Bitfinex Review: Crypto exchange house of cards

![]() Bitfinex is a well-known crypto exchange tied to tether (USDT). Turns out it’s also an MLM company.

Bitfinex is a well-known crypto exchange tied to tether (USDT). Turns out it’s also an MLM company.

Bitfinex was launched in 2012 by Raphael Nicolle. Nicolle parted ways with Bitfinex during the in early 2017.

Today Bitfinex is owned by iFinex Inc., a BVI shell company.

Names we can attach to Bitfinex include:

- Jean-Louis van der Velde (CEO) from the Netherlands

- Giancarlo Devasini (CFO) from Italy and

- Paolo Ardoino (CTO), also from Italy

To the best of my knowledge, none of Bitfinex’s executives have any prior MLM executive experience.

Being one of the oldest cryptocurrency exchanges, Bitfinex has a well-documented history:

- in June 2016 the CFTC fined Bitfinex $75,000 for failing to register itself and “offering illegal off-exchanged financed commodity transactions”

- a 2019 investigation by the New York Attorney General revealed Bitfinex hid over $1 billion in losses through Crypto Capital Corp from its investors

- in October 2021 the CFTC again fined Bitfinex $1.5 million, this time for performing “illegal, off-exchange retail commodity transactions in digital assets with Americans”

There’s a fair bit more, with Bitfinex’s Wikipedia entry making for good reading.

Read on for a full review of Bitfinex’s MLM opportunity.

Bitfinex’s Products

Bitfinex operates as a cryptocurrency exchange.

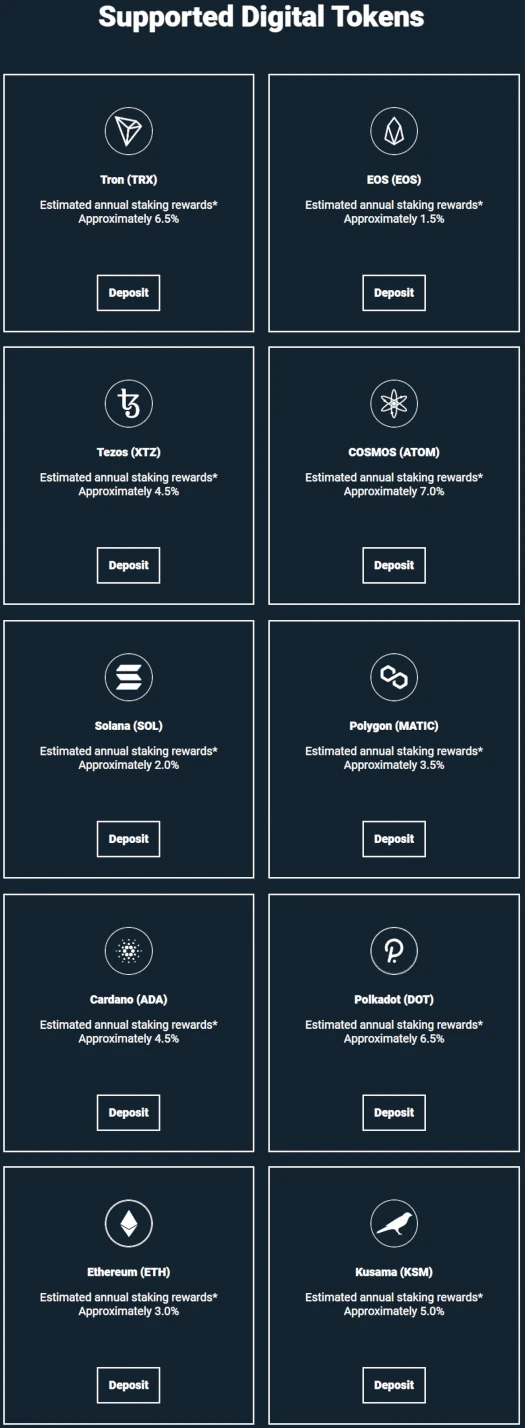

The company also offers passive returns on various cryptocurrencies via a staking model:

Staking returns are paid out weekly based on the above advertised annual ROI rates.

Bitfinex’s Compensation Plan

Bitfinex affiliates earn commissions on trading and margin funding fees paid by retail customers and recruited affiliates.

Bitfinex pays commissions down three levels of recruitment (unilevel):

- level 1 (personally recruited affiliates) – 18%

- level 2 – 6%

- level 3 – 2%

Note that the above commission amounts appear to reduce by 0.5% every 30 days.

The percentage of the fees you receive for each member of your network will start at 18% (6% or 2% based on its connection level) and will reduce every second in a straight-line fashion so that by the end of each thirty days, it is reduced by 0.5%.

This suggests that eventually Bitfinex affiliates will be screwed out of commissions earned on personal customers and referred affiliates.

