AladinCoin Review: AIC Ponzi points scheme

![]() AladinCoin provide no information on their website about who owns or runs the business.

AladinCoin provide no information on their website about who owns or runs the business.

The AladinCoin website domain (“aladincoins.com”) was privately registered on March 21st, 2017.

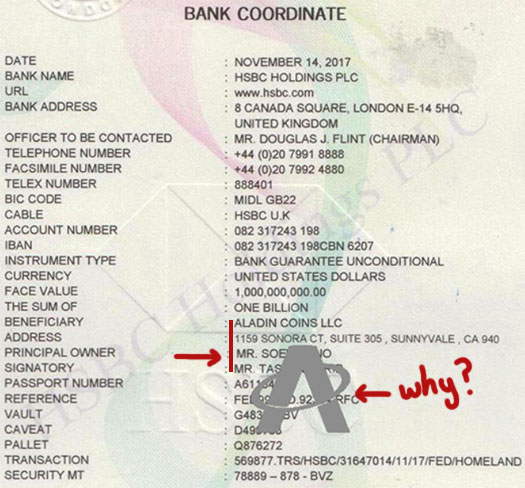

In what appears to be an attempt to feign legitimacy, AladinCoin provide a HSBC UK “Deposit of Fund” certificate on their website.

The deposit is for $1 billion USD and was made by Taswin Tarib, an Indonesian citizen, on November 14th, 2017.

For some reason AladinCoin took it upon themselves to block out the company owner on the document.

Where things get interesting is the provided address for Aladin Coins LLC is in California.

According to a Business Entity Search with the California Secretary of State, Aladin Coins LLC is not a registered entity in California.

Getting back to the certificate itself, note the different font used for the address and non-alignment of the “Principal Owner” field:

Three other anomalies are the US spelling of “legalized”, the presence of a Homeland Security stamp on a UK deposit certificate and in the first page of the document, a purple border digitally covering the watermark:

Out of curiosity I ran both pages through ELA and perhaps not surprisingly, it indicated text areas had been digitally altered:

Although no conclusive, that was enough for me to flag the deposit certificate as highly suspicious.

On the website for Aladin Capital, Kevin Gluckstal (right) is identified as co-founder and CEO of the company.

On the website for Aladin Capital, Kevin Gluckstal (right) is identified as co-founder and CEO of the company.

As per Gluckstal’s Aladin Capital bio;

Kevin D. Gluckstal is experienced and knowledgeable in many fields such as: international economics, real estate, infrastructure development, renewable energy, telecommunications, oil & gas, mining of previous metals, securities and public finance.

Corporation Wiki ties Kevin Gluckstal to “Aladin Capital LLC“, which was purportedly incorporated in Florida on September 15th, 2017.

A search with Florida’s Division of Corporations confirms Aladin Capital LLC was incorporated by Kevin Gluckstal on September 15th.

The address used to incorporate Aladin Capital LLC and provided for Gluckstal actually belongs to Capital Executive Suites.

On their website Capital Executive Suites market virtual office space.

Whether Aladin Capital LLC or Kevin Gluckstal have any physical operations in the US is unclear.

I also noted an Aladin Capital LLC incorporated in Delaware, however I wasn’t able to find anything further.

In any event, Gluckstal’s Facebook profile suggests he married abroad (South East Asia by the looks of it) late last year.

At the time of publication Alexa estimate that 75% of traffic to the AladinCoin website originates out of Vietnam.

In addition to running AladinCoin, Gluckstal is also the founder and CEO of MacroTrend Capital Group.

From the MacroTrend Capital Group website;

Mr. Gluckstal has extensive knowledge of markets which include securities trading, international economics, real estate and infrastructure development, renewable/clean energy, telecom, oil and gas, precious metals mining, public securities and finance, private secondary market finance and institutional banking.

Mr. Gluckstal is CEO and Chief Investment Officer Aladin Capital AG, as well as Chief Investment Officer and General Manager of the MacroTrend Investment Fund, LP.

Gregory Lustic and Barry Manning, two MacroTrend Capital Group executives, also hold executive positions in Aladin Capital.

Whether Gluckstal has any prior MLM experience is unclear.

Read on for a full review of the AladinCoin MLM opportunity.

