so do your propper research based on the laws in the country of origin of the company, Belgium not USA, and make your own conclusions.

That falls apart considering the US is the only country being avoided.

Want to invest from some island off the African coast? No worries.

Face it, the only reason the US is excluded is because CBM Global is committing securities fraud.

Lol OneCoin lol.

Yup, who cares. The business is dead as noted in the review.

Securities fraud isn’t legal anywhere in the world. In Belgium securities are regulated by the FSMA.

You can search yourself and verify CBM Global is not registered to offer securities in Belgium:

fsma.be/en/search-page

You suck at due-diligence and I award you no points.

Barkleys bank is the bank managing your money, and they are registered… wtf man, everyone makes mistakes, just admit you made one and rewrite your review.

fsma.be/en/party/barclays-bank

If CBM Global isn’t registered to offer securities in Belgium then they are comitting securities fraud. Ditto everywhere else in the world.

Whether Barkleys Bank or any other bank is registered with the FSMA is irrelevant.

Go read up on securities law instead of making excuses for scammers.

And to check if a company is dead, look up their figures, they are public, not the website traffic. It is a consultancy company in Belgium, website traffic is probably not very high.

I’m not saying the company is the most thriving but your research methods are bias.

A technology company with zero website traffic = a dead company. It’s not rocket science.

There’s nothing bias about commenting on the fact a tech company’s website is tumbleweeds. Stop making excuses for scammers.

Can you give me a link to the website traffic figures you base on?

Since I don’t get a popup to approve tracking on their sites it’s actually illegal to track visitors on these sites according to the GDPR, so stop making excuses for yourself and track the health of a company the proper way.

Alexa. Look it up yourself. I have no idea what it is now, I checked when I wrote the review.

…that’s not what the GDPR is.

Bottom line, dead website traffic = dead technology company. This is irrespective of whatever stones you want to throw at Alexa’s methodology (I know it’s coming).

It is part of GDPR… but whatever.

No, the Belgisch Staatsblad/Moniteur Belge is merely the official organ where lots of legal documents, including those setting up a company, have to be published (once a print publication, since many years online-only).

Publication there tells you nothing about the current existence, or status, of a company, for that you have to consult the companies register, the Crossroads Bank for Enterprises (called that because a number of separate government databases are linked through there – it’s “bank” in the meaning of database). In this case:

kbopub.economie.fgov.be/kbopub/toonondernemingps.html?lang=en&ondernemingsnummer=647631485

So Force International is indeed a properly registered company, but CBM Global isn’t.

That alone makes one wonder: why does a very small company, operating out of a building where you can rent office space by the hour, feel the need to do business under at least 13 aliases (besides the 12 listed above, there is also ABP Technologies), when they could just as well use their legal name?

But what you really need to know, of course, is whether Force International is licensed to offer any kind of financial or investment services in Belgium.

Such licenses are issued by the Financial Services and Markets Authority, FSMA. A search on the FSMA’s website using Force International’s company number shows it isn’t licensed for anything.

Trying to find out a bit more, I also came across an interesting website from someone in the CBM Global MLM, touting its product (they also tout SkyWay).

It’s from someone in Belgium, who mentions talking to Force International owner/CEO Gerry Dekens personally. Here is the relevant URL:

besparingconsulent.be/team

It contains some interesting information, which flatly contradicts CGM Global’s own stuff. It’s in Dutch, so I’ll summarize.

(1) They started trading in 2014, initially with money from a few investors, to make sure everything worked before starting marketing to the general public.

Since the company was only set up in 2016, how is this possible?

(2) It says nothing at all about the magical money-making forex trading robot. It claims that the money is made by commissions on trades, regardless of whether those trades make money.

Just to document it properly, I’ll quote the relevant bit in Dutch, then translate:

Translated (the original is very badly written):

(And oh yes, in passing that site also claims that CBM Global is licensed, although it doesn’t say for what or where.)

If all that looks fine to you, by all means give your money to Mr. Dekens.

That is total bullshit. The GDPR protects against the gathering of personal information, except under strict rules.

Simply recording what country an IP address is from, which is all Alexa does, has got absolutely nothing to do with the GDPR.

Neither does tracking on the basis of IP addresses, or using cookies. Neither of those things identify a person. So al those US websites that ban access from an IP address in the EU claiming that’s somehow because of GDPR are just talking bollocks.

I really wonder who started spreading this nonsense in the US. (I think it’s the US only, I’ve never seen it on websites from other countries.)

Your IP address alone isn’t “personal information”. The internet wouldn’t work in EU if that was the case.

Not necessarily. It means they are using cookies or other trackers to retain personal information on all their users. They can do that to US or other non-EU users without their consent because data protection law is weaker, but not to EU users.

It is not the IP address that is the problem, it is all the other data they collect from all their user without their consent. The IP address is used to ban users from whom they can’t mine this data legally.

They don’t have to ban EU users. They could simply stop collecting data from users that they don’t need. (If they need it it’s covered under the “legitimate interests” basis of GDPR.) But if they ban EU users that confirms they’d rather mine data and sell it on.

Note that one of those stupid messages saying “we use cookies, click here to see what a cookie is” is not consent to collect personal data which the website doesn’t need to display the service you asked for.