7Eleven-INS Review: Generic fintech ruse Ponzi

![]() 7Eleven-INS fails to provide ownership or executive information on its website.

7Eleven-INS fails to provide ownership or executive information on its website.

7Eleven-INS’ website domain (“7eleven-ins.com”), was privately registered on May 30th, 2024.

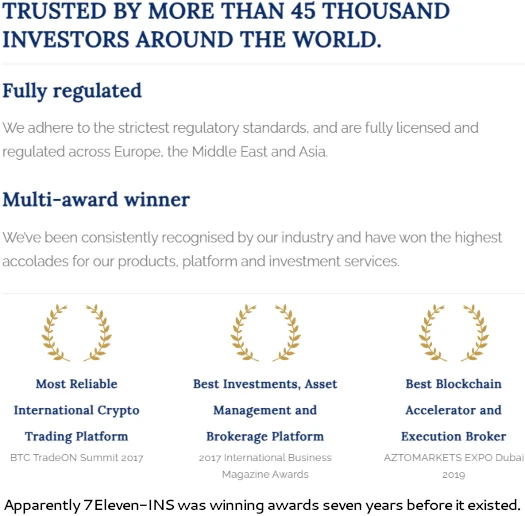

On its website 7Eleven-INS claims to have “more than 45 thousand investors”. The company also claims to have won several awards dating back to 2017.

Based on 7Eleven-INS only existing for about a month and a half, the marketing claims on its website are obviously false.

The Chicago address 7Eleven-INS provides on its website appears to be a random office building that has nothing to do with the company.

Of note though is the UK’s FCA citing a firm for securities fraud in 2022, purportedly claiming to operate from the same address.

Whether the same scammers behind Horizon Crypto are also also behind 7Eleven-INS is unclear. What we can confirm though is at least one group of scammers have used the seemingly random Chicago address 7Eleven-INS pretends to operate from.

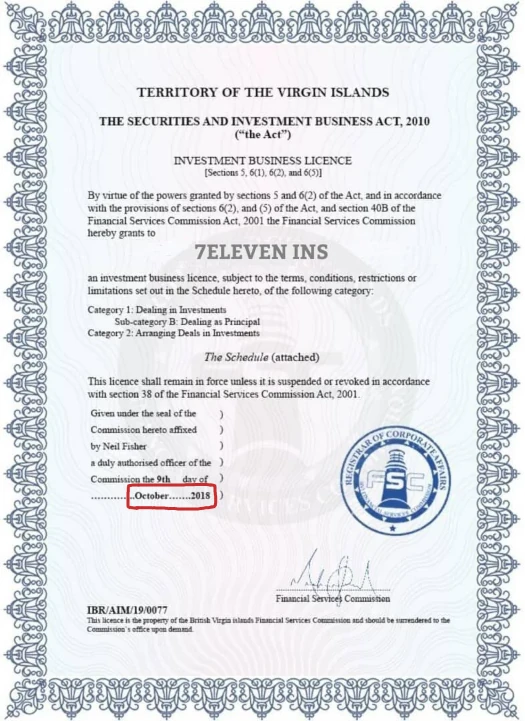

In an attempt to appear legitimate, 7Eleven-INS provides a BVI Investment Business License on its website:

Given the certificate is dated October 2018, it’s either doctored or has nothing to with 7Eleven-INS.

Notwithstanding BVI being a scam-friendly jurisdiction with little to no regulation of MLM related fraud. 7Eleven-INS representing any ties to BVI is an immediate red flag.

With respect to actual regulation, the Central Bank of Russia issued a 7Eleven-INS pyramid fraud warning on June 25th, 2024.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

7Eleven-INS’s Products

7Eleven-INS has no retailable products or services.

Affiliates are only able to market 7Eleven-INS affiliate membership itself.

7Eleven-INS’s Compensation Plan

7Eleven-INS affiliates invest USD equivalents in cryptocurrency.

This is done on the promise of advertised returns:

- Plan 1 – invest $50 to $499 and receive 6% a day

- Plan 2 – invest $500 to $1000 and receive 10% a day

- Plan 3 – invest $1000 to $5000 and receive 15% a day

- Plan 4 – invest $5000 or more and receive 30% a day

7Eleven-INS pays referral commissions on invested cryptocurrency down three levels of recruitment (unilevel):

- level 1 (personally recruited affiliates) – 5%

- level 2 – 2%

- level 3 – 1%

Joining 7Eleven-INS

7Eleven-INS affiliate membership is free.

Full participation in the attached income opportunity requires a minimum $50 investment.

7Eleven-INS solicits investment in various cryptocurrencies.

7Eleven-INS Conclusion

7Eleven-INS is your typical generic finance template Ponzi scheme.

In addition to lying about the foundation of the company, 7Eleven-INS’ website presents itself as a generic finance themed template.

The site is populated with copious amounts of generic finance jargon, accompanied by a plethora of stock images.

As a passive returns investment scheme, 7Eleven-INS is required to register itself with financial regulators. 7Eleven-INS fails to provide evidence it has registered with any financial regulators.

A doctored BVI certificate that predates 7Eleven-INS by six years is not credible for obvious reasons. Furthermore, even if the certificate was legitimate it would only apply to BVI. 7Eleven-INS would still be offering unregistered securities outside of the BVI.

Thus, at a minimum, 7Eleven-INS is committing securities fraud.

7Eleven-INS’ business model also fails the Ponzi logic test.

7Eleven-INS’ business model also fails the Ponzi logic test.

If 7Eleven-INS is already managing $6562 billion and generating 20% a day, what do they need your money for? And why are they wasting time soliciting $50 investments in cryptocurrency from randoms over the internet?

As it stands the only verifiable source of revenue entering 7Eleven-INS is new investment.

Using new investment to pay ROI withdrawals would make 7Eleven-INS a Ponzi scheme. Additionally with nothing marketed or sold to retail customers, the MLM side of 7Eleven-INS operates as a pyramid scheme.

As with all MLM Ponzi schemes, once affiliate recruitment dries up so too will new investment.

This will starve 7Eleven-INS of ROI revenue, eventually prompting a collapse.

The math behind Ponzi schemes guarantees that when they collapse, the majority of participants lose money.

It’s missing the verification QR code in the upper-right that should have been there since 2014. This is so obviously fake, it’s laughable.

bvifsc.vg/certificate-validation