AladinCoin Products

AladinCoin has no retailable products or services, with affiliates only able to market AladinCoin affiliate membership itself.

The AladinCoin Compensation Plan

AladinCoin affiliates invest funds on the promise of an advertised 0.83% to 1% daily ROI:

- Starter – invest $180 and receive a daily ROI for 180 days

- Trainee – invest $500 and receive a daily ROI for 210 days

- Basic – invest $1000 and receive a daily ROI for 240 days

- Premium – invest $2500 and receive a daily ROI for 270 days

- Pro – invest $8000 and receive a daily ROI for 300 days

- Pro+ – invest $20,000 and receive a daily ROI for 330 days

- Pro X2 – invest $50,000 and receive a daily ROI for 360 days

- VIP – invest $100,000 and receive a daily ROI for 390 days

Note that ROI payouts are made in Aladin Coin (AIC).

AladinCoin Affiliate Ranks

Certain commissions and bonuses within the AladinCoin compensation plan are determined by rank.

There are eight affiliate ranks within the AladinCoin compensation plan.

Along with their respective qualification criteria, they are as follows.

- Associate – sign up and recruit at least two affiliates

- Gold – recruit at least three affiliates and generate at least $60,000 in total downline investment volume or recruit at least twenty affiliates

- Platinum – maintain at least three personally recruited affiliates and generate at least $120,000 in total downline investment volume or recruit at least thirty affiliates

- Ruby – recruit at least five affiliates and generate at least $250,000 in total downline investment volume or recruit at least forty affiliates

- Sapphire – recruit at least six affiliates and generate at least $500,000 in total downline investment volume or recruit at least fifty affiliates

- Diamond – recruit at least eight affiliates and generate at least $1,000,000 in total downline investment volume or recruit at least sixty affiliates

- Blue Diamond – maintain at least eight personally recruited affiliates and generate at least $2,500,000 in total downline investment volume

- Crown Diamond – maintain at least eight personally recruited affiliates and generate at least $5,000,000 in total downline investment volume

Recruitment Commissions

AladinCoin affiliates are paid recruitment commissions via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

AladinCoin cap payable unilevel levels at twenty, with commissions paid out as a percentage of funds invested across these twenty levels.

How many levels an AladinCoin affiliate earns recruitment commissions on is determined by how much they’ve invested:

- Basic affiliates receive 1% on levels 1 to 3 and 0.5% on levels 4 and 5

- Premium affiliates receive 1% on levels 1 to 3 and 0.5% on levels 4 to 8

- Pro affiliates receive 1% on levels 1 to 3 and 0.5% on levels 4 to 10

- Pro+ affiliates receive 1% on levels 1 to 3 and 0.5% on level 4 to 12

- Pro X2 affiliates receive 1% on levels 1 to 3 and 0.5% on levels 4 to 15

- VIP affiliates receive 1% on levels 1 to 3 and 0.5% on levels 4 to 20

ROI Referral Commissions

AladinCoin affiliates receive a referral commission on ROI payments made to downline affiliates.

ROI referral commissions are paid using the same unilevel compensation structure as recruitment commissions (see above), capped down three levels of recruitment.

Percentage levels paid out across these three levels are determined by how much an AladinCoin affiliate has invested:

- Starter affiliates receive 5% on level 1 (personally recruited affiliates)

- Trainee affiliates receive 5% on level 1 and 1% on level 2

- Basic affiliates receive 5% on level 1, 2% on level 2 and 1% on level 3

- Premium and Pro affiliates receive 6% on level 1, 2% on level 2 and 1% on level 3

- Pro+ affiliates receive 7% on level 1, 2% on level 2 and 1% on level 3

- Pro X2 affiliates receive 7% on level 1 and 2% on levels 2 and 3

- VIP affiliates receive 10% on level 1, 3% on level 2 and 2% on level 3

Residual Commissions

AladinCoin pay residual commissions via a binary compensation structure.

A binary compensation structure places an affiliate at the top of a binary team, split into two sides (left and right):

The first level of the binary team houses two positions. The second level of the binary team is generated by splitting these first two positions into another two positions each (4 positions).

Subsequent levels of the binary team are generated as required, with each new level housing twice as many positions as the previous level.

Positions in the binary team are filled via direct and indirect recruitment of affiliates. Note there is no limit to how deep a binary team can grow.

