AtomicMeta Review: ATMC token staking Ponzi

![]() AtomicMeta fails to provide ownership or executive information on its website.

AtomicMeta fails to provide ownership or executive information on its website.

AtomicMeta’s website domain (“atomicmeta.com”), was first registered in 2021. The private registration was last updated on July 27th, 2025.

On the WayBack Machine we can see AtomicMeta’s website domain was for sale as of March 2025. AtomicMeta’s website went live in or around August 2025, so it’s likely the domain itself was purchased in or around July 2025.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

AtomicMeta’s Products

AtomicMeta has no retailable products or services.

Promoters are only able to market AtomicMeta promoter membership itself.

AtomicMeta’s Compensation Plan

Atomic Meta promoters invest tether (USDT) for AtomicMeta’s own ATMC token.

This is done on the promise of advertised passive returns:

- Starter – invest 50 USDT, receive 50 USDT worth of ATMC token and receive 5% a month for 20 months

- Standard – invest 200 USDT, receive 250 USDT worth of ATMC token and receive 5% a month for 20 months

- Elite – invest 500 USDT, receive 750 USDT worth of ATMC token and receive 5% a month for 20 months

- Premium – invest 1000 USDT, receive 2000 USDT worth of ATMC token and receive 5% a month for 20 months

The MLM side of AtomicMeta pays on recruitment of promoter investors.

AtomicMeta Promoter Ranks

There are ten promoter ranks within AtomicMeta’s compensation plan.

Along with their respective qualification criteria, they are as follows:

- Stage 1 – recruit one promoter investor and generate 50 USDT in downline investment volume

- Stage 2 – recruit two promoter investors and generate 100 USDT in downline investment volume

- Stage 3 – recruit three promoter investors and generate 300 USDT in downline investment volume

- Stage 4 – recruit four promoter investors and generate 400 USDT in downline investment volume

- Stage 5 – recruit five promoter investors and generate 500 USDT in downline investment volume

- Stage 6 – recruit six promoter investors and generate 600 USDT in downline investment volume

- Stage 7 – recruit seven promoter investors and generate 700 USDT in downline investment volume

- Stage 8 – recruit eight promoter investors and generate 800 USDT in downline investment volume

- Stage 9 – recruit nine promoter investors and generate 900 USDT in downline investment volume

- Stage 10 – recruit ten promoter investors and generate 1000 USDT in downline investment volume

Welcome Bonus

New AtomicMeta promoter investors receive 1% of USDT invested by the previous ten promoters who joined before them.

Referral Commissions

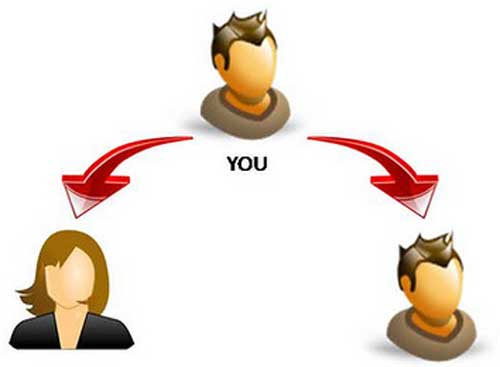

AtomicMeta pays referral commissions via a unilevel compensation structure.

A unilevel compensation structure places a promoter at the top of a unilevel team, with every personally recruited promoter placed directly under them (level 1):

If any level 1 promoters recruit new promoters, they are placed on level 2 of the original promoter’s unilevel team.

If any level 2 promoters recruit new promoters, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

AtomicMeta caps payable unilevel team levels at ten.

Referral commissions are paid as a percentage of USDT invested across these ten levels based on rank:

- Stage 1 ranked promoters earn 2% on level 1 (personally recruited promoters)

- Stage 2 ranked promoters earn 2% on levels 1 and 2

- Stage 3 ranked promoters earn 2% on levels 1 to 3

- Stage 4 ranked promoters earn 2% on levels 1 to 4

- Stage 5 ranked promoters earn 2% on levels 1 to 5

- Stage 6 ranked promoters earn 2% on levels 1 to 6

- Stage 7 ranked promoters earn 2% on levels 1 to 7

- Stage 8 ranked promoters earn 2% on levels 1 to 8

- Stage 9 ranked promoters earn 2% on levels 1 to 9

- Stage 10 ranked promoters earn 2% on levels 1 to 10

2×1 Matrix Cycler

In addition to its main investment scheme, Atomic Meta also runs a 2×1 matrix cycler.

A 2×1 matrix places an AtomicMeta promoter at the top of a matrix, with two positions directly under them:

Entry into the cycler costs 100 USDT. The goal is to fill both matrix positions under you.

Positions are filled by cycler position purchases by directly and indirectly recruited promoters.

Once both positions are filled, 50 USDT is paid to the promoter at the top of the matrix. 50 USDT is additionally paid to their upline.

The triggers a “cycle”, wherein a new cycler position is created with the remaining 100 USDT.

Withdrawal Commissions

AtomicMeta charges a 20% withdrawal fee. This fee is used to fund commissions:

- 10% is paid to ten promoters who joined before the promoter requesting a withdrawal (split 1% each)

- 10% is paid to ten promoters who joined after the promoter requesting a withdrawal (split 1% each)

Joining AtomicMeta

AtomicMeta promoter membership is free.

Full participation in the attached income opportunity requires a minimum 50 USDT investment.

An optional 100 USDT cycler position purchase allows for participation in AtomicMeta’s matrix cycler.

AtomicMeta Conclusion

AtomicMeta is running a simple unregistered staking model MLM crypto investment scheme.

ATMC token is a BEP20 token. A BEP20 token can be set up in a few minutes at little to no cost.

The ruse behind AtomicMeta’s unregistered staking investment scheme is “mirror trading”:

AtomicMeta fails to provide verifiable evidence it generates external revenue of any kind.

Furthermore, AtomicMeta’s passive returns staking investment scheme constitutes a securities offering.

AtomicMeta fails to provide evidence it has registered with financial regulators in any jurisdiction.

At a minimum this constitutes securities fraud. Additional wire fraud and money laundering violations may also apply.

Instead of registering with financial regulators and operating legally, AtomicMeta serves up this nonsense in its website terms and conditions;

Governing Law

This agreement is governed by international DeFi standards and operates outside the jurisdiction of traditional finance regulations.

There are no “international DeFi standards”. Neither does AtomicMeta doesn’t operate outside of “traditional finance regulations”.

AtomicMeta is required by law to adhere to financial regulations in every jurisdiction it solicits investment in.

As it stands the only verifiable source of revenue entering AtomicMeta is new investment.

Using new investment to pay ATMC ROI withdrawals would make AtomicMeta a Ponzi scheme.

As with all MLM Ponzi schemes, once promoter recruitment dries up so too will new investment.

This will starve AtomicMeta of ROI revenue, eventually prompting a collapse.

AtomicMeta’s collapse will begin by disabling of ATMC withdrawals. This may coincide with dumping of ATMC on dodgy exchanges.

Math guarantees that when a Ponzi scheme collapses, the majority of participants lose money. In AtomicMeta this will occur through the majority of promoters bagholding worthless ATMC tokens.