- level 1 commissions will reach 0% after 36 months

- level 2 commissions will reach 0% after 12 months

- level 3 commissions will reach 0% after 4 months

Multipliers

Bitfinex offers multipliers on referral commissions, subject to the following qualification criteria:

- affiliate’s account is KYC verified (Basic Plus tier or higher) – 1.2x multiplier

- downline customer/affiliate is KYC verified (Basic Plus tier or higher) – 1.2x multiplier on their commissionable volume

- downline customer/affiliate has more than 500 USDT in LEO token in their account = 1.1x multiplier on their commissionable volume

- downline customer/affiliate has more than 5000 USDT in LEO token in their account = 1.2x multiplier on their commissionable volume

- downline customer/affiliate has more than 50,000 USDT in LEO token in their account = 1.5x multiplier on their commissionable volume

Note that Unus Sed Leo (LEO) is owned by Bitfinex’s parent company iFinex.

Developer Rebate

If a Bitfinex affiliate is also a developer, they receive a 5% rebate on any trading fees generated by their platform/app.

Joining Bitfinex

Bitfinex affiliate membership is free.

Bitfinex Conclusion

Bitfinex as an MLM opportunity is completely shadowed by its connection to tether and ongoing US criminal investigations.

Before we get into that (a lot of which is subjective analysis on my part), let’s evaluate Bitfinex’s MLM opportunity independently.

With Bitfinex as an MLM company we have a straight-forward exchange that charges fees. Said fees fund its compensation plan and there’s nothing wrong with that.

Thing start to fall apart however with diminishing commission rates, which are reduced by 0.5% every month.

This pretty much kills the “residual” nature of Bitfinex’s commissions, which in MLM is (supposed to be) one of the major drawcards.

Another red flag is Bitfinex’s staking investment scheme. Through said scheme, Bitfinex customers invest cryptocurrency on the promise of advertised passive returns.

As per the Howey Test, this constitutes a securities offering. In the US, securities are required to be registered with the SEC.

A search of the SEC’s public Edgar database reveals neither Bitfinex or parent company iFinex are registered.

This means that at a minimum, Bitfinex is committing securities fraud in the US.

Following two CFTC fines, Bitfinex appears to have spun off its commodities division into “Bitfinex Securities”.

Out of curiosity I ran search for Bitfinex and iFinex on the CFTC’s BasicNet database. There’s nothing for Bitfinex but iFinex comes up as an NFA non-member to note the 2021 CFTC fraud fine.

Bitfinex Securities falls outside the scope of this review so I can’t really comment on whether Bitfinex has rememied its Commodities Act violations.

Regardless, registering with the CFTC doesn’t remedy Bitfinex’s failure to register its staking investment opportunity with the SEC.

In conclusion; as a stand-alone MLM opportunity, Bitfinex offers trading, securities fraud and unattractive diminishing commission rates.

Now the elephant in the room: Tether.

Tether is a stablecoin also owned by iFinex. Not surprisingly, Bitfinex executives hold the same executive roles between the two companies.

Tether’s original schtick was it was backed 1:1 by USD. This turned out to be a lie and Tether’s exact USD reserves remain a mystery.

Tether does put out unaudited statements periodically but, for obvious reasons, these are meaningless.

As of August 2022, iFinex, Bitfinex and Tether are believed to be the subject of an ongoing US criminal investigation.

Now we get to the subjective red flags.

Tether is widely regarded as the primary tool used to prop up the cryptocurrency market.

The simple version of this is iFinex prints unbacked tether on demand, uses it to buy bitcoin, bitcoin pumps, iFinex sells (real money extracted out of the market), rinse and repeat.

This is obviously fraud and, along with money laundering and evading banking laws, is likely at the center of investigations into iFinex.

Bearing in mind global sanctions that are currently in place, SimilarWeb currently tracks Russia as the top source of traffic to Bitfinex’s website.

Over the past few years US authorities have been working their way up to the bigger crypto fish. This year the fish are getting bigger, and we’ve already seen FTX and Celsius go down.

The SEC filed suit against Binance and owner Changpeng Zhao in June, for

operating unregistered exchanges, broker-dealers, and clearing agencies; misrepresenting trading controls and oversight on the Binance.US platform; and the unregistered offer and sale of securities.

It’s likely that Zhao has also been indicted but, pending his arrest, we won’t know for sure (Zhao fled to Dubai after the SEC Complaint dropped).

What’s bigger than Binance? iFinex.

I suspect the cases against iFinex (DOJ, SEC and possibly another one from the CFTC), will ramp up following Zhao’s arrest.

Zhao’s arrest will have a major impact on the cryptocurrency market, possibly even sending Tether into an implosion.

The same also holds true if charges against iFinex and its executives are announced. Either was on the cards but given the SEC’s lawsuit, I believe Binance will be first.

Binance and iFinex simultaneously would be epic but, due to the magnitude of fraud and subsequent immediate fallout, probably unlikely (I’d love to be proven wrong on this).

The bottom line? Bitfinex has enough baggage and potential regulatory risk through iFinex and Tether, that nobody should be taking it seriously as an MLM company.

Zhao is in the UAE.

Ah they confirmed it last month.

binance.com/en/feed/post/886441

We all figured he was there when the SEC charges dropped. Good to see it’s official.