At the end of each day AladinCoin tallies up new investment volume on both sides of the binary team.

Residual commissions are paid as a percentage of funds tallied up on the weaker binary side.

The exact percentage of funds paid out is determined by AladinCoin affiliate rank:

- Associate – 5%

- Gold – 6%

- Platinum – 7%

- Ruby – 8%

- Sapphire – 9%

- Diamond – 10%

- Blue Diamond – 11%

- Crown Diamond – 12%

Matching Bonus

AladinCoin pay a Matching Bonus on residual commissions paid to downline affiliates.

The Matching Bonus is paid out using the same unilevel compensation structure recruitment commissions are paid out with (see above), capped at five levels of recruitment:

- Gold affiliates earn a 5% match on level 1 (personally recruited affiliates)

- Platinum affiliates earn a 5% match on levels 1 and 2

- Ruby affiliates earn a 5% match on levels 1 to 3

- Sapphire affiliates earn a 5% match on levels 1 to 4

- Diamond affiliates earn a 5% match on levels 1 to 5

- Blue Diamond affiliates earn a 6% match on levels 1 to 5

- Crown Diamond affiliates earn a 7% match on levels 1 to 5

Rank Achievement Bonus

AladinCoin reward affiliates with a Rank Achievement Bonus when they qualify at the Gold and higher ranks:

- qualify as a Gold and receive $2500 in AIC

- qualify as a Platinum and receive $2500 in AIC

- qualify as a Ruby and receive $5000 in AIC

- qualify as a Sapphire and receive $10,000 in AIC

- qualify as a Diamond and receive $30,000 in AIC

- qualify as a Blue Diamond and receive $50,000 in AIC

- qualify as a Crown Diamond and receive $100,000 in AIC

Joining AladinCoin

AladinCoin affiliate membership is tied to investment in one of eight offered packages:

- Starter – $180

Trainee – $500

Basic – $1000

Premium – $2500

Pro – $8000

Pro+ – $20,000

Pro X2 – $50,000

VIP – $100,000

The more a new affiliate invests the higher their income potential via the AladinCoin compensation plan.

Conclusion

Aladin Coin as a cryptocurrency is a classic example of MLM Ponzi points.

AIC has no use or value outside of AladinCoin itself, with affiliates encouraged to invest on lofty promises of future wealth:

The figures above are of course based on nothing more than wishful thinking.

In reality AIC is backed solely by new affiliate investment, despite AladinCoin’s representation that it’s “back up by financial institutes and hedge funds”.

AladinCoin use newly invested funds to pay recruitment commissions and bonuses, as well as AIC ROI withdrawal requests.

Presumably AIC ROI withdrawals are handled through an internal exchange as AIC is not publicly tradeable.

In any event, using newly invested funds to pay existing affiliates a ROI makes AladinCoin a Ponzi scheme.

Being a Florida corporation, AladinCoin through Aladin Capital LLC are required to register their investment opportunity with the SEC.

A search of the SEC’s Edgar database reveals neither AladinCoin, Aladin Capital LLC or Kevin Gluckstal are registered to offer securities in the US.

This means AladinCoin is operating illegally. All the more comical considering Gluckstal’s claim to have “extensive knowledge” of “securities and finance”.

Call my cynical but it appears the sole purpose of AladinCoin and AIC is to screw as many gullible Vietnamese investors out of as much money as possible.

As with any Ponzi scheme, once affiliate investor recruitment slumps so too will ROI revenue.

This will see AladinCoin unable to meet its ROI obligations, eventually prompting a collapse.

The math behind Ponzi schemes guarantees that when they collapse the majority of investors lose money.

I tried to read the ‘About Us’ page at aladincapital.com and had to close it immediately. The page looks designed to trigger epileptic seizures! Why did I try to read it? Well, I read this article, Googled the company, and saw a fragment of copy that seemed straight out of a Nigerian Prince scam letter.

Researching ‘Aladin Trust’ brought me to Indonesian news and a COO named Eric Nguyen. The aladintrust.com website appears to be solely advertised in Vietnamese, but shares the Cloudflare hosting of the other two websites.

The address in Sunnyvale is just an office for rent, no idea who actually rents suite 305 now though, but Google says several companies, Implicit, and ASC Consulting or something like that.

And what the heck is a “legalized document”? Shouldn’t it be “legal document”, “notarized document”, or “certified document”?

Feels like one of those Nigerian scams where a “supreme court judge” allegedly proves this so-and-so is a character of good value or something like that. 😛

– what is this ELA? – It looks interesting but Googling only turns up language stuff . .

Thanks,

Phil.

Error Level Analysis.

Thanks! Some more tech to read and potentially make use of . .

Regards,

Phil.

much more to this story.

Nah. Obvious Ponzi is obvious.

Best of luck with the scamming.

agreed. more to this scam will come out – Aladin is only one side of the scam and the florida connection seems like there is a US angle.

The U.S. connection…

macrotrendcapitalgroup.com

aladincapital.com

mobile.facebook.com/aladincoinvietnam/

mobile.facebook.com/groups/4337013570375

Same key team members as management. MacroTrend is ruse telling companies seeking funding they have sovereign fund under their management. They claim they can fund through the Swiss Aladin Trust which is a subsidiary of MacroTrend. Aladin Capital is also a subsidiary.

MacroTrend charges fees to companies they have entered into under LOI’s and IA’s for due diligence ($25k, $35k), fees for legal costs pre-closing at $35k and 2% of total closing transaction which must be deposited prior to close in escrow for the company to be funded.

MacroTrend never funds. They collect fees and keep delaying.

Greg Lustig and Kevin Gluckstal are the two owners of MacroTrend Capital Group. Agreements are poorly written and require significant investment by companies and time wasted as closing dates are set and missed.

Aladincoin recently was launched by Aladin Capital Europe in Austria.

There is clearly evidence of fraud and false claims.

More to follow…

sounds either like money laundering into the US or they use the US part of scam to convince outside investors they are money good, never fund and then take the investor money and run.

classic and exactly what just happened with OneCoin, Prodeum, Plexcorps, Arisebank, the Chuck E. Cheese bitcoin scam…

I had to laugh when I read that the ‘contact officer’ was none other than the Chairman of HSBC… lol.

Not even sure what the certificate is meant to represent.

Is it a transaction confirmation? If so wouldn’t the sender get that from the bank he transferred the money from?

Is it a transaction receipt? Then it would be a standard confirmation.

Is it meant to be a ‘bank guarantee’ then it would be specific to a contract to purchase.

The bank account number has too many digits (should be 8).

There is no sort code (branch code) and I doubt that the ‘head office’ of HSBC would even have a branch.

More interestingly here are all the associated domains to aladincoin.

Here are all the other websites that are connected to Aladincoin

strikebitclub.com

btcprofits.org

aladincoins.com

office.strikebitclub.com

richgame.org

coinb.network

bitglobal.co

biturl.biz

biturl.us

fulllink.us

bgcoin.ch

emeg.info

btcprofits.org

aladincoins.com

KKevin Gluckstal in action…

m.facebook.com/story.php?story_fbid=589696368033398&id=442600602742976

and the scam continues – the same HSBC document used again by susan moore for the same scam – –

m.facebook.com/story.php?story_fbid=146598736127076&id=100023308523

This is precisely why you never associate legal documents with legitimacy.

If the business model is rotten (AladinCoin is just another Ponzi points scheme), then whatever else they show you doesn’t matter.

thank you for what you are doing to uncover this. check out what they are also saying in Indonesia – completely fraudulent statements everywhere:

cnsteem.com/cryptocurrency/@kemalmustafa/similar-bitcoin-aladin-coin-enter-indonesia-9e0351ecdcac9

Amazing how brazen these scammers are – glad to see the community uncover such frauds. hope someone reports them to authorities.

Personally know K.Gluckstal. Is it enough for MLM to investigate?

FBI should be involved. So many complaints and no one is doing anything and he is comiting Ponzi scheme for years.

Mike – If you know something, the best thing is to file a report with SEC, CFTC, FTC, or FBI. it is easy to find forms online.

Even Bitcoin coming out to distance themselves from Aladin Coin:

(Ozedit: Snip, see below.)

Bitcoin isn’t an entity, company or individual. It can’t “come out to distance itself” from anything.

Thanks to all who posted here. I went looking around aladin capital website and it looks like they shut down. ditto for the facebook pages.

kudos to you Oz and all the folks above who uncovered this scam. i tried to figure out how much they scammed under Aladin Coin.

No way to really know – but given that 6mm coins were mined i would guess at least a few million. i can only hope that the authorities are now involved and chasing these guys down.

I was curious what happened with all the coins issued and went looking for AIC prices on the internet. what did i find??….the scam continues. here is a look into aladin coin secondary markets:

on Buffalo Exchange – AIC is quoted at $0.11 per unit

buffalo.exchange/markets/BTC-AIC

on AZC Money – AIC is quoted at $2.86 per unit

azcmoney.com/trade?symbol=AIC_BTC

notice on AZC Money – you can clearly see that the trades appear to be “robo” trades executed on a 1 minute schedule once per month. hence, they are probably curated/managed by aladin coin or aladin capital to feign legitimacy.

you can actually see what appear to be internal automated trades of $30 each to lend the appearance that aladin coin price is improving.

what makes this more laughable is that the robo-trades are pricing aladin coin as appreciating in price when Bitcoin has been falling.

this is highly unlikely given that AIC trades against Bitcoin. all the more reason this all looks fake. also, notice that all the Aladin Coin apps are not functional.

this is a classic sign of a “pump and dump” scheme.

not much to add to this news – not much a surprise…on bitcointalk.org/index.php?topic=2909424.0

JohnDoe1975

Aladin Capital Shut down in Austria

publicnow.com/view/6DBAB765C856F29E8BB18A16C3EB74AD5BD10B2F?2018-07-05-12:00:25+01:00-xxx2230

Swiss FINMA Also Blacklists Aladin Capital

finma.ch/en/finma-public/warning-list/aladin-capital-ag/

Thanks for the heads up!

I prefer the fairy tale “Aladin and the magic lamp“:

NOLINK://share-your-photo.com/3ef7d4ea32

i had not seen all the traffic in Indonesia – this is really interesting stuff.

https://bitcointalk.org/index.php?topic=2856039.140

you can translate into English.

the people pure scam artists – for all to see

the fraud led by these people – facebook.com/pg/Aladin-Capital-AIC-431883577228208/posts/

still on facebook page

More information on Greg Lustig on the web. Looks like they operated penny some stock schemes in the US. same with gluckstal in silver falcon mining. they were penny stock operations to lure investors in with promises of funding.

note that the best part of the article is…”the financing never materialized.” same scam.

investorshub.advfn.com/boards/read_msg.aspx?message_id=129165234

hey Oz been checking and it appears that Aladin Coin has shut down trading on Top Coin.

topcoinfx.com/currencies/AIC/aladincoins/

the Ponzi looks like it is over. thank you for what you did to research this and oncover the scam.

Yes, it scam. aladincoin, avanacoin the same.

This is Kevin Gluckstal. This is very straight forward. I was taken advantage of by Francois Trans, Taswin Tarib and Other Vietnamese nationals. They ran Aladin – NOT ME.

Check the company address on the fake BG that they posted. You are so fast to assume post on these boards but don’t do any real DD. I made ever attempt to fix the problems caused by Francois Trans.

The only thing I did was set up their swiss trust company. When they would do the required compliance & KYC that I demanded, I knew they would not run a legitimate business.

AGAIN – I NEVER AUTHORIZED APPROVED OR KNEW ABOUT THIS terrible HSBC posting on the internet. As soon as I learned of it I demanded it be taken down and I made them issue a notice that I never authorized it.

There is a person on here who is Alan Edwards, whom we fired from Macrotrend for making unauthorized statements to clients. We were forced to file a lawsuit against him.

This was a very complexed situation and NEVER did macrotrend do anything illegal.

I know who the people who were in charge of Aladin are and stated quite as I fear for my life and my wife’s life. So people need to go knock on Francois Trans’ door. Not mine.

You can’t fix a Ponzi points scheme. It’s a scam from day one. So… bullshit?

Nah. You saw dollar signs and traded your reputation for a quick Ponzi buck.

By all means blame others but you were the named founder and CEO on AladinCoin’s website.

Thank you Oz for your very capable response to the obvious fraud Kevin Glukstal is. Here are some of the facts directed towards Mr. Gluckstal;

Fact # 1

Taswin Tairib was a well known scam artist dating back to 2015.

You knew exactly what you were doing with all documents that were lifted from his fraudulent scams.

Fact # 2

The fake bank guarantee you refer to was posted on the the Macrotrend website and directly distributed to Macrotrend employees by Kevin Glukstal

Fact # 3

The Swiss trust company you created was set up and where you claimed you had funds that were represented to Macrotrend clients was clearly fraudulent for money laundering purposes.

That’s why your business partner was Dieter Neupert, a known money launderer.

Fact # 4

When Macrotrend clients found out the bank guarantee was fake they confronted you. You were aware of the altered document which you denied was fake.

Fact # 5

Your legal case against Alan Edwards was fraudulent and summarily dismissed by the judge in federal court.

Fact # 6

Macrotrend voilated numerous laws in the United States and you know it. They are;

Numerous violations of employment laws.

Bank fraud.

Wire fraud.

Securities law violations.

Use of numerous fraudulent documents and misrepresentations to employees and clients.

Public policy violations.

Money laundering.

Clear violations of client confidentiality.

All of this information is freely available on the internet. Mr. Gluckstal, everyone knows you are guilty. Good luck running from justice.

Kevin Gluckstal Resume from MacroTrend Website.

Note below he was CIO of DMDV International. DMDV used similar fraudulent documents on Macrotrend website from Taswin Tarib in 2016 that were shared with Macrotrend team. More documents to follow in another posting.

See all the DMDV name changes and in 2017 to then to Aladin Capital

Registrations for Aladin Capital Switzerland: Aladin Capital AG Former and current Business names

1 3 IMC Inter-Med-Com AG

1 3 (IMC Inter-Med-Com SA) (IMC Inter-Med-Com Ltd)

3 4 IMC Inter-Med-Com AG in Liquidation

3 4 (IMC Inter-Med-Com SA en liquidation) (IMC Inter-Med-Com Ltd in liquidation)

4 6 IMC Inter-Med-Com AG

4 6 (IMC Inter-Med-Com SA) (IMC Inter-Med-Com Ltd)

6 8 DMDV INTERNATIONAL TRUST AG

6 8 (DMDV INTERNATIONAL TRUST SA) (DMDV INTERNATIONAL TRUST Ltd.)

8 9 ALADIN CAPITAL AG

8 9 (ALADIN CAPITAL SA) (ALADIN CAPITAL Ltd.)

9 Swiss Dynasty Trust AG

9 (Swiss Dynasty Trust SA) (Swiss Dynasty Trust Ltd.)

The company name ALADIN CAPITAL AG existed since 16/10/2017.

On 30/05/2018 the company was renamed to Swiss Dynasty Trust AG, maybe because ALADIN CAPITAL AG was added to the warning list of swiss government financial regulator FINMA:

FROM MACROTREND WEBSITE:

EVERYONE here is speaking to Alan Edwards who we had to sue. MacroTrend v Edwards. Attached are documents showing Aladin Coins LLC name was changed to VI Coins LLC.

Francois Trans is a swindler who posted this BG with Taswin Tarib and the Aladin owners in Vietnam. I had ZERO knowledge of this. In fact I personally lost $100k into this deal when I though I had it fixed.

They didn’t comply with the required KYC protocol to move forward. I only signed my CEO agreement with them 4 months after they posted the BG as I was trying to rectify the situation. Attached is proof.

Every single thing Macrotrend did was 100% above board. Alan Edwards was telling potential investments Owners that we were closing on a specific date. And Greg, Rick nor I was aware of these statements. Again, hence the lawsuit.

This was a very difficult situation and ruined our lives. We did everything we could to correct a situation we did not create our selves.

Alan Edwards…. this is who is posting these alligations.

CHECK CALIFORNIA SEC OF STATE – VI COINS LLC – NAME WAS CHANGE FROM ALADIN COINS LLC – FRANCOIS TRANS. LOOK UP FILE NUMBER 201731010390.

TOM CAO (NEW MEMBER NAME) IS FRANCOIS LONG TIME FRIEND IN CALIFORNIA AND WAS PROVIDING FRANCOIS WITH MONEY OVER THE YEARS. MY GUESS IS, TOM CAO MUST HAVE CONSPIRED WITH HIM.

DOWNLOAD ALL OF THE FILINGS AND DO REAL HOMEWORK – IDIOT.

Fact # 1

Taswin Tairib was a well known scam artist dating back to 2015. FRANCOIS TRANS and Taswin Tarib are THE CULPRITs. Lawyers in Vietnam know the truth.

You knew exactly what you were doing with all documents that were lifted from his fraudulent scams.

HSBC BG WAS POSTED WITHOUT OUR KNOWLEDGE, BY FRANCOIS TRANS. MACROTREND ISSUED HIM A CEASE & DESIST ORDER IN AUGUST, 5 MONTHS BEFORE THIS BG WAS POSTED. ATTEMPT WAS MADE TO CORRECT THE SITUATION.

Fact # 2

The fake bank guarantee you refer to was posted on the the Macrotrend website and directly distributed to Macrotrend employees by Kevin Glukstal

Fact # 3

The Swiss trust company you created was set up and where you claimed you had funds that were represented to Macrotrend clients was clearly fraudulent for money laundering purposes. WRONG WRONG WRONG – NEVER EVEN HAD A BANK ACCOUNT.

NEVER CLAIMED HAD CLEARED FUNDS READY TO INVEST – NEVER. NEVER INSTRUCTED YOU, ALAN EDWARDS, TO TELL PEOPLE THAT. HENCE OUR LAW SUIT AGAINST YOU.

That’s why your business partner was Dieter Neupert, a known money launderer.

THE COMPANY IN CALIFORNIA THAT SOLD US THE TRUST USED NEUPERT AS THE LAWYER. WE DID NOT KNOW ANYONE ELSE IN SWITZERLAND.

Fact # 4

When Macrotrend clients found out the bank guarantee was fake they confronted you. You were aware of the altered document which you denied was fake.

MACROTREND NEVER EVER SHOWED ANY BANK DOCUMENTS TO ANYONE. THE ALADIN SITUATION WAS COMPLETELY 100% SEPARATE FROM OUR BUSINESS IN USA WITH OUR LENDING PARTNER IN EUROPE. BECAUSE YOU ARE MAKING THESE THINGS UP, YOU ARE STICKING YOUR FOOT IN YOUR MOUTH. THIS WHOLE STORY WAS ALREADY PROVIDED ALONG WITH PROOF, TO THE SEC – A LONG TIME AGO.

Fact # 5

Your legal case against Alan Edwards was fraudulent and summarily dismissed by the judge in federal court. ONLY BECAUSE WE DONT HAVE MONEY TO PURSUE – OTHERWISE I WOULD HAVE SCREWED YOU TO THE WALL FOR THE DAMAGE YOU HAVE CAUSED US.

Fact # 6

Macrotrend voilated numerous laws in the United States and you know it. They are;

BULLSHIT BULLSHIT. WE HAVE EVERY INTENTION, WORKED IN GOOD FAITH. YOU WERE THE ONE WHO LIED. IN FACT, YOUR LONG TIME CHILDHOOD FRIEND (WHO i WILL NOT NAME HIS NAME, BUT WAS OUR SCIENCE OFFICER, STATED TO US ALL, MULTIPLE PARTIES ON THE PHONE, “THAT ALAN WAS UNSTABLE AND MAKING CLAIMS THAT WE WERE NOT AWARE OF).

All of this information is freely available on the internet. Mr. Gluckstal, everyone knows you are guilty. Good luck running from justice.

LIKE I SAID, JUSTICE ALREADY KNOWS WE HAVE ONLY FAILED TO PUT THE TRANSACTION TOGETHER, AS WE DID RECEIVE A $21M PLEDGE TO COVER THE INTEREST ON A POTENTIAL LOAN FROM A LENDER.

MacroTrend was never legit and was involved with Aladin – this was well known and public.

MacroTrend (Gluckstal and Lustig) have run an extensive series of investment schemes and outright investment scams in the US and abroad.

Through false statements, fake documents, and outright lies, they have defrauded numerous counterparties and investors. Through the use of an elaborate scam, fake representatives, fake claims, and fraudulent documents – and even fake people – they run an operation that seeks to defraud companies and individuals by claiming that they have extensive financial assets and large-scale financial backing.

They have successfully taken in fees from numerous companies and individuals by claiming to have access to funding and by charging fees prior to closing financial arrangements.

They do not appear to ever close or complete funding. They do not honor commitments or legal agreements. These victims (Companies and individuals) have all suffered financial losses and impairments as a result of MacroTrend’s activities.

Recently, Companies who have been victimized by MacroTrend have been pursuing refunds of their fees and expenses.

Several Companies have an extensive data set of emails and documents from MacroTrend showing the extent of the frauds committed.

It is not an exaggeration to say that literally every document produced by MacroTrend has some element of fake or fraudulent representations.

These extend into personal resumes, counterparty relationships, personal references, background details, bank escrow documents, funding agreements, and documentation on proof and sources of funds.

MacroTrend uses the names of large and blue chip business, banks, and law firms in order to pass themselves off as legitimate.

From a distance, it looks increasingly like a criminal gang activity whereby they even have representatives who act as “references”.

These references most likely are part of the scam in some small way and seek to be compensated when funds are brought onshore into the US.

Even now, when we research the names of firms and organizations that MacroTrend has provided, it is completely clear that MacroTrend attempts to use the names of legitimate businesses in order to “pretend” that they are either affiliated or part of these firms.

So many examples of this are now evident.

MacroTrend attempts to scam in volume. They are adept at using their techniques on a variety of firms – they don’t try to scam “big numbers”; rather, they go for volume and frequency.

They focus on smaller levels in order to make it not worthwhile for the victims to follow up or pursue. It is very clear that this has been their modus operandi for some time now.

Because each one of the fee amounts collected – average size of $25,000 to $35,000 – are somewhat small and because MacroTrend scams primarily early stage or late stage growth companies, MacroTrend has been able to extend this fraud for years because these said companies do not have the time and energy and inclination to pursue MacroTrend in court.

Beyond this, many if not all of these companies do not want their names sullied or tarnished by any affiliation with MacroTrend and its partners.

However, the recent example of the fraud has run into the many hundreds of thousands of dollars because of fees, legal expenses and other expenses each of the companies has suffered and had to pay.

Alongside (and in conjunction with) this activity, and on a much larger scale, MacroTrend supported a crypto currency scam under the entity called Aladin Capital, Aladin Coin, and Avana Coin.

Aladin Capital is a completely bogus operation that makes outrageous claims to funding, financial backing, financial performance, and access to large portfolios of investments.

Aladin Capital actually uses the names of the Companies that have been scammed by MacroTrend to show investors that they have assets under management.

Aladin Capital runs its scam under the Aladin Coin brand. Aladin Coin has been uncovered as a Ponzi scheme and is run by the same partners as MacroTrend.

Whistleblowers who have uncovered the operation have been threatened in various ways. They have also threatened the representatives of the Companies who have sought to have fees and expenses repaid.

In addition, MacroTrend has been notified in writing by third parties that their activity is regulated in various jurisdictions and that MacroTrend executives have appeared to have been engaged in improper activities.

They have never responded nor have they taken action to correct any of these issues.

Here is an example –

This is from a MacroTrend Investment Portfolio Document shared with investors.

This was prepared by Kevin Gluckstal and Greg Lustig. It was shared amongst investors (Aladin Coin) and companies defrauded by Macrotrend.

Note: The names of the Companies have been redacted to protect their privacy

Copy below of correspondence describing a fraudulent document prepared by Kevin Gluckstal. This included a Proof of Funds for MacroTrend or DMDV International Trust AG using the fake Bank guarantee + an investment termsheet.

The investment term sheet (for a capital injection into MacroTrend) was produced and shared with the companies as proof of funds + Terms demonstrating that a loan in the amount of 230,000,000 Euros to MacroTrend Capital LLC (Kevin Gluckstal) was to close on or around December 21, 2017.

The purpose of the loan was to cover the closings of the portfolio companies that failed to close in November 22, 2017 due to absence of funds. Again, this was produced as proof of funds.

The document was provided to all MTCG executives as evidence of closing to the Companies Macrotrend had committed funding.

Upon review of the document, several concerns which were articulated to Mr. Gluckstal, Mr. Greg Lustig, CEO, and Mr. Rick Jordan, President of MacroTrend Capital.

The entire document was later shown to be fake.

Email Communication between Macrotrend Partners (including Gluckstal, Lustig, Jordan) – in 1/2018:

Person XXX (redacted) –

Kevin Gluckstal response 1/